Bunker prices are back to their pre-pandemic levels; What should we look out for in the next 12 months?

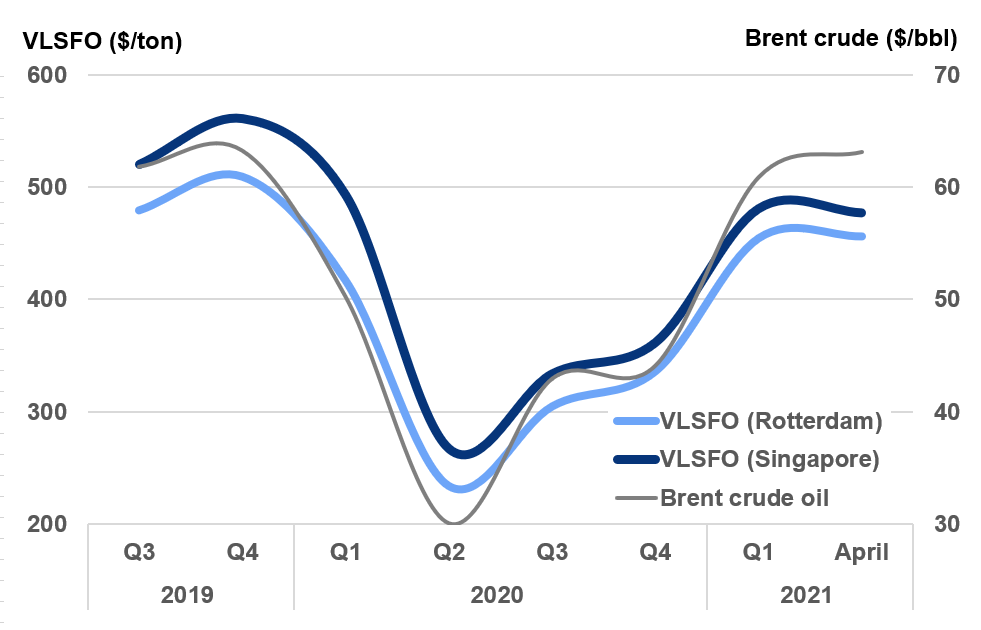

Brent crude oil prices are now back to the low $60s and where they were at the end of 2019, before the pandemic hit.

Although VLSFO price quotes are not quite back to earlier levels, part of this will be because of the market assessments and initial introduction of the VLSFO grade at end 2019/early 2020; in general terms we are back where we started.

After prices more-or-less halved in the first 3 months of 2020, the huge shifts in global oil supply & demand over the past 9-12 months have led prices back up.

Major cutbacks in crude oil production from the OPEC+ group, plus production losses because of low prices, principally in the US, have pushed prices higher. At the same time, oil demand has increased since the Q2 2020 low, although this has generally been slower than most people expected, with second and potential third waves of the virus. Nonetheless, demand is rising and the introduction of vaccination programs is supporting higher demand and higher prices.

This prompts the question: after the most turbulent 12 months in recent history, what should we be looking at for bunker price direction in the coming 12 months?

Bunker Demand & prices compared with the rest of the oil market

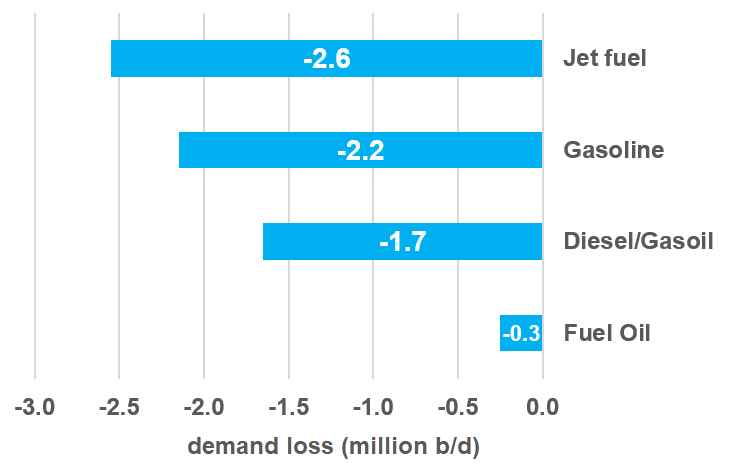

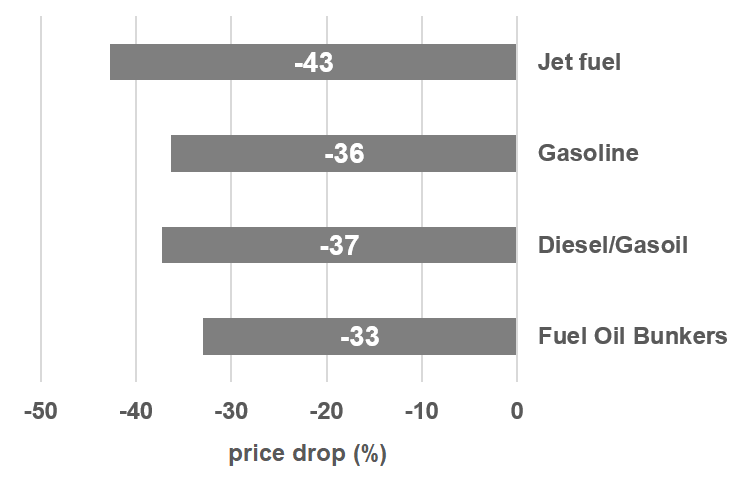

As always, the answers lie outside our markets. In fact, the bunker market has been one of the least affected sectors in terms of the demand impact from the pandemic. However, price falls for bunkers have been similar to crude oil, gasoline and diesel/gasoil, where the loss of demand has been far greater; we are not an ‘isolated’ market and it is what is happening in the other areas of the oil industry that almost entirely determine the absolute price we pay for bunkers.

Putting this in context, jet fuel has taken by far the biggest hit in demand because of the pandemic. Demand for jet in the main markets of the US, Europe and Asia was down by 2.6 million b/d (42%) in 2020. In contrast, fuel oil demand in the same area dropped by only 0.3 million b/d (7%). The volume demand impact on gasoline and diesel/gasoil lay somewhere between these two extremes.

However, these relative shifts in demand are ‘lost’ when it comes to price movements. Jet prices did fall by slightly more than other products, but price falls in the gasoline, diesel/gasoil and bunker markets were all very similar, at around 33-37% lower in 2020 than in 2019.

The inter-relationship between product prices and what happens within the refinery means prices in the bunker market are always going to reflect what is happening across the entire oil barrel.

It is worth noting that these ‘big issues’ will always be the main driver for the underlying price of bunkers, but there is also a ‘fine tuning’, with changes in the relative price of products. In fact, going forward the relative price of VLSFO could rise as gasoline demand picks up, with VGO shifted away from bunker blending to what was its typical use as a feedstock to produce gasoline.

What is happening to world oil supply?

On the oil supply side, indications are that crude production will increase, at least through to July. This follows the recent OPEC+ decision at its April 1st meeting to allow a staged increase of 1.1 million b/d from the quota allocations. In addition, Saudi Arabia is easing its additional voluntary cutback of 1 million b/d over the same period. Therefore, an additional 2.1 million b/d crude production is likely within the next 3 months.

The OPEC+ group is on a planned easing of their production cutbacks. However, some industry participants were slightly surprised by the decision, given that oil prices had already eased back by $5/bbl in the 4 weeks leading up to the meeting, and that there were further concerns surrounding the demand rebound, especially with another wave of lockdowns and a slower than anticipated vaccine uptake in Europe.

There is also another potentially bearish price indication on the supply side, with the possible return of the US to the Iranian nuclear deal. This is not immediate, with preliminary, indirect talks only starting earlier this month. However, further negotiations are planned and any indication of an agreement and easing of sanctions will have a bearish sentiment on prices, with the prospects of at least another 1 million b/d of Iranian crude entering the market.

There is also a risk that this goes beyond just these incremental Iranian supplies, or that these are heavy, higher sulphur crudes, with possible political ramifications involving Saudi Arabia’s oil policies.

From the crude supply side, it does look like more volumes are coming and this could put downwards pressure on prices generally. The focus for us will be on any further OPEC+ decisions and importantly, the triangular politics between the US, Iran and Saudi Arabia and what this may mean for Iranian and Saudi crude exports.

Where is the growth in world oil demand coming from?

If supply is likely to increase, then it is down to a more positive outcome on the demand side to counter this if prices are to rise. In the past month this hasn’t really been the case and Brent crude has fallen from a (strong) peak of $70/bbl in early March to $63/bbl more recently. The same kind of drop has taken place in the bunker market, with VLSFO in Singapore down by $40/ton in the past 5 weeks.

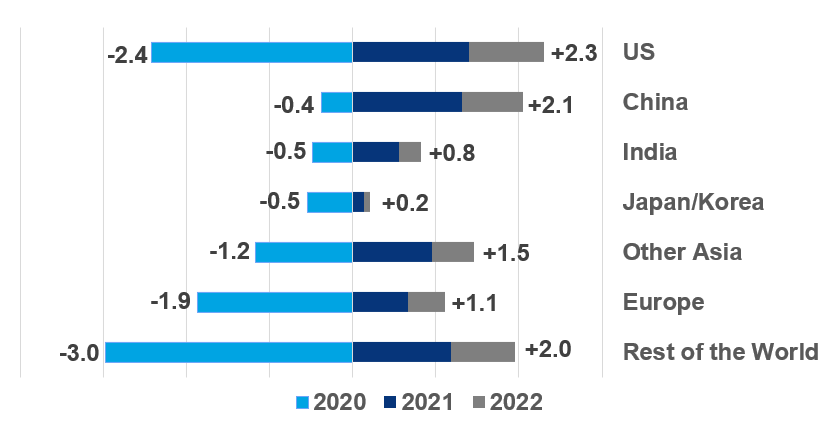

The prospects for further gains in oil demand are very much focused on a region-by-region approach. China and the US appear to be the ‘stand-out’ areas for increases in oil demand, where-as in Europe the concerns about the current surge in infections and more lockdowns make any strong demand gains here more unlikely.

In the US, the mass role out of vaccination programs, coupled with the announced $1.9 trillion fiscal stimulus policy is expected to get oil demand rising steeply. The net result is that the 2.4 million b/d loss in US oil demand in 2020 is expected to be more-or-less made up by end 2022 (+1.4 million b/d this year and another 0.9 million b/d gain in 2022). In China the market indications are even stronger, with the 0.4 million b/d demand loss last year already more than covered and the country well into ‘growth mode’.

The rest of Asia (excluding Japan and Korea) is also projected to increase its demand for oil well above the 2019 levels, although current higher infection rates in parts of India could mean a slight risk in the near term. Elsewhere, demand prospects in Japan/Korea and Europe look as though they will remain very constrained and well below pre-pandemic levels.

In terms of individual products, gasoline and diesel/gasoil demand on a global level is expected to return to 2019 levels next year. It is the global jet market that is still taking the brunt of the demand loss and is not expected to fully rebound until 2023/24.

As outlined above, any loss of demand in our market has been limited and consequently there is no ‘rebound’ to take place. Total demand for bunkers is seen as relatively stable, but with the much stronger prospects in Asian economies, demand and trade, bunker demand east of Suez is likely to grow far more than west.

Can demand increases in China & the US exceed production increases in OPEC+ (and Iran)?

Bringing these fundamentals together highlights the market uncertainties we are facing. At a high level there will be a strong focus on demand prospects in the US and China countering the anticipated increases in crude production. Within these very broad parameters, how quickly (or not) the aviation industry can get flying and the US stance to the Iranian nuclear position will also have a huge bearing on price direction.

The forward curve is never a good forecast of where things are going, but it does represent a measure of sentiment at a given time and currently there is a slight bearish tinge to the curves. Even price forecasters have adopted a very cautious approach, with a number showing flat to slightly declining prices over the next 12 months.

With a number of extremely influential factors still to be determined, the key known issues to watch for are: the US economy/demand, China, OPEC+ and the ‘curved ball’ of Iranian sanctions being lifted and any potential political fallout from this, if it happens.

The current forward curve shows a gentle decline in prices over the next 12 months; looking at the factors outlined in this note, it doesn’t look like a ‘gentle’ period of pricing ahead of us.

Steve Christy

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.