Bunker Quality Trends Report September 2025

September 10, 2025

Integr8 Fuels’ Bunker Quality Trends Report H1 2025

Integr8 Fuels’ latest biannual Bunker Quality Trends Report explores how sanctions, new regulations, and alternative fuels are reshaping marine fuel markets in 2025.

Key findings include:

-

Sanctions: U.S. measures have reshaped global fuel flows, leading to quality issues in key hubs where Russian stock has been replaced by barrels from the Middle East.

-

Mediterranean ECA: The 0.1% sulphur cap has transformed the regional fuel mix, with VLSFO use halving and distillate demand surging. Early ULSFO quality issues are now easing.

-

Biofuels: While niche, biofuels are becoming cost-competitive under EU and ECA rules if savvy-buying strategies are followed. Risks include pour point challenges, but strategic buying can unlock regulatory and financial advantages.

Trusted by thousands of operators, owners, bunker buyers and market analysts, this report is a go-to resource for mitigating risk and improving buying performance.

A word from the author, Chris Turner, Bunker Quality & Claims Manager:

“Sanctions, new ECAs and alternative fuels are all reshaping the bunker landscape at the same time. Our latest whitepaper shows how these changes are not only affecting fuel availability and compliance but also creating new risks and opportunities in quality and cost. Shipowners need to stay on top of these shifts to avoid exposure and unlock the benefits where they exist.”

Cheaper Bunkers Ahead? Supply Surge Signals More Downside

August 21, 2025

Falling prices in August

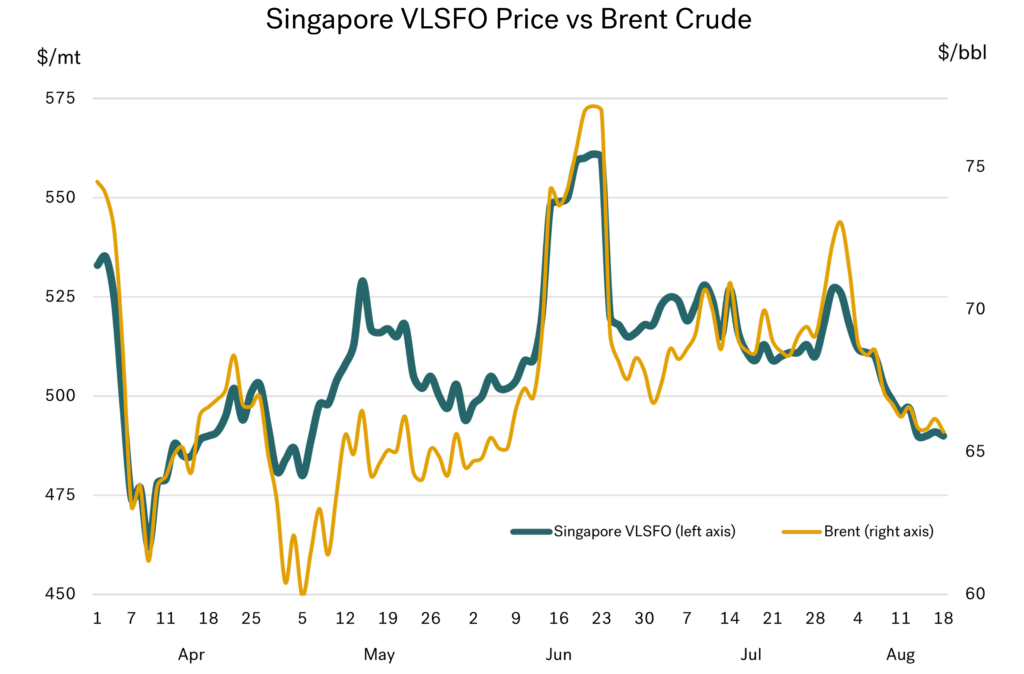

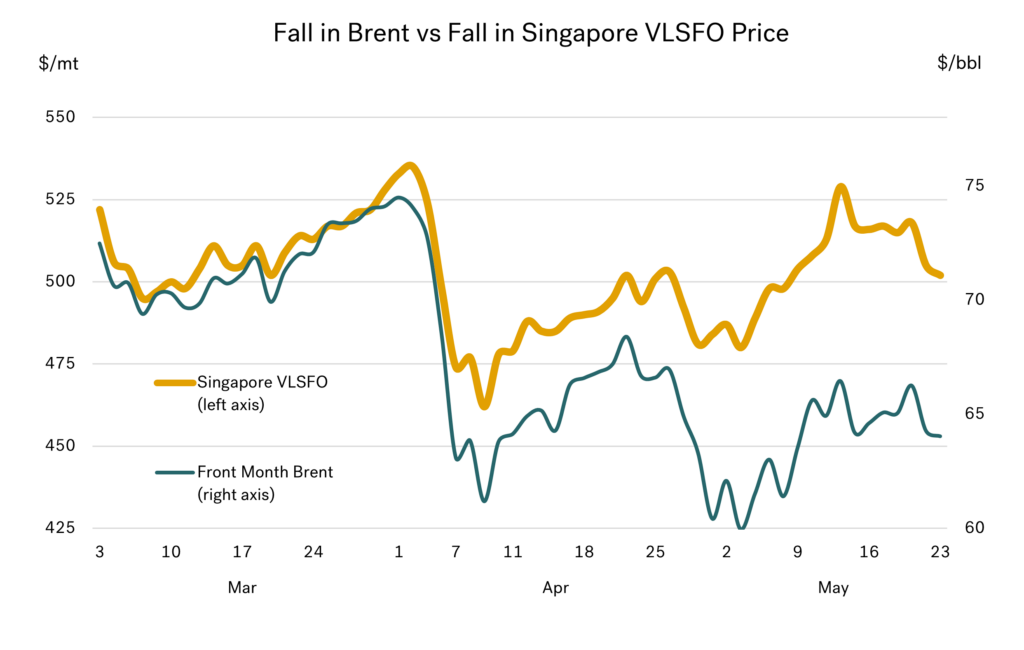

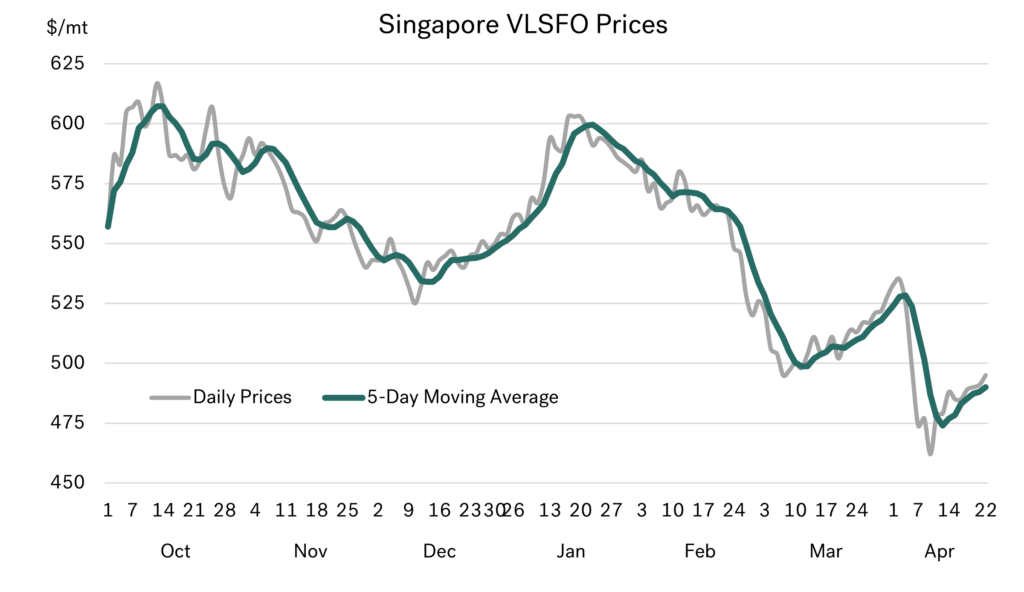

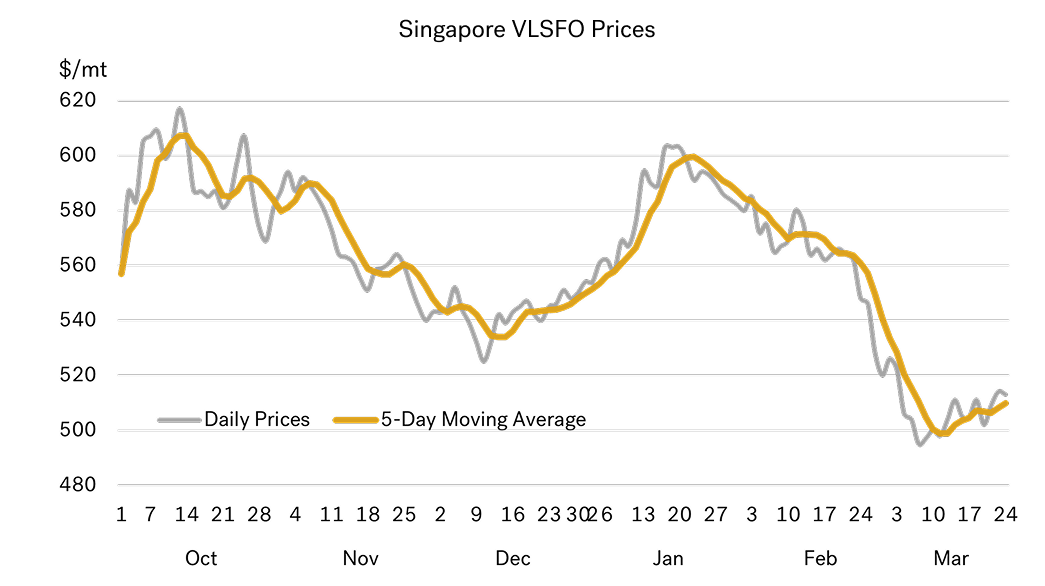

Singapore VLSFO prices have continued to track Brent crude, and the good news for bunker buyers is that Brent prices have fallen. VLSFO prices in the main bunker centres are now at their lowest levels for around three months.

Source: Integr8 Fuels

The challenge is always to gauge where prices are going from here. Of course, politics, war and sentiment are going to have a huge bearing, and who knows where the ongoing discussions between President Trump and President Putin will take us. Stating the obvious, an end to the war in Ukraine (and the removal of sanctions on Russia) would see oil prices fall; an escalation in the war, or heightened tensions, or further direct and indirect sanctions on Russian oil exports could see prices rise. But even political experts will struggle to tell us which way it is going to go!

All we can do here is to take onboard the dynamics in international relations, and then separate and focus on the main drivers within the oil market.

OPEC+ unwinding production cuts is pushing prices lower

On the supply side, in April, OPEC+ members started to unwind the 2.2 million b/d of voluntary production cutbacks (these cutbacks were agreed in November 2023 and started in the first quarter of 2024). At the same time as the OPEC+ increase, UAE’s production quota is being raised by 0.3 million b/d.

The increase in OPEC+ production since April has not been linear. There are also other complications, in that some countries are unlikely to be able to raise production back to their quota levels. However, in early August, OPEC+ agreed to increase September production by 0.55 million b/d, which will fully unwind the cuts. This means Saudi Arabian output is likely to be close to 10 million b/d (versus 9 million b/d earlier in the year) and UAE production is forecast to rise as its agreed higher quota is introduced. As a result, by September/October, OPEC+ output is likely to be around 2 million b/d higher than it was in March.

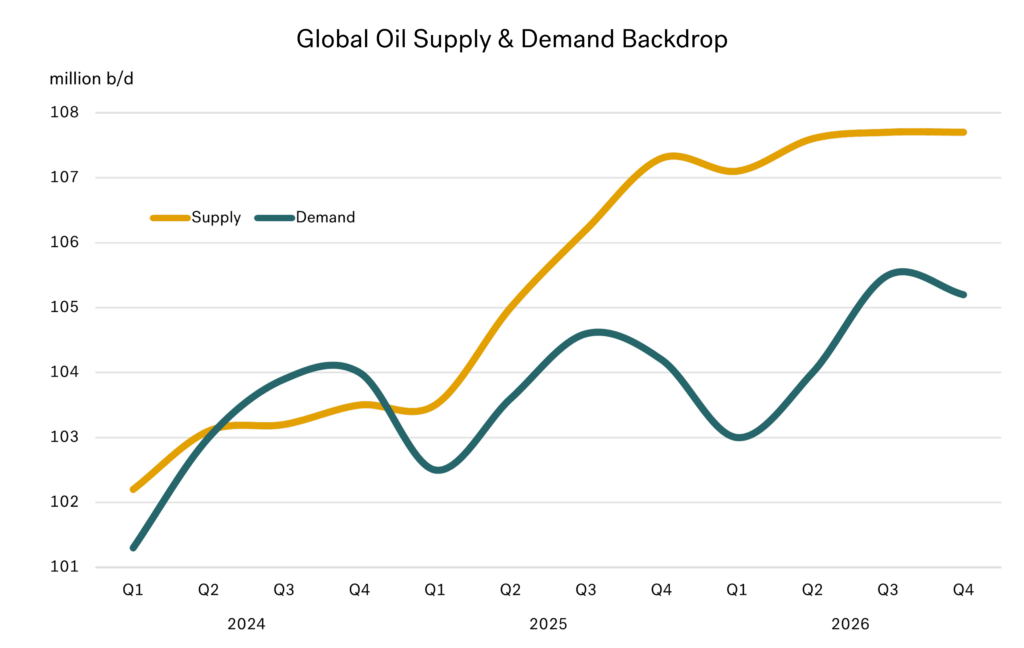

On top of this, non-OPEC+ production is forecast to rise by around 1 million b/d over the same period. Hence supply is forecast to rise very steeply this year, with the graph below illustrating the hike from 104 million b/d in Q1 to 107 million b/d in Q4.

Source: Integr8 Fuels

However, the same cannot be said for oil demand. Relatively weak underlying economies, huge economic uncertainty surrounding proposed hikes in US tariffs and the continual shift towards more electric vehicles (EVs) has undermined growth in global oil demand. There have been continual downwards revisions to forecast demand for this year and next, with the IEA currently indicating growth of 0.7 million b/d for 2025 and another 0.7 million b/d in 2026 (equivalent to 0.7%).

Global oil stocks set to rise sharply?

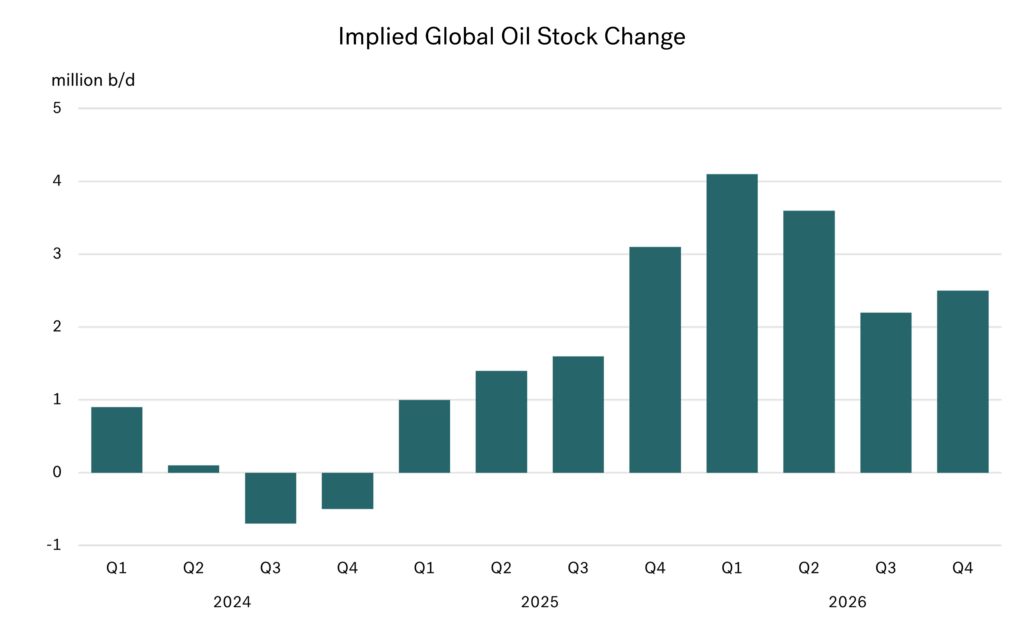

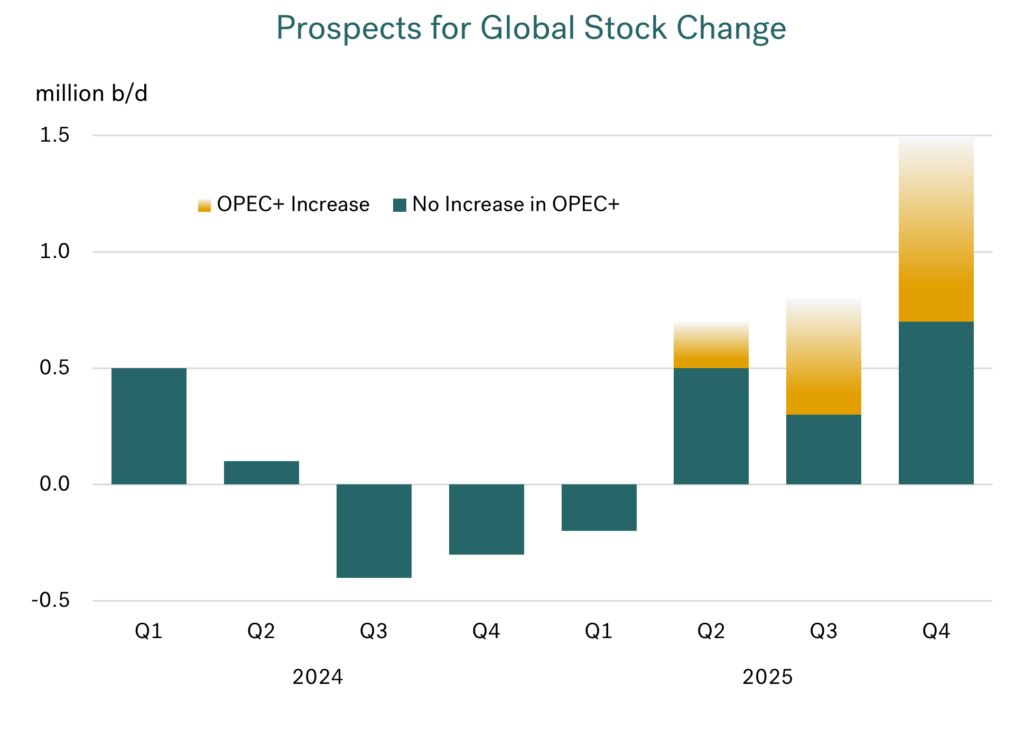

With OPEC+ restricting output in 2024, oil supply and demand were more-or-less in balance. But this balance is literally unwinding as OPEC+ remove their voluntary production cutbacks over the second and third quarters of this year.

We have already seen slight global stock-builds so far this year. Now we are expecting OPEC+ production to ramp up at the same time as world oil demand goes into a seasonal decline from the third to the fourth quarter. Nowadays peak oil demand is in the northern hemisphere summer months, with a seasonal fall of around 1.5 million b/d from Q3 to Q1 the next year.

The pointers are very clear on this basis; we are looking at potentially very big oil stock-builds over the remainder of this year and going into next year. This bearish view is compounded when looking at the demand fundamentals for next year. Even if OPEC+ keep to their plans and maintain their other 3.65 million b/d of cuts in place through 2026, there is still too much oil in the market!

In the case outlined here, stock builds would start to balloon to around 3 million b/d in the fourth quarter this year and then continue at 3-4 million b/d through the first half of next year.

Source: Integr8 Fuels

The issue for OPEC+ is these bearish fundamentals don’t go away, with potential stock-builds going through the second half of next year as well.

War and politics will cloud the outlook and drive oil prices at certain key periods. But we can’t get away from the fact that OPEC+ unwinding their voluntary production cutbacks at this time has placed a massive bearish fundamental position on the oil market. War, Trump, Putin, and sanctions aside, it would look like bunker prices should go much lower over the rest of this year and into 2026.

Given this, what can change?

Any escalation in wars, or the threat of wider involvement will push oil prices high. As will any tightening of sanctions on Russia (or Iran). These developments would ‘cover’ the increases in OPEC+ output and likely support oil prices at higher levels.

Alternatively, any end to the war in Ukraine and ‘reinstatement’ of Russia back into the international arena will only add to the bearish fundamentals outlined here, and push prices even lower. This second option looks good for ‘world order’ and for bunker buyers!

If prices go ‘too low’ then expect an OPEC+ response

However, if prices fall to very low levels because of very weak fundamentals, or a solution to the Russia/Ukraine war, or a combination of both, then OPEC+ is likely to respond. The big players in these OPEC+ decisions are still hugely reliant on oil incomes for their economies and development programs. They are also very good, and ultimately successful, at responding to extreme price falls, with production cuts to re-balance the market. A 10% cut in oil production by these players would result in a much bigger than 10% rise in oil prices, i.e. a cut would raise their revenues.

So, perhaps we want lower prices, but not too low to provoke an OPEC+ response!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Widening Spreads: VLSFO Steady While HSFO Hits Two-Year Low

July 30, 2025

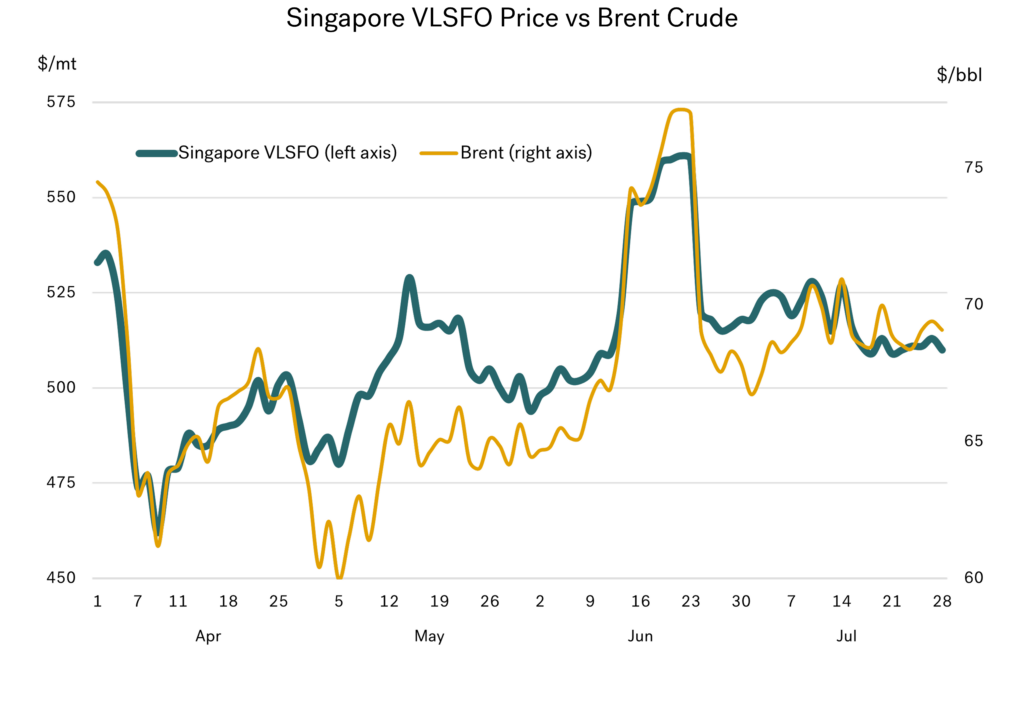

Relative strength in Singapore VLSFO has disappeared

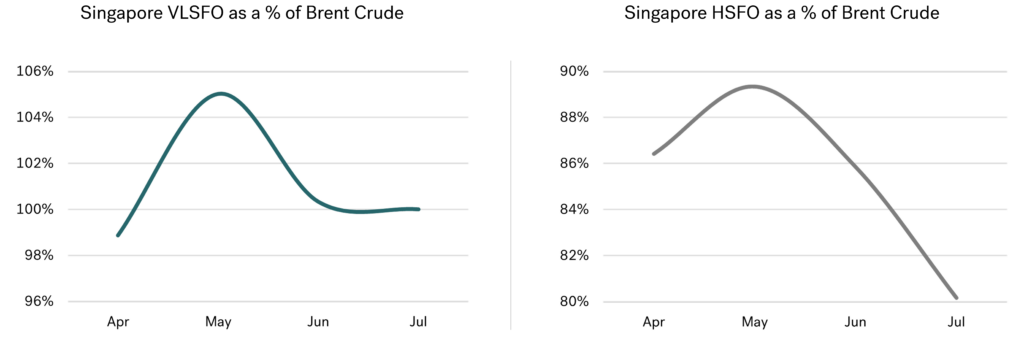

Two months ago, we wrote about how Singapore VLSFO prices had moved to a strong premium versus Brent crude. This took place in late April/early May, as crude prices fell sharply and bunker prices failed to follow. At the time Singapore VLSFO was about $40/mt ‘more expensive’ than if we had continued at a parity with crude.

Around mid-June there was a spike in all prices, in response to US, Israeli and Iranian attacks in the Middle East region. Since then, there has been a significant rebalancing of VLSFO supplies in Asia, with a big leap of supplies and components arriving in the region. Arbitrage volumes coming in so far this month are some 40% higher than in June, and also running well above the average year-to-date figure. The net result is that, after a period of relative strength, the past two weeks have seen Singapore VLSFO come back into line with Brent crude; a similar position to three months ago.

Source: Integr8 Fuels

Source: Integr8 Fuels

Hence, over the past four months we have seen Singapore VLSFO prices move up from around 99% to 105% of Brent crude, and now back down and stabilised at around 100%.

Singapore HSFO also strengthened April/May, but since then it’s been down and down

In April/May, Singapore HSFO prices similarly strengthened relative to Brent crude, up from around 86% to close to 90%. Like VLSFO, there was also a turning point in the Singapore HSFO market in May to June, but since then the Singapore HSFO market has just kept falling relative to Brent crude!

Source: Integr8 Fuels

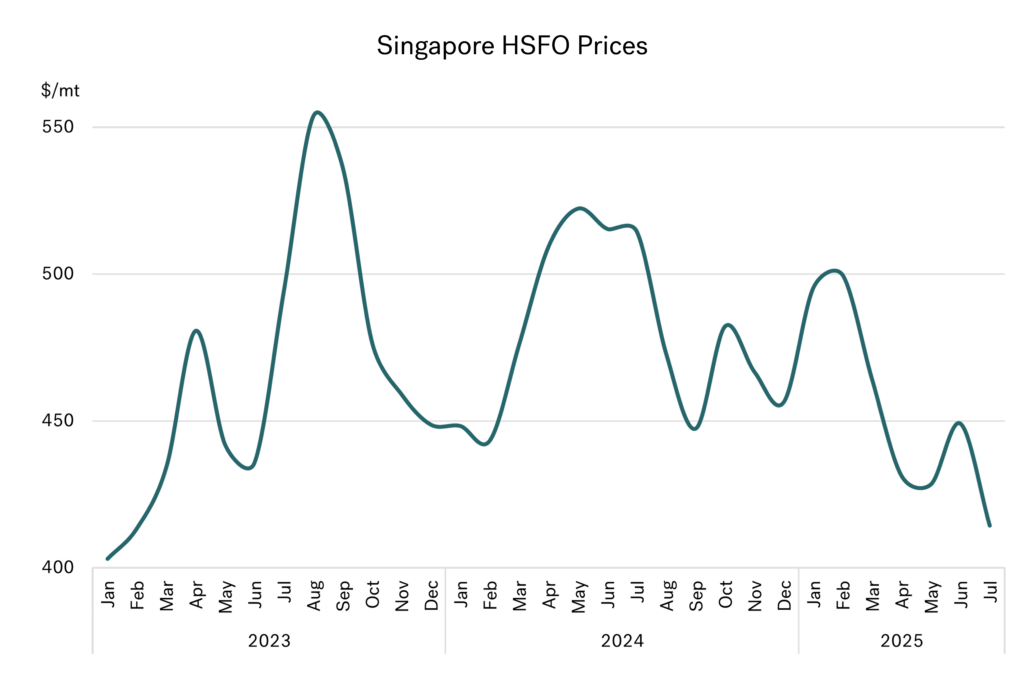

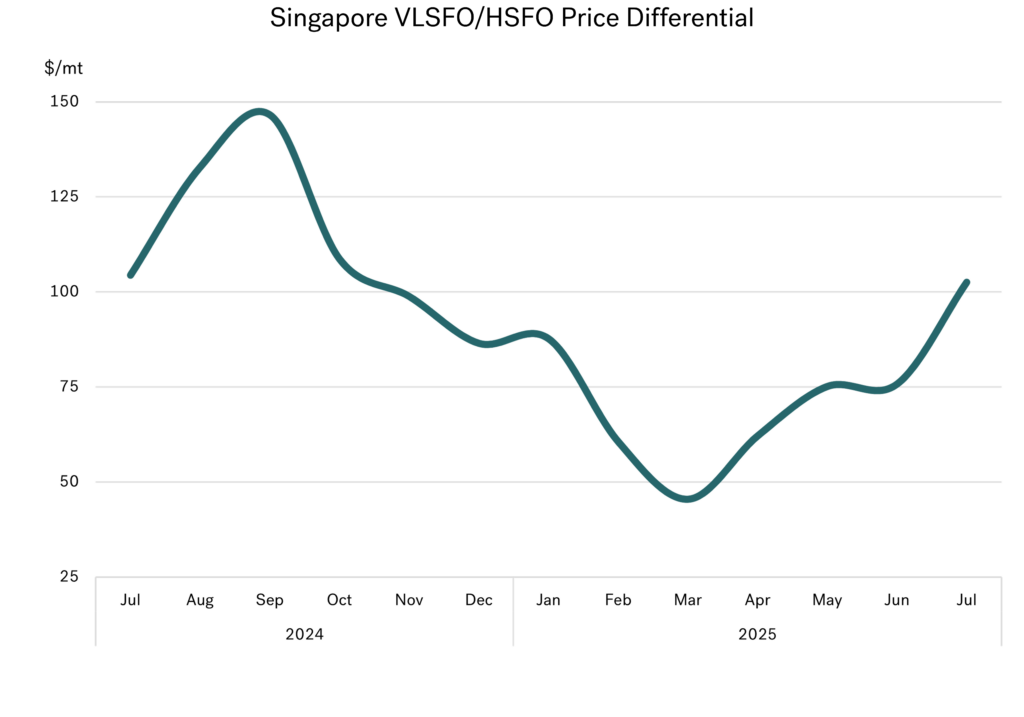

These market movements have led Singapore HSFO prices down to around $415/mt, which is the lowest level for more than two years.

The extent of the current weakness is reflected in the fact that Singapore HSFO prices have moved from backwardation into contango. The July/August contango is now at $6/mt, its most extreme for almost five years. This is not something that typically happens at this time of year when demand for HSFO in the Middle East power sector for air conditioning is usually high.

Source: Integr8 Fuels

Source: Integr8 Fuels

Why have Singapore prompt HSFO prices fallen so much?

In mid-June, the Israel/Iran conflict had raised concerns about natural gas supplies in the region, and this had bolstered HSFO prices as a replacement into power generation. However, the subsequent ceasefire then removed these worries and prices started to fall, and then fall sharply.

This unseasonably sharp drop in HSFO prices came about after stock levels had increased in June and then a significant number of cargoes came onto the market in July. There were several cargoes from at least four refiners in India that were made available, and on top of this volumes from Bahrain and Iraq were also put on the market in July. This is a rare occurrence.

At the same time, Saudi Arabia is on a strategy to burn less fuel oil in its power sector. It looks like Saudi Arabia imported around 70,000 b/d less fuel oil in June 2025 than in June 2024, and exported around 90,000 b/d more than the previous year. This alone is a net swing of 160,000 b/d in ‘available’ volumes in the HSFO market.

To compound these weaker developments, during this period OPEC+ has been unwinding its voluntary crude production cuts. As part of this, Saudi Arabia increased its June production by a massive 700,000 b/d. This is mostly heavier and more sour grades, and so will ultimately have a positive impact on the amount of HSFO coming out of the refining system.

Lower demand, higher availabilities, and more trading; a recipe for lower prices

All these developments have led to a big increase in HSFO volumes in the market and a big increase in the amount of trading taking place. Given this, it clearly explains the current weakness in Singapore and Fujairah HSFO bunker prices. As this Saudi strategy to burn less fuel oil continues, and Saudi Arabia continues to increase (heavier and more sour) crude production as the OPEC+ cuts are unwound, then we are likely to see more HSFO cargoes in the market.

Slightly lower VLSFO prices & much lower HSFO prices

So, although Singapore VLSFO prices have moved down and back into line with Brent crude, the even bigger drop in HSFO bunker prices has led the VLSFO/HSFO differential to much wider levels. So far in July this spread has averaged more than $100/mt, it’s biggest for 8 months.

Source: Integr8 Fuels

Now to look at the future!

Looking ahead in the short to medium term, the oil supply/demand balance does look bearish, with increasing OPEC+ and non-OPEC+ production, against a backdrop of more limited increase in global oil demand. However, global conflicts and a more unpredictable political scene make this a far from a ‘done deal’ towards lower bunker prices. One subject now on everyone’s lips is Russia. The planned EU sanctions on banning imports of oil products derived from Russian crude starting in 2026 is one issue. But possible US sanctions against Russia in light of the President Trump/President Putin ‘relationship’ could be a far bigger deal.

Summing up what we all know, but what we can’t predict is: the fundamentals look bearish, the political risks look bullish and any solutions to the wars in Ukraine and Gaza could bring prices down. Not very helpful, but at least we know what we are looking at!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Med ECA: Immediate Operational and Commercial Impact of Implementation

July 7, 2025

This article offers a preview of insights from our next bi-annual Bunker Quality Trends Report, coming September 2025. Sign up here to receive the full report when it’s published.

An early look at how the new sulphur limit is reshaping bunker demand, fuel availability and quality, and operational strategies across the Mediterranean.

Figure 1: Map of IMO ECAs in 2025

Source: Integr8 Fuels

Focus on the Mediterranean ECA

The Mediterranean Emission Control Area (Med ECA) came into force on 1 May 2025, requiring every ship in the Mediterranean Sea to burn fuel with no more than 0.10% m/m sulphur. Adopted under MARPOL Annex VI (MEPC.361(79)), it became the first ECA to cover an entire enclosed sea, marking a unified effort by all bordering states to curb regional shipping emissions. The rule applied immediately, with no grace period, to both international and domestic voyages, placing new demands on fuel procurement, supply infrastructure and quality assurance in ports that had not previously handled significant volumes of 0.10% fuel.

This paper’s role is to assess the immediate operational and commercial impacts of the Med ECA’s implementation, by:

- Evaluating shifts in regional fuel availability and quality statistics

- Identifying emerging non-conformance trends (e.g. total sediment potential (TSP), sulphur, water, ash) and their root causes

- Highlighting supply chain and storage practices that may exacerbate blend instability

- Offering practical guidance for buyers and ship operators on quality assurance, certificate scrutiny and risk mitigation in a post-ECA environment

Through data-driven analysis and targeted recommendations, the paper equips stakeholders to navigate the new low-sulphur landscape with greater confidence.

Availability and Fuel Mix

Fuel mix proportions have shifted markedly in the lead-up to and immediate aftermath of the ECA’s enforcement. Very Low Sulphur Fuel Oil (VLSFO) has declined from over 60% of Mediterranean supply in December to just 37.5% by May 2025. In contrast, Low Sulphur Marine Gas Oil (LSMGO) has risen steadily, making up nearly 30% of supply by May, representing proportional growth of over 120%, even if its absolute volume is still much lower than VLSFO. High Sulphur Fuel Oil (HSFO) has remained relatively stable given the continued demand from scrubber equipped tonnage across the basin.

Figure 2: Fuel Supply Share by Grade % – Med ECA

Source: Integr8 Fuels

The number of ports supplying LSMGO has also steadily increased across the Mediterranean, rising from 105 in December to 131 by May 2025, an overall gain of 24% over six months. In contrast, VLSFO availability has contracted sharply, with the number of active supply ports falling from 68 to just 36, a net decline of 47% over six months. The steepest monthly decline occurred in May, at 30.8%, highlighting the pivot away from 0.50% fuels toward 0.10% compliant distillates in a post-ECA environment.

Ultra Low Sulphur Fuel Oil (ULSFO) has historically been a niche product, with supply concentrated in Algeciras and limited operational uptake. However, recent data shows its share of the Mediterranean fuel mix has climbed from 0.3% in December to 3.6% by May 2025—a twelvefold relative increase. While volumes remain modest, this shift confirms a material resurgence in ULSFO liftings within the region. The extent to which this reflects structural change or opportunistic lifting remains to be seen, but the trend is now clearly established.

Those trends, long anticipated by industry analysts, are now materialising and will inevitably reshape the Mediterranean fuel-supply landscape over time.

Impacts on Quality

With any change in legislation comes a shift in supply chains, often resulting in unintended consequences for delivered quality. The introduction of the Med ECA on 1 May 2025 marked a clear step change to 0.10% sulphur fuels across the region. HSFO aside, quality data from Q1 through the changeover shows a familiar pattern: early volatility, tightening product tolerances, and operational strain around storage, segregation, and blend consistency. In the run-up to enforcement, there were rising cases of sulphur exceedance, elevated water content, and signs of instability in both VLSFO and ULSFO deliveries—reflecting the typical bedding-in period that follows major regulatory shifts.

The following sections provide a breakdown of developments by fuel grade, covering the period December 2024 to May 2025, with a focus on risk areas, supply patterns, and buyer impact under the new ECA framework.

VLSFO

VLSFO off specification prevalence in the Mediterranean rose from 1.5% in December 2024 to 3.8% in May 2025, indicating a general deterioration in delivered quality following the implementation of the Med ECA.

Figure 3: VLSFO Off Specification % by Parameter – Med ECA

Source: Integr8 Fuels

Sulphur non-compliance has remained broadly stable in recent months, holding between 0.7% and 0.8% from March to May. This relative consistency may reflect steady HSFO demand, which has limited the need for frequent barge switching and reduced the risk of sulphur cross-contamination between grades.

Reports of elevated water reached 1.1% in May, indicating a higher frequency of non-homogeneous fuels. This may coincide with a decline in VLSFO demand, which has slowed tank turnover and led to consolidation of residual stocks across the supply chain, increasing the risk of instability at the point of delivery.

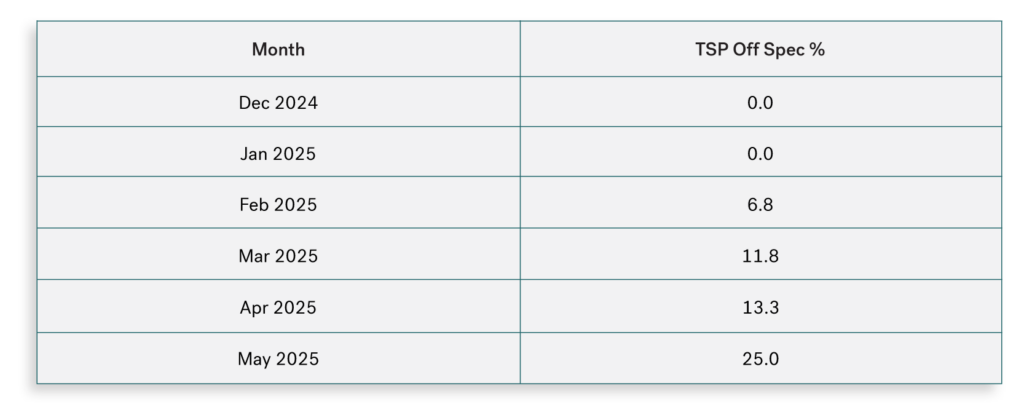

TSP infractions began to rise from February 2025 onwards, with no reported cases in either December or January. By May 2025, TSP accounted for 25% of all VLSFO notifications, highlighting the early possibility of a deteriorating trend in blend stability.

Figure 4: Total Sediment Potential Off Spec % – Med ECA

Figure 4: Total Sediment Potential Off Spec % – Med ECA

Source: Integr8 Fuels

TSP, or total sediment potential, is a measure of how likely a fuel is to form sludge due to unstable blending. When TSP levels rise, it signals that heavier components in the fuel, such as asphaltenes, are starting to separate—posing a risk of clogging filters and damaging engines.

Whether this is a temporary bump or a lasting shift remains to be seen. However, the increase may be attributed to several factors.

First, hydrodesulfurisation (HDS) in Mediterranean refineries has ramped up significantly since IMO 2020 to meet low sulphur targets. While highly effective at removing sulphur, HDS also reduces the fuel’s natural ability to keep asphaltenes suspended, making them more likely to manifest as sediment—leading to higher TSP readings and the possibility of handling issues on board the vessel.

Other quality strains were likely driven by extended in-tank storage, the consolidation of residual volumes during the VLSFO wind-down and temporary multi-grade barge operations—all of which increased the risk of instability at the point of delivery.

Although data on this trend is still limited it warrants caution, and buyers should scrutinise Certificates of Quality, particularly those issued well before lifting that show TSP values of 0.05 % Wt or higher (indicating moderate thermal instability and a risk that the fuel’s true properties may differ at delivery).

LSMGO

LSMGO off spec prevalence fluctuated between 2.8% and 3.5% from December 2024 through April 2025, before falling sharply to 1.2% in May. This recent reduction may reflect improved operational control or greater stability in post-ECA fuel streams, but further data is required to confirm whether this marks a sustained trend.

Figure 5: LSMGO Off Spec % by Parameter – Med ECA

Source: Integr8 Fuels

Flash point continues to be the dominant cause of quality non-conformance in LSMGO across the Mediterranean, responsible for more than two-thirds of all cases in most months. While sulphur, pour point, and other parameters remain largely stable, the consistently high incidence of flash point issues highlights the need for increased oversight—particularly in markets where EN590 automotive diesel may still be present in the marine distribution system. Fuels with a flash point below the SOLAS minimum of 60°C present both safety and regulatory risk and require urgent attention from buyers and operators.

These issues are not limited to minor or irregular supply points. Spain, Turkey, and Italy together account for over three-quarters of all flash point-related quality incidents across the region. Spain alone contributed nearly 30% of total recorded cases, while Turkey’s issue rate was disproportionately high relative to its supply volume. Italy followed closely, showing similar alignment between case count and fuel availability. Although France and Libya saw fewer liftings, both registered significantly higher non-conformance rates, indicating localised risk zones.

The recurrence of potential SOLAS infractions at key supply locations reflects the continued presence of low flash fuels with high kerosene content and low viscosity, often associated with inland or automotive grades. This reinforces the need to use quality data to pinpoint pools of lower flash fuels, to allow buyers to plan bunkering accordingly.

ULSFO

Test data remains limited for ULSFO, making it difficult to establish meaningful trends at this stage. However, when examining individual supply locations, more established ports such as Algeciras are performing markedly better, with a non-conformance rate of just 0.9%, compared to significantly higher rates in newer or more marginal ULSFO supply locations. This supports the recurring pattern seen throughout bunker supply history, where early implementation phases under new regulatory regimes often bring a degree of volatility and quality uncertainty.

Among the 10 reported ULSFO quality cases from January to May 2025, the breakdown is as follows: sulphur exceedance accounted for 50.0% of cases, total sediment potential for 30.0%, with the remainder split between water content (10.0%) and viscosity (10.0%). The majority of issues relate to sulphur slippage and signs of instability.

ULSFO is well known for its compatibility challenges, particularly when mixed with residual onboard product. As a result, sediment is formed which can trigger major operational difficulties on board the vessel, potentially rendering the fuel unusable. This risk makes segregation and pre-transfer checks critical to avoiding sediment-related issues in the early stages of ECA deployment.

Conclusion

- While supply availability has broadly kept pace with demand, the quality picture is more uneven.

- VLSFO has shown early signs of instability as tank turnover slows and residual inventories are cleared.

- LSMGO remains widely available but continues to carry flash point exposure in several key markets, raising the risk of potential SOLAS non-conformities.

- ULSFO volumes are rising but remain operationally complex, with sulphur and sediment issues emerging in early data.

These developments follow a familiar pattern seen in past regulatory transitions: early volatility, reduced product tolerance, and greater exposure at the point of delivery.

Buyers operating under the new ECA regime will need to remain vigilant—not only in terms of compliance, but in ensuring that the fuels they lift are operationally sound, physically segregated, and backed by robust documentation. The Med ECA may be a regional regulation, but the shift it has triggered will continue to influence sourcing practices, operational safeguards, and quality risk management across the broader marine fuel supply chain.

Chris Turner

Manager, Bunker Quality & Claims

chris.t@integr8fuels.com

From Growth to Decline: The IEA’s 2030 Outlook and What It Means for Bunker Markets

June 26, 2025

The ‘Oil World’ will start to decline within the next 5 years

With oil prices in turmoil, moving much higher because of US, Israeli and Iranian attacks, and then much lower on what looks like a fragile ceasefire, it is perhaps a good time to take a ‘bigger picture’ look at the direction of the oil industry over the next 5 years. The IEA has just published its oil market outlook to 2030, and there is a lot within this analysis that will shape the bunker market over the rest of this decade.

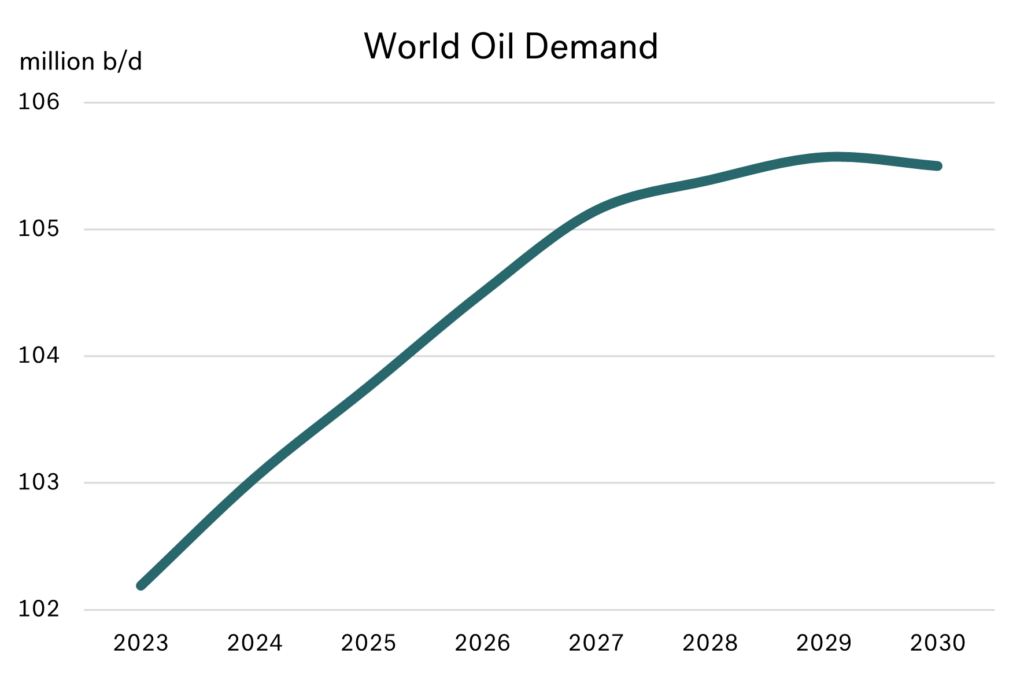

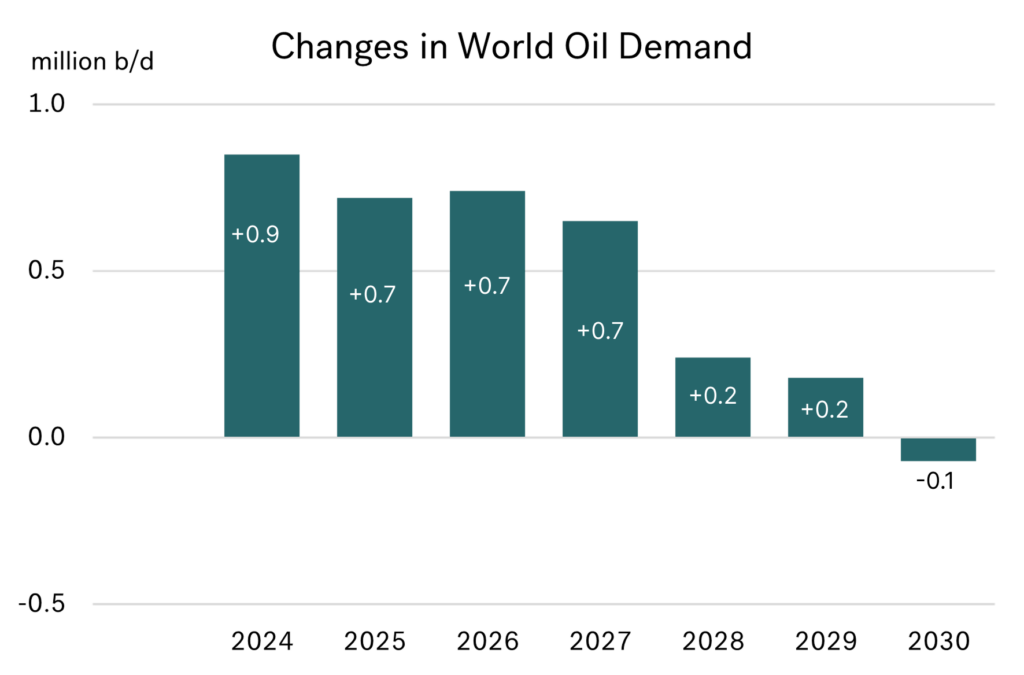

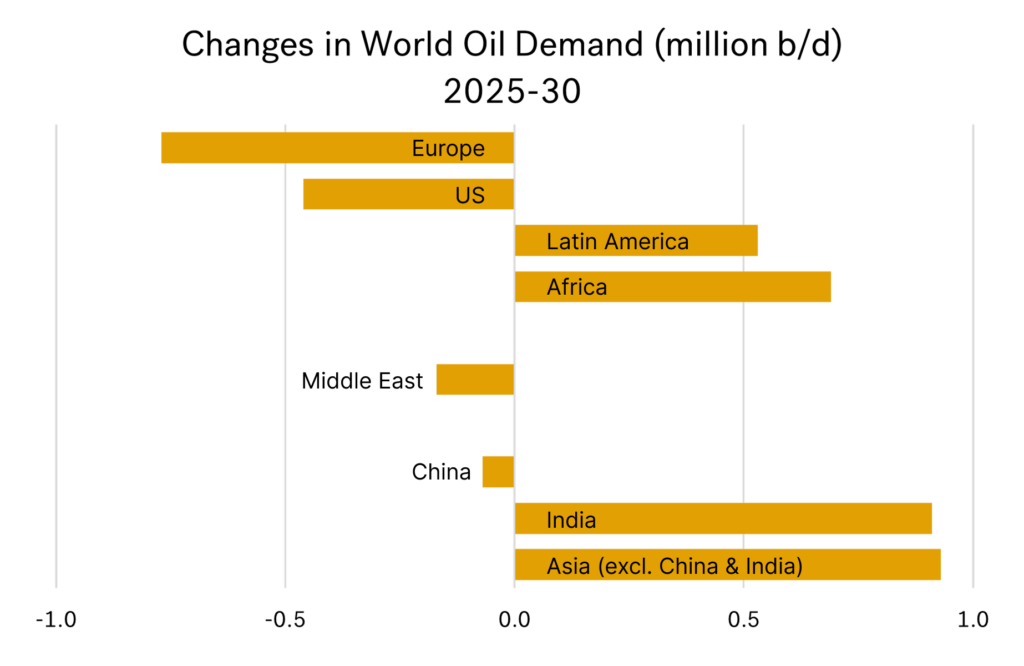

Importantly, we are moving from an industry that has been growing, to one that will soon be in decline. In the IEA outlook, world oil demand is forecast to show only modest gains over the next 2 years, with minimal gains in 2028/29 and then go into decline in 2030.

Source: Integr8 Fuels

Source: Integr8 Fuels

Source: Integr8 Fuels

Source: Integr8 Fuels

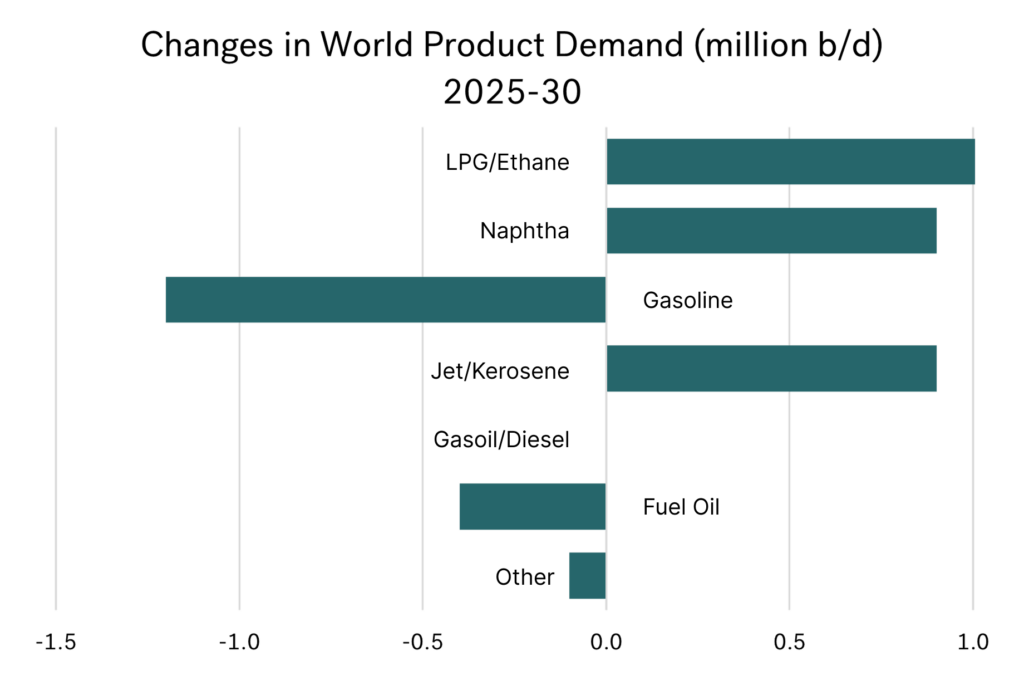

Petrochemicals and aviation is where the growth is

Looking at the key aspects of the oil products markets over the next 5 years, there are a few high-profile developments taking place. Firstly, there is significant growth in the petrochemical sector, and this will drive higher demand for LPG, ethane, and naphtha.

Secondly, there is also growth in jet demand. This follows the continued increases air travel and transport, and that jet fuel still essentially can only come from an oil refinery.

Source: Integr8 Fuels

Source: Integr8 Fuels

Bunker demand is expected to remain flat

Within their analysis, the IEA expects demand for bunkers to remain stable at around 5 million b/d over the outlook period. Their basis is that a 2% p.a. growth in tonne-kilometres demand will be offset by efficiency gains in the shipping industry and IMO regulations supporting some switching to lower emissions fuels, such as biofuels and ammonia.

Oil demand is falling as EVs are increasing

Gasoline and diesel have accounted for around 40% of total world oil demand. The main reason for oil demand starting to decline at the end of the decade is the expansion of electric vehicles (EVs) and the accompanying loss of gasoline and diesel demand in the transport sector.

For us in bunkers, it is the gasoil/diesel and fuel oil sectors that will be most influential.

Substantial changes in the outlook for US & China

- Two major changes from last year’s IEA report are that:

US oil demand is still forecast to fall, but at a much slower pace (which is not surprising under President Trump’s policies). - Oil demand in China will fall much earlier than previously anticipated.

China is now the world leader in EVs in terms of manufacturing and sales. This, along with massive investments in the high-speed rail network and structural shifts in the economy, mean the IEA is now expecting China’s oil demand to start falling within the next 4 years! This is a radical change, with China being the powerhouse behind increases in world oil demand in recent years.

In contrast, before President Trump was elected, the forecast was for US oil demand to fall by 1.5 million b/d between 2025 and 2030. Now, with Trump in power, the IEA has ‘downgraded’ this forecast decline to just 0.45 million b/d

Europe shows the biggest drop in oil demand

The agency has kept its previous expectation for a 0.8 million b/d drop in European oil demand between now and 2030. This means Europe is now at the forefront of changes in oil demand over the next 5 years.

There are no planned refinery closures in Europe after this year, but lower demand in the region will lead to lower refinery throughputs and product availabilities. It is how product balances unfold between cuts in refinery output versus the drop in oil demand; this will impact trade, pricing and how bunker markets are supplied in the region.

Limited changes in the US; but no market can stand alone

The situation in the US may be more balanced given the slower pace at which oil is removed from the energy mix. But we know how markets are ‘interwoven’, and no international bunker market is immune to what is happening elsewhere in the world.

Source: Integr8 Fuels

Latin America & African demand continues to rise

It is by coincidence that forecast declines in demand in Europe and the US are exactly matched by increases in oil demand in the growing economies of Latin America and Africa. This means that oil demand in the Atlantic Basin is expected to be close to current levels in 5 years time. However, with very few new refinery projects in the growth regions, it does stress the need for additional trade volumes to move between areas to achieve regional balances across different product groups. We in bunkers will be affected by these additional trade flows and price implications.

The Middle East not as it seems; its rising

On the face of it, there is a slight decline in Middle East oil demand over the next 5 years. However, once you dig into this, Saudi Arabia’s strategy to stop burning domestic oil for power generation and desalination plants* more than explains the cut. If this is taken out of the equation, Middle East product demand is forecast to increase by around 0.4-0.5 million b/d by 2030.

* part of this is a reduction is in fuel oil use, which could push more of this into the international market.

Nonetheless, the Middle East is one of the key areas where new refining capacity, upgrading and desulphurisation is taking place. Therefore, long haul product exports from the region are likely to continue to increase. This will cover some of the imbalances elsewhere in the world, but will also have price implications.

Asia & China could see the biggest changes for us

Finally, some of the biggest issues hitting the oil and bunker markets are likely to be seen in Asia As outlined, oil demand in China is expected to start falling by the end of the decade. But this is in contrast to what is happening in India and other Asian countries, where a combined growth of almost 2 million b/d is seen between now and 2030.

This is where trade flows, pricing and market influence could be interesting. Despite no growth in Chinese oil demand, there are still a number of refinery capacity additions in the pipeline. There are of course a number of scenarios surrounding these dynamics, but one obvious one is that China becomes an even bigger products exporter over the next 5 years. Again, this will have implications for all the major products, including what happens to us in bunkers.

This report poses more questions than answers

Clearly these are prominent issues for us in the bunker market. Longer term planners in our business will be assessing the potential surpluses and shortfalls by region for VLSFO, blending components and HSFO based on these demand and refining forecasts. It will be interesting to see how trade flows, bunker pricing and China influence our business over the next 5 years.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Why Bunker Prices Aren’t Dropping — Even as Oil Sinks Below $65

May 29, 2025

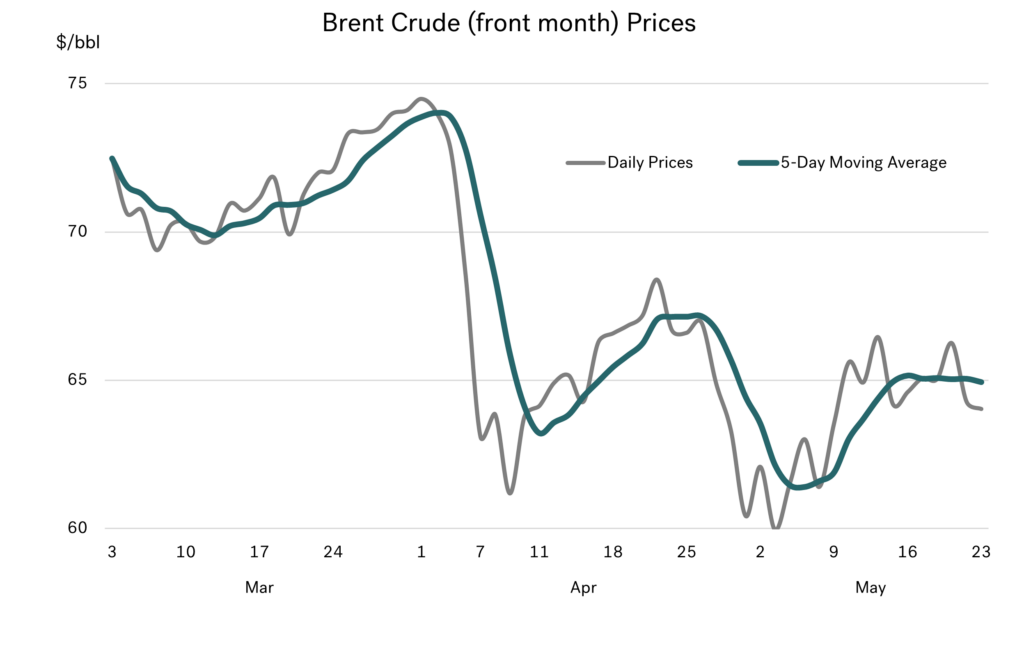

Brent prices even lower than a month ago

Brent prices are some $4/bbl lower than their peak at end April, and in the interim we have seen another dive back down towards $60/bbl. Its like the crude price chart reflects a ‘friendship rating’ between the US and China, with Brent $15/bbl lower than when Trump came to power. Instead of prices around $80/bbl at the start of the year, we are now generally trading in the $60-65/bbl range, and have been for almost two months.

Source: Integr8 Fuels

Source: Integr8 Fuels

We speculated last month that if President Trump and President Xi became ‘good friends’ it would trigger a return to confidence in global markets and higher oil and bunker prices. This clearly is not happening at the moment!

Much bigger increases in OPEC+ than previously planned

Brent crude prices have moved off their $60 lows, to around $65/bbl. Although there has been another delay in imposing the full US tariffs on China, the pickup in price is more a reflection of the latest round of tighter EU sanctions on Russia.

However, the good news for bunker buyers is that any rise in oil prices is being limited by OPEC+, as they start to unwind their voluntary production cutbacks. The process started in April, and the increases are much bigger than previously planned, rising by around 0.4 million b/d in April and another 0.4 million b/d anticipated in May (as opposed to an earlier planned rise of only some 0.15 million b/d each month).

So, although more EU sanctions on Russia is a bullish element to the market, this has been overshadowed by no political solution to the proposed US tariffs on China, and much bigger than expected increases in OPEC+ production. Hence, Brent is even lower than a month ago, and trading in the $60-65/bbl range.

But in bunkers, we are still not seeing the full effect of lower crude prices

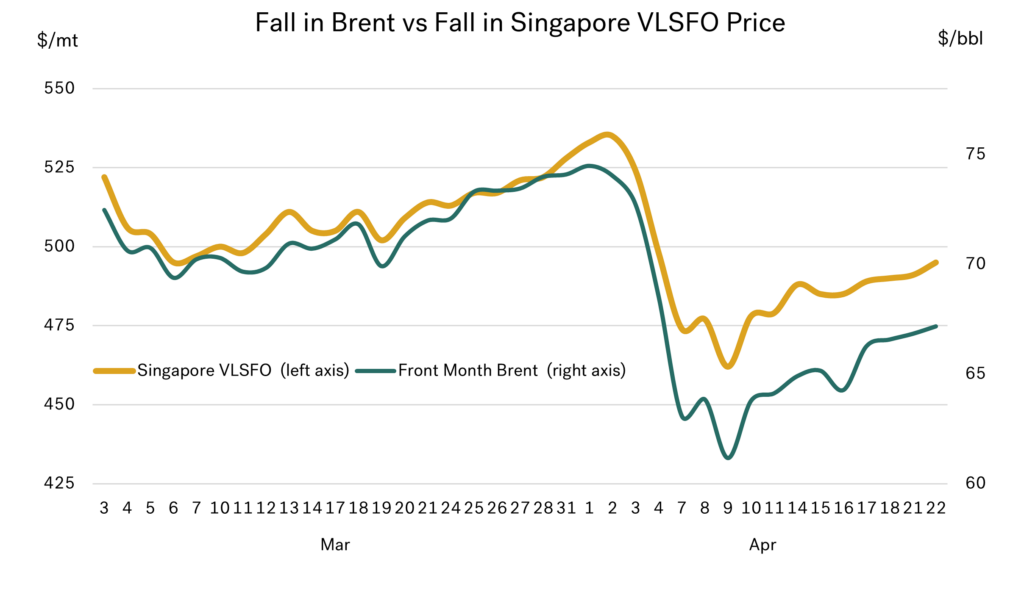

In last month’s report we highlighted the fact that the fall VLSFO prices was nowhere near as big as the fall in crude. If we had seen the same drop in bunkers as we saw in crude, then VLSFO in Singapore would have been another $25/mt lower in April.

This trend has not only continued into May, but has actually got even worse for us. Instead of using the crude headline of “even lower prices”, we must use “VLSFO prices are slightly higher than a month ago”. In fact, Singapore VLSFO prices have been above $500/mt for most of May, and higher than all but the first few days of April; something that can’t be said for the crude market. The graph below illustrates this recent divergence in prices between Brent and Singapore VLSFO, with both axes scaled the same.

Source: Integr8 Fuels

Source: Integr8 Fuels

Whereas last month we said that Singapore VLSFO would have been $25/mt lower if it had tracked crude; now we are saying Singapore VLSFO would be $50/mt lower if it had tracked crude!

There is relative strength in product prices

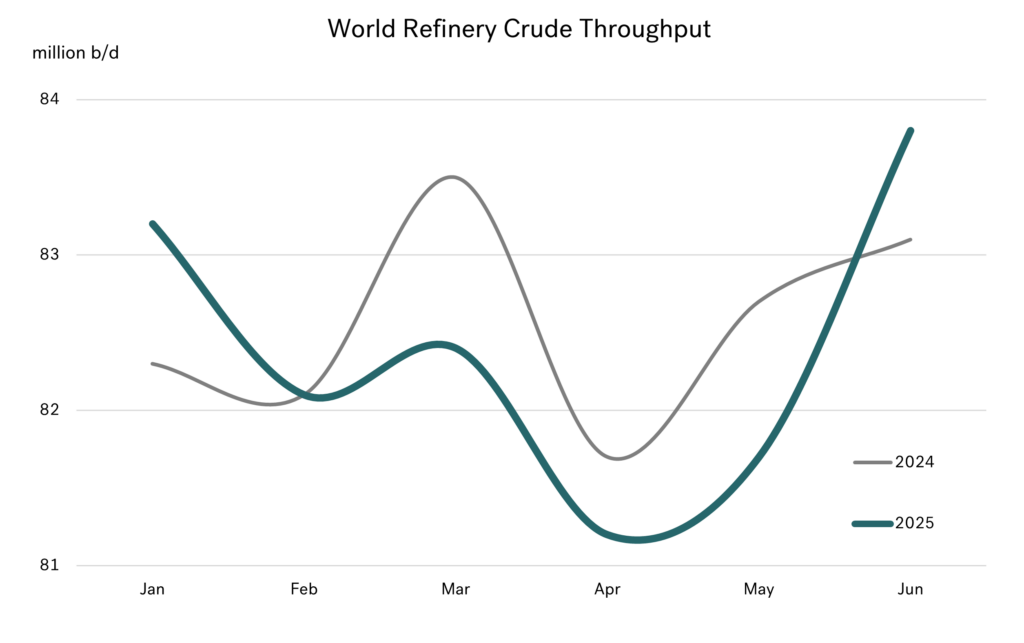

Planned refinery maintenance, plus some unplanned shutdowns, have hit refinery crude throughputs over April/May extremely hard. As a result, global throughputs are much lower than in the same period last year, and also lower than in April/May 2023.

Source: Integr8 Fuels

There is no adjustment to crude production during these periods of much lower crude processing. This year the situation is even more extreme, with a bigger drop in throughputs taking place at the same time as significant increases in OPEC+ production. Naturally, this has led to a relative weakness in crude prices.

The bottom line is lower crude throughputs mean tighter product availabilities and more ‘spare’ crude. Hence, we have seen crack spreads widen over April/May across most products and in most regions. For us, VLSFO crack spreads in Singapore and NW Europe both rose by some $6/bbl, which is equivalent to around $40/mt.

It’s therefore not surprising that recent VLSFO prices have not tracked crude prices to their lows.

When will VLSFO pricing fall back in line with crude?

There are early signs that things are changing. After a cutback in trade in April and May, the arb on light/sweet West African crudes moving to Asia is opening up, and cargoes are likely to load and go east, but this is for the June loading program. There are also expectations of more VLSFO arrivals into Singapore, but again not until later in June and July.

This ties in with the expectations of a strong rebound in refinery throughputs in June, to levels higher than last year, resulting in increasing product availabilities coming later in June and into July.

It’s a fix, but not a quick fix, with these pointers suggesting we still have a number of weeks where VLSFO will remain at a relative strength to crude, but this should start to ease back later June and into July.

The question then is: What are the pointers for VLSFO prices?

Bullish signs on oil prices could be if there is a quick end to the war in Ukraine, which isn’t looking likely at the moment. An even bigger bullish factor would be signs that President Xi and President Trump have become ‘good friends’ and end the planned use of high tariffs; again, not seen as a high probability in the very near term.

In the immediate short term, there are more bearish signals for VLSFO prices.

If the crude market is unchanged by the end of June, with Brent trading in the $60-65/bbl range, then we would expect Singapore VLSFO prices to fall from just above $500/mt, to the $450-475/mt level. If crude oil prices fall from current levels, to below $60/bbl, the fall in VLSFO prices will be even greater.

If crude prices remain the same, this means lower bunker prices; if crude prices fall this means even lower bunker prices!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Tariffs, Tensions, and Tumbling Oil: The Market Reacts

April 24, 2025

Another big drop in crude oil prices

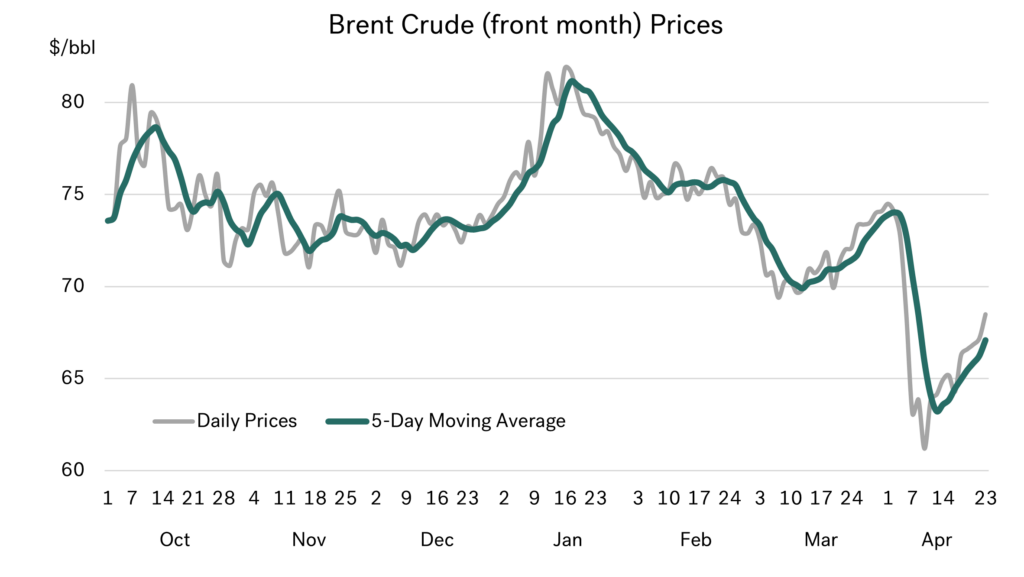

In these monthly reports we take a ‘bigger picture’ look at oil industry developments. We try to vary the aspects we focus on, but in recent months the only subject to talk about is price. In our end March report, we said that oil prices were likely to continue falling, but I am not sure we anticipated a drop of more than $13/bbl (18%) in front month Brent over just 9 days at the start of this month!

Source: Integr8 Fuels

Source: Integr8 Fuels

New US trade tariffs announced in early April, with reprisals from China and even greater fears of recession, all led prices down. If this wasn’t enough, some OPEC+ members also decided to start unwinding voluntary production cuts in April/May. The consequence was for Brent to fall to a 4-year low (back to COVID-19 times), and at one point drop below $59/bbl.

As it is under the Trump regime, there were further announcements and some delays/backtracking, and prices have moved back up off their lows. But prices are still low by recent standards. Everyone is acutely aware of the uncertainty surrounding President Trump’s announcements on tariffs, China’s responses, and high-profile institutions such as the International Monetary Fund (IMF) revising down their economic forecasts.

Of course, bunker prices have fallen

Given all these factors, it has been impossible to put a bullish slant on the market and of course bunker prices have also fallen. Across the main international markets, VLSFO prices dropped by around $70/mt (14%) in the first 9 days of April. There has been a rebound since then, but we are still $40/mt lower than at the start of the month.

Source: Integr8 Fuels

But bunker buyers have not benefitted as much as they might have

There are always nuances across crude and product prices, and in the VLSFO market the price drop has not been as big as for crude. The graph on the following page illustrates a disparity in the price drop between Singapore VLSFO and Brent crude – both axes are scaled the same, showing the bigger drop in crude. If all things were equal (they never are!), we would have seen Singapore VLSFO at lows of around $430/mt, and even now at prices close to $475/mt.

Source: Integr8 Fuels

Source: Integr8 Fuels

VLSFO prices in Asia are strengthening relative to crude. This is based on lower volumes of low sulphur material moving from west to east, potentially tightening supplies once again. The market pointers are also there, with increased backwardation and rising crack spreads. Speculation of increased bunker demand ahead of the 90-delay in US tariffs being implemented (except for China) has added another positive talking point. However, these are all nuances to VLSFO prices; the big story still surrounds tariffs and what President Trump does next.

Analysts are revising down everything

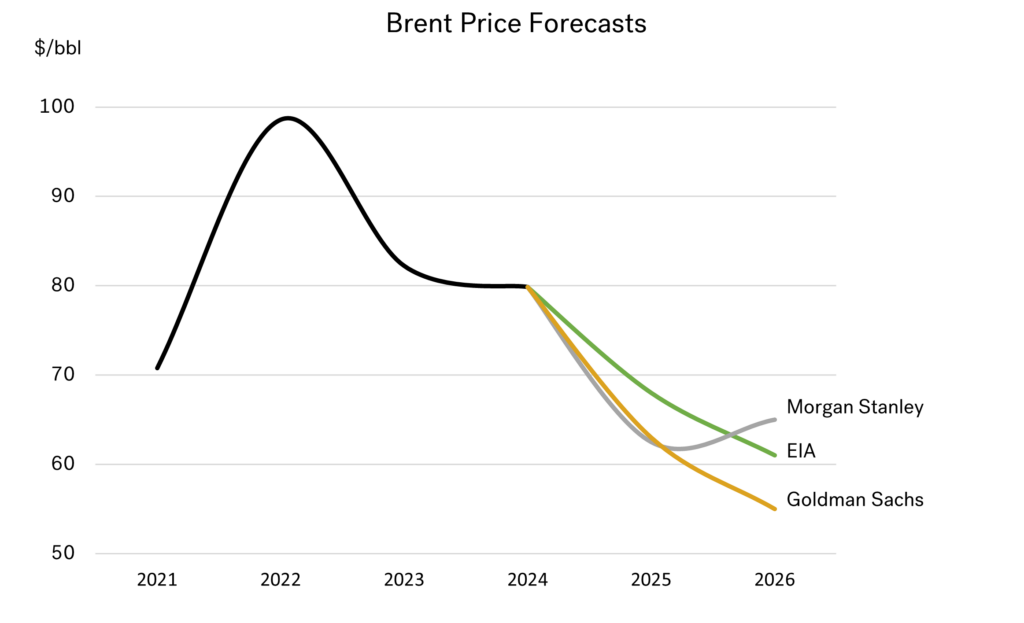

In the current market it is very difficult for us to write about anything other than Trump and oil/bunker prices. The precarious nature of political decisions, and the threats of recession mean the market is focusing on bearish sentiments and low oil prices. Oil industry forecasters have already revised down their outlook for oil demand for this year and next. In mid-April, the IEA lowered its forecast for oil demand in 2025 by 0.3 million b/d, whilst the US EIA reduced its 2025 forecast by 0.4 million b/d.

In the same context, oil price forecasts are also being revised down. The EIA has just lowered its 2025 and 2026 Brent price forecasts by $6-7/bbl, to average $68 this year and $61 next year. Morgan Stanley has reduced its 2025 Brent price by $5/bbl (to $62.50/bbl), and Goldman Sachs are down by $2/bbl (to $63/bbl). The general trend (at the moment) is for even lower prices next year, with Goldman Sachs at the low end of the range, at $55/bbl.

Source: Integr8 Fuels

Source: Integr8 Fuels

To re-enforce the bearish sentiment, these projections were made before publication of the IMF’s latest economic report, which came out this week. The IMF forecasts are downbeat, and it is no surprise that the biggest revision was to the US, where GDP growth for 2025 has been downgraded to 1.8%, from 2.7% projected in their January report. Downward revisions for other major economies have been set at around 0.4-0.5%. If based on this, it could be that the next round of oil demand forecasts are even lower.

We are only talking about one thing; Trump’s actions

US tariffs and international responses, particularly from China, are now at the forefront of everyone’s mind. There are still the wars in Ukraine and Gaza, and issues surrounding sanctions on Russia, Iran, and Venezuela, but still everyone’s focus comes back to President Trump and tariffs.

A lot of US policy decisions have been hugely unpredictable. Looking at tariffs, continual downwards revisions to the economy and corresponding downgrades of growth in oil demand, the pointers are towards lower bunker prices.

But we don’t know what is going to happen next. The day the IMF launched its more gloomy prospects for the economy, Trump hinted at a softer position with China, and the financial and oil markets both rose; Trump trumps the IMF?

It is still possible that President Trump could remove the planned tariffs, make international agreements, and be ‘good friends’ with China’s President Xi. We do know markets are very quick to respond, and any signs that the US is going to reverse its strategy on tariffs would trigger a return to confidence in the global economy, give us much stronger financial markets, and instantaneously push oil (and bunker) prices much higher.

If, or when this happens is the great unknown. As is always said, forecasts are only based on what we know today; the unpredictable nature of President Trump is that this may be completely different to what we know tomorrow!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Have We Reached the Bottom for Bunker Prices?

March 27, 2025

Prices have dropped sharply again…

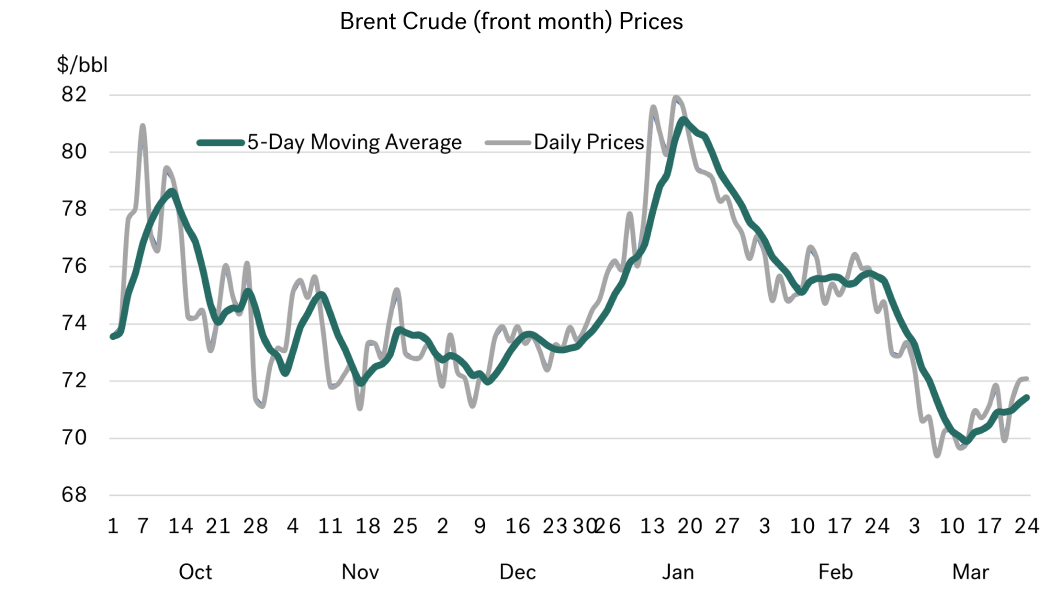

In the past four months we have talked consistently about the bearish nature in oil markets, both on the fundamental and political fronts. The mantra of ‘too much oil’, and a Trump led end to the wars in Ukraine and Gaza have, until now, led oil prices down sharply. Front month Brent has hit the low $70s, and is some $10/bbl below peak levels seen two months ago.

Source: Integr8 Fuels

Source: Integr8 Fuels

For us in bunkers, Singapore and Fujairah VLSFO prices have fallen by almost $100/mt in the past two months, to around $500/mt. The absolute drop in Rotterdam VLSFO prices has been less, at around $70/mt. But the main point is VLSFO bunker costs are now 13-15% lower than in mid-January.

Source: Integr8 Fuels

Source: Integr8 Fuels

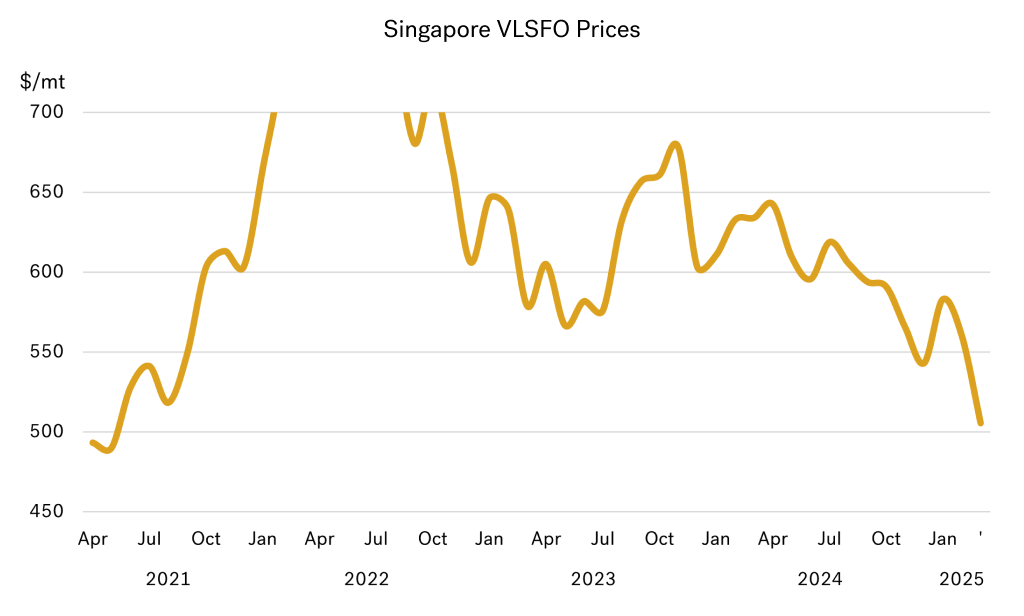

Singapore VLSFO at a 4-year low

Putting this in a more historical context, Singapore VLSFO prices are at their lowest for four years; back to levels we last saw in the first half of 2021.

Source: Integr8 Fuels

Source: Integr8 Fuels

Given this, are we now at a position where the downside risk to prices is far more limited?

Watching peace negotiations & OPEC+

There are always bullish and bearish factors to consider in our market; it’s just that over the past four months the bearish factors have been huge. Given where we are today, are we in a more ‘balanced position’ in terms of price direction?

We still have the potentially bearish issue of OPEC+ unwinding their voluntary production cutbacks starting in April. In early March, the group re-iterated the plan, but it looks like the increases will now be staggered and that any gain in April is likely to be minimal. These moves by OPEC+ are already factored into current prices, and so the group is likely to ‘take a backseat’ in determining oil price direction in the very near-term.

Another bearish fundamental is the expectation that there will be too much oil over the next 12-18 months, even before any increase in OPEC+ output. But again, this is largely baked into current prices.

The upside to prices is if there is any faltering in peace negotiations in the Ukraine/Russian war.

No one wants ‘failure’, but at the moment these negotiations are taking small steps and look highly precarious.

But everyone wants to know how far President Trump will go

In the short term it seems a lot of the sentiment in price direction will come from the US peace talks with Russia and Ukraine.

However, President Trump’s strategy and rhetoric on US tariffs means there is now another bearish factor to consider, which goes well beyond our market. Potential trade wars and any accompanying recession has already contributed to the bearish sentiment and the recent fall in oil prices. If the situation escalates and major tariffs are fully implemented, it is a double-edged sword for us; yes, we could see lower bunker prices, but this world be at the expense of recession and a reduction in world trade.

So, having said we have hit a four-year low in bunker prices and we could be at a more balanced view on the price outlook, there still seems to be more bearish stories around, rather than bullish!

And now for something completely different… Refining

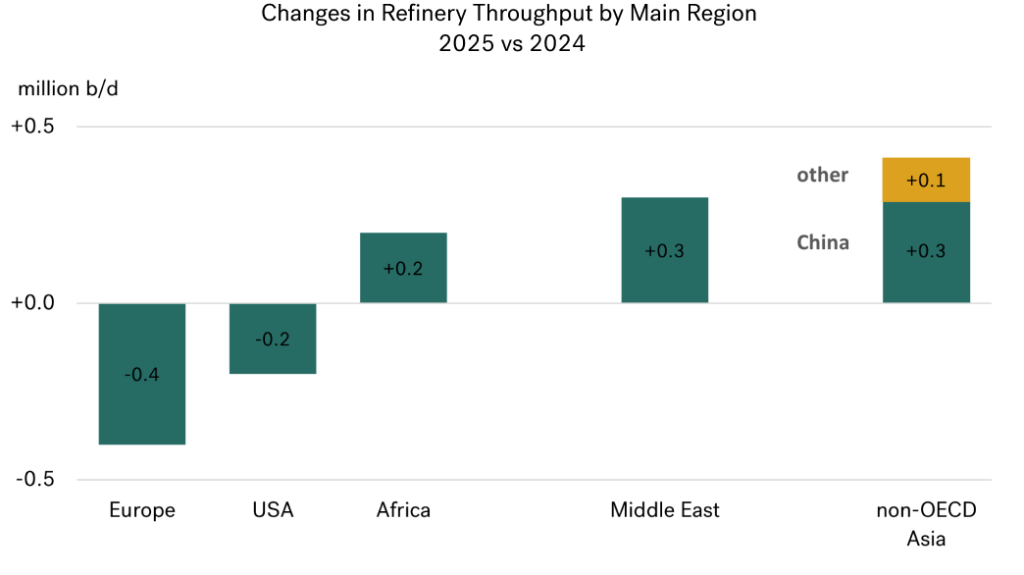

Taking a ‘side-step’ from looking at peace negotiations, tariffs, and economic prospects, here we look at some broad directions in the refining sector. Clearly supplies and blending in the oil bunker markets are dependent on refining and international trade. There is a clear direction here that refinery capacity and throughputs in Europe and the US are declining, whilst the reverse is happening in the Middle East and non-OECD Asia, with rising refinery investments and increased throughputs.

The graph below shows the clear shift in refinery operations this year from west to east, and, as highlighted in the following paragraphs, all the indications are that this trend will continue.

Source: Integr8 Fuels

Source: Integr8 Fuels

BP has plans to cut around 30% of its European refining interests. There are also at least three refineries in Germany up for sale, with more assets in France likely to go. There are further complications in the region, with the Russian companies Lukoil and Rosneft trying to disentangle themselves from their European refining interests by selling them. Although independent refiners and traders could takeover some of these refineries, the end result is still that European crude runs in the future will be less than this year.

In the bigger picture, oil demand is falling in the west, so the overall strategy of selling/closing refineries may appear ‘sensible’. But this could be a key issue for the bunker market. Although the moves towards EVs, renewables and electrification mean total oil demand in the west is falling, for us in bunkers, along with aviation, we are the two sectors where oil demand in the region is rising. There are a lot of ‘moving parts’ in the outlook, but the possibility is that more bunker products/blending components will have to be moved into Europe and less HSFO moved out.

Summing up

It is always worth looking at some of the longer-term issues in the bunker market, such as refining. BUT it is very hard to move away from some of the bearish sentiment still in the market, and what is happening now politically around President Trump, and what impact this will have on bunker prices going forward.

Taking all of this into account, many analysts are still lowering their crude price forecasts for next year, with a number projecting Brent in the mid/high $60s. So, overall, this is not the time to stop talking about falling bunker prices!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Bunker Prices Poised to Drop — But Watch for the Curveballs!

February 27, 2025

Prices are down: Is Trump close to ending the Ukraine war?

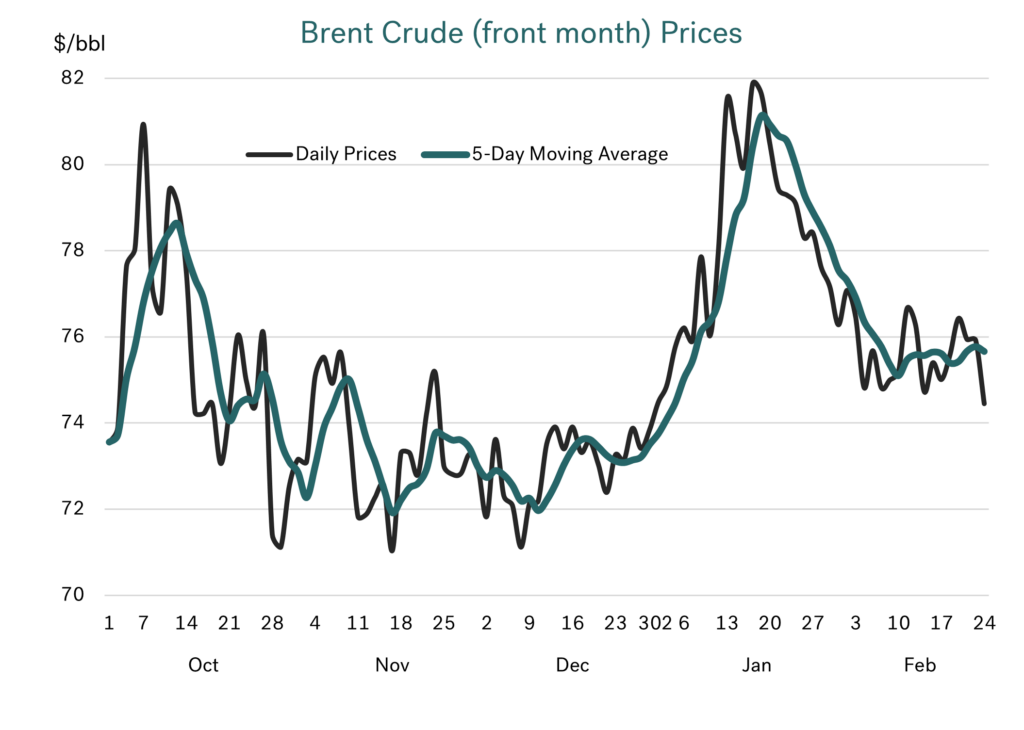

Uncertainty, uncertainty, uncertainty is running through the oil markets. The biggest news stories surround Trump and Putin getting closer and a potential negotiated end to the war in Ukraine. Who is involved in the negotiations, what might be ceded and how Ukraine comes out in all this is not yet precise. But when you look at crude prices, it shows the market has taken a general view that the situation has eased a lot since Biden’s 10th January, last gasp imposition of sanctions on Russia.

Source: Integr8 Fuels

Source: Integr8 Fuels

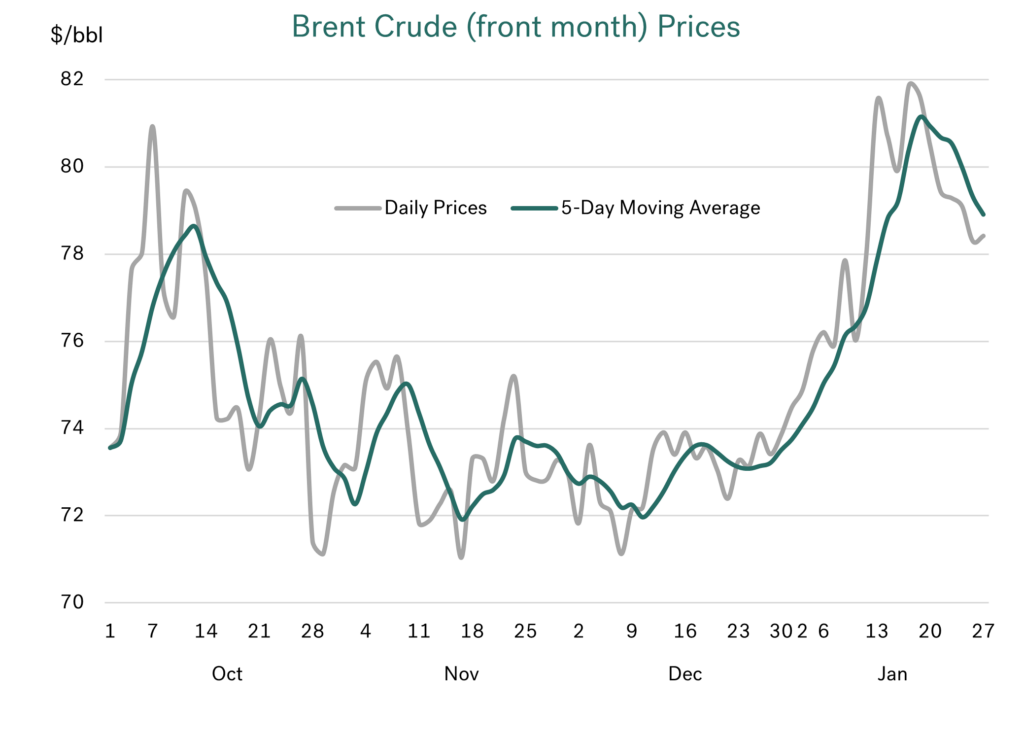

Front month Brent had fallen back by $6/bbl from its recent peak, and has seen another sharp drop this week. The market is certainly taking pointers towards a settlement in the Russia/Ukraine war.

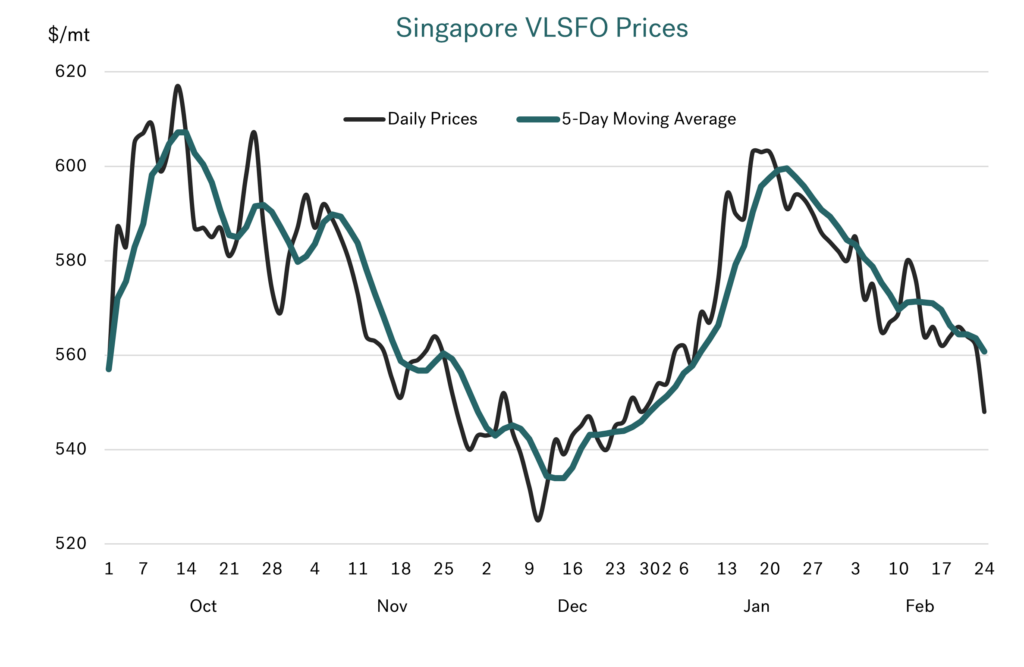

VLSFO prices have fallen alongside crude, with Singapore prices down from $600/mt to below $550/mt, including a significant fall at the start of this week. The drop in Rotterdam VLSFO prices has not been as great, with some strength in European middle distillate refinery margins and lower diesel trade from the US to Europe. Nonetheless, VLSFO prices are still lower than a month ago, although not yet back down to their December levels.

Source: Integr8 Fuels

Source: Integr8 Fuels

It must be intriguing being a political analyst

Even experts in the political world have been surprised by some of the recent rhetoric, and how political relationships have changed. We have no special insight into how the Russia, Ukraine, US, European affiliations may pan out, which may become more clear as a number of European leaders meet with Trump. However, at this stage it is worth us using our expertise in the oil markets to look at what could happen if the Ukraine war does come to an end and Russia is somehow brought back into the international (or at least the US) fold.

Has the door just shut on OPEC+

In our report a month ago we mentioned that a tightening of sanctions on Russia could further constrain Russian oil exports and finally open a door for OPEC+ to start unwinding their 1.7 million b/d of voluntary production cutbacks. At their early February meeting, the OPEC+ Joint Ministerial Monitoring Committee (JMMC) reiterated their previous plan to start unwinding cutbacks from April. However, the renewed Trump/Putin dialogue and moves towards ending the Ukraine war seem to have removed any ‘easy’ option for OPEC+ to bring back this production into the international market anytime soon.

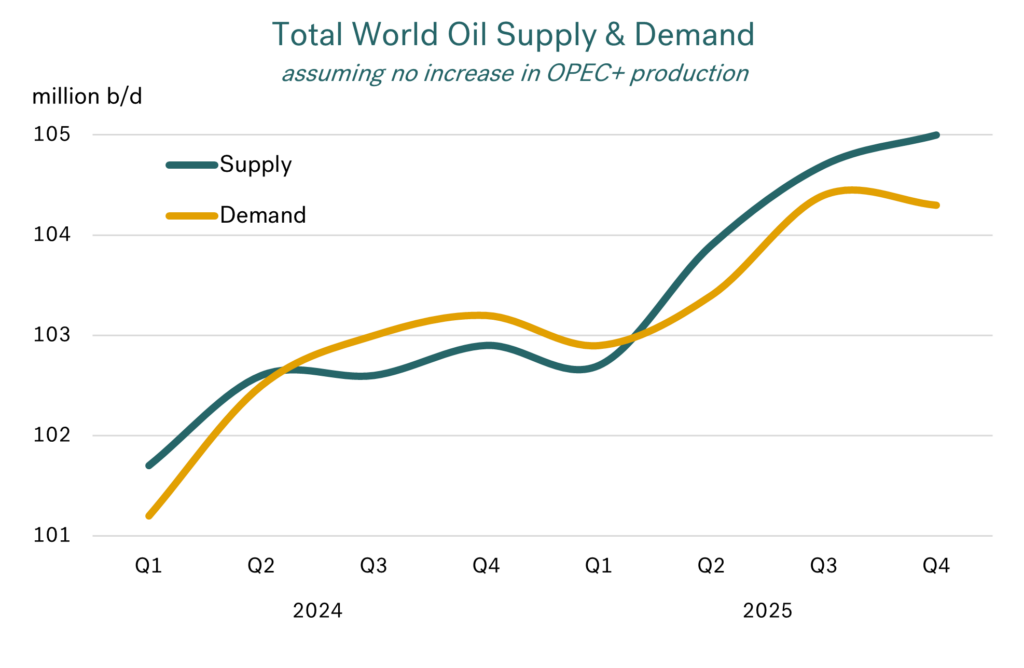

The world looks like it has more than enough oil, even without ‘extra’ OPEC+ volumes

Looking at analysts’ views of the oil market for this year, the general expectation is that even if OPEC+ maintain their voluntary cutbacks until the end of the year, there is still ‘too much oil’. The chart below illustrates total world oil supply and demand for 2024 and the outlook for 2025. This shows markets shifting from demand higher than supply between the third quarter 2024 and the first quarter this year, to supply exceeding demand from the second quarter 2025 onwards; and this is based on OPEC+ maintaining their cutbacks for the entire year!

Source: Integr8 Fuels

Source: Integr8 Fuels

The expectation now is that although the increase in demand this year will be slightly bigger than in 2024, the gain will still be relatively modest, at around 1.2-1.3 million b/d. At the same time, production increase in the US, Brazil, Guyana, and Norway, along with minor gains elsewhere (and declines in some countries), means global oil supply is forecast to rise by around 1.6 million b/d, even without ‘extra’ OPEC+ oil.

Taking the analysts’ work, it looks like we are moving from a global stock-draw in the first quarter 2025, to a phase of global stock-builds over the rest of the year. The underlying position is for potential gains of around 0.3-0.5 million b/d over the second and third quarters of this year, rising to about 0.7 million b/d in the fourth quarter (even assuming OPEC+ maintain their cutbacks).

Source: Integr8 Fuels

Source: Integr8 Fuels

If OPEC+ stick by their commitment to start ramping up production in April, then these stock-builds will be even bigger, at around 0.7-0.8 million b/d through Q2 and Q3, rising to well above 1 million b/d in Q4.

The signs are there for bunker prices to fall

If we were in a purely fundamental market (which we are not), this would imply oil and bunker prices falling this year, with the price declines even greater if OPEC+ unwind their cutbacks.

But we know we are also in a market which is highly driven by politics and psychology. Current politics are more extreme than in recent years, but if Trump can ‘pull off’ an end to the war, it will take a huge amount of ‘upside risk’ out of the market. If Russia can then trade oil more freely, it will also bring about a more settled position in the market.

This is obviously a very simplified view of what could happen, and a lot still has to be done internationally to bring an end to the war in Ukraine. But the starting position is one of a market that looks very well supplied for this year. If there is then an end to the war, and ‘normalisation’ in Russian oil trades, then we could see bearish price developments on a fundamental, a political and a psychological basis.

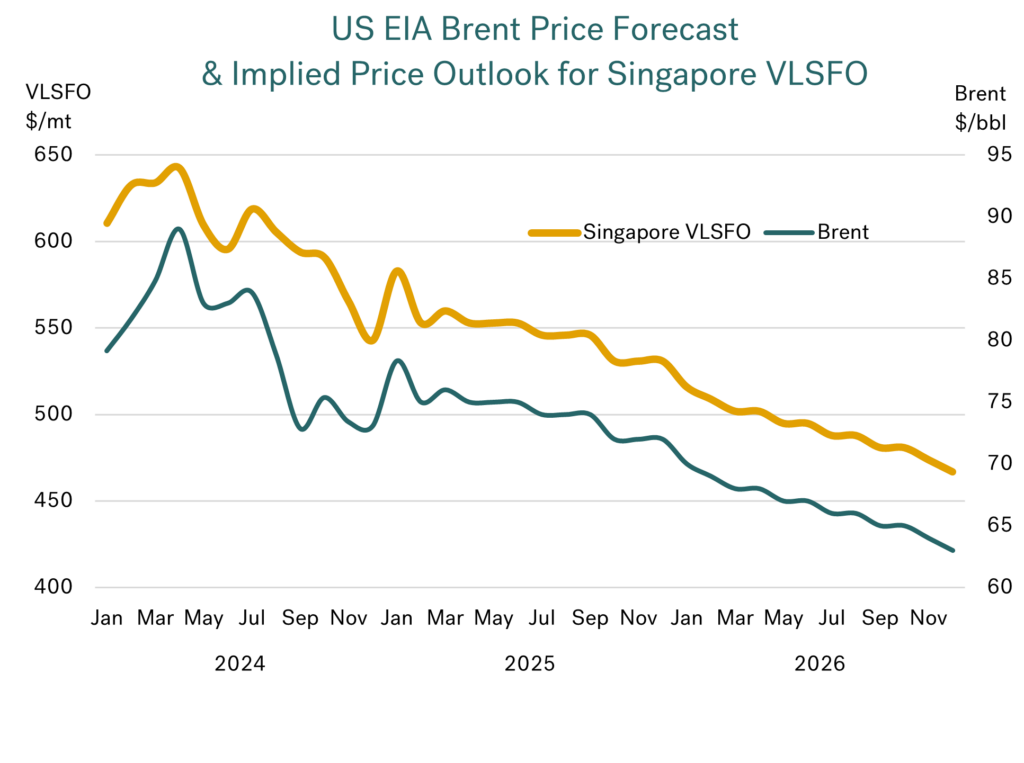

Perhaps the chart below illustrates this, showing the US EIA’s latest price forecast for Brent crude oil, and us superimposing the corresponding outlook for Singapore VLSFO. The projections go through to end 2026, with Brent prices dropping from mid $70s today, to low $70s by end year, and low $60s by end 2026. The implication for Singapore VLSFO is prices dropping from around $550/mt currently, towards $525/mt by December 2025 and $475/mt by end 2026.

Source: Integr8 Fuels

Source: Integr8 Fuels

It looks like bunker prices will fall, but watch out for the curveballs!

Looking this far ahead must be taken with caution, especially in the current political environment. We haven’t even mentioned tariffs, Israel/Gaza, or Iran. Even bearing this in mind, it is always good to have a baseline position to work from, and this analysis provides that using a fair representation of where we stand today. We just have to be agile and adapt to new circumstances (which will surely happen!), but at the moment an end to the Russian/Ukraine war seems more likely, AND, at the same time, the fundamentals look bearish. It suggests we will be paying less for bunkers going forward. Just watch out for the ‘curveballs’ that may be coming our way!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Oil Prices Surge as Sanctions Shake the Market

January 29, 2025

Biden and Trump mean we are paying more for bunkers

Through most of last year, and especially in the fourth quarter, we highlighted the weak fundamentals in the oil market and the downward pressures on oil (and bunker) prices. Markets were at ‘obvious’ low prices through to the end of last year, and then politics kicked in, and prices surged!

Brent crude back to $80/bbl

Politics have triggered a significant hike in crude oil prices to their highest level in 5 months, with front month Brent up from the low $70s to a high close to $82/bbl. Prices have eased back after their initial hike, but they are still 7% higher than in December. Clearly politics trump any bearish fundamentals in the market; no one at the moment is talking about oil supply exceeding demand this year!

Source: Integr8 Fuels

Source: Integr8 Fuels

Biden started the ball rolling

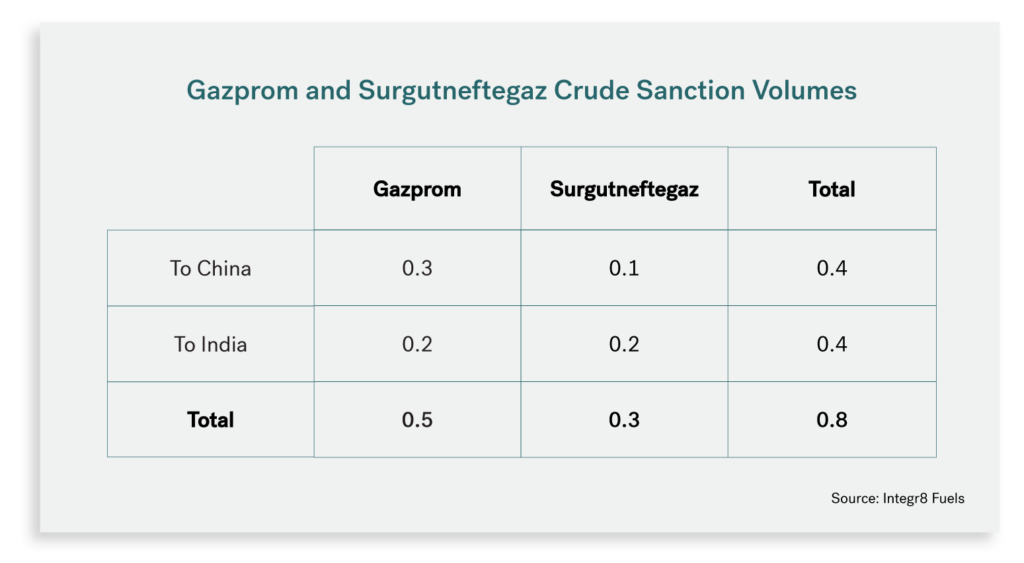

The first surprise was that right at the end of his term, on 10th January, President Biden imposed new sanctions on Russia, targeting around 160 tankers (the ‘dark/shadow fleet’), marine insurance companies and two Russian production companies, Gazprom and Surgutneftegaz. These two companies had been exporting around 0.8 million b/d of crude, mainly to China and India. Now buyers from these companies only have a grace period until February 27th to offload their cargoes before facing sanctions themselves.

The implications and uncertainty surrounding these new US sanctions has meant the Russian crude export market has now ground to a halt. The response has been for Chinese and Indian buyers to act quickly and enter the market looking for alternative supplies, including from the Middle East, West Africa, and Brazil. The net result is that China and India are now competing with each other, alongside previous buyers of these crude grades. Such an increase in competition and uncertainty about the future could only lead to one thing, a surge in oil prices.

VLSFO prices up by around 8%

Consequently, we have been hit with much higher bunker prices. Singapore VLSFO has been back up at around $590-600/mt, with Rotterdam prices around $540-550/mt, 9% and 7% higher than their December averages.

Source: Integr8 Fuels

Source: Integr8 Fuels

Oil sanctions on Russia are making us pay the price

Direct sanctions on the two Russian oil companies amount to around 0.8 million b/d of crude exports, split 50:50 between India and China.

Source: Integr8 Fuels

Source: Integr8 Fuels

This alone may seem relatively small, given Russia had been exporting a total of some 4.6 million b/d of crude and 2.7 million b/d of products. However, there are further issues that restrict export volumes, with non-compliant tankers also sanctioned, and these moved an estimated 1.6 million b/d of Russian exports last year. Also, with sanctions on marine insurance companies and issues fulfilling US dollar financial transactions, it is no surprise there has been a halt in Russian exports and a rush to secure alternative crude volumes.

Russian sanctions will open the door for OPEC+

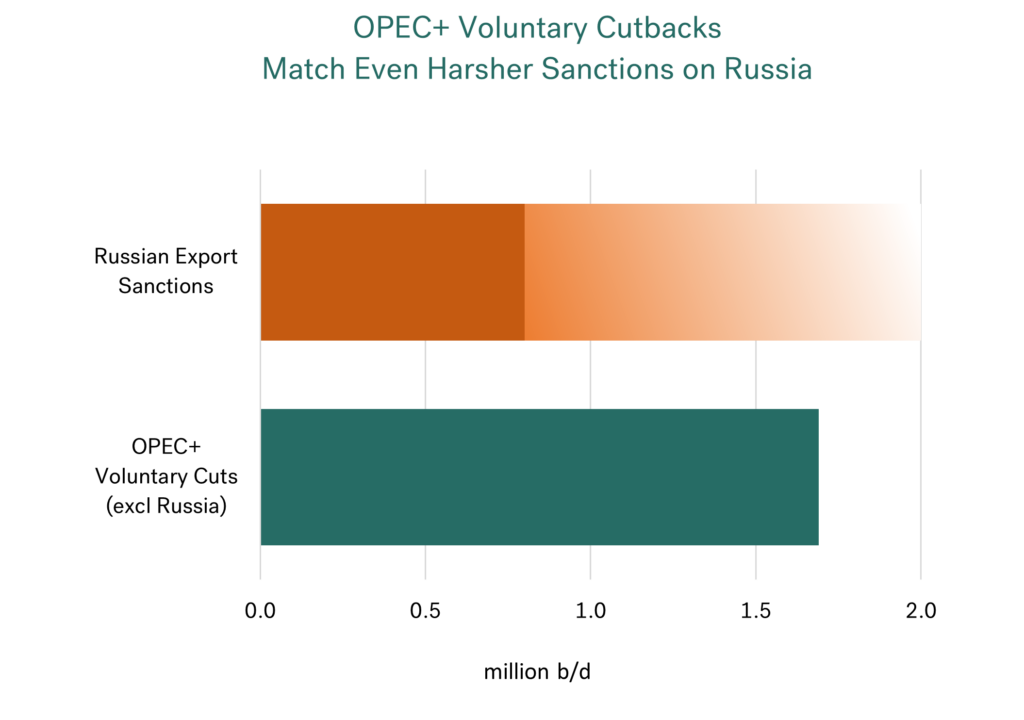

When one door closes, another often opens. In this case the closure of Russian ‘doors’ now makes it far easier for the opening of OPEC+ ‘doors’. If we exclude Russia, OPEC+ currently has 1.7 million b/d of voluntary production cutbacks that they have been looking to unwind since last year. The re-introduction of these volumes has been pushed back to April this year because previous ‘market conditions’ were not right (i.e. oil prices were too low).

President Trump has already asked Saudi Arabia and OPEC+ to reduce oil prices, and the only mechanism they have for this is to raise production. Although lower oil prices would appear to contradict incentives for companies to “Drill Baby Drill” in the US, an increase in OPEC+ production would ultimately take the sting out of prices following sanctions on Russia. In fact, the full unwinding of OPEC+ cutbacks could offer Trump an ability to put even tighter sanctions on Russian oil exports, if he chooses.

Source: Integr8 Fuels

Source: Integr8 Fuels

An eye on a bigger prize?

There are many dichotomies in what President Trump has said so far, such as talk of putting 25% tariffs on Canada and Mexico (and China?) and wanting lower oil prices, and wanting the US to “Drill Baby Drill”. But, if it takes such a tight sanction squeeze on Russia (or even the threat of one) to start negotiating an end to the 3-year war with Ukraine, then President Trump could be a peacemaker. Then Iran next?

This unpredictable, or ‘non-traditional’ approach to politics looks like we will continue to get extremes in oil prices. Timings never match; a tightening of sanctions on one country will never coincide with an agreement to raise production in another country. However, Saudi Arabia has an estimated 3 million b/d of spare capacity, the UAE another 1 million b/d, with Kuwait and Iraq another 1 million b/d between them. If Trump works with these countries, there is potentially up to 5 million b/d of ‘replacement oil’ to work with if he imposes even tighter oil sanctions on Russia, or decides to escalate the position with Iran.

Higher bunker prices today, but where do we go from here?

There are nuances in bunker prices in different regions, and in their relationship with crude, but we are essentially ‘price-takers’ in the oil market. Biden and Trump have made their moves, and we are currently paying around 7-9% more for bunkers than in December.

At the moment we are in the ‘initial shock’ period, which has meant a reversal in all the bearish oil price dynamics we were looking at for most of 2024. However, prices have eased back a bit, and there will be ways that alleviate the initial response to these sanctions. Buyers of Russian crude will have to use unsanctioned tankers and also prove the purchase price of Russian crude is less than the $60/bbl imposed cap; but it can be done (at the moment).

In the bigger picture, President Trump says he wants to end the war between Russia and Ukraine, following the Israel-Hamas ceasefire agreed on January 15th. We are not political commentators, nor forecasters of where the Nobel peace prize may go, but Biden has disrupted Russian oil exports and President Trump will continue disrupting global politics and markets throughout his term.

In the short-term, politics have pushed bunker prices higher, and obviously even tighter ‘Trump sanctions’ on Russia could see another leap in prices. But if there is a negotiated peace in the Russia/Ukraine war, or one looks highly likely, then we could see oil prices tumbling and the Nobel peace prize making its way to the US.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com