Americas Market Update 22 Oct 2025

Houston’s VLSFO price has come off to shrink its Hi5 spread to the narrowest it has been in two years.

IMAGE: A ship being loaded with fuel moored along the Buffalo Bayou, just east of downtown Houston. Getty Images

IMAGE: A ship being loaded with fuel moored along the Buffalo Bayou, just east of downtown Houston. Getty Images

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Balboa ($12/mt), New York and Los Angeles ($7/mt), and down in Houston ($17/mt)

- LSMGO prices up in New York, Los Angeles ($10/mt) and Houston ($2/mt), and down in Balboa ($9/mt)

- HSFO prices up in Houston, New York ($6/mt) and Los Angeles ($5/mt), and down in Balboa ($7/mt)

Houston’s VLSFO price has come down against the general market direction amid several lower-priced offers of $424-439/mt in the past day. Last Friday, the port’s benchmark dropped to its lowest in over a year. It has since recovered by $30/mt, before the past day’s $17/mt drop.

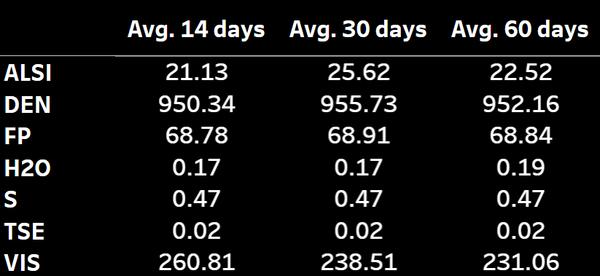

Houston’s Hi5 spread has been squeezed by $23/mt in the past day, to just $12/mt. This means that scrubber-fitted ships have much less to benefit from bunkering HSFO in Houston compared to their VLSFO-consuming rivals.

Supply of residual fuel oil out to bunker terminals and other outlets across the US has plunged by 135,000 b/d from September to 154,000 b/d so far this month, according to official US Energy Information Administration (EIA) data. Supply has not been this low since April 2021.

Balboa’s Hi5 spread has moved the other way to expand by $19/mt in the past day. But at $34/mt, it is still low compared to its historical average.

Houston ($12/mt) and Balboa’s ($30/mt) Hi5 spreads are much narrower than in New York ($61/mt) and Los Angeles ($117/mt), where high VLSFO price levels pull the Hi5s wider.

Brent

The front-month ICE Brent contract has moved $0.96/bbl higher on the day, to $62.34/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

The American Petroleum Institute (API) has estimated a 2.98 million-bbl draw in US crude stocks over the past week, which could mark the first decline, after two consecutive weeks of builds. The official US Energy Information Administration (EIA) data is expected later today.

Trump has said he expects to reach a “great deal” with China when he meets President Xi Jinping later this month, according to CNBC. “It’s going to be a great trade deal. It’s going to be fantastic for both countries, and it’s going to be fantastic for the entire world,” CNBC quoted him as saying.

“Trump’s trade negotiation comments are likely providing some support to the market,” ING’s head of commodity strategy, Warren Patterson said.

“Further support is likely coming from the cancellation of the Trump-Putin summit, which erodes hopes for a Russia-Ukraine peace deal,” Patterson added.

Downward pressure:

On the flip side, lingering concerns of an oversupplied market could temper optimism.

A US licensing update has allowed Venezuela to resume crude exports to the US “following a five-month pause,” commodities research firm Energy Aspects said. Reuters reported in August that Chevron had been granted a “restricted license” by the US Treasury Department to operate in Venezuela.

“The prompt Brent discount to the six-month contract has widened sharply, reflecting a growing belief that OPEC+ output increases and rising non-OPEC supply will keep the market well stocked through the winter,” Ole Hanson, head of commodity strategy at Saxo Bank said.

“With Brent stuck below USD 65, speculative sentiment remains fragile. Managed money accounts have been reducing long exposure in recent weeks while adding to gross shorts, betting on further downside as inventories build and the curve softens,” Hanson added.

By Erik Hoffmann and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.