East of Suez Market Update 24 Jul 2024

Prices in East of Suez ports have moved in mixed directions, and bunkering at all anchorages in Zhoushan have been suspended since Monday due to Typhoon Gaemi-induced rough weather.

PHOTO: Container ship and working crane bridge with Hong Kong skyline in the background. Getty Images

PHOTO: Container ship and working crane bridge with Hong Kong skyline in the background. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

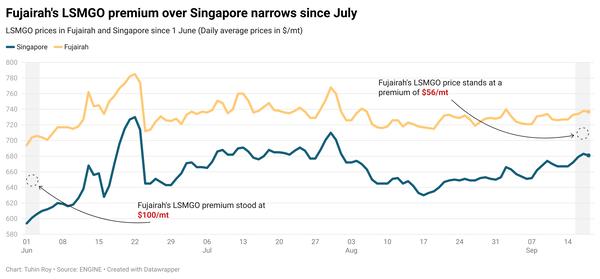

- VLSFO prices up in Singapore ($2/mt), and down in Fujairah ($8/mt) and Zhoushan ($5/mt)

- LSMGO prices down in Fujairah ($6/mt), Singapore ($5/mt) and Zhoushan ($4/mt)

- HSFO prices up in Zhoushan ($12/mt), and down in Fujairah ($5/mt) and Singapore ($1/mt)

Fujairah's VLSFO price has dropped by $8/mt in the past day, while prices in Singapore and Zhoushan have remained largely stable. This has pushed Fujairah's VLSFO price to a $10/mt discount to Singapore. Zhoushan’s VLSFO price remains near-parity level with Fujairah.

Zhoushan’s HSFO price has increased by $12/mt, supported by a higher-priced HSFO stem fixed recently in the port, while its VLSFO price has decreased some. These differing price movements have narrowed the port's Hi5 spread from $89/mt to $72/mt. Zhoushan’s Hi5 spread is still significantly narrower than Fujairah’s $118/mt spread and Singapore’s $105/mt spread.

VLSFO and LSMGO grades are readily available in Zhoushan, with suppliers recommending lead times of 5-7 days. HSFO availability has improved, with lead times decreasing from 7-10 days last week, to 5-7 days now.

However, bunker deliveries in Zhoushan have been halted since Monday due to bad weather caused by Typhoon Gaemi. Some suppliers in Zhoushan expect bunker deliveries to resume on 29 July, when calmer weather is forecast.

Hong Kong has an ample supply of all bunker fuel grades, with typical lead times of around seven days. Strong wind gusts of 24-27 knots and swells exceeding a meter, induced by Typhoon Gaemi, are forecast to hit Hong Kong between Thursday and Friday. This could impact bunker deliveries in the port.

Brent

The front-month ICE Brent contract lost $0.92/bbl on the day, to trade at $81.63/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Crude oil inventories in the US dropped by 3.9 million bbls in the week that ended 19 July, according to estimates from the American Petroleum Institute (API). The API's estimate of a crude stock drawdown has lent some support to Brent.

A draw in US crude stocks indicates oil demand growth and could push oil prices higher. The US trade body reported “sizeable across-the-board oil inventory draws,” VANDA Insights’ founder and analyst Vandana Hari said.

Oil supply risks from wildfires in Canada's Alberta province have continued to exert upward pressure on Brent’s price, according to market analysts. Oil producers, including Suncor Energy and Altair Energy, have halted production due to operational disruptions caused by wildfires, Bloomberg reported.

“While wildfires have already forced some producers to curtail production, these fires still threaten a large amount of supply,” two analysts from ING Bank said.

The oil market will closely monitor Saudi Arabia-led OPEC's upcoming meeting on 1 August, as the organisation is expected to discuss strategies to increase prices, according to reports.

Downward pressure:

A weak economic outlook in China has raised concerns about oil demand growth in the country. This has contributed to pull Brent's price lower, according to analysts.

China reported its “weakest economic growth in five quarters last week, putting a damper on the outlook [for oil], ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Economic activity in the world’s second-largest oil consumer declined in the second quarter. China's GDP growth dropped from 5.3% in the first quarter to 4.7% in the second quarter.

Ceasefire talks between Israel and Hamas have shown progress after Israeli Prime Minister Benjamin Netanyahu signaled that a deal could be cracked to end the nine-month-old conflict in the Gaza Strip.

Netanyahu is currently visiting Washington, where he will address the US Congress, the Associated Press (AP) reports. The US, along with Egypt and Qatar, are proactively endorsing a phase-out plan that would stop Israel’s military operations in Gaza and free the remaining Israeli hostages. This could ease concerns over supply disruptions in the Middle East.

“Brent crude fell… hitting its lowest levels in over a month due to renewed Israel-Hamas ceasefire talks and demand concerns,” analysts from Saxo Bank said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.