VLSFO Prices Are At An All-time High – Politics Have Trumped Oil Fundamentals

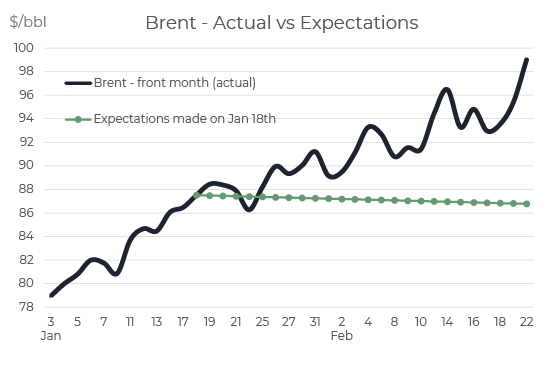

Brent is close to $100/bbl – Around $12/bbl higher than expected

Last month we outlined all the fundamental reasons why Brent crude prices were justified in the $80 region and why prices were expected to fall to the $70s in the second half of this year (and that bunker prices would follow the trend). We ended the note with a brief caveat on the politics around Russia and around Iran; clearly the caveat has kicked in and geopolitics have come to the forefront and taken oil prices up another level, with Brent futures in the range of $96 – $99/bbl.

Source: Integr8 Fuels

Source: Integr8 Fuels

The political and military developments in Russia/Ukraine, talk of an imminent invasion and the very recent

heightened tensions have pushed prices way above the expectations made a month ago.

Brent front month futures have been trading within a range of $96 – $99/bbl, and physical Brent has moved well above the ‘magical’ $100/bbl marker. It’s a reminder that fundamental analysis typically gives us the basis for price direction, but military and political threats trump the fundamentals.

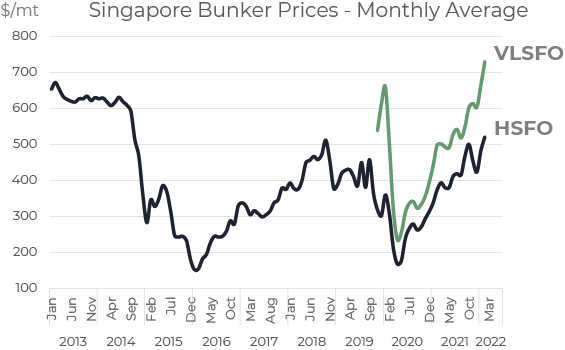

VLSFO prices are at all-time highs – Around $80/mt more than expected

Crude sets the underlying price for all oil products, and bunker prices have moved in line with Brent. It means that VLSFO prices in Singapore have been quoted in the range $750 – $770/mt, which is at an all-time high; even higher than the early January 2020 ‘introductory’ prices.

Singapore HSFO prices have also risen sharply, and averaged $520/mt so far this month, and at the time of writing are being quoted between $540 – $550/mt. You have to go back more than 7 years (to Oct 2014) to see higher prices; buying bunkers at the moment is an expensive business.

Source: Integr8 Fuels

The easy political analysis

Looking ahead, we are in the realms of the ‘known unknowns’; you don’t have to be much of a political analyst to suggest if Russia invades Ukraine, then oil and bunker prices are likely to go even higher and if an agreement or military withdrawal is reached then prices will go lower. In the big picture, we are now focused on the news briefings rather than the oil fundamentals.

Oil fundamentals still tell us something

However, it is still worth scratching below the surface of the fundamentals, just to see what responses the oil markets have come up with. Whether by design, or constraints, the short answer to this question is ’Nothing’. OPEC (and more recently OPEC+) has historically taken the role of managing oil prices, and $100/bbl crude has been seen as too high. At these levels we would have expected OPEC to boost oil production to take the ‘sting’ out of the market, but this hasn’t happened. In reality it is only Saudi Arabia, Kuwait and the UAE that are likely to have significant spare production capacity and able to boost output, with Iraq and Russia possibly also able to produce a bit more.

The current OPEC+ agreement is unwinding, but production increases are falling short of the planned expansion. In January it is estimated the group produced 0.9 million b/d less than the overall agreement. It seems a number of the OPEC+ countries cannot hit their targets because of ‘insufficient’ upstream spending and those countries with spare capacity are not willing to make up the production shortfall.

It’s politics coming at us from all angles

This again, emphasises the political dilemmas; the US would want the Saudis to boost oil production to ease oil prices, but the Saudis are in what can be considered as a successful alliance with the OPEC+ countries, and this includes Russia.

Keeping with the political theme, and the assumption most economically powerful countries want lower oil prices, it begs the question if the US will work more aggressively to get an agreement with Iran and so potentially open up another 1 million b/d of crude supply. Indirect talks between the US and Iran (in Vienna) are reportedly in their final stages, although these ‘final stages’ have been going on for some time. Iran is demanding that major sanctions

are lifted and legal assurances the US will not exit the deal again. A Washington comment is that this would be impossible, but the Russian/Ukraine situation is likely to give Iran a stronger negotiating stance.

Agreements are clearly a huge challenge at any time, but today the US is at the centre of two; Russia/Ukraine and the Iranian nuclear position. Even if there are solutions, there is also very often a political fall-out. With the US, Russia, China, Saudi Arabia and Iran all having a position, it’s going to take more of a political analyst to unravel any combination of alliances and discords between these five countries and what impacts they may, or may not have on oil prices.

Clearly an invasion of Ukraine is an extreme outcome and, bringing it down to our markets, prices would rise even further. However, a pull-back by Russia, and/or a successful summit between Russia and the US would obviously ease the situation and lower prices.

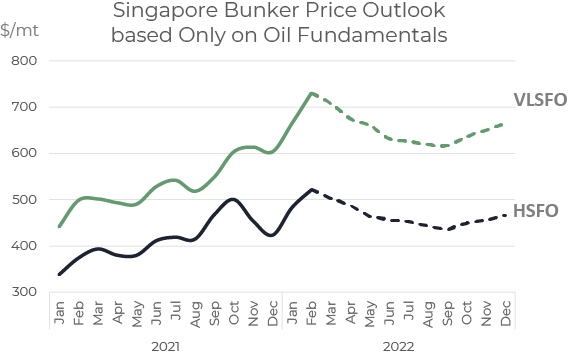

Let’s at least start with a ‘fundamental’ price forecast

A whole range of price outlooks can be determined using various scenarios around different geopolitical outcomes, but as a starting point, the graph below illustrates a bunker price outlook based purely on an oil fundamental viewpoint. The general sentiment here is slightly firmer than a month ago, with a starting point of lower oil product stocks; demand prospects a bit strong and supply developments a bit weaker. We could take this as a base position

and increase the price forecasts depending on any perceived or actual political or military threats, wherever they may take place.

Source: Integr8 Fuels

Source: Integr8 Fuels

At the moment, this price forecast would seem to set a floor. The conclusion this time round is the main price drivers are geopolitical, and the caveat is the relatively tight oil fundamentals.

Steve Christy, Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.