East of Suez Market Update 20 Sep 2023

Prices have moved down in major Asian bunker hubs, and availability remains good across all grades in Zhoushan.

PHOTO: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

PHOTO: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($24/mt), Fujairah ($17/mt) and Singapore ($14/mt)

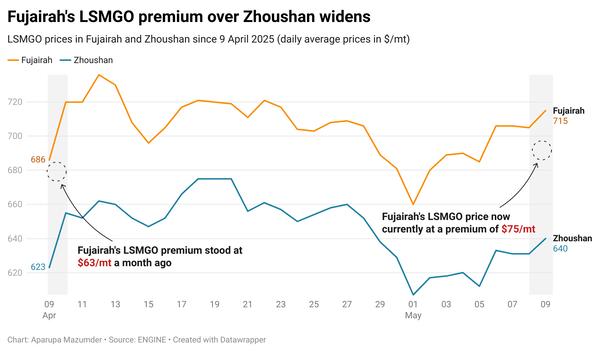

- LSMGO prices down in Fujairah ($53/mt), Singapore ($41/mt) and Zhoushan ($36/mt)

- HSFO prices down in Singapore ($26/mt), Zhoushan ($21/mt) and Fujairah ($15/mt)

Bunker benchmarks in East of Suez ports have declined in the past day, mirroring Brent’s downfall. Zhoushan’s VLSFO price has declined by $24/mt – steepest among the three major Asian bunker hubs. A total of five VLSFO stems were fixed in the Chinese bunkering hub in a wide range of $42/mt. Some VLSFO stems at the lower end of the range contributed to drag the port’s benchmark down.

Zhoushan’s steep VLSFO price decline has meant that its VLSFO premium over Singapore has been erased and now stands at a marginal discount of $3/mt. Its VLSFO premium over Fujairah has narrowed to $13/mt now.

Availability of all grades remains good in Zhoushan amid low bunker demand, with most suppliers recommending unchanged lead times of 3-5 days.

Several Indian ports, including Kandla, Cochin and Chennai, have good availability of VLSFO and LSMGO, with short lead times of 2-3 days advised. On the other hand, supply of both grades remains tight in the Indian ports of Mumbai, Tuticorin, Haldia and Visakhapatnam, with deliveries subject to enquiry, a source says.

Bad weather conditions are forecast in the Indian port of Visakhapatnam on 2 October, in the Sri Lankan port of Colombo on 30 September and in the Kiwi port of Tauranga on 23 September, which might disrupt bunkering at these ports.

Brent

The front-month ICE Brent contract has lost $2.25/bbl on the day, to trade at $92.90/bbl at 17.00 SGT (09.00 GMT).

Upward pressures:

Brent futures gained some support after the American Petroleum Institute (API) reported a bigger-than-expected decline in the US commercial crude inventories in the week ended 15 September.

US crude stocks fell by 5.25 million bbls, while analysts expected a fall of 2.67 million bbls, reported Trading Economics citing API data from its Weekly Statistical Bulletin that tracks crude stock builds in the US.

This week’s data “marked the fifth week of declines in the US Crude Oil Inventories in the last six weeks,” said Trading Economics.

Moreover, the Russian government is planning to impose an export duty of $250/mt on all oil products starting 1 October 2023 until 1 June 2024 as a measure to combat fuel supply shortage in the country, Reuters reported citing sources. This move by Russia could push Brent futures higher from current levels in the fourth quarter of 2023.

Downward pressures:

Brent futures lost previous day’s gains as the oil investors focused on the outcomes of the ongoing US Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) meeting.

Oil investors are awaiting the US Fed’s interest rate decision, which could have a direct effect on global oil demand.

"The oil rally is taking a little break as every trader awaits a pivotal Fed decision that might tilt the scales of whether the US economy has a soft or hard landing," said OANDA’s senior market analyst Ed Moya.

Another cycle of rate hikes in the US would make dollar-denominated commodities like oil costlier for non-dollar holders. Higher interest rates discourage borrowing and spending, which leads to a decline in economic activity and fuel demand.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.