East of Suez Market Update 19 Sep 2023

Regional bunker prices have moved in mixed directions, and availability of VLSFO and HSFO is tight in Singapore.

PHOTO: Cargo terminal at the Port of Singapore. Getty Images

PHOTO: Cargo terminal at the Port of Singapore. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

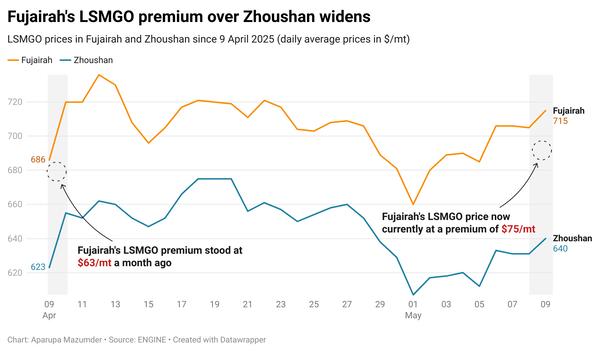

- VLSFO prices up in Zhoushan ($7/mt), and down in Fujairah ($12/mt) and Singapore ($1/mt)

- LSMGO prices up in Fujairah ($9/mt), and down in Singapore ($11/mt) and Zhoushan ($1/mt)

- HSFO prices down in Fujairah ($12/mt), Zhoushan ($9/mt) and Singapore ($2/mt)

Bunker prices across all grades have come down in Singapore in the past day. But tight availability of HSFO and VLSFO has limited the price drop in the port’s benchmarks. Securing prompt deliveries of the two grades can be difficult in the Southeast Asian bunker hub, where several suppliers are recommending lead times of 9-13 days for VLSFO and 7-9 days for HSFO, a source says.

On the other hand, Zhoushan’s VLSFO price has increased some in the past day. The diverging price moves have flipped Singapore’s VLSFO price to a discount of $7/mt to Zhoushan from near parity levels the previous day. Two VLSFO stems in a range of $12/mt have been fixed in Zhoushan in the past day.

Availability of all bunker fuel grades in Zhoushan is said to be normal amid sluggish demand. Lead times of 3-5 days are advised by most suppliers there. However, there is a forecast of bad weather conditions in Zhoushan today and tomorrow, which could disrupt bunker operations in the port, a source says.

HSFO prices in East of Suez ports have come down in the past day. Fujairah’s HSFO price has dropped by $12/mt – steepest among three major Asian hubs. One lower-priced HSFO stem fixed in Fujairah in the past day has contributed to drag the port’s benchmark down. Meanwhile, bunker fuel availability is said to be tight in Fujairah, with recommended lead times of 5-7 days across all grades, a source says.

Brent

The front-month ICE Brent contract has moved up $1.16/bbl on the day, to trade at $95.15/bbl at 17.00 SGT (09.00 GMT).

Upward pressures:

Brent futures erased previous day’s losses as concerns about the tight global supply pushed oil prices higher today.

Saudi Arabia and Russia’s decision to extend oil output cuts into the fourth quarter of 2023 has prompted concerns about a supply crunch in the global market.

“Oil prices remain well supported, with ICE Brent edging closer towards $95/bbl as the market continues to become increasingly concerned over the tightness in the oil balance for the remainder of the year,” said ING’s head of commodities strategy Warren Patterson.

Commercial oil inventories in Europe, the US, and Japan are experiencing a “substantial decline”, commented SPI Asset Management’s managing partner Stephen Innes. “This sharp downturn results from a combination of remarkably resilient global demand and substantial production cuts enforced by the OPEC+ alliance, contributing to the current bullish dynamic in oil markets,” he further added.

Downward pressures:

Meanwhile, oil analysts expect the recent surge in oil prices to have a substantial impact on global inflation. Oil plays a pivotal role in major industries and with its prices on the rise, it might also influence prices for other goods and services. “The recent surge in oil prices, which have reached a 10-month high of $95/bbl, is causing ripples across the global economy and financial markets,” said Innes.

“There's a growing concern about the potential inflationary pressures this [oil prices] could exert on the global economy, potentially leading to an unfavourable shift in the global growth/inflation balance,” Innes added.

Moreover, Saudi Aramco’s chief executive Amir Nasser has lowered the company’s outlook for global oil demand, Reuters reported. The company now expects global demand to reach 110 million b/d by 2030, lower than its previous estimate of 125 million b/d. This news has added additional downward pressure on Brent futures.

By Shilpa Sharma and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.