East of Suez Market Update 24 May 2024

Most bunker benchmarks in East of Suez ports have come down, and VLSFO and LSMGO supply remains good across most Australian ports.

PHOTO: An aerial view of Melbourne central business district, Victoria, Australia. Getty Images

PHOTO: An aerial view of Melbourne central business district, Victoria, Australia. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

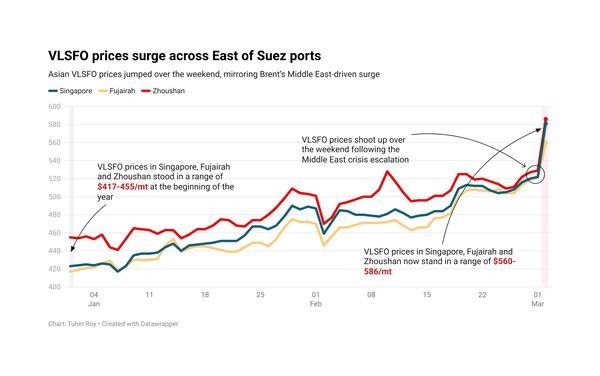

- VLSFO prices up in Fujairah ($2/mt), and down in Singapore ($19/mt) and Zhoushan ($11/mt)

- LSMGO prices down in Singapore ($17/mt), Zhoushan ($15/mt) and Fujairah ($12/mt)

- HSFO prices down in Singapore ($8/mt), and Fujairah and Zhoushan ($6/mt)

VLSFO prices in Singapore and Zhoushan have decreased in the past day, while the grade's price in Fujairah remained stable. Singapore's VLSFO price dropped by $19/mt, hitting its lowest level since January. A lower-priced VLSFO stem fixed in Singapore contributed to dragging the benchmark down. Despite the steep fall in Singapore's VLSFO price, its premium over Fujairah remains at $8/mt. The port's VLSFO price is at parity level with Zhoushan.

Bunker demand in Singapore has seen some improvement this week. Lead times for VLSFO have shown significant fluctuations recently, with most suppliers recommending up to nine days for deliveries there. However, some can accommodate stems within four days.

HSFO supply remains limited in the port, with recommended lead times unchanged at 8-13 days. Lead times for LSMGO vary widely, ranging from 3-8 days.

In Western Australia, both Kwinana and Fremantle ports offer VLSFO and LSMGO, with lead times typically ranging from 7-8 days. In New South Wales, LSMGO is readily available in Sydney, while HSFO supply is mostly subject to enquiry. In Victoria, Melbourne has good availability of VLSFO and LSMGO. Ample supply of VLSFO is available in Geelong. However, prompt HSFO supply can be limited in both Victorian ports.

In Queensland, Brisbane and Gladstone ports maintain sufficient stocks of VLSFO and LSMGO, with lead times of 7-8 days. However, HSFO availability remains constrained in Brisbane.

Brent

The front-month ICE Brent contract lost $1.00/bbl on the day, to trade at $81.01/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Currently, the oil market’s attention is on the Organization of the Petroleum Exporting Countries and its allies (OPEC+).

“The key issue that currently moves [Brent] oil prices is whether or not OPEC will extend production cuts into 2025,” Price Futures Group’s senior market analyst Phil Flynn remarked.

The coalition is expected to convene in the first week of June to decide whether an extension of the ongoing 2.2 million b/d voluntary production cut is required in the second half of this year.

“There’s no doubt about the commitment by OPEC plus to continue along the path that they are on,” Flynn said.

Downward pressure:

Brent futures moved lower for the fourth consecutive day amid demand growth concerns in the world’s leading crude oil-consuming country, the US.

“Ongoing market recalibration of expectations over the US Federal Reserve’s monetary policy through the rest of this year remains centre-stage for the oil complex,” VANDA Insights’ founder and analyst Vandana Hari said.

Minutes from the US Federal Reserve’s (Fed) latest Federal Open Market Committee (FOMC) meeting showed that sticky inflation remained the US central bank’s biggest concern.

“The Fed Minutes were a buzz kill for smoking hot commodities after it said that some Fed officials might be willing to raise interest [rates], if need be,” Flynn said.

The Fed’s bearish remarks dampened the oil market’s expectation of a steady demand growth this year as it could delay interest rate cuts.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.