Europe & Africa Fuel Availability Outlook 26 Jun 2024

Bunker supply is normal in the ARA hub

High bunker demand in Ceuta

LSMGO is tight in Durban

PHOTO: Ship docked in the Port of Zeebrugge. Getty Images

PHOTO: Ship docked in the Port of Zeebrugge. Getty Images

Northwest Europe

Availability is normal in Rotterdam and in the wider ARA hub. Lead times of 3-5 days are recommended for all three grades, consistent for last week, a trader said.

The ARA’s independently held fuel oil stocks have averaged 1% lower in June so far than across May, according to Insights Global data.

The region has imported 248,000 b/d of fuel oil so far this month, slightly down from 252,000 b/d of fuel oil imported in May, according to data from cargo tracker Vortexa. The ARA imported low-sulphur fuel oil (LSFO) and HSFO in a 54/46 ratio in May. This trend has continued into this month with the ratio tilting more towards LSFO at 64/36.

The Bahamas has emerged as the ARA’s top fuel import source this month, accounting for 18% of the region’s total imports. France has come second, accounting for 14% of the total imports, followed by the UK (13%), Lithuania (12%) and Sweden (6%).

The ARA hub’s independent gasoil inventories — which include diesel and heating oil — have declined by 2% this month.

Dock workers’ strike actions in the French ports of Saint-Nazaire and Montoir are expected to conclude this week, with the final strikes scheduled on Wednesday and Friday. The strikes may impact bunkering in these ports, with suppliers unlikely to offer on the days when the strike action takes place, a trader told ENGINE.

Bunker fuel availability remains good in Hamburg and several suppliers are able to offer stems for prompt delivery dates, a trader said. Lead times remain unchanged from the last few weeks with 3-5 days advised for all three grades in the port.

Off Skaw, securing prompt delivery dates is difficult for all grades, a trader said. Lead times range between 7-10 days. Bad weather may disrupt bunkering on Friday and Saturday.

Mediterranean

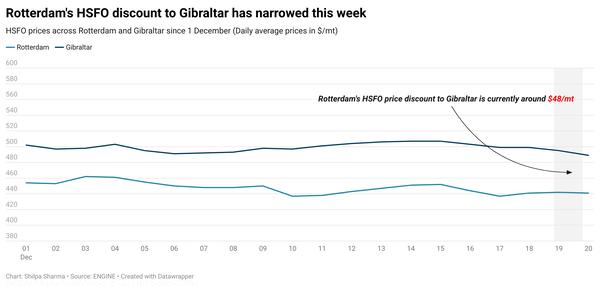

Availability of bunker fuel is normal in Gibraltar across all grades, a trader said. Lead times of 3-5 days advised for all grades. Bunkering was proceeding normally in Gibraltar on Wednesday, but wind gusts of 22 knots are forecast to hit the region on Friday and may impact bunkering in the port.

Bunker fuel availability is good in Ceuta and there is no tightness in VLSFO and LSMGO supply in the port, shipping agent Jose Salama & Co told ENGINE. Demand has been high in the port, the shipping agent added.

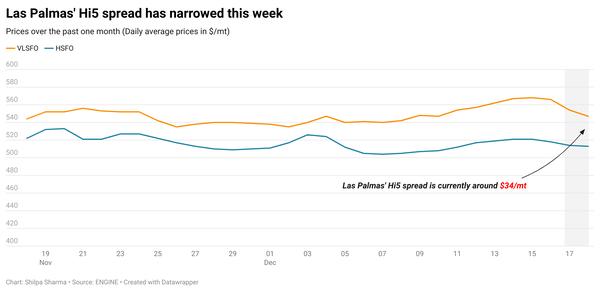

Securing very prompt supply (0-2 days) may be difficult in the Canary Islands’ port of Las Palmas. A trader recommends lead times of 4-6 days for all grades in the port. Rough weather is forecast in periods between Wednesday and Friday, which could delay operations or trigger suspension there.

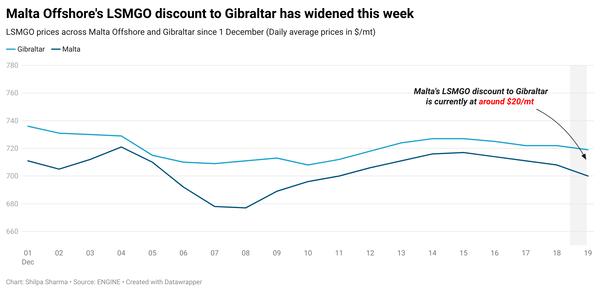

Bunker demand remains low in other Mediterranean ports of Piraeus, Malta Offshore and Istanbul, according to a trader.

The Greek port of Piraeus has normal availability across all fuel grades, a trader said. Lead times of 3-4 days advised across all grades. Bunkering could be impacted due to rough weather forecast between Wednesday to Friday, according to a source.

Bunker availability is also normal off Malta, a trader said. Availability is mostly good for prompt delivery dates with lead times of 3-4 days advised for all grades. Adverse weather is forecast on Wednesday and could disrupt bunkering there.

Availability is good in the Turkish port of Istanbul, with similar lead times of 3-4 days recommended for optimal coverage from suppliers. Bad weather-induced bunkering disruptions may arise in Istanbul between Wednesday and Saturday.

Africa

Prompt VLSFO availability remains tight in the South African ports of Durban and Richards Bay. Most suppliers are able to offer the grade for non-prompt delivery dates. Lead times of 7-10 days are advised for the grade, a trader told ENGINE.

LSMGO availability has tightened in Durban and is even more scarce for prompt dates. This has stretched lead times for the grade from last week's 7-10 days to two weeks now.

All bunker barges have left Algoa Bay amid the offshore bunkering suspension. TFG Marine and Minerva Bunkering moved their bunker barges away from the disputed bunker location between 28 May and 10 June, Unathi Sonti, executive chairperson of South Africa’s Maritime Business Chamber (MBC) told ENGINE.

Minerva’s barges were the last of the bunker barges off Algoa Bay, a source from Port Elizabeth confirmed.

Since the offshore bunkering suspension was enforced in Algoa Bay in September last year, suppliers have been diverting their barges to locations along the west African coast, another trader said.

Offshore bunkering has been suspended in Algoa Bay since last September when the South African Revenue Service (SARS) detained bunker barges due to import duty disputes. Bunker suppliers TFG Marine, BP and Minerva Bunkering actively supplied bunker fuel via barges off Algoa Bay before the suspension. Supply is currently limited to in-port deliveries by one supplier in Port Elizabeth, which is adjacent to Algoa Bay.

As a result of this offshore bunkering impasse and the Red Sea conflict, Namibia’s Walvis Bay has emerged as a popular refuelling hub for vessels rerouting around the Cape of Good Hope. Walvis Bay continues to see high demand compared to 2023, Monjasa’s commercial manager Gustavo Ferreria da Costa told ENGINE.

Total bunker volumes have remained steady since February–March this year, and Monjasa has been adjusting its operations and bunker fleet size to avoid stretched waiting times for customers seeking bunkers in Namibia, Da Costa said.

Bunker demand in Namibia's Walvis Bay soared in January, with the port witnessing heightened demand due to the Red Sea diversions announced by several shipping firms in December.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.