Rare Antwerp-Bruges bunker sales release shows it as fourth biggest bunker hub

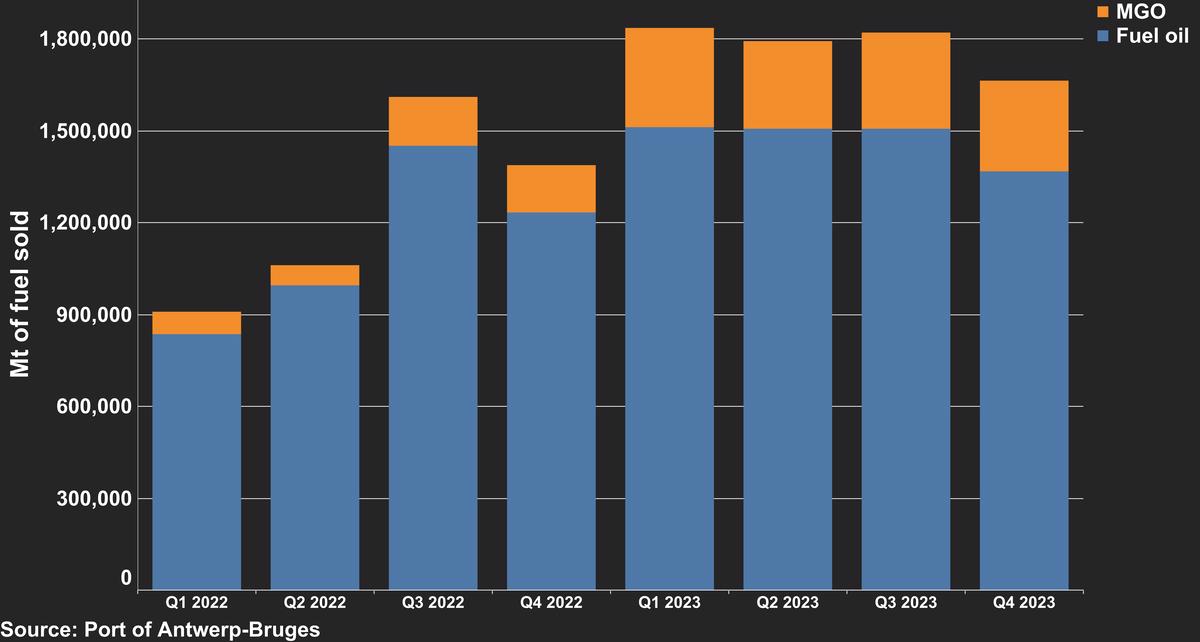

The Port of Antwerp-Bruges’ bunker fuel sales hit record highs last year, backed by a strong first quarter.

Bunker sales in Antwerp-Bruges since Q1 2022

Changes in Antwerp-Bruges bunker fuel sales from 2022 to 2023:

- Total sales up by 2.14 million mt to 7.12 million mt

- Fuel oil sales up by 1.38 million mt to 5.90 million mt

- MGO sales up by 765,000 mt to 1.22 million mt

The Port of Antwerp-Bruges released its bunker sales figures for the first time in years. The port released Antwerp sales data which goes back to 2015, while Zeebrugge sales are from 2016 onwards. The Port of Antwerp-Bruges’ combined sales might have reached their highest level ever last year, and were at least greater than in any year since 2015-2016.

The sales figures also revealed an increase in total bunker fuel sales in every quarter of 2023. Consolidated fuel oil bunker sales in Antwerp-Bruges were up by 31%. While Antwerp provides more granular data by specific fuel grades like VLSFO, ULSFO and HSFO, Zeebrugge bulks them into fuel oil and gasoil groups.

Zeebrugge’s total fuel oil sales declined by 15% in 2023, pulled down by a weak fourth quarter. Antwerp showed a 46% rise in fuel oil sales, backed by a 133% increase in the first quarter.

Antwerp’s VLSFO sales increased by 24% and were at their highest ever level since the grade was introduced ahead of the IMO’s 0.50% sulphur cap in 2020.

ULSFO sales in Antwerp plunged 27% lower year-on-year. ULSFO sales showed a moderate 7% increase in the first quarter, after which the numbers dipped consistently. The third quarter showed a steep drop of 54%. ULSFO sales also declined compared to the 2016-2019 period when sales were significantly higher.

Antwerp’s HSFO sales saw a significant 177% upswing, the highest since 2020. HSFO sales shot up by 294% in the third quarter, but have yet to return to previous highs observed in the 2015-2019 period when the figure was well above the 3 million mt mark.

Consolidated marine gasoil sales figures for Antwerp-Bruges surged by 169%, with a 347% rise in the first quarter alone. This pushed MGO sales past the 1 million mt mark, a feat last achieved in 2019. Zeebrugge’s MGO sales dipped in 2023, with no sales reported in the second quarter of the year. This dragged the overall sales figure down. Antwerp’s MGO sales jumped by 187%, also backed by a strong first quarter.

Singapore maintained its position as the biggest conventional bunker hub with a combined 51.85 million mt sales figure for conventional and bio-blended bunkers in 2023. Rotterdam held onto the second spot with 9.63 million mt of conventional and bio-blended bunkers sold.

Fujairah came in third with 7.36 million mt bunker fuels sold, followed by Antwerp-Bruges which emerged as the fourth biggest bunker port with 7.12 million mt. Zhoushan took fifth place with 7.05 million mt.

The Port of Antwerp-Bruges did not split its sales figures into conventional and bio-blended bunker fuels. They are both combined into its overall sales figure.

The huge year-on-year variations in Antwerp-Bruges' sales figures could also be a result of changes to data collection.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.