Bunker Prices Poised to Drop — But Watch for the Curveballs!

Prices are down: Is Trump close to ending the Ukraine war?

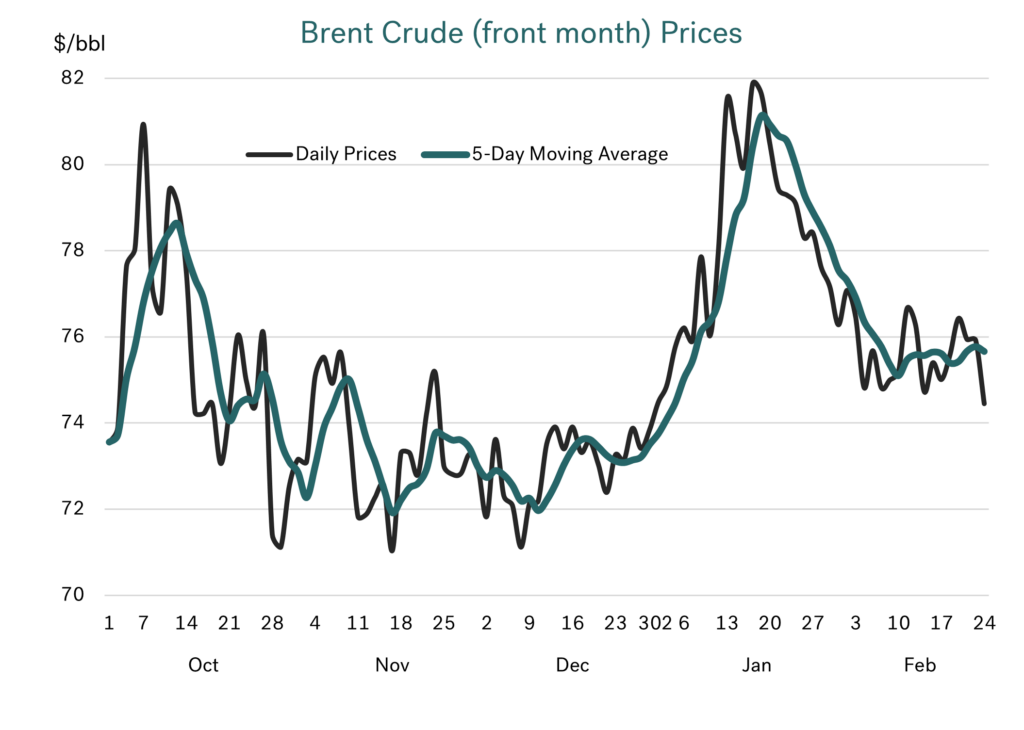

Uncertainty, uncertainty, uncertainty is running through the oil markets. The biggest news stories surround Trump and Putin getting closer and a potential negotiated end to the war in Ukraine. Who is involved in the negotiations, what might be ceded and how Ukraine comes out in all this is not yet precise. But when you look at crude prices, it shows the market has taken a general view that the situation has eased a lot since Biden’s 10th January, last gasp imposition of sanctions on Russia.

Source: Integr8 Fuels

Source: Integr8 Fuels

Front month Brent had fallen back by $6/bbl from its recent peak, and has seen another sharp drop this week. The market is certainly taking pointers towards a settlement in the Russia/Ukraine war.

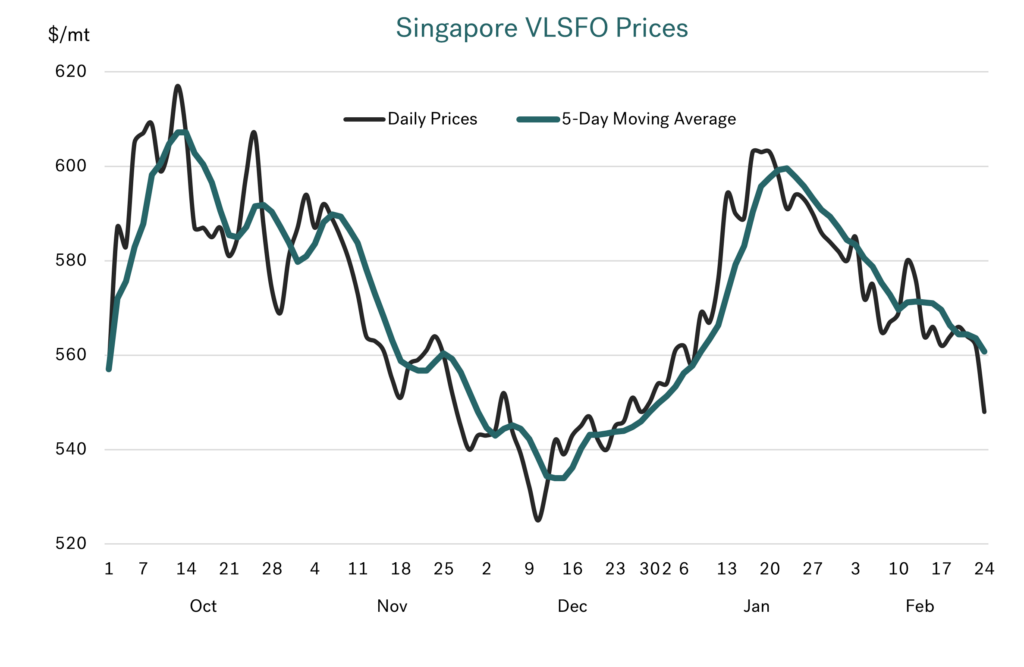

VLSFO prices have fallen alongside crude, with Singapore prices down from $600/mt to below $550/mt, including a significant fall at the start of this week. The drop in Rotterdam VLSFO prices has not been as great, with some strength in European middle distillate refinery margins and lower diesel trade from the US to Europe. Nonetheless, VLSFO prices are still lower than a month ago, although not yet back down to their December levels.

Source: Integr8 Fuels

Source: Integr8 Fuels

It must be intriguing being a political analyst

Even experts in the political world have been surprised by some of the recent rhetoric, and how political relationships have changed. We have no special insight into how the Russia, Ukraine, US, European affiliations may pan out, which may become more clear as a number of European leaders meet with Trump. However, at this stage it is worth us using our expertise in the oil markets to look at what could happen if the Ukraine war does come to an end and Russia is somehow brought back into the international (or at least the US) fold.

Has the door just shut on OPEC+

In our report a month ago we mentioned that a tightening of sanctions on Russia could further constrain Russian oil exports and finally open a door for OPEC+ to start unwinding their 1.7 million b/d of voluntary production cutbacks. At their early February meeting, the OPEC+ Joint Ministerial Monitoring Committee (JMMC) reiterated their previous plan to start unwinding cutbacks from April. However, the renewed Trump/Putin dialogue and moves towards ending the Ukraine war seem to have removed any ‘easy’ option for OPEC+ to bring back this production into the international market anytime soon.

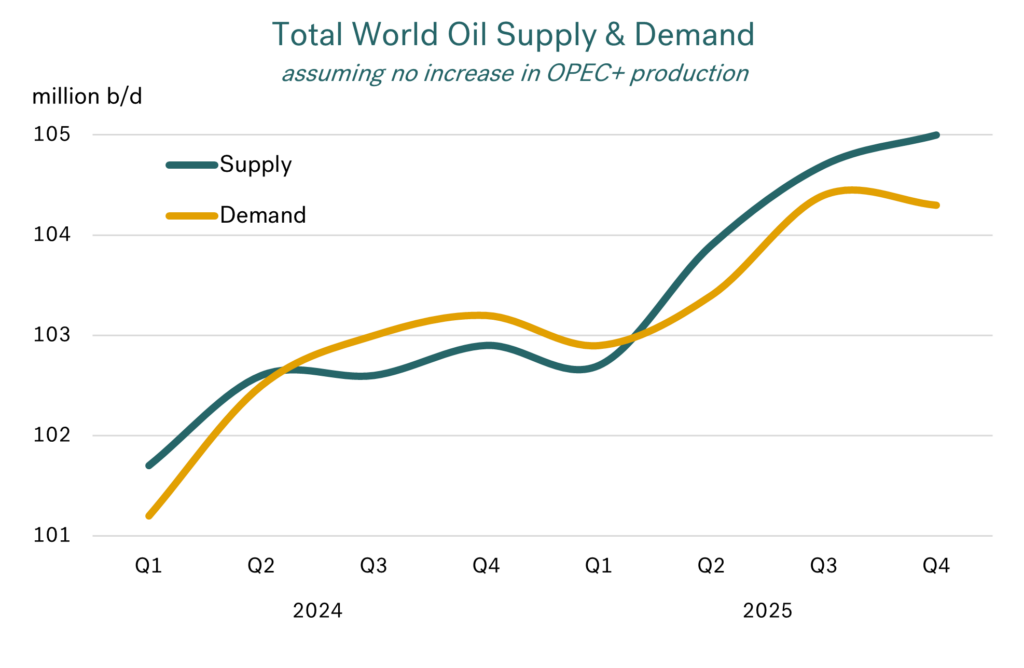

The world looks like it has more than enough oil, even without ‘extra’ OPEC+ volumes

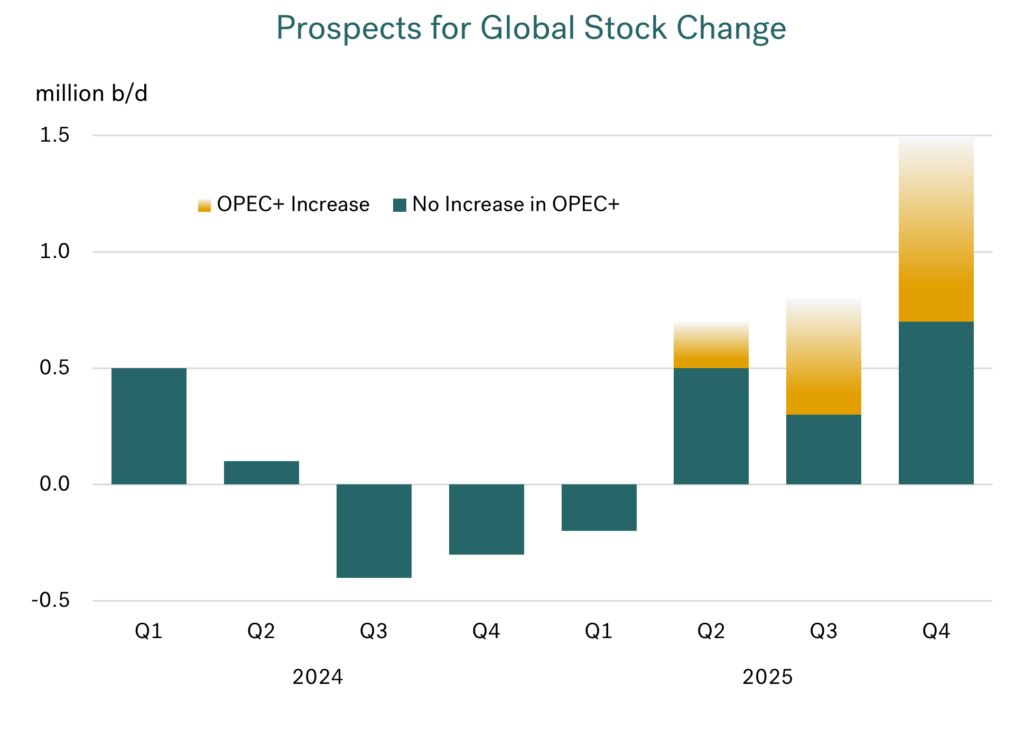

Looking at analysts’ views of the oil market for this year, the general expectation is that even if OPEC+ maintain their voluntary cutbacks until the end of the year, there is still ‘too much oil’. The chart below illustrates total world oil supply and demand for 2024 and the outlook for 2025. This shows markets shifting from demand higher than supply between the third quarter 2024 and the first quarter this year, to supply exceeding demand from the second quarter 2025 onwards; and this is based on OPEC+ maintaining their cutbacks for the entire year!

Source: Integr8 Fuels

Source: Integr8 Fuels

The expectation now is that although the increase in demand this year will be slightly bigger than in 2024, the gain will still be relatively modest, at around 1.2-1.3 million b/d. At the same time, production increase in the US, Brazil, Guyana, and Norway, along with minor gains elsewhere (and declines in some countries), means global oil supply is forecast to rise by around 1.6 million b/d, even without ‘extra’ OPEC+ oil.

Taking the analysts’ work, it looks like we are moving from a global stock-draw in the first quarter 2025, to a phase of global stock-builds over the rest of the year. The underlying position is for potential gains of around 0.3-0.5 million b/d over the second and third quarters of this year, rising to about 0.7 million b/d in the fourth quarter (even assuming OPEC+ maintain their cutbacks).

Source: Integr8 Fuels

Source: Integr8 Fuels

If OPEC+ stick by their commitment to start ramping up production in April, then these stock-builds will be even bigger, at around 0.7-0.8 million b/d through Q2 and Q3, rising to well above 1 million b/d in Q4.

The signs are there for bunker prices to fall

If we were in a purely fundamental market (which we are not), this would imply oil and bunker prices falling this year, with the price declines even greater if OPEC+ unwind their cutbacks.

But we know we are also in a market which is highly driven by politics and psychology. Current politics are more extreme than in recent years, but if Trump can ‘pull off’ an end to the war, it will take a huge amount of ‘upside risk’ out of the market. If Russia can then trade oil more freely, it will also bring about a more settled position in the market.

This is obviously a very simplified view of what could happen, and a lot still has to be done internationally to bring an end to the war in Ukraine. But the starting position is one of a market that looks very well supplied for this year. If there is then an end to the war, and ‘normalisation’ in Russian oil trades, then we could see bearish price developments on a fundamental, a political and a psychological basis.

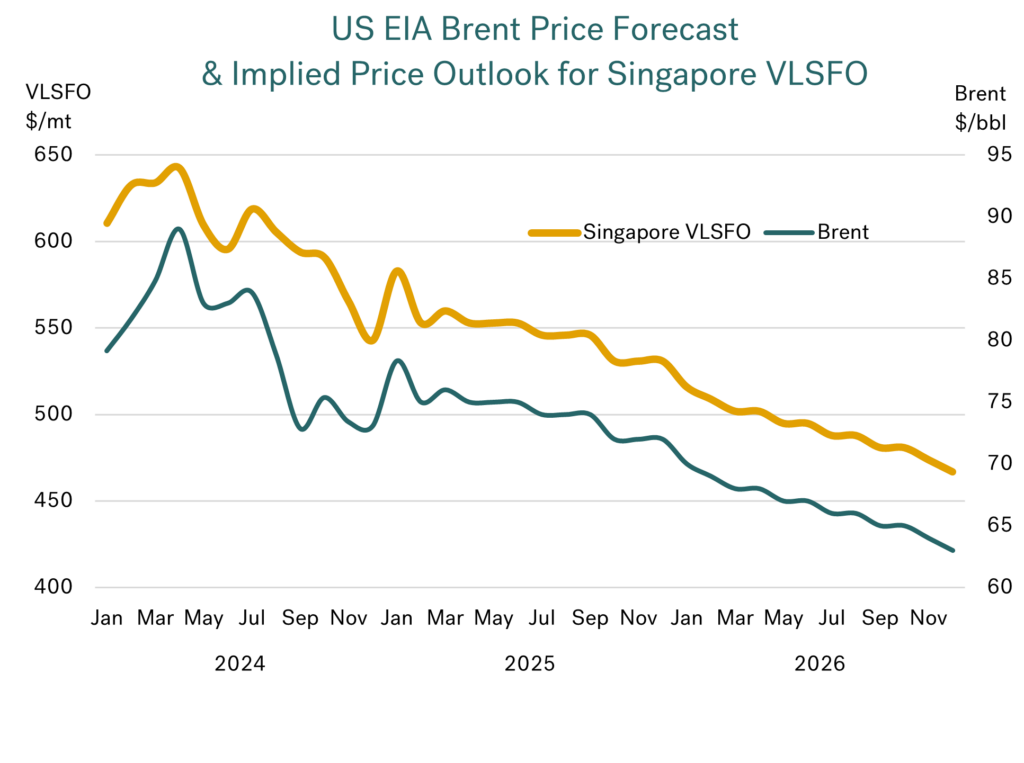

Perhaps the chart below illustrates this, showing the US EIA’s latest price forecast for Brent crude oil, and us superimposing the corresponding outlook for Singapore VLSFO. The projections go through to end 2026, with Brent prices dropping from mid $70s today, to low $70s by end year, and low $60s by end 2026. The implication for Singapore VLSFO is prices dropping from around $550/mt currently, towards $525/mt by December 2025 and $475/mt by end 2026.

Source: Integr8 Fuels

Source: Integr8 Fuels

It looks like bunker prices will fall, but watch out for the curveballs!

Looking this far ahead must be taken with caution, especially in the current political environment. We haven’t even mentioned tariffs, Israel/Gaza, or Iran. Even bearing this in mind, it is always good to have a baseline position to work from, and this analysis provides that using a fair representation of where we stand today. We just have to be agile and adapt to new circumstances (which will surely happen!), but at the moment an end to the Russian/Ukraine war seems more likely, AND, at the same time, the fundamentals look bearish. It suggests we will be paying less for bunkers going forward. Just watch out for the ‘curveballs’ that may be coming our way!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.