Bunker Quality Trends Report Sept 2025

July 4, 2025

Coming in September 2025, the bi-annual Bunker Quality Trends report is an essential resource for shipowners, charterers, and operators seeking to make informed decisions in an increasingly complex regulatory and market environment.

The exact contents will be shared near to the publication date. Key topics include:

- Global availability and quality of key marine fuel grades, including:

- Conventional fuels; VLSFO, HSFO, LSMGO, ULSFO

- Alternative fuels: Certified biofuels, LNG

- plus, which ISO fuel specifications have been traded

- Mediterranean ECA: The immediate operational and commercial impact of implementation

- Smarter buying: Problematic parameters and global hotspots

Sign up ahead of time to make sure you’re the first to receive it.

ADNOC L&S highlights Integr8 as key to its alternative bunker fuel strategy

June 9, 2025

DUBAI, 09 June 2025 – ADNOC Logistics & Services (ADNOC L&S), subsidiary of the Abu Dhabi National Oil Company, has named Integr8 as a central component of its strategy to scale up alternative bunker fuel supply, including biofuels and LNG.

In a recent interview with S&P Global Commodity Insights, ADNOC L&S CEO Abdulkareem Al Masabi, explained how Integr8’s global footprint, market expertise, and data-led trading capabilities position the company as a critical partner in delivering cleaner, more compliant marine fuels. The comments underscore Integr8’s strategic role in supporting ADNOC L&S’s ambitions to grow its influence in the evolving alternative fuels market.

“Integr8 will play an integral part going forward (when we) look at alternate fuels,” Al Masabi said. “Whether it be ammonia, biofuels and LNG… all of these things are actually in the game plan for Integr8 going forward.”

As demand for lower-emission fuels grows and compliance challenges increase, ADNOC L&S’s endorsement highlights the vital role of agile, globally connected traders like Integr8 in supporting the maritime energy transition.

Read the interview on the S&P Global website here.

Media Contact:

Angela Freeth, angela.f@integr8fuels.com

Integr8 announced as Emerald Sponsor and Cocktail Host at PULSES 25

May 19, 2025

SINGAPORE, 19 May 2025 – Integr8 Fuels is proud to be an Emerald Sponsor of PULSES 25, the Global Pulse Confederation’s (GPC) flagship conference, taking place in Singapore from 20–22 May 2025.

As part of its sponsorship, Integr8 will host the closing cocktail reception on 22 May, bringing delegates together for a relaxed and sociable end to three days of discussion, insight and networking.

PULSES 25 brings together stakeholders from across the global pulse sector to explore critical issues including food security, sustainability, innovation, investment, and the digitalisation of trade. The event features keynote addresses from industry leaders and expert-led panel discussions, making it a key fixture in the GPC calendar for members looking to stay ahead in a rapidly evolving global market.

“Integr8 is proud to support an event that fosters international collaboration and dialogue on issues that impact the global food supply chain,” said a spokesperson at Integr8 Fuels. “We look forward to welcoming delegates at the closing cocktail reception in Singapore.”

PULSES 25 is open exclusively to members of the Global Pulse Confederation. Membership provides access to the event and a range of benefits throughout the year.

For more information about the event and how to attend, visit https://pulses25.globalpulses.com.

Media Contact:

Angela Freeth, angela.f@integr8fuels.com

Integr8 Report Highlights VLSFO Quality Challenges, Biofuel Compliance Strategies, and Future Bunkering Trends

January 14, 2025

London, United Kingdom – 14 January 2025: Integr8 Fuels has published its latest Bunker Quality Trends report, offering unparalleled insights into the evolving landscape of marine fuels. Drawing on comprehensive data from over 130 million metric tons (MT) of deliveries, the report provides an in-depth analysis of critical quality issues, regulatory implications, and market trends. This edition of the report highlights five key developments:

- Why Changes in VLSFO Blends Could Trigger a Wave of Problem Fuels (Pg 10)

- The Smart Way to Meet Biofuel Targets: Plan Biofuel Bunkering on a Fleet or Pool Level (Pg 23)

- Barge Bottlenecks: The Sulphur Compliance Challenge in Southern Europe (Pg 12)

- Rising Automotive Fuel Blends Are Driving Flash Point Risks in the Med (Pg 19)

- Biofuels and LNG: Key Players in the Future of Fuel Compliance (Pgs 21-26)

Why Changes in VLSFO Blends Could Trigger a Wave of Problem Fuels

The introduction of the ISO 8217:2024 specification has brought renewed focus on viscosity limits, with a significant proportion of VLSFOs currently failing to meet the updated standards. Data from the report shows that over 45% of global VLSFO supply would not meet the RM380 2024 specification without adjustments to blend recipes. These changes could lead to a spike in problematic fuels, as was observed during the IMO 2020 transition, potentially affecting fuel stability and other critical parameters. Regions like Singapore and Houston are flagged as hotspots for adjustments, with over two-thirds of VLSFO in Singapore requiring reformulation. Buyers are urged to adapt charterparty wording to ensure suppliers comply with the latest standards to reduce the risk of critical handling issues.

The Smart Way to Meet Compliance Targets: Plan Biofuel Bunkering on a Fleet or Pool Level

When it comes to compliance with environmental regulations, FuelEU Maritime doesn’t specify a fixed biofuel percentage. The focus is on reducing the greenhouse gas (GHG) intensity across a vessel’s voyages over the course of a calendar year. The target is a 2% reduction in GHG intensity between two EU ports, which translates to around 3% biofuel blended with VLSFO or HSFO, or 2% biofuel with MGO. However, it’s more efficient to take larger biofuel quantities on select vessels and transfer compliance surpluses across your fleet or between ships in multiple fleets, which is also known as pooling. The most common biofuel grades stocked by suppliers are B24 and B30 blends, and pure B100. Their availability varies by port and region. Shipowners are advised to carefully manage their biofuel strategies and check the GHG intensity figures in Proof of Sustainability documents provided by suppliers.

Barge Bottlenecks: The Sulphur Compliance Challenge in Southern Europe

Sulphur compliance for VLSFO remains a pressing concern, with 2.4% of supplies exceeding the 95% confidence limits for ISO 8217 Table 2 parameters in the past six months. Geographical variances are significant, with higher non-compliance risks reported in bunker hubs such as Rotterdam and Balboa compared to Singapore. Infrastructure constraints, including the practice of switching between HSFO and VLSFO on the same barges, are identified as contributing factors. The report underscores the importance of data-driven procurement and robust supplier practices to mitigate these risks.

Rising Automotive Fuel Blends Are Driving Flash Point Risks in the Med

The integration of automotive diesel into bunkering pools has led to heightened risks of flash point non-compliance, particularly in the Mediterranean. Automotive fuels often have a minimum flash point of 55°C, below the 60°C threshold mandated for marine fuels under SOLAS regulations. The report identifies specific ports where these risks are most prevalent and calls for enhanced due diligence when purchasing in regions reliant on automotive diesel imports. Ensuring DMA specifications are met is critical to avoiding costly compliance breaches.

Biofuels and LNG: Key Players in the Future of Fuel Compliance

The report highlights the growing role of biofuels and LNG as transitional solutions for meeting stringent emissions regulations, such as FuelEU Maritime and the upcoming Mediterranean Emission Control Area (Med ECA). While LNG remains a reliable option due to its consistent quality and negligible SOx emissions, biofuels are gaining momentum as suppliers expand blending capabilities globally. The report cautions buyers about potential operational risks, such as biofuel-related cold flow challenges in colder climates and the limited availability of LNG bunker vessels. The introduction of the Med ECA from 1 May 2025 will likely boost LNG bunker demand in the region, however, the delivery of LNG bunker vessels is failing to keep up with growing demand, tightening the LNG supply chain.

The full report is available to download for free from the Integr8 website: https://integr8fuels.com/fuel-quality-trends-q1-2025/

Press Contact: Angela Freeth

Email: marketing@integr8fuels.com

To see how we can assist you with your fuel procurement requirements, visit our Contact Us page.

Bunker Quality Trends Report Jan 2025

January 14, 2025

This January 2025 edition of Integr8’s Bunker Quality Trends report is an essential resource for shipowners, charterers, and operators seeking to make informed decisions in an increasingly complex regulatory and market environment.

Leveraging data from over 130 million metric tons (MT) of global bunker fuel deliveries, the report highlights the most critical issues and actionable insights for the industry, including:

Strategic Buying

- Why Changes in VLSFO Blends Could Trigger a Wave of Problem Fuels

- Barge Bottlenecks: The Sulphur Compliance Challenge in Southern Europe

- Rising Automotive Fuel Blends Are Driving Flash Point Risks in the Med

- Smarter Procurement: Strategies to Tackle Fuel Quality and Availability Challenges

Practical Compliance

- Biofuel Compliance: How Much Ship Operators Need and the Smartest Way to Buy

- Navigating ISO 8217:2024 and Med ECA Rules: Adapting to a New Era

- Biofuels and LNG: Key Players in the Future of Fuel Compliance

Published January 2025

Integr8 Fuels renews ISCC EU certification for sustainable biofuel trading

December 31, 2024

Dubai, UAE – 31 December 2024 – Integr8 Fuels is pleased to announce the renewal of its International Sustainability and Carbon Certification (ISCC) certificate for the trading of sustainable biofuels. This renewal underscores Integr8’s ongoing commitment to providing shipowners with biofuels that are produced from legitimate feedstocks and via processes that meet stringent environmental regulations.

The ISCC EU certification is a globally recognised standard for sustainable production, sourcing, and trading of bio-based feedstocks and biofuels. With this renewed certification, Integr8 continues to offer Proof of Sustainability (PoS) for various liquid and gaseous biofuels, including fatty acid methyl ester (FAME), hydrotreated vegetable oil (HVO), and liquefied biomethane (LBM).

A PoS follows a fuel batch throughout its whole supply chain with greenhouse gas estimates. This documentation enables shipowners to demonstrate compliance with environmental regulations such as the EU Emissions Trading System and FuelEU Maritime, which require verifiable use of sustainable low-carbon fuels.

Chris Turner, Integr8’s Bunker Quality and Claims Manager, emphasised the importance of this certification:

“Renewing our ISCC EU certification reflects our dedication to supporting the maritime industry’s transition to more sustainable energy solutions. It ensures that our clients can continue to rely on us for compliant and ethically sourced biofuels.”

Integr8 Fuels remains committed to facilitating the shipping industry’s efforts to reduce greenhouse gas emissions by providing certified sustainable biofuels and comprehensive support to navigate evolving environmental regulations.

Press Contact: Angela Freeth

Email: marketing@integr8fuels.com

To see how we can assist you with your fuel procurement requirements, visit our Contact Us page.

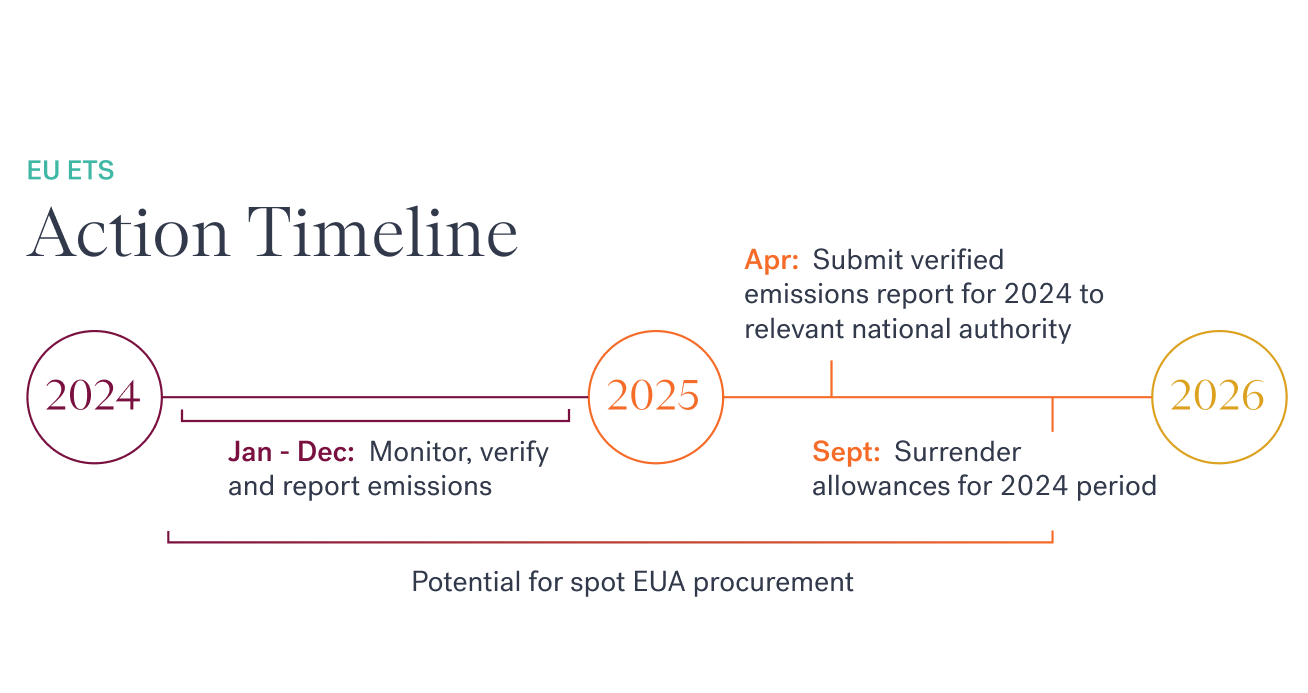

Utilising the physical spot EUA market for 2025 EU ETS compliance

December 12, 2024

Marketing Communication

How strategic buying can help shipping companies avoid a compliance headache.

In less than a year, shipping companies will need to surrender enough European Union Allowances (EUAs) to cover their emissions for the 2024 reporting period.

With this date fast approaching, waiting until the September 2025 deadline to purchase EUAs could be costly. Many forward-thinking shipowners have been choosing a proactive approach by buying allowances immediately post-voyage in 2024 and will continue to do so in early 2025.

Why Adopt a Buy-As-You-Go Strategy for EUAs?

A buy-as-you-go approach to purchasing EUAs offers businesses a practical and efficient way to manage their carbon compliance obligations. This strategy is particularly beneficial for organisations looking to balance cost, stability, and regulatory compliance in a dynamic market environment.

One of the main advantages of this approach is improved budget management. Rather than waiting until deadlines to make potentially large payments, businesses can spread the cost of EUAs over time, by factoring in the cost of EUAs into freight prices on an ongoing basis and purchasing EUAs accordingly. This allows for greater financial flexibility and helps avoid the strain of lump-sum purchases at the last minute.

Additionally, a buy-as-you-go strategy can help mitigate the effects of price volatility in the EUA market. By purchasing allowances incrementally, companies can reduce their exposure to sudden price fluctuations, creating a more stable and predictable financial framework.

Finally, this approach ensures businesses stay ahead in meeting compliance requirements. Regularly purchasing allowances helps to avoid the risk of falling short, ensuring companies can meet their obligations and steer clear of fines or sanctions.

By adopting a buy-as-you-go strategy, businesses can take a proactive, balanced approach to managing their carbon responsibilities while maintaining financial control and operational peace of mind.

Simplifying EUA Procurement

Navigating the complexities of EUA procurement and compliance obligations can be challenging, which is why Integr8 offers a specialised team to support shipowners with the task. By leveraging the expertise of seasoned traders, Integr8’s Carbon Desk provides a flexible service tailored to meet the needs of businesses of all sizes.

One of the key advantages of the service is its accessibility (subject to confirmations of eligibility on a case-by-case basis). There are no minimum purchase requirements, meaning traders can start with as few as one EUA. This flexibility allows businesses to engage with the market on their own terms, whether they are looking to make small-scale purchases or explore larger opportunities over time.

Integr8 also eliminates upfront costs by forgoing commitment fees, making it easy for eligible companies to begin trading without financial barriers. The onboarding process is simple and efficient, with a straightforward KYC (Know Your Customer) process that ensures quick setup and minimal disruption.

All transactions are conducted in USD, helping to reduce foreign exchange risks and provide greater financial clarity. This approach is particularly beneficial for eligible businesses seeking to minimise complexities when managing their carbon compliance obligations.

By providing a seamless and accessible platform, Integr8’s Carbon Desk allows eligible businesses to streamline their EUA procurement and focus on achieving their environmental and compliance goals with confidence.

To request a free 30-minute consultation or to receive a brochure, email carbon@integr8fuels.com or contact your trading representative.

Media Contact:

Angela Freeth, angela.f@integr8fuels.com

Integr8 Fuels announces sponsorship of IBIA Annual Convention 2024

October 29, 2024

Athens, Greece – 29 October 2024 – Integr8 Fuels, a leading provider of marine fuel procurement and carbon trading services, is proud to announce its role as bronze sponsor of the IBIA Annual Convention 2024, taking place in Athens from 6-7 November. This flagship event, hosted by the International Bunker Industry Association (IBIA), will gather industry leaders from across the maritime and bunker sectors to address the evolving challenges and opportunities within the fuel supply chain.

Integr8 Fuels delivers a comprehensive range of services for shipowners and operators worldwide, offering data-driven insights and robust fuel management solutions. The company’s expertise in fuel procurement and risk management has made it a trusted partner for global fleets looking to optimise fuel strategies and navigate market volatility.

“We are excited to sponsor the IBIA Annual Convention 2024,” said an Integr8 Fuels spokesperson. “As the industry continues to focus on sustainability and operational efficiency, this event provides a vital forum for collaboration and exchange. We look forward to connecting with our industry peers to explore innovative ways to address these pressing challenges.”

Throughout the event, representatives from the Integr8 Fuels Athens office will be available to discuss the company’s latest offerings and insights into the trends shaping the future of marine fuel.

To arrange a meeting with an Integr8 Fuels representative at the convention, please email athens@integr8fuels.com.

For more information about the event, visit https://www.ibiaconvention.com/.

Media Contact:

Angela Freeth, angela.f@integr8fuels.com

Integr8 Fuels achieves ISO 9001 accreditation across key global entities

September 10, 2024

Dubai, UAE – 10 September, 2024 – Integr8 Fuels is proud to announce that it has achieved ISO 9001:2015 accreditation for Quality Management Systems (QMS) across its global entities. This certification demonstrates our commitment to delivering the highest standards of service and operational excellence to our clients worldwide.

The ISO 9001:2015 certification, recognised as the international standard for quality management, specifies requirements for a robust quality management system. This accreditation ensures that our company consistently provides products and services that meet customer and regulatory requirements while demonstrating a continuous improvement process. Further information on the ISO 9001 standard can be found here.

Integr8 Fuels’ entities in Dubai and Singapore have successfully renewed their ISO 9001 certifications. In addition to the renewals, we are delighted to announce that our newest entities in Taiwan and Australia have achieved ISO 9001 certification for the first time. The establishment of these new entities represents a strategic expansion of our global footprint, allowing us to be closer to our customers in these vital regions. This proximity enables us to provide more tailored and localised services, ensuring we meet the unique needs of our clients on the ground.

Integr8 Fuels’ Fuel Quality and Claims Manager, Chris Turner, commented, “Achieving ISO 9001 certification across our key global entities reflects our commitment to excellence and our continuous efforts to enhance customer satisfaction. With our new entities in Taiwan and Australia now certified, we are well-positioned to deliver even greater value to our clients in these regions.”

The ISO 9001:2015 accreditation affirms Integr8 Fuels’ position as a trusted partner in the bunker trading industry. As we continue to expand our global presence, this certification will play a crucial role in ensuring we uphold our high standards across all our operations.

Media Contact:

Angela Freeth, angela.f@integr8fuels.com

Report reveals Red Sea closure’s impact on VLSFO compliance, and emerging bunker quality trends

June 11, 2024

This is the fourth bi-annual report analysing the bunker fuel landscape

In the latest report from Integr8 Fuels, bunker quality and claims manager Chris Turner advises shipowners and bunker buyers on how they can improve their buying processes and performance. Tapping into the world’s biggest bunker fuel quality sample database, Turner reveals the most pressing quality issues the industry is up against. These include:

- Red Sea closure affecting VLSFO compliance for vessels rerouting around Africa

- Global VLSFO compliance suffers as suppliers stretch barges to cash in on rising HSFO demand, driven by increasing scrubber numbers

- Two-thirds of fuels are still sold with obsolete (pre-2017) specifications. Can the new ISO specs finally shake up old school practices?

- Profit margin-motivated blenders push more HSFOs over ISO limits

- VLSFO sulphur off specs worsening in the ARA and partly driven by high- to low sulphur barge switching

Red Sea closure impact on VLSFO compliance

Geopolitical events often have a knock-on effect on fuel quality, sometimes relating to blending economics, and occasionally, also relating to the impact on barge infrastructure because of rapidly changing demand.

Since October 2023, many more vessels have been rerouting around Africa rather than travelling via the Red Sea, resulting in a significant increase in volume of HSFO demand, with . During the same period, there has been a 30% increase in VLSFO sulphur off specification incidents in ports along the African coast and nearby Spain, which upon closer inspection, show a root cause of affected barges also carrying HSFO.

Integr8 Fuels’ analysis has identified suppliers running a similar model who are unaffected – this likely due to their infrastructure allowing double valve segregation and separate manifolds onboard the barge preventing any cross-over contamination, and/or proper management of grade changeover.

The increase in HSFO demand is also putting pressure on supply models.

Another factor is the significant increase in the number of vessels equipped with scrubbers, resulting in a far higher demand for HSFO than in recent years with data available to Integr8 suggesting approximately 100 million MT of deadweight tonnage being either delivered or retrofitted with scrubbers in 2023. This combined with the price spread which remains very appealing, and scrubber assets travelling further at higher speeds, continues to support the demand going forwards.

Suppliers of course want to meet this increased demand and in doing so place transitional temporary pressure on existing assets or could be forced into a sea change in strategy, both of which may result in the practice of storing both HSFOs and VLSFOs onboard the asset.

This is made apparent by increased sulphur off specification occurrences with the root cause being the switching of grades by certain suppliers, in ports including but not limited to Barcelona, Callao and Hong Kong.

New ISO specs

The International Organization for Standardization’s (ISO) recently launched ISO 8217:2024 standards present a rare opportunity to do away with the industry’s reliance on obsolete fuel specifications. This is no easy task as research from Integr8 shows that two-thirds of residual bunker fuels and three-quarters of distillate bunker fuels are still sold with pre-2017 specifications.

ISO 8217:2024 introduces several important amendments. Notably, it sets minimum viscosity limits across all residual grades, addressing handling issues with low-viscosity fuels. It also identifies specific chemical species linked to operational problems, such as organic chlorides, and incorporates international testing standards. The new specification prepares the industry for the growing use of biofuel blends by establishing new testing parameters for these fuels, such as FAME content and net heat of combustion.

There are however missed opportunities, namely related to de-minimis levels of organic chlorides and cold flow properties.

Suppliers may again attempt to avoid the small print on organic chlorides as they have previously done with Clause 5, which could possibly have been better addressed by incorporating a maximum limit in tables. Cold flow properties must only be reported, not guaranteed, leaving the potential need for buyers to seek additional guarantees outside ISO 8217:2024. This remains a concern as certificates of quality (where such values are reported) often lack reliability when provided at a distant time from delivery.

Despite these challenges, the ISO 8217:2024 specification represents a substantial step forward, providing the necessary framework to address many current fuel quality issues. The uptake of the 2024 specification will depend significantly on ship owners demanding these new standards be incorporated into charterparty agreements. By doing so, owners can drive the transition from outdated specifications to the latest version, paving the way for a more reliable and efficient future in marine fuel standards.

Global HSFO off specs

Global HSFO quality has worsened in the past six months. The number of off-specification HSFO samples has gone up from 3% to 3.4%, and this is significantly higher than for VLSFO (2.1%) and MGO (2.8%).

Profit-motivated blending can go some way to explain the deteriorating HSFO trend. Almost half of HSFO off specs have been blending-related and come as a result of blending close to HSFOs density and viscosity limits, Turner argues. Water content is the second most likely usual off spec suspect and has made up around a third of HSFO off specs.

But fortunately, neither density, viscosity nor most of the water off specs qualify as so-called “critical” or “high risk” off specs. They are not likely to lead to serious engine trouble or debunkerings, which can cost shipowners dearly. These off specs are typically economically motivated. Density and viscosity off specs are more common for HSFO than for VLSFO and LSMGO because they are the blending targets for HSFO, and blenders have an incentive to blend as close to those limits as possible to save money.

VLSFO sulphur off specs

Sulphur is the biggest off spec concern for VLSFO. Again, this has to do with blending as the 0.50% sulphur limit is the target that blenders have their eyes on. Blending too far from the limit can eat into your profit margins, and we have seen the average sulphur contents in VLSFOs creep up in both the ARA and Singapore in the past six months.

In Singapore, you were 2.5 times more likely get a VLSFO stem with a sulphur content of 0.51-0.53% in the past six months as you were getting one in the preceding six-month period. It is evident that blending is being optimised towards the 0.50%.

But while only 0.3% of VLSFOs test off spec for sulphur in Singapore, the ARA has seen 2% of VLSFOs testing off spec. In the ARA, “we regretfully report that we are almost twice as likely to face a sulphur off specification incident now than in the previous reporting period,” Turner writes.

The report is available to download for free from the Integr8 website at https://integr8fuels.com/fuel-quality-trends-2024/

Media Contact:

Angela Freeth, angela.f@integr8fuels.com