Geopolitical Risk is High, but Oil Prices Remain Contained

Recent geopolitical events would normally send shockwaves through the market—but not this time.

- The US military will enter Caracas, Venezuela and capture President Maduro and his wife.

- Major and widespread protests breakout in Iran against the regime, with hundreds dead and thousands injured, plus the US threatening military strikes against Iran.

- President Trump looking to ‘takeover’ Greenland, potentially implicating the future of NATO.

- The US launch air attacks in Nigeria against militants linked to the Islamic State (IS).

- The US seize a number of sanctioned tankers linked to Venezuela.

Having covered the oil markets for many years, my reaction to even just a few of these events would have been to say we would see a massive increase in oil prices, without necessarily quantifying how big ‘massive’ is—but things have changed.

Crude is up by just $4/bbl (6%)

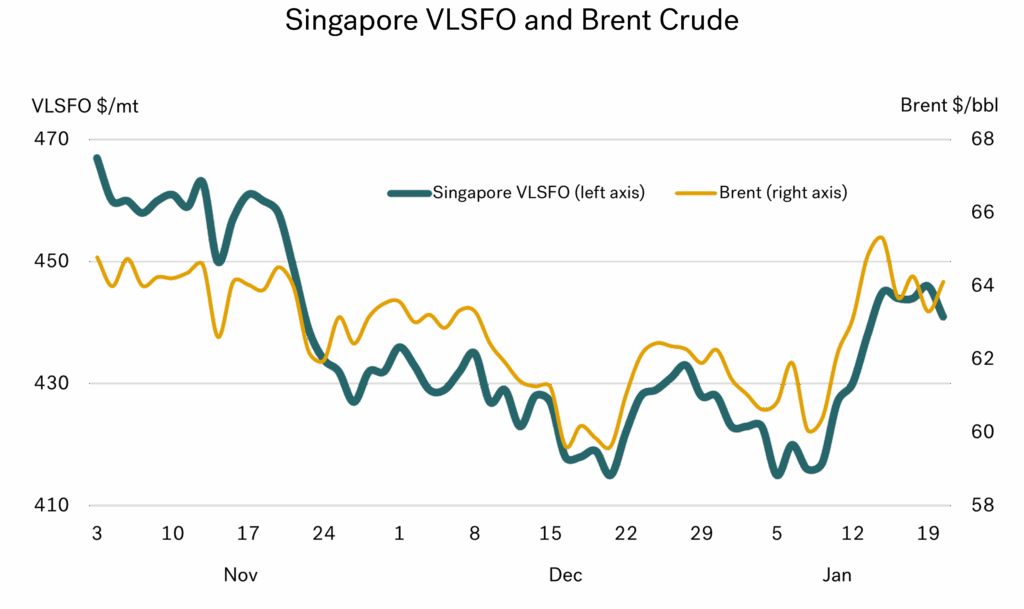

We have seen the above global events take place since our last report of 2025, and they all possess a potentially heavy bearing on the oil market. However, we have seen Brent crude prices rise from $60/bbl on the 19th of December, to only $64/bbl on the 22nd of January. So, the actual rise in oil price has just been $4/bbl, which is not ‘massive’ by anyone’s reckoning!

Source: Integr8 Fuels

Source: Integr8 Fuels

For those of us in bunkers, VLSFO prices have tracked crude prices and have only risen by $20-30/mt from their early January lows. Given the list of geopolitical events in the past month, this could be considered astonishing. To reinforce this, bunker prices are still lower than what we were paying in November!

We have to come to grips with a new world order

The global environment has clearly changed—have we become more immune to potentially very significant events and uncertainty on the world stage?

Looking at monthly average VLSFO prices being paid, the continual slide since mid-2025 has come to an end, but look at what it has taken to do this. In Singapore we are still paying $150/mt less and in Rotterdam, $125/mt less than what we paid last January, roughly a price cut of 25%.

Source: Integr8 Fuels

Source: Integr8 Fuels

This does not necessarily set a precedent where future geopolitical events will not have a major impact on oil and bunker prices, but it does illustrate vastly different price responses to those we may have seen in the past.

The forward curve has risen, but not by much

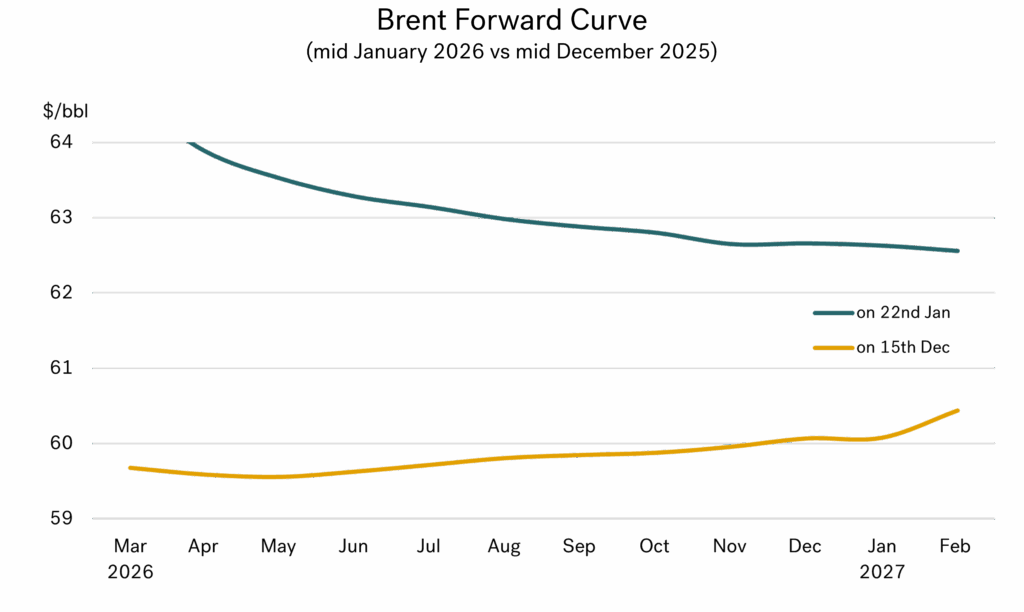

To illustrate what little impact the recent geopolitical events of the past month have had, the graph below shows the Brent forward curve from this week, versus the position in mid-December, prior to the events in Venezuela, Iran, Greenland, etc.

Source: Integr8 Fuels

Source: Integr8 Fuels

As outlined, March contracts have risen by just over $4/bbl and outer months in the second half of this year are only $2/bbl higher than a month ago. This is quite a muted response to what has happened and what could potentially happen in the coming months.

Latest forecasts still show low oil prices for this year and next

Goldman Sachs has reinforced their views of a ‘low oil price’ world for this year, with their Brent price averaging $56/bbl for 2026 and falling to a low of $54/bbl in the fourth quarter. In their forecast, Goldman recognise the geopolitical risks from Iran, Venezuela, and Russia but like most other analysts, they see these military and regime risks as ‘overpowered’ by the fundamental surplus in oil supply.

The group does see some recovery in oil prices in 2027, but still only puts the Brent average at $58/bbl. This is a downgrade of $5/bbl from the previous 2027 forecast, and shows just how little the current political risks and uncertainty are having on oil price views. So, Goldman Sachs’ forecast puts average 2026 Brent prices some $7/bbl lower than today, and their average 2027 price around $5/bbl less than current levels.

The US EIA have a similar Brent price forecast for this year at $56/bbl, but they put the 2027 price even lower, at $54/bbl—an encouraging price view for bunker buyers.

Goldman Sachs’ view for longer term prices is not extreme at all

It is not until later this decade that Goldman see prices much higher than today, with their 2030-35 Brent forecast at $75/bbl. However, this is still lower than the average Brent price paid in 2024.

For those of us in bunkers, it would suggest Singapore VLSFO prices averaging around $410/mt this year and $425/mt in 2027. Even in the 2030-35 period, Goldman Sachs implies Singapore VLSFO prices of around $550/mt and Rotterdam at around $525/mt, again less than we were paying in 2024.

The biggest events on the world stage are having the smallest of impact on prices

To summarise, if we had seen anything like the current events from the last four weeks in recent years, I am sure analysts would have put their oil and bunker price forecasts much higher. Never say “never”, but for now it seems that these big episodes have little impact on what we are paying for bunker fuel.

It shows just how interesting and challenging our industry is, and that we are always learning, even after all these years.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.