Europe & Africa Market Update 11 Dec

Bunker fuel prices in major European and African ports have mostly declined, and availability is prompt off Malta amid soft demand.

IMAGE: Tankers during a bunker operation off Malta. Getty Images

IMAGE: Tankers during a bunker operation off Malta. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices unchanged in Durban, down in Gibraltar ($2/mt) and Rotterdam ($1/mt)

- LSMGO prices down in Gibraltar ($13/mt) and Rotterdam ($1/mt)

- HSFO prices down in Gibraltar, Durban ($2/mt) and Rotterdam ($1/mt)

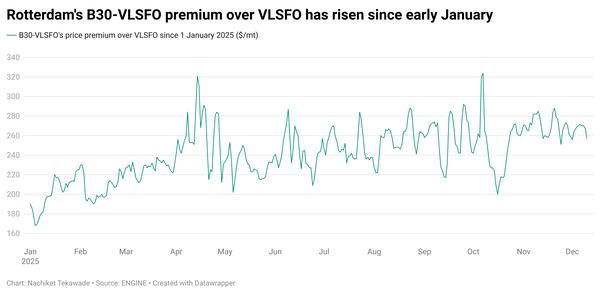

- Rotterdam B30-VLSFO premium over VLSFO down $3/mt to $254/mt

- Gibraltar B30-VLSFO premium over VLSFO down by $11/mt to $350/mt

Gibraltar’s LSMGO price has fallen more steeply compared to Rotterdam. This has narrowed its price premium over the Dutch port by around $12/mt in a single day.

Off Malta's LSMGO benchmark price has also shown a considerable decline, sliding $11/mt over the last day.

The ULSFO price off Malta has dropped just $4/mt since yesterday, compared to the $18/mt decline observed in Rotterdam. Consequently, Malta’s offshore ULSFO price is now priced around $74/mt more than Rotterdam’s, compared to a $60/mt premium yesterday.

Demand is soft off Malta though fuel availability remains stable, with delivery of all fuel grades possible promptly, a trader said.

Some suppliers avoid reloading towards the end of the year to draw down fuel carried by delivery vessels, the trader added.

Brent

The front-month ICE Brent contract has lost $0.44/bbl on the day, to trade at $61.44/bbl at 09.00 GMT.

Upward pressure:

Brent’s price has felt some upward pressure following news that the US Department of Homeland Security and the US Coast Guard have seized an oil tanker off the coast of Venezuela.

The oil tanker had been used to carry sanctioned oil on behalf of Venezuela and Iran, the US government has argued, marking a major escalation in geopolitical tensions.

China, the world’s second-largest crude oil consumer, “has been the biggest buyer of Venezuela’s crude in recent years,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Additionally, the US Energy Information Administration’s (EIA) latest oil inventory report showed a decline in crude stocks, supporting Brent’s price.

Commercial US crude oil inventories decreased by 1.8 million bbls to 426 million bbls for the week ending 5 December, according to data from the EIA.

The decline was unexpected, Hynes said, noting that it was “the first draw on stocks in about three weeks.”

Downward pressure:

Brent crude’s price has shrugged off bullish market fundamentals and traded lower this week, largely on expectations of a ceasefire between Russia and Ukraine.

Leaders from the UK, France and Germany held a telephone call with US President Donald Trump to discuss Washington's continued efforts to end the war in Ukraine, Reuters reported.

The meeting was a "critical moment" in the process of securing a ceasefire that could potentially end the four-year long conflict, Reuters reported.

Oil analysts say a peace deal between Russia and Ukraine could prompt an easing of global sanctions on Russian energy, potentially bringing sanctioned oil volumes back to the global market.

“With Ukraine peace uncertainty overshadowing all other factors, crude has become largely rangebound,” VANDA Insights’ founder Vandana Hari said.

By Nachiket Tekawade and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.