East of Suez Fuel Availability Outlook 16 Jul 2024

Bunkering disrupted in weather-exposed Zhoushan

Bunker demand is low in South Korean ports

LSMGO supply good across Omani ports

PHOTO: Container ship and working crane bridge with Hong Kong skyline in the background. Getty Images

PHOTO: Container ship and working crane bridge with Hong Kong skyline in the background. Getty Images

Singapore and Southeast Asia

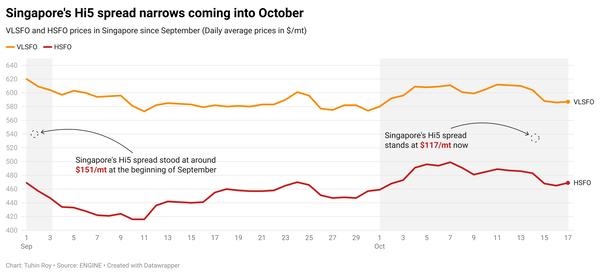

In recent weeks, lead times for VLSFO have fluctuated significantly in Singapore, with most suppliers now suggesting up to 14 days. However, some suppliers can manage stems within five days. Last week, the recommended lead times were approximately 7–11 days for the grade.

The availability of prompt HSFO supply remains tight, with lead times ranging between 9-14 days, which is almost unchanged from the previous week. Meanwhile, lead times for LSMGO have remained stable at 3–7 days.

According to Enterprise Singapore, Singapore’s residual fuel oil stocks have averaged 11% lower so far this month than compared to June. The port’s fuel oil stocks have dropped below 18 million bbls because of a significant 31% decline in net fuel imports this month. Both imports and exports have decreased, with fuel oil imports falling by 1.28 million bbls, surpassing the 283,000-bbl drop in exports.

The port’s middle distillate stocks have also declined, averaging 8% lower this month.

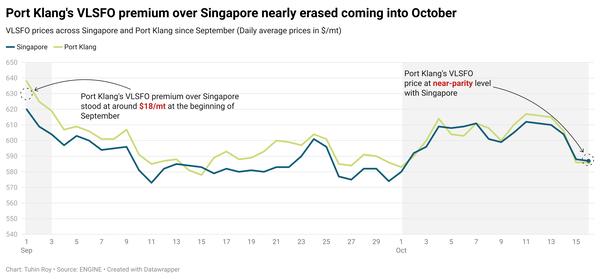

In Malaysia's Port Klang, VLSFO and LSMGO grades are abundantly available. Some suppliers can offer VLSFO and LSMGO for prompt deliveries for smaller stem sizes, but HSFO supply is mostly limited.

In the Indonesian ports of Jakarta and Surabaya, VLSFO and LSMGO grades are readily available. Additionally, Balikpapan port has prompt VLSFO supply available.

East Asia

All grades are readily available in Zhoushan, with suppliers recommending lead times of 5-7 days. However, bunker deliveries at Zhoushan’s Tiaozhoumen and Xiazhimen outer anchorages have remained suspended since Friday due to rough weather. Most suppliers are unsure when operations will resume in these anchorages. Overall, demand has been low in Zhoushan.

In Northern China, VLSFO and LSMGO grades are easily accessible in Dalian, Qingdao, and Tianjin, although HSFO supply is limited in Qingdao and Tianjin. Shanghai has a good supply of VLSFO and LSMGO, but HSFO remains scarce. In Fuzhou and Xiamen, VLSFO and LSMGO grades are readily available, while prompt availability is restricted in Guangzhou and Yangpu.

Chinese refiners produced 1.29 million mt of VLSFO in June, slightly down from 1.31 million mt in May, market intelligence provider JLC reported.

In Taiwanese ports such as Hualien, Kaohsiung, and Keelung, VLSFO and LSMGO deliveries are available with lead times of 2-3 days, similar to last week. Suppliers in Taichung require slightly longer lead times of 4-5 days for both grades.

Hong Kong has an ample supply of all bunker fuel grades, with lead times of approximately 3-5 days.

In South Korean ports, the availability of all fuel grades remains good due to low bunker demand. Most suppliers are recommending lead times of approximately three days for VLSFO and LSMGO across the country. For HSFO, lead times of around 2-3 days are advised in western South Korean ports, while suppliers in southern ports require a slightly longer six days. This week, strong winds and high waves may intermittently affect bunker operations in the South Korean ports of Ulsan, Onsan, Busan, Daesan, Taean, and Yeosu.

In Japan, bunker demand remains low. Lead times differ across major ports, with 5-7 days needed in Tokyo, Chiba, Osaka, Kobe, and Mizushima, while longer periods of 12–13 days are required in Nagoya, Yokkaichi, and Oita.

Adverse weather conditions are expected throughout the week in the Thai port of Koh Sichang. Similarly, the Vietnamese port of Ho Chi Minh is anticipated to experience adverse weather from 18-22 July, which could potentially impact bunker deliveries.

Oceania

In Western Australia, VLSFO and LSMGO grades are available at ports including Kwinana, Fremantle, and Kembla, with typical lead times of 7-8 days. In New South Wales, LSMGO is readily available in Sydney, while prompt HSFO supply depends on the enquiry.

Victoria's ports of Melbourne and Geelong have good availability of VLSFO and LSMGO, though prompt HSFO deliveries can be challenging. In Queensland, Brisbane and Gladstone have ample stocks of VLSFO and LSMGO, with lead times around 7-8 days, but HSFO availability is limited in Brisbane.

In New Zealand, Tauranga and Auckland have ample VLSFO supply, with Auckland also having good LSMGO availability. However, Tauranga is expected to experience rough weather conditions over the weekend, which may impact bunker operations.

South Asia

In several Indian ports, including Kandla, Tuticorin, Chennai, Cochin, Visakhapatnam, and Haldia, the availability of VLSFO and LSMGO is currently limited.

Mumbai, Kandla, Sikka, Cochin, and Visakhapatnam are expected to encounter intermittent rough weather conditions this week, potentially disrupting bunker operations.

Similarly, the Sri Lankan port of Colombo is forecast to experience intermittent rough weather, which may impact bunker deliveries.

Middle East

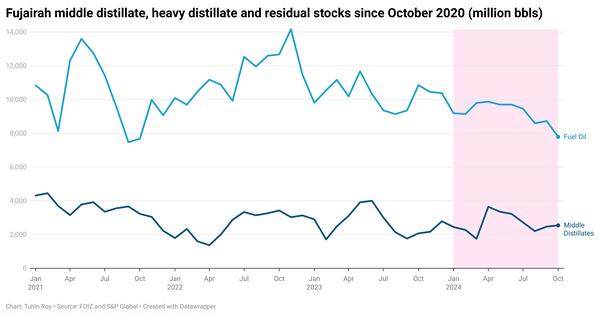

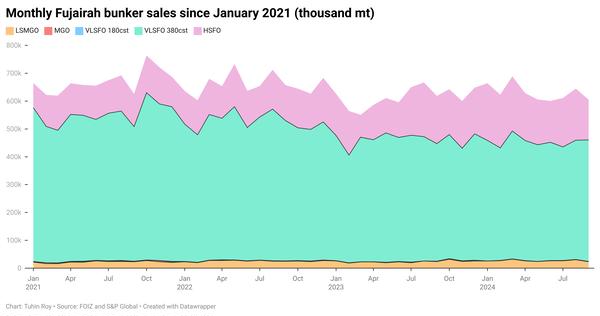

In Fujairah, prompt availability of all grades has tightened, with most suppliers now requiring lead times of 7–10 days, up from 5-7 days last week.

Similarly, in the UAE port of Khor Fakkan, prompt availability of all grades is tight, with recommended lead times of 7-10 days.

In Saudi Arabia's Jeddah port, there is an ample supply of VLSFO and LSMGO. In Djibouti, some suppliers are experiencing shortages of VLSFO, while LSMGO remains unaffected.

In Iraq’s Basrah, there is good availability of VLSFO and LSMGO, whereas Qatar’s Ras Laffan is nearly depleted of both low-sulphur fuel grades.

LSMGO is readily available in Omani ports, including Sohar, Salalah, Muscat, and Duqm.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.