What is OPEC+ going to do in June (and the rest of this year)? It will be an important issue for us in bunkers!

Bunker prices are at their lowest for three months

Although VLSFO has been in a relatively narrow price range, prices are now at their lowest for more than 3 months. The sharp drop in oil prices at the start of this month has meant Singapore and Fujairah VLSFO prices are down by $20/mt since end April, with Rotterdam VLSFO down by $30/mt.

General concerns about future economic growth, a perceived greater chance of a truce in the Israel/Gaza conflict, weaker oil demand (especially in Europe) and rising oil stock levels have all contributed to this bearish sentiment and led prices down.

Source: Integr8 Fuels

Source: Integr8 Fuels

Lower crude prices mean OPEC+ has tough decisions to take

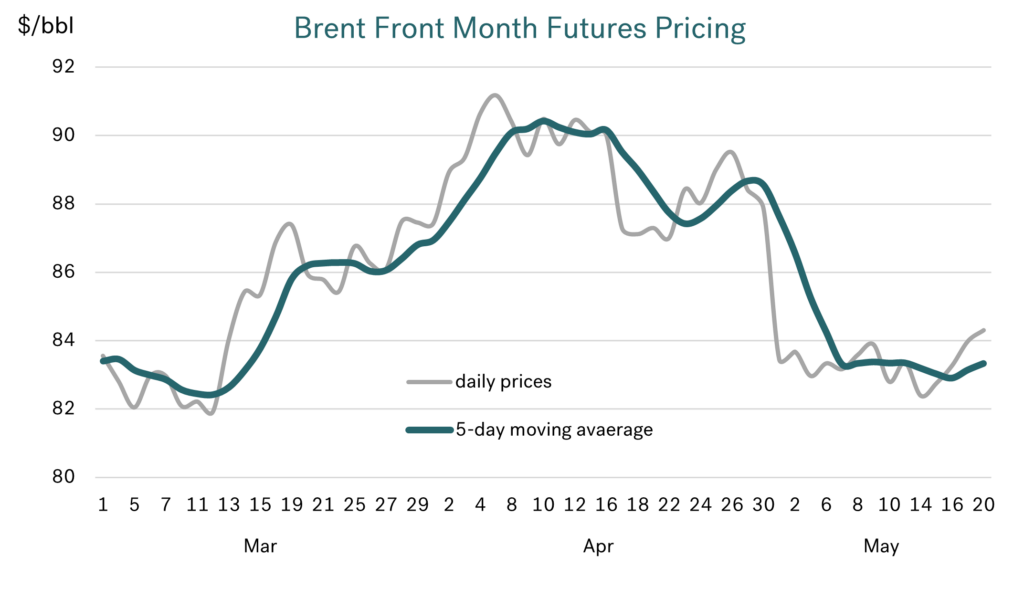

The drop in crude prices has meant Brent has fallen from $90+ levels, back down to the low $80s, and is why OPEC+ is facing a significant dilemma at their upcoming June 1st meeting.

Source: Integr8 Fuels

Source: Integr8 Fuels

The big questions for OPEC+ surround their production cutbacks, where there are three key aspects:

- First, the main cutbacks from all OPEC+ countries that amount to around 3.7 million b/d. These have been extended a number of times and are now scheduled to run until the end of this year, and so perhaps will not be a primary focus just yet.

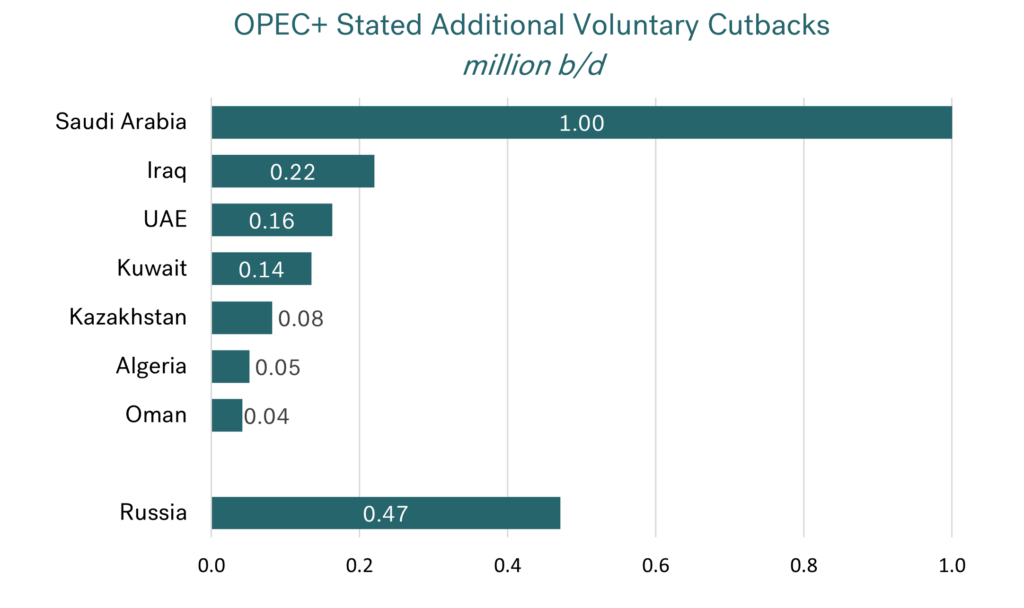

- The main issue now surrounds a limited number of OPEC+ countries that have made additional voluntary cutbacks totalling 2.2 million b/d. These were implemented in July 2023 and have been extended through to the end of the second quarter this year.

- Finally, the extent of continued over-production by some countries. In April, the main ‘over-producers’ were Iraq (at 0.24 million b/d), UAE (0.24 million b/d), Kazakhstan (0.13 million b/d) and Russia (0.20 million b/d)

The immediate dilemma for OPEC+ is: what do those countries making the additional voluntary cutbacks do? The quote from OPEC in early March was that from end June “these voluntary cuts will be returned gradually subject to market conditions”. Will they do this?

Which countries are we talking about?

Of the eight countries involved in the additional 2.2 million b/d cutbacks, Saudi Arabia is by far the biggest, and most likely to drive the decision to extend or unwind this part of the agreement.

Source: Integr8 Fuels

Source: Integr8 Fuels

On paper, Russia also has a significant role, but this is ‘clouded’ by the fact that the crude cutbacks are split between production for the domestic market and those for export. It is only the export volumes that matter to the fundamentals and sentiment in international oil markets.

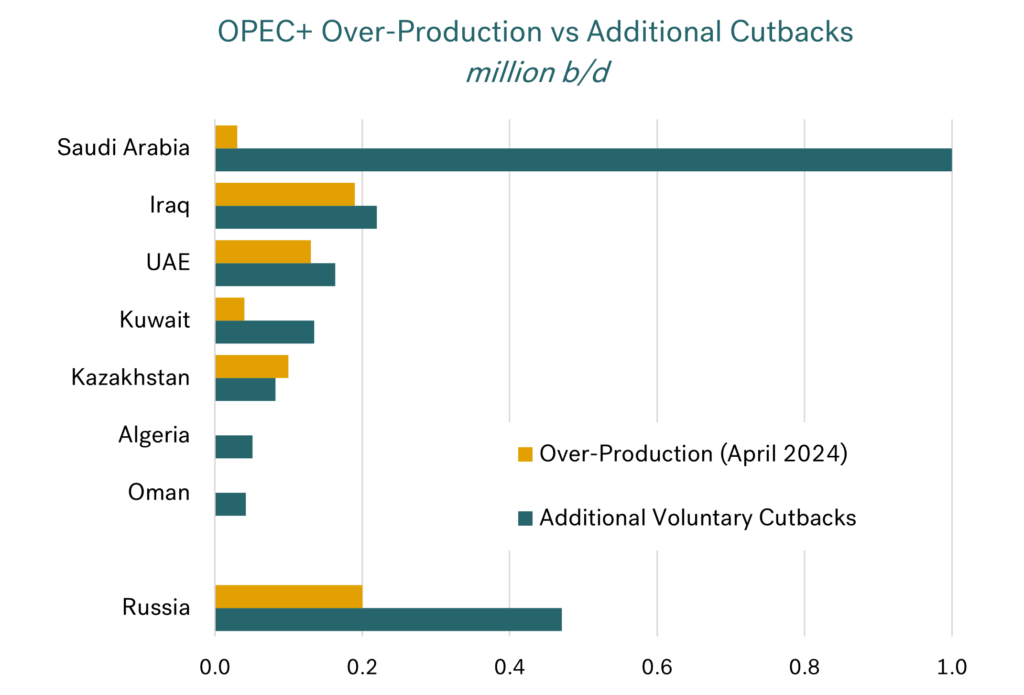

Not all eight countries will have an impact

Outside of Saudi Arabia, and possibly Russia, there may be little impact from the unwinding this ‘additional’ agreement. Even if it does go ahead, it is possible that there will be very little (if any) change in production from six of the eight member countries involved.

The reasoning here is that in the broader OPEC+ agreement covering all countries, the four members that are producing substantially more than their allocation (Iraq, UAE, Kazakhstan, and Russia) are also included in the eight members that make up this additional 2.2 million b/d cutback.

The graph below illustrates the extent of over-production versus the agreed additional cutbacks made by each of the eight countries involved.

Source: Integr8 Fuels

Source: Integr8 Fuels

For instance, Iraq is currently producing around 0.19 million b/d more than its 4.00 million b/d allocation. If the additional cutbacks are removed, then Iraq’s new allocation will rise to 4.22 million b/d. This is virtually in-line with their current production. So, for Iraq, it could be that they just maintain current production levels as the additional cutbacks are unwound. This would mean they automatically fall into line as a ‘good’ member, adhering to their new, higher allocation; AND there will be no increases in world oil supply!

It is exactly the same for UAE and Kazakhstan; their output levels can just continue at current levels, and they will also ‘fall into line’ with their new allocation as the additional cutbacks are unwound.

After this, Algeria and Oman are relatively small players in volume terms, and so will have limited impact. It does mean that Saudi Arabia and Russia will be the main protagonists.

So, what will happen if the additional cutbacks are unwound in Q3?

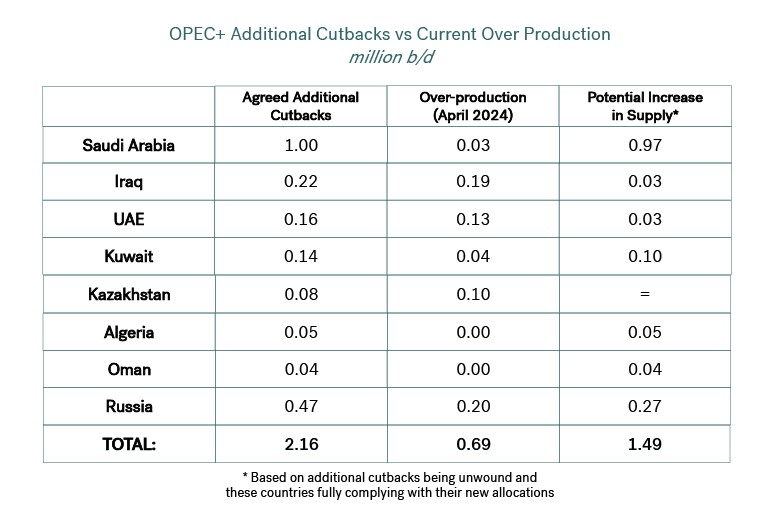

Based on the scenario above, which is credible, if the additional cuts are removed then Saudi Arabia is highly likely to ramp up production by 1 million b/d, and Kuwait potentially by 0.1 million b/d.

That then leaves Russia, which is highly uncertain given it may not have capacity to raise output, and if it has, whether this would go to their domestic market, or into the international market.

The table below indicates what the agreed additional cutbacks are, compared with the latest levels of over-production. Assuming the agreement is unwound and each country abides by its new production allocation, the final column shows the potential gain in oil supply.

Source: Integr8 Fuels

Either way, it looks like a removal of the additional OPEC+ cuts would result in an extra 1.0-1.2 million b/d to world oil supply (outside of Russia), and not the full 2.2 million b/d headline figure.

What signal would an ‘unwinding’ send to the market?

The IEA and the US EIA put the call on OPEC+ remaining more-or less flat through the rest of this year, and also flat to a potential slight decline next year (highlighted in our report April 24th). This implies any unwinding of the OPEC+ additional cuts would be a bearish signal to the market this year (and even in 2025!).

However, market analysis by OPEC contradicts this, and shows a much stronger growth in oil demand for 2024 and 2025 than other organisations. In their latest report, OPEC indicates the call on OPEC+ increasing by around 0.8 million b/d over the remainder of this year, and another 0.9 million b/d between end 2024 and end 2025. On their basis there is room for OPEC+ to start unwinding the additional cutbacks from end June and there would be only a small material change to the fundamental oil balance.

It is likely to come down to Saudi policy

Although an announcement could be made at any time, the market focus will be on the run-up to the June 1st OPEC+ meeting.

If the group decides to extend the additional cuts again, then this is more likely to be seen ‘price neutral’.

For most, an unwinding is likely to be seen as a bearish signal. In this case, bunker prices would fall. There are also further implications for us in bunkers, as almost all the crude supply gains would be heavy/sour grades from the Middle East, and so have a potential impact on the VLSFO/HSFO spread.

Is there a ‘curved ball’, where OPEC+ make more cuts? We can only keep an eye on OPEC+ and Saudi Arabia ahead of the June meeting (and for the rest of this year and next!).

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.