East of Suez Market Update 21 Sep 2023

VLSFO and LSMGO prices have moved in mixed directions in East of Suez ports, and prompt availability remains tight across all grades in Fujairah.

PHOTO: Container cargo freight ship with working crane bridge in shipyard in Singapore. Getty Images

PHOTO: Container cargo freight ship with working crane bridge in shipyard in Singapore. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices unchanged in Fujairah, and down in Singapore ($6/mt) and Zhoushan ($2/mt)

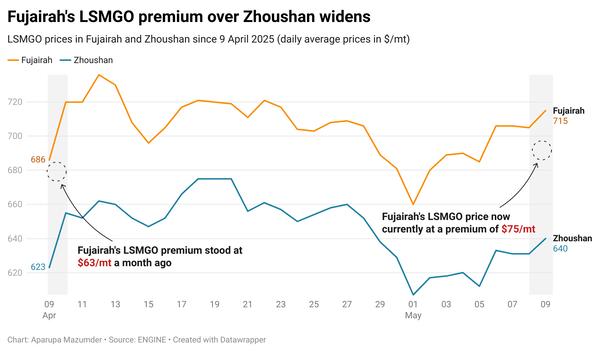

- LSMGO prices up in Fujairah ($2/mt) and Zhoushan ($1/mt), and down in Singapore ($4/mt)

- HSFO prices down in Fujairah ($16/mt), Singapore ($6/mt) and Zhoushan ($5/mt)

Fujairah’s VLSFO price has remained steady in the past day, while the grade’s prices in Singapore and Zhoushan have declined for the second consecutive day. Two higher-priced VLSFO stems fixed in Fujairah have helped the benchmark resist Brent’s downward pull.

Despite Fujairah’s steady VLSFO price, the port’s VLSFO discounts to Zhoushan and Singapore stand at $11/mt and $10/mt, respectively.

A source says good bunker demand has kept prompt availability under pressure in the Middle Eastern bunker hub, with most suppliers recommending lead times of 5-7 days across all grades. But some suppliers can supply all grades for prompt delivery dates depending on stem size.

Meanwhile, Singapore’s LSMGO price has declined by $4/mt in the past day, but the grade’s prices in Fujairah and Zhoushan have risen marginally. A total of four LSMGO stems were fixed in Singapore in a wide range of $39/mt, with some stems fixed at the lower end of the range contributing to drag the benchmark down.

Singapore’s LSMGO discounts to Zhoushan and Fujairah stand at $16/mt and $10/mt, respectively.

Prompt availability of both VLSFO and HSFO remains tight in Singapore, with lead times of 6-10 days and 5-9 days, respectively – almost unchanged from last week. On the other hand, LSMGO remains in ample supply in the port, with prompt dates available.

All bunker fuel grades remain in good supply in Hong Kong, with unchanged lead times of 5-7 days.

Brent

The front-month ICE Brent contract has shed $0.43/bbl on the day, to trade at $92.47/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures felt some upward pressure after the US Energy Information Administration (EIA) reported a decrease of 2.14 million bbls in commercial US crude inventories in the week that ended 15 September.

The weekly crude stock draw was mainly due to strong oil exports, the EIA said in its weekly report. The current crude inventory levels in the US stand at 418.47 million bbls, according to the latest figures released by the EIA.

“Brent is still trading well above $90/bbl and a tightening balance suggests that there is still more upside,” said analysts at ING.

Downward pressure:

The recent surge in Brent futures has been capped amid concerns that the US Federal Reserve’s (Fed) could hike interest rates in future.

The US Fed kept its interest rates unchanged during the two-day-long Federal Open Market Committee (FOMC) meeting on 19-20 September. However, oil market analysts have perceived this move as a hawkish pause, leaving room for future rate hikes.

“The Fed kept rates unchanged at yesterday’s FOMC meeting as widely expected. However, it was still seen as a hawkish pause, which put some pressure on risk assets,” which includes oil, said ING’s head of commodities strategy Warren Patterson.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.