LNG Bunker Snapshot: Singapore’s price dips on muted gas demand

Rotterdam’s LNG bunker price has eased down amid milder weather and gas demand across Europe, while Singapore’s price has dipped on the back of sluggish broader demand in East Asian LNG market.

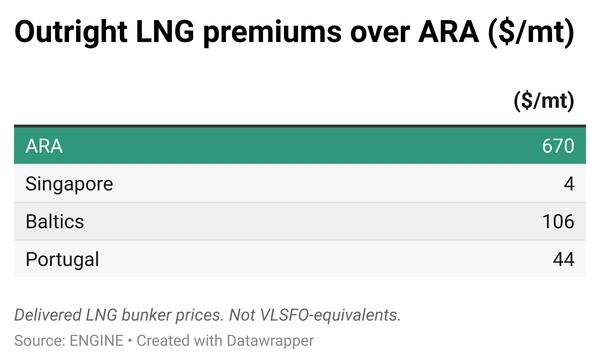

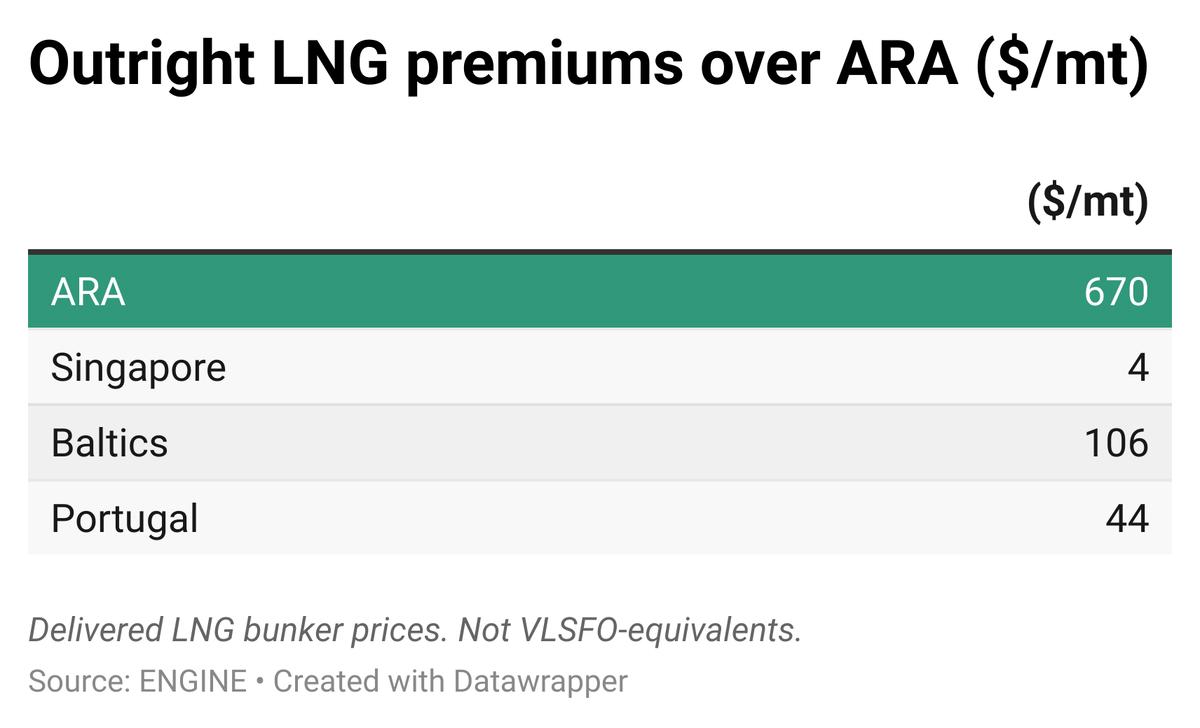

Weekly changes in LNG bunker prices:

- Rotterdam down by $5/mt to $670/mt

- Singapore down by $6/mt at $674/mt

Rotterdam

Rotterdam’s LNG bunker price has declined by $5/mt, even as the assessed bunker delivery premium is up by nearly $16/mt over the past week. The drop has mainly been driven by a 4% fall in the front-month Dutch TTF Natural Gas contract, a key benchmark for European gas prices.

The TTF price eased due to “stable supply, favorable wind power generation, and forecasts of rising temperatures,” according to the Japan Organization for Metals and Energy Security (JOGMEC).

“Mild and windy weather keeps demand low right now,” Mind Energy (formerly Energi Danmark) noted.

“European gas prices fell as near-term weather forecasts signalled limited heating demand,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

A “very strong increase in LNG inflows” further weighed on prices, according to Greg Molnár, gas analyst at the International Energy Agency (IEA).

EU underground gas storage stood at 82.8% on 31 October, slightly down from 82.9% the previous week and 13.4% lower year-on-year, data from Gas Infrastructure Europe showed.

Singapore

Singapore’s LNG bunker price has declined by $6/mt over the past week, weighed down by sluggish regional gas demand across East Asia amid “abundant supply,” according to JOGMEC.

“China's LNG imports continued to decline in Oct… weaker manufacturing activity (with the PMI now down to 49) is weighing on the country's gas demand… and China's domestic spot prices remain below JKM, further limiting China's LNG buying appetite,” noted Greg Molnár, gas analyst at the IEA.

This downward trend corresponds with a $0.21/MMBtu ($11/mt) fall in the NYMEX Japan/Korea Marker (JKM) benchmark over the same week, bringing the front-month contract to $11.00/MMBtu ($572/mt).

As of 29 October, Japan’s LNG inventories for power generation stood at 1.97 million mt, marking a 160,000 mt decrease from the previous week, according to the Ministry of Economy, Trade and Industry (METI).

Meanwhile, Singapore’s LNG bunker price premium over Rotterdam remains nearly unchanged from last week at $4/mt.

Other LNG bunker news

Ferry operator Tallink said that its shuttle vessel MyStar has been supplied with bio-LNG six times in recent months. Pacific International Lines (PIL) has launched the Kota Orkid, the fourth and final ship in its series of 8,200 TEU LNG dual-fuel container vessels built by China’s Yangzijiang Shipbuilding.

Meanwhile, Dutch LNG supplier Titan Clean Fuels recently delivered liquefied biomethane (LBM) to a Brittany Ferries vessel during its call at Portsmouth International Port.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.