Europe and Africa Market Update 29 Oct 2025

Conventional bunker fuel prices in major European and African ports have mostly gained, and VLSFO supply remains stable in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($9/mt) and Rotterdam ($7/mt), and down in Durban ($5/mt)

- LSMGO prices up in Gibraltar ($23/mt) and Rotterdam ($16/mt)

- HSFO prices up in Durban ($9/mt), Gibraltar ($8/mt) and Rotterdam ($2/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $8/mt to $256/mt.

- Gibraltar B30-VLSFO premium over VLSFO down by $13/mt to $332/mt

Conventional fuel prices have mostly increased in European and African ports in the past day. Durban’s VLSFO price has been an exception, having slipped over the day. A lower-priced 150-500 mt VLSFO stem fixed at $524/mt has weighed on the benchmark.

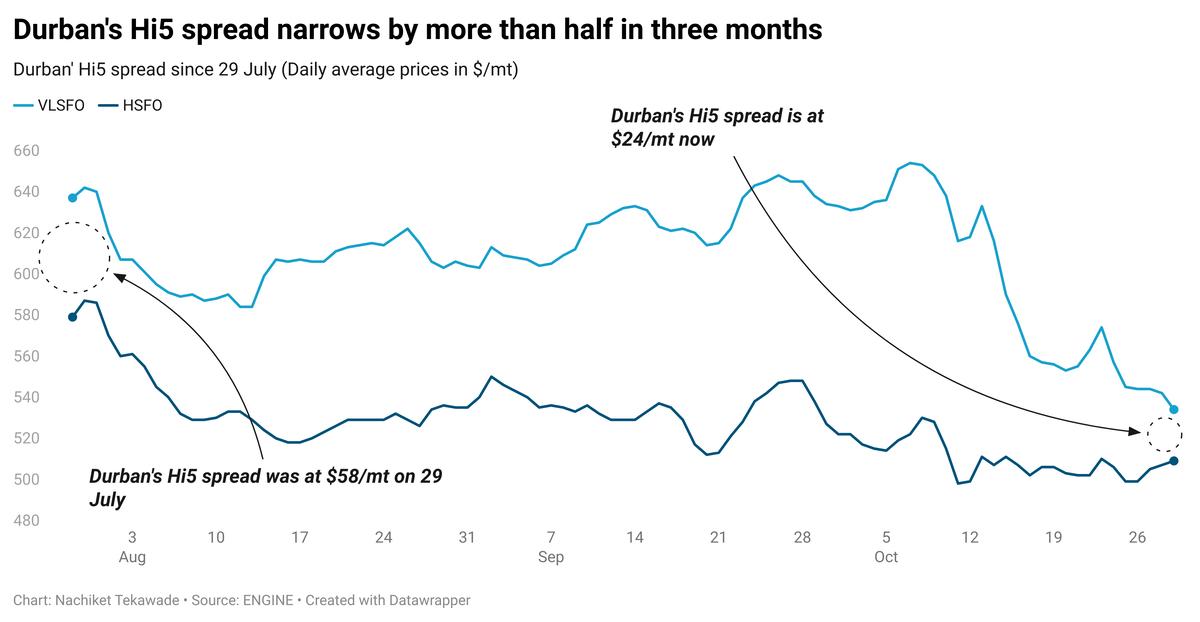

Meanwhile, the port's HSFO price has increased in line with the broader trend. This has narrowed the Hi5 spread at the port by around $14/mt in a single day to $24/mt. The Hi5 spread has contracted by more than half over the last three months, from $58/mt on 29 July.

VLSFO supply in Durban is normal, with a notice of two days sufficient to secure deliveries, while HSFO supplies are tighter for prompt dates, with most suppliers requiring about a week to arrange deliveries, a trader told ENGINE.

Wind gusts of more than 25 knots and waves ranging above 2.5 meters are forecast on 31 October, 9 November and 13 November, which could suspend bunkering operations at the South African port.

Brent

The front-month ICE Brent contract has lost by $0.38/bbl on the day, to trade at $64.05/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price has found some support after the American Petroleum Institute (API) reported a draw in US crude stocks.

US crude oil inventories declined by 4 million bbls in the week ending 24 October, according to the API estimates cited by Trading Economics.

Market analysts had expected a smaller draw of 2.9 million bbls. A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

“The American Petroleum Institute reported an across-the-board plunge in US crude as well as product inventories,” VANDA Insights’ Vandana Hari wrote.

Downward pressure:

Brent’s price has lost momentum ahead of the US Federal Reserve’s Federal Open Market Committee (FOMC) meeting, which is set to conclude later today.

Market participants are closely watching the meeting as they await the US central bank’s decision on a potential interest rate cut.

“This meeting isn’t about whether [Fed chairman] Jerome Powell cuts but rather how many [cuts are planned],” remarked SPI Asset Management managing partner Stephen Innes.

The FOMC is scheduled to meet again in December to discuss further interest rate reductions.

Higher interest rates in the US can dampen demand growth and make dollar-denominated commodities like oil more expensive for holders of other currencies.

By Nachiket Tekawade and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.