Americas Market Update 13 Sep 2024

Bunker benchmarks in most Americas ports have tracked Brent’s upward movement, and suppliers in Louisiana ports have resumed bunker operations.

Changes on the day, to 08.00 CDT (13.00 GMT) today:

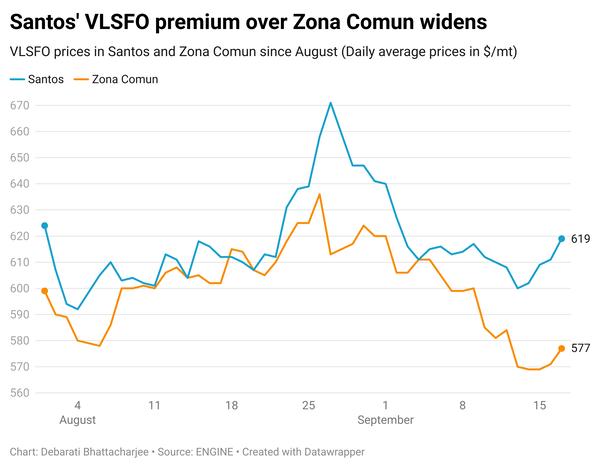

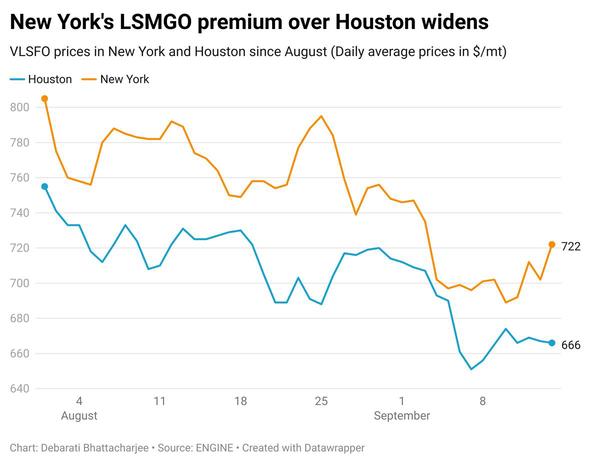

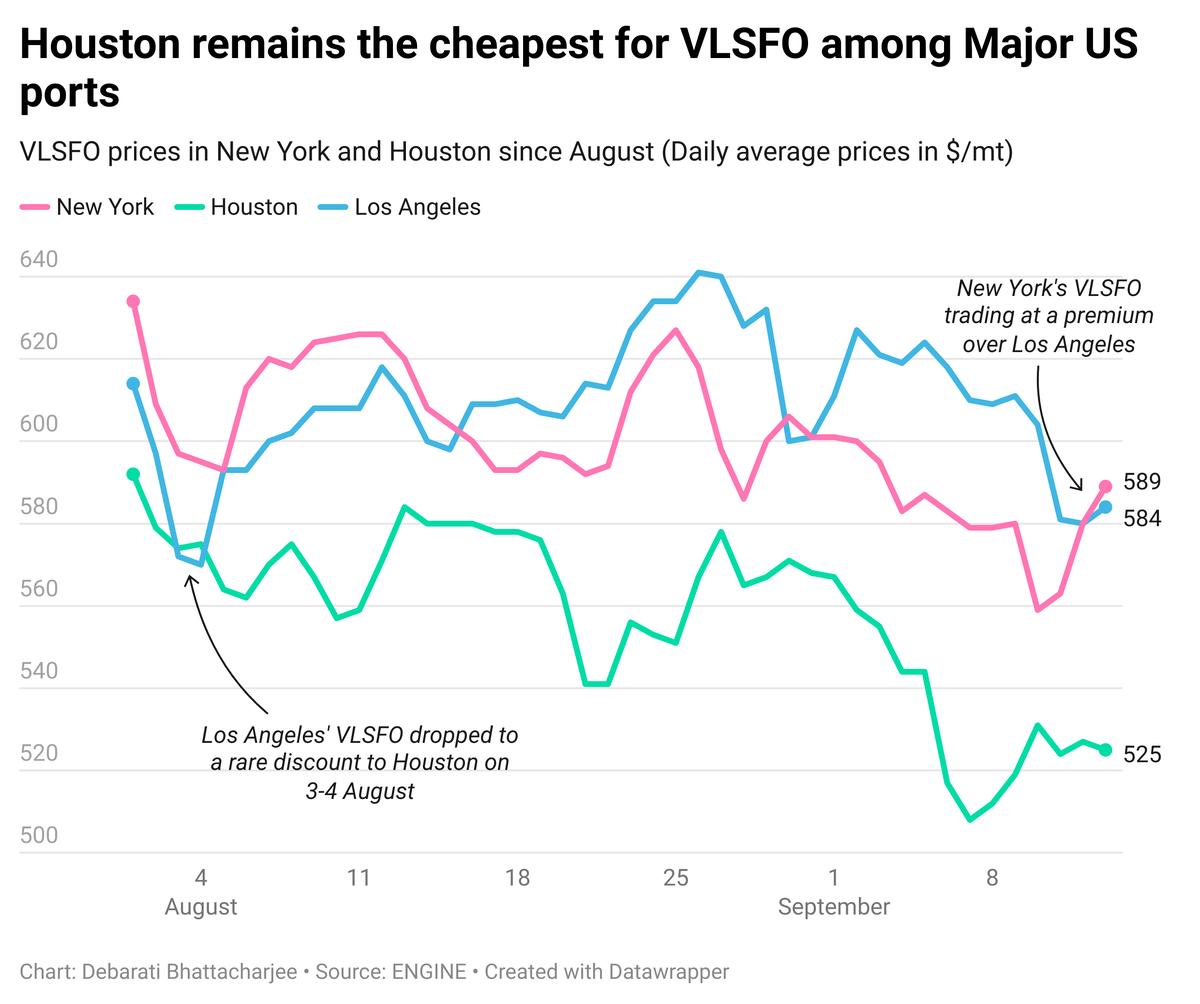

- VLSFO prices up in New York ($15/mt), Balboa ($12/mt), Los Angeles ($11/mt) and Houston ($2/mt), and down in Zona Comun ($15/mt)

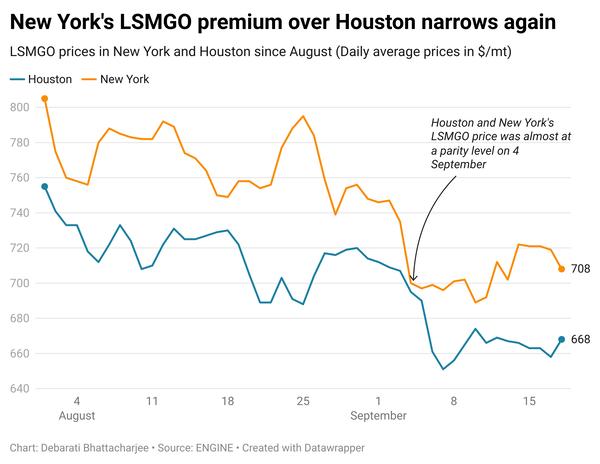

- LSMGO prices up in Los Angeles ($17/mt), Balboa ($14/mt) and Houston ($2/mt), and down in New York ($1/mt)

- HSFO prices up in New York ($13/mt), Balboa ($12/mt), Los Angeles ($8/mt) and Houston ($6/mt)

New York’s VLSFO price has gained more than Houston's VLSFO in the past day, widening its VLSFO price premium over Houston from $53/mt to $66/mt.

Los Angeles’ LSMGO price has gained by $17/mt in the past day, while Seattle’s LSMGO price has gained by $6/mt. This has narrowed Seattle’s LSMGO price premium over Los Angeles from $28/mt yesterday, to $16/mt now.

Most ports in Louisiana, including New Orleans, Mobile, and Port Fourchon, which were closed since Wednesday evening due to Tropical Storm Francine have reopened for vessel traffic today following the passing of the storm, a source says.

Currently, suppliers in these ports are working to clear the bunker backlog.

Brent

The front-month ICE Brent contract has moved $1.40/bbl higher on the day, to trade at $72.72/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

Brent crude futures moved higher on the back of supply disruption concerns emerging from the US and Libya.

Preventive shutdowns and evacuations of offshore oil production platforms in the US Gulf of Mexico due to concerns over Hurricane Francine’s impact has provided upward pressure to Brent’s price this week. Persistent disruption in Libya’s oil production provided additional support to Brent futures.

“[Brent] crude oil rallied for a second consecutive day as supply risks loomed over the market,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Nearly 42% of the total oil production capacity in the US Gulf of Mexico has been shut as of yesterday, Reuters reports.

“Supply disruptions from Hurricane Francine continue to provide some support,” to oil prices, two analysts from ING Bank remarked.

Downward pressure:

The International Energy Agency’s (IEA) oil market report yesterday reinforced a “bearish picture” in the global oil market, analysts said. Brent’s price gains were partially capped after the Paris-based energy agency cut the global oil demand growth outlook.

It now expects global oil demand to grow by 900,000 b/d, with total consumption expected to reach 103 million b/d in 2024, noting a decline of 70,000 b/d from its previous month’s projection. This decline can be attributed to a slowdown in China’s economic growth.

“In contrast to OPEC’s relatively positive outlook earlier this week, IEA said demand growth is slowing as China’s economy cools,” Hynes remarked.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.