East of Suez Market Update 22 Apr 2024

VLSFO prices in most East of Suez ports have inched up, and availability of all grades remain tight in China’s Zhoushan.

PHOTO: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

PHOTO: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

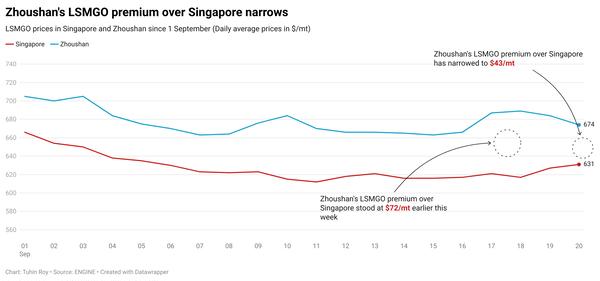

- VLSFO prices up in Zhoushan ($7/mt) and Singapore ($1/mt), and down in Fujairah ($3/mt)

- LSMGO prices up in Zhoushan ($8/mt), and down in Singapore ($15/mt) and Fujairah ($2/mt)

- HSFO prices up in Singapore ($12/mt), Fujairah ($11/mt) and Zhoushan ($7/mt)

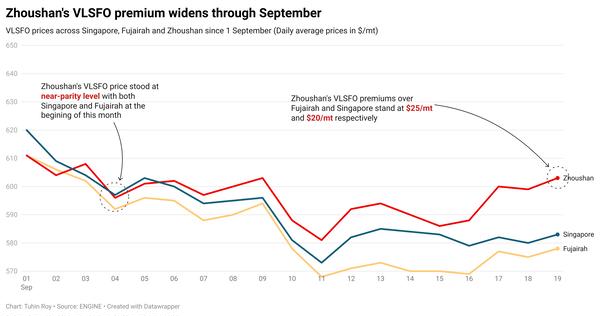

Over the weekend, Zhoushan's VLSFO benchmark has increased by $7/mt, while Singapore and Fujairah's prices have remained largely stable. Zhoushan's marginal VLSFO discounts to both Singapore and Fujairah have been erased and now stand at near parity levels.

Tight barge availability has constrained the supply of all grades in Zhoushan, with suppliers suggesting lead times of around 4-8 days for VLSFO and LSMGO, and 6-7 days for HSFO.

In Hong Kong, all bunker fuel grades are available with lead times of seven days, unchanged from the previous week.

HSFO prices in East of Suez ports have risen, particularly in Singapore, which saw a $12/mt increase over the weekend, driven by a higher-priced HSFO stem fixed on Friday. Despite this increase, Singapore's HSFO price remains at a marginal discount of $3/mt to Zhoushan and at near parity levels with Fujairah.

Lead times for VLSFO in Singapore have fluctuated significantly, with most suppliers recommending up to 12 days, while some can accommodate stems within six days. Prompt HSFO availability in Singapore has improved, with recommended lead times now at 4-7 days, down from 8-14 days last week. Lead times for LSMGO vary widely between 2-10 days in Singapore.

Brent

The front-month ICE Brent contract lost $1.00/bbl on the day from Friday, to trade at $86.37/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Despite Brent’s latest price drop, the benchmark has remained supported due to geopolitical tensions between Israel and Iran that have kept the oil market on its edge with supply concerns.

“[Oil] investors should pay close attention to oil prices as the war continues to evolve,” J. P. Morgan’s global market strategist Jack Manley said.

Oil market analysts continue to price in the chances of an Israeli airstrike in the future that could disrupt Iranian oil facilities. “Any further escalation would only bring the oil market closer to actual supply losses,” ING Bank’s head of commodities strategy Warren Patterson said.

The oil market has been beset with further supply-side risks. The US government reimposed oil sanctions on Venezuela after the country’s President Nicolás Maduro failed to fully meet the commitments made regarding holding fair presidential elections in the second half of this year.

This could potentially disrupt about 600,000 b/d of crude exports from Venezuela, ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent futures decline today can be attributed to the de-escalation of conflict between Israel and Iran.

“Crude futures were on a slippery slope… as relative calm on the Israel-Iran front over the weekend started to chip away at the Mideast geopolitical risk premium in prices,” VANDA Insight’s founder and market analyst Vandana Hari said.

It seems that currently both Iran and Israel are downplaying the implications of the latest events, market analysts added.

“Iran downplaying Israel’s attacks and showing no urgency to retaliate,” has put a downward pressure on Brent’s price, Saxo Bank’s head of FX strategy Charu Chanana said in a note.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.