Where do forecasters see VLSFO prices by the end of the year?

High prices took a sharp dip last week; but it was only very brief

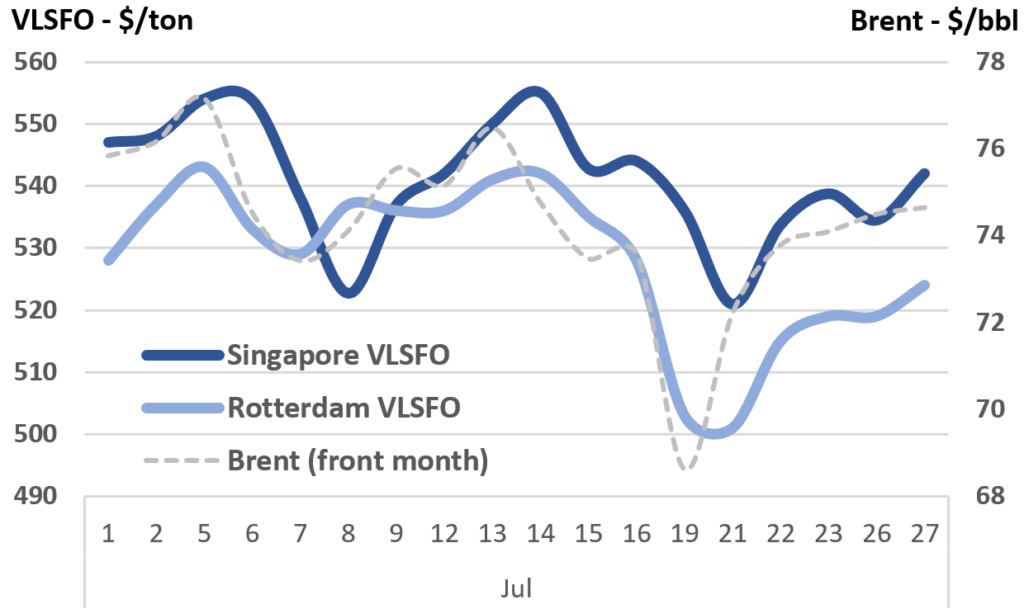

In our report a month ago we highlighted the bullish nature the oil market has adopted and through the first half of this month the average Brent crude price (front month futures) was at $75/bbl; its highest for almost 3 years. Throughout this period Brent traded in the $74-78/bbl range, but prices never stay the same, and at the start of last week there was a ‘wobble’ and we saw Brent fall by $5/bbl, to below $70/bbl (minus 7%)

This sharp drop came with ‘jitters’ in the financial markets surrounding higher Covid cases and at a time of a two-week delay in OPEC+ reaching an agreement from its early July meeting.

However, what is interesting is that the bearish signals were very short-lived, and prices have very quickly rebounded, with Brent back above $74/bbl; the underlying price sentiment is still supportive at these levels.

Bunker prices will trend with crude price movements, and the crude price drop last week led to VLSFO quotes in Rotterdam and Singapore falling by $25-30/ton (minus 4-5%). This was slightly less than the 7% fall in Brent prices, but the price tracking is clear.

Like crude, the drop in bunker prices was extremely brief and since then there has also been a rebound, with prices now back to where they were one and a half weeks ago.

OPEC+ has come up with a strong, price supportive agreement

In our report a month ago we highlighted the demand-led nature in the price recovery, and in particular the drive from the US. We then made some concluding comments on oil supply, with US oil production, Iranian sanctions and what the OPEC+ group will do.

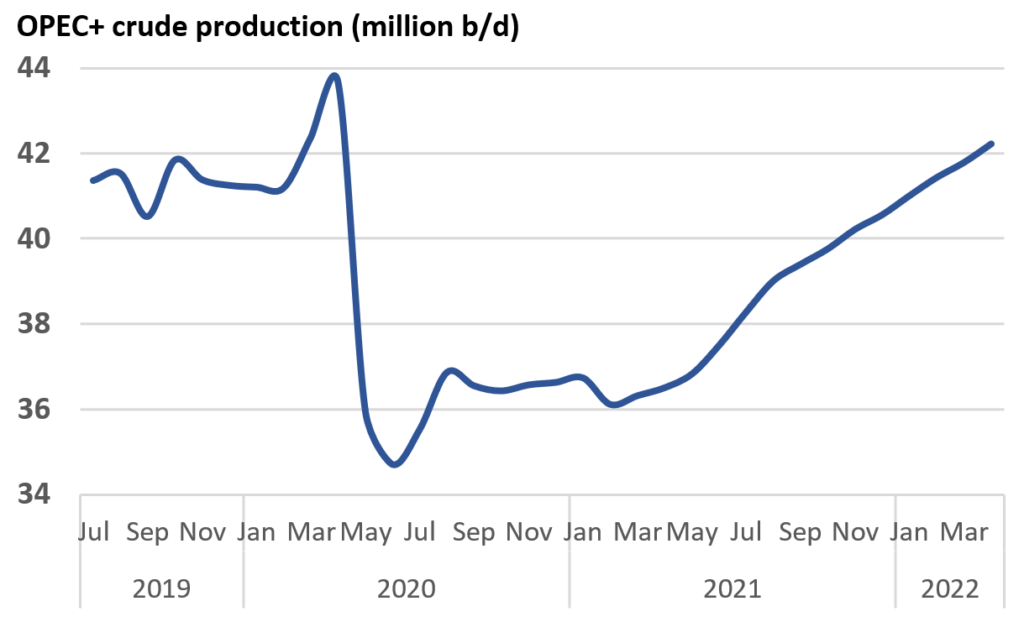

Oil supply is an important feature of ongoing price determination, and this was clouded in the wake of initial disagreement at the July 1st-2nd OPEC+ meeting. At this session the UAE blocked any extension to the current agreement, wanting an increase in its’ baseline reference allocation. Things were resolved after two weeks, with 5 OPEC+ countries getting a higher reference allocation from next May and the end date of the agreement was extended from April 2022 to December 2022. On this basis there now appears to be a rigorous agreement in place, gradually phasing in a production increase of 0.4 million b/d per month through to April next year, and then further increases through to December 2022.

This ties in with OPEC’s general approach to the market, managing an underlying price (it is impossible to micro-manage an exact and consistent price). It also gives international markets the confidence of sufficient supplies to prevent prices surging and damaging economic growth; any damage to future economic growth will ultimately come back to lower oil demand and reduced requirements for OPEC crude. In fact, the Saudi oil minister stressed the importance of looking further ahead, and in this case to end 2022.

The graph below illustrates the extent of the major production cutbacks undertaken by the OPEC+ group and how the planned, managed return in output is expected to take place.

Within this, there may be issues that some OPEC+ countries are not able to get back to their pre-pandemic production levels because of deterioration in their upstream sector over the past 18 months. This could cause a potential spike in prices, and one analyst is still talking about $100 prices in the middle of next year. However, if this is the case, it is highly likely that OPEC will respond by using some of its’ spare production capacity to make up the shortfall in order to prevent any such extreme price spike.

This managed and gradual increase in OPEC+ production is now seen as supportive to oil prices. At the same time, anticipated increases in oil demand with successful vaccination programs will keep oil fundamentals ‘tight’. This is the general view in the market at the moment and is reflected in the leading forecasts of oil prices over the rest of this year and going into 2022.

Analysts see crude prices at, or above current levels for the rest of the year

Price dips like last week may be a continued feature of the market, with economic concerns being raised with any hint of increased lockdowns, negative news on Covid variants, or even delays to opening up. But as long as there is a visible path back to ‘normality’ with oil demand rising and OPEC+ managing, then it seems the underlying bullish nature in the market will continue.

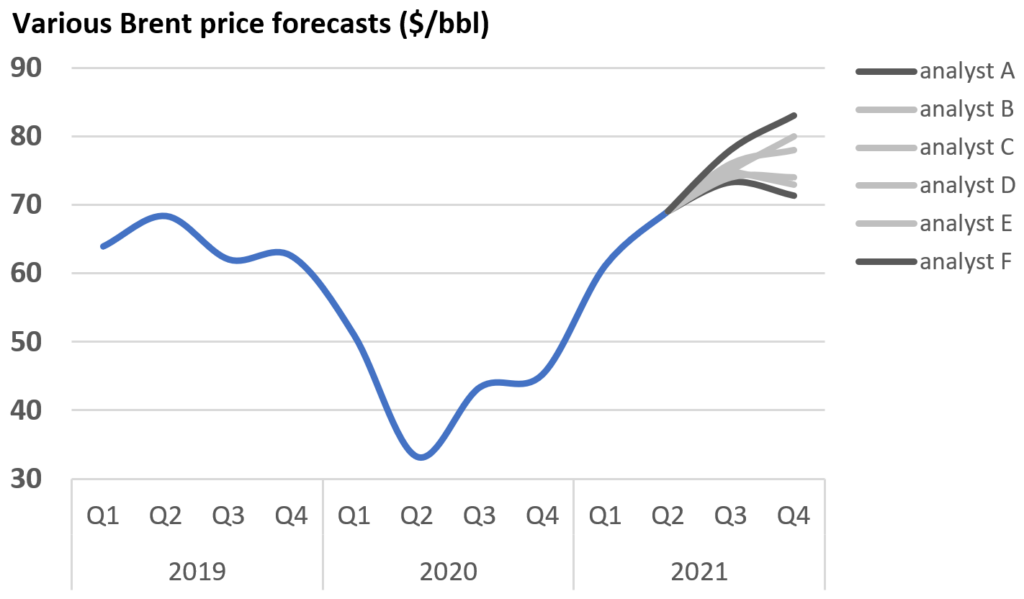

Looking at a range of crude price forecasts over the rest of this year, the view is that prices will at least remain around current levels. The lowest forecasts for Brent crude through to end year are in the low $70s, with the higher forecasts some $10/bbl above this, in the low $80s. A number of forecasters then fall somewhere within this relatively narrow range.

The consensus view is that we are definitely well beyond low oil prices, and all the listed analysts’ price projections are considerably higher than we saw throughout 2019, before the pandemic hit. In fact, you have to go back to mid/late 2018 to see prices at similar levels to these forecasts.

What does this mean for bunker prices?

It is often ‘dangerous’ when there is such a close consensus on the outlook, but this does reflect current thinking and a relatively balanced world; lower covid numbers and a well-managed production profile going forward.

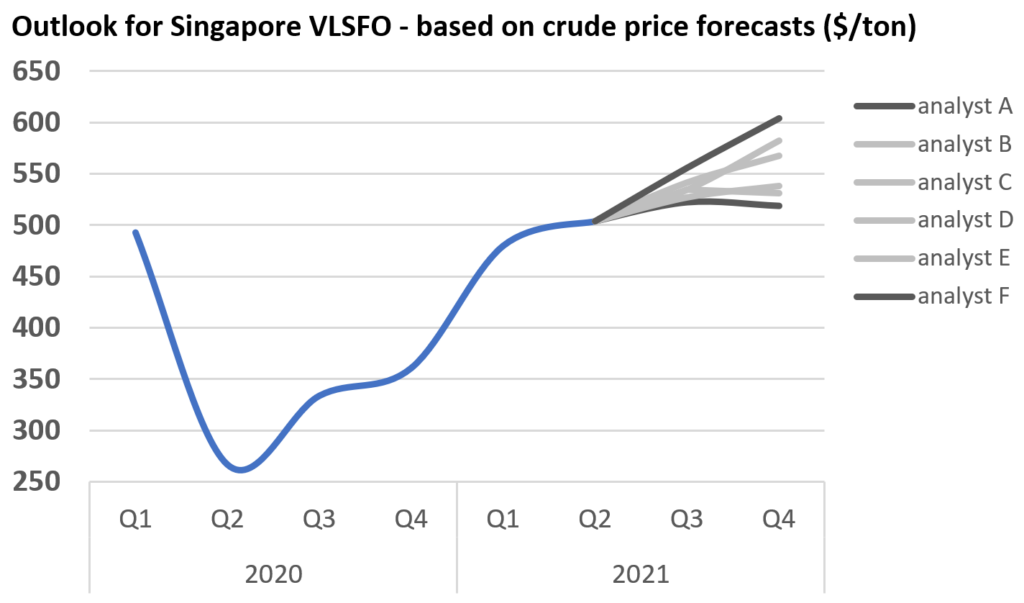

The question then is: what does this look like for bunker prices? With the end 2019 introduction of the VLSFO grade, there is not the same period of historical comparison, but if these crude price analysts are correct, it would mean VLSFO prices at least remaining close to current levels through to the end of the year, and a consensus view that prices could be slightly higher.

Singapore VLSFO prices are currently quoted around $535/ton, and based on the lower crude price outlook this would suggest Singapore VLSFO averaging around $525/ton in the 4th quarter this year. Taking the higher forecast of Brent at just above $80/bbl would imply Singapore VLSFO slightly above $600/ton in Q4; some $70/ton higher than today.

It then depends on how much you believe the forecasters. These groups only work with what they know and their view of the future based on today’s understandings. We have seen how rapidly new events can change things, but it is still important to understand what is happening in the market and what is driving prices in our business (and it also keeps forecasters employed).

Steve Christy

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.