East of Suez Market Update 21 May 2024

VLSFO and LSMGO prices in East of Suez ports have moved down, and both grades are readily available in Port Klang and Hong Kong.

PHOTO: Various cargo ships waiting to load and unload in the harbour at the port of Singapore. Getty Images

PHOTO: Various cargo ships waiting to load and unload in the harbour at the port of Singapore. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

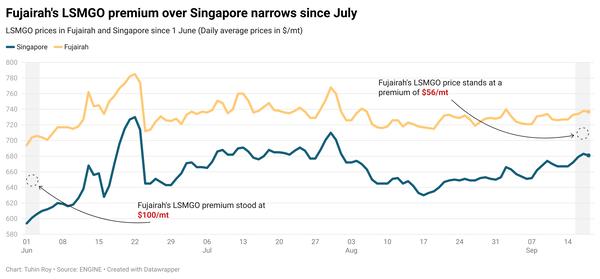

- VLSFO prices down in Singapore ($10/mt), Fujairah ($7/mt) and Zhoushan ($6/mt)

- LSMGO prices down in Zhoushan ($8/mt), Singapore ($2/mt) and Fujairah ($1/mt)

- HSFO prices up in Fujairah ($10/mt) and Zhoushan ($2/mt), and down in Singapore ($2/mt)

Bunker benchmarks in East of Suez ports have mirrored Brent's downward trend. Singapore's VLSFO price has seen the most significant drop of $10/mt, compared to two other major Asian bunker ports. A lower-priced VLSFO stem fixed in the past day has contributed to drag the benchmark down. Singapore's VLSFO price currently holds a premium of $8/mt over Zhoushan and is at near parity levels with Fujairah.

Lead times for VLSFO in Singapore have shown notable fluctuations recently. Currently, most suppliers are suggesting lead times of up to 10 days for this grade, while some can accommodate stems within five days.

HSFO supply remains restricted in the port, with recommended lead times unchanged at 8-12 days, similar to last week. Lead times for LSMGO vary widely, ranging from 2-8 days.

In Malaysia's Port Klang, VLSFO and LSMGO grades are readily available, and certain suppliers can provide prompt deliveries for smaller parcel sizes. However, HSFO remains in short supply at the port.

In Hong Kong, all fuel grades are in good supply, and the recommended lead times remain approximately seven days, consistent with last week.

Brent

The front-month ICE Brent contract moved $0.95/bbl lower on the day, to trade at $83.06/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures found some support from the escalating political turmoil in the Middle East, while the recent drone attacks on Russian energy facilities have raised supply concerns in the global oil market.

“The Middle East political landscape was shaken by the death of Iran’s President. Separately, there are concerns over the health of Saudi Arabia’s King, Salman bin Abdulaziz,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

A barrage of missiles caused a fire in Russian state-owned oil company Rosneft’s Tuapse refinery in Krasnodar region over the weekend, the country’s defense ministry said. The news supported Brent futures as the oil market “got a reminder that geopolitical risks have not evaporated,” Hynes said.

With supply concerns still looming, oil market watchers will now focus on the OPEC+ coalition, which is scheduled to convene in June to discuss output policies for the rest of the year. “There are growing expectations that it [OPEC+] will extend these [2.2 million b/d supply cuts] until the end of the year,” Hynes added.

Downward pressure:

Brent’s price lost upward momentum after officials from the US Federal Reserve (Fed) claimed that more signs of a slowdown in inflation were required before considering interest rate cuts this year.

"Inflation readings in the first quarter of this year were disappointing. These results did not provide me with the increased confidence that I was hoping to find to support easing monetary policy," Fed vice chair for supervision Michael Barr said at an Atlanta Federal Reserve conference on financial markets, according to Reuters.

The Atlanta Fed president Raphael Bostic said it will "take a while" for the US central bank to be assured that a slowdown in inflationary pressures was achieved, Reuters reported.

Brent’s price gains were capped after Fed’s senior official Michael Barr said the central bank “should maintain interest rates at current elevated levels for longer than previously expected due to stubbornly high inflation data,” VANDA Insights’ founder and analyst Vandana Hari remarked.

Higher interest rates can reduce oil demand by increasing the cost of commodities like oil for non-dollar holders.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.