East of Suez Market Update 29 Oct 2025

Most prices in East of Suez ports have moved up, and bad weather is expected to impact bunkering operations across several Indian ports.

IMAGE: Cargo ships in the Port of Mumbai. Getty Images

IMAGE: Cargo ships in the Port of Mumbai. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($8/mt) and Singapore ($1/mt), and down in Zhoushan ($3/mt)

- LSMGO prices up in Singapore ($16/mt), Fujairah ($7/mt) and Zhoushan ($2/mt)

- HSFO prices up in Singapore ($6/mt) and Fujairah ($3/mt), and down in Zhoushan ($8/mt)

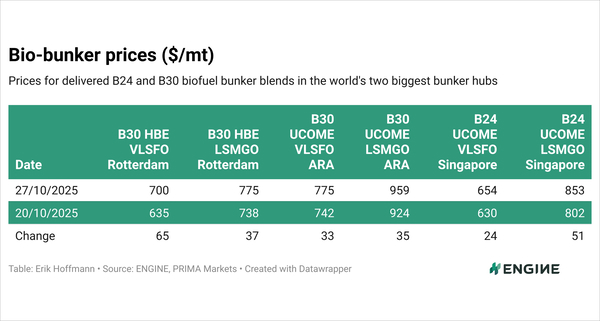

- B30-VLSFO at a $245/mt premium over VLSFO in Singapore

- B30-VLSFO at a $257/mt premium over VLSFO in Fujairah

Fujairah's VLSFO price has rebounded by $8/mt after two consecutive days of declines, while prices in Singapore and Zhoushan have remained steady. Consequently, Fujairah’s VLSFO discount to Zhoushan has narrowed by $11/mt to $23/mt, and its small discount to Singapore has been erased.

In Fujairah, prompt bunker availability remains tight across all fuel grades despite subdued demand, as several suppliers face low inventories and loading delays. Lead times of 5–7 days are generally advised, though some suppliers can accommodate urgent deliveries at a premium, a trader said.

Meanwhile, adverse weather conditions are expected to disrupt bunkering operations along India’s west coast — in Mumbai from 30 October to 2 November, Kandla from 29 to 31 October, and Sikka from 29 October to 1 November, according to a source.

On India’s east coast, severe Cyclone Montha made landfall south of Kakinada at midnight on 28 October and is moving northwest across coastal Andhra Pradesh, weakening into a deep depression. Berthing at Kakinada port is expected to resume later today, subject to wind and weather conditions, with cautionary warnings still in place.

At Vizag, vessel movements resumed this morning, but cargo operations at the inner harbour — briefly restarted earlier — were suspended again due to heavy rainfall. Gangavaram Port has yet to finalise its re-berthing schedule for vessels at anchorage.

Elsewhere, vessel movements and cargo operations at Chennai, Ennore, Kattupalli, Karaikal, Krishnapatnam and Dhamra continue as normal. At Paradip, outward vessel movements resumed this morning, while inward movements remain suspended, according to GAC Hot Port News.

Brent

The front-month ICE Brent contract has lost by $0.38/bbl on the day, to trade at $64.05/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has found some support after the American Petroleum Institute (API) reported a draw in US crude stocks.

US crude oil inventories declined by 4 million bbls in the week ending 24 October, according to the API estimates cited by Trading Economics.

Market analysts had expected a smaller draw of 2.9 million bbls. A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

“The American Petroleum Institute reported an across-the-board plunge in US crude as well as product inventories,” VANDA Insights’ Vandana Hari wrote.

Downward pressure:

Brent’s price has lost momentum ahead of the US Federal Reserve’s Federal Open Market Committee (FOMC) meeting, which is set to conclude later today.

Market participants are closely watching the meeting as they await the US central bank’s decision on a potential interest rate cut.

“This meeting isn’t about whether [Fed chairman] Jerome Powell cuts but rather how many [cuts are planned],” remarked SPI Asset Management managing partner Stephen Innes.

The FOMC is scheduled to meet again in December to discuss further interest rate reductions.

Higher interest rates in the US can dampen demand growth and make dollar-denominated commodities like oil more expensive for holders of other currencies.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.