East of Suez Market Update 3 Sep 2024

Most prices in East of Suez ports have moved up, and prompt availability of all grades remains tight in Zhoushan.

PHOTO: Aerial view of Zhoushan, Zhejiang, China. Getty Images

PHOTO: Aerial view of Zhoushan, Zhejiang, China. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($18/mt), Fujairah ($7/mt) and Singapore ($4/mt)

- LSMGO prices up in Zhoushan ($25/mt) and Fujairah ($4/mt), and down in Singapore ($3/mt)

- HSFO prices up in Zhoushan ($18/mt) and Fujairah ($2/mt), and down in Singapore ($9/mt)

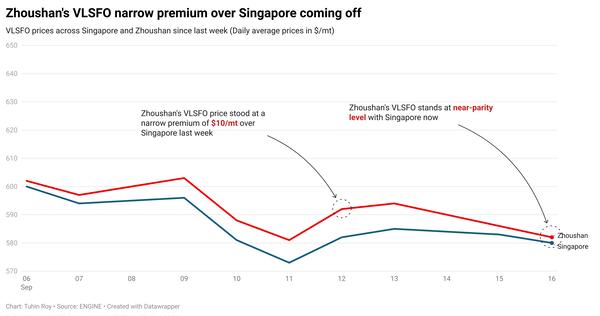

Zhoushan's VLSFO price has surged by $18/mt in the past day, marking the steepest increase among the three major Asian bunker ports. Four VLSFO stems were fixed in Zhoushan within the price range of $18/mt yesterday. Stems booked at the higher end of this range have contributed to the benchmark's rise. Zhoushan's VLSFO price discounts to both Singapore and Fujairah have nearly disappeared and stand at near-parity levels now.

Additionally, Zhoushan’s LSMGO price has climbed by $25/mt, whereas prices in Fujairah and Singapore have remained stable. Two higher-priced LSMGO stems fixed in Zhoushan have contributed to this increase. As a result, Zhoushan’s LSMGO price is now at a $57/mt premium over Singapore, while at a $67/mt discount to Fujairah.

Despite low bunker demand, prompt availability of all grades in Zhoushan has tightened, with suppliers recommending lead times of 5-7 days.

In Hong Kong, lead times for all grades are about seven days, unchanged from last week. In Taiwanese ports—Hualien, Kaohsiung, Taichung, and Keelung—VLSFO and LSMGO supplies remain stable, with prompt lead times of about two days, same as last week.

Brent

The front-month ICE Brent contract has moved $0.23/bbl lower on the day, to trade at $76.98/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price found some support from escalating tensions in the Red Sea, which have fueled concerns in the global oil market about potential supply disruptions.

On Monday, Iran-aligned Houthi forces launched two anti-ship ballistic missiles (ASBM) at two crude oil tankers transiting the Red Sea, the US Central Command (CENTCOM) said.

Both vessels carrying crude oil were hit by the missiles, CENTCOM said.

Besides, oilfield closures and export bans in Libya have also supported Brent’s price today.

Libya’s state-owned oil company National Oil Corporation (NOC) confirmed oilfield closures in the country last week. On Monday, it declared force majeure on the El Feel oilfield, one of the biggest oilfields in Libya.

“[Brent] Crude oil gained as supply disruptions in Libya worsen,” ANZ Bank’s senior commodities strategist Daniel Hynes said. The El Feel crude oilfield has a capacity of 70,000 b/d, Reuters reports.

Downward pressure:

Brent’s price declined as demand growth concerns from the world’s second-largest oil consumer, China, continued to temper market sentiment.

China’s manufacturing activity slumped in August, with the country's manufacturing Purchasing Manager’s Index (PMI), a key economic indicator to understand demand growth, coming in at 49.1.

“Demand was also in focus following more weak economic data in China. Factory activity contracted for a fourth consecutive month in August,” Hynes added.

A PMI reading below 50 indicates a decline in the country’s economic health. It can also dampen the demand growth for commodities like oil.

“Crude oil prices are again struggling as the outlook for global demand turns increasingly bleak,” SPI Asset Management’s managing partner Stephen Innes remarked. “The risks are skewed to the downside, particularly with China—the world’s second-largest consumer and a key driver of global oil demand growth—stuck in an economic funk,” he added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.