Fuel Switch Snapshot: Bio-bunker discounts widen in Rotterdam

B100’s discount to VLSFO widens to $167/mt

HBE for B100 gains $30/mt on the week

Singapore’s B100 at $425–477/mt premiums over LNG

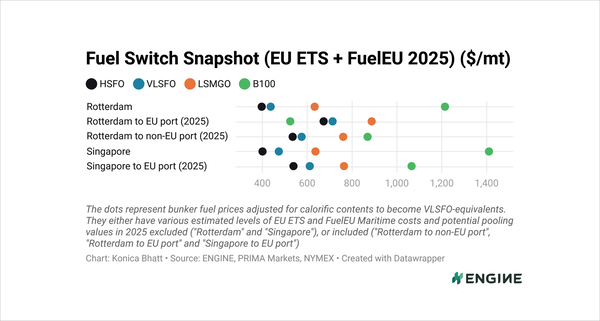

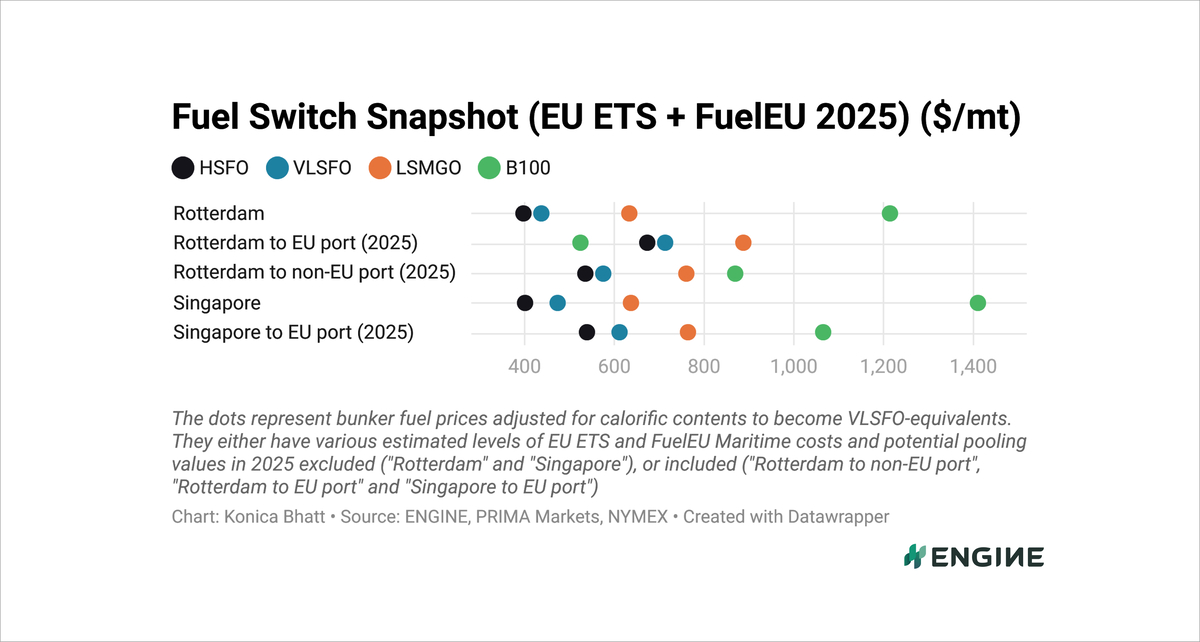

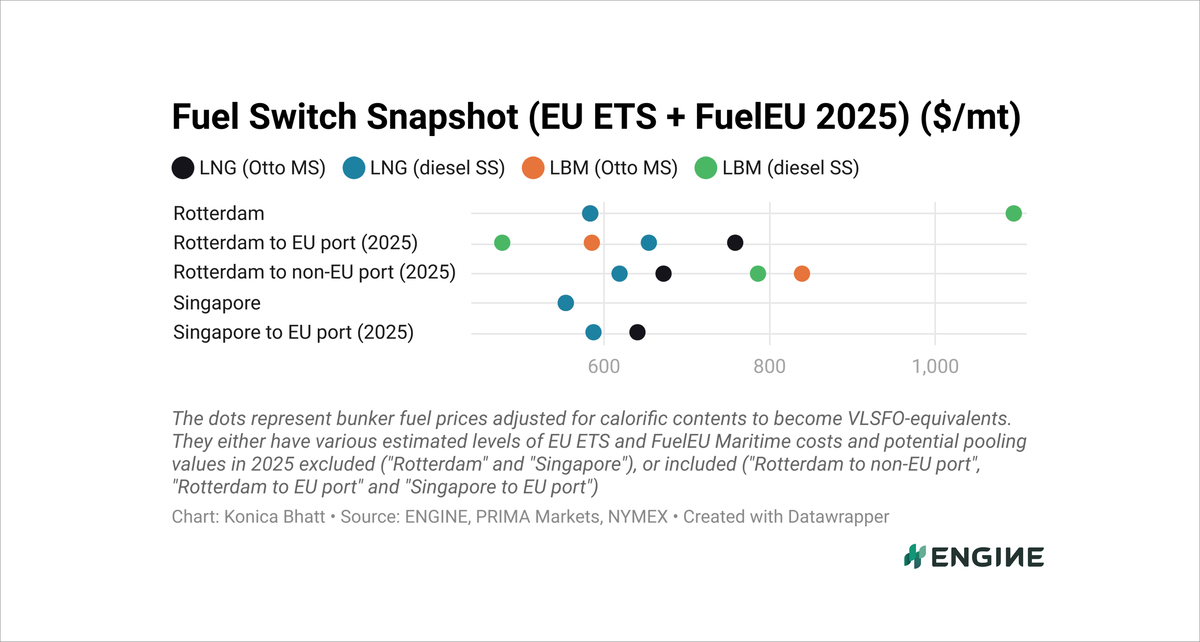

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

B100’s discount to VLSFO in Rotterdam has widened by $8/mt to $187/mt over the past week, and its discount to LSMGO has edged up by $1/mt to $363/mt.

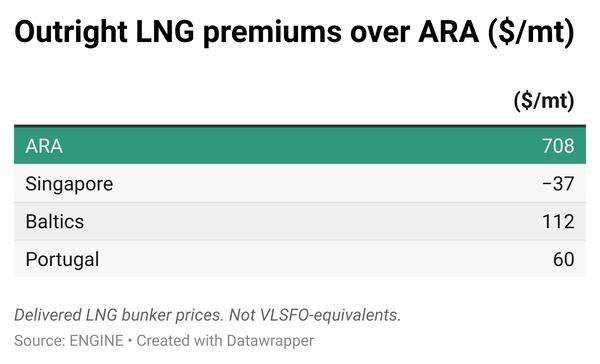

B100 also stands at $169–233/mt discounts to LNG in Rotterdam.

In Singapore, B100 does not have a price advantage. It is priced at a steep $303/mt premium over LSMGO, $453/mt premium over VLSFO and $425–477/mt premiums over LNG.

Liquefied biomethane (LBM) is priced at $173–177/mt discounts to LNG in Rotterdam, and a $48/mt discount to B100 when the LBM is used in dual-fuel engines with low methane slips.

Liquid fuels

VLSFO prices have declined in Rotterdam (-$5/mt) and Singapore (-$14/mt), but not by as much as front-month ICE Brent, which is down by a sharp $41/mt ($5.60/bbl) on the week.

Fuel supply remains normal across the ARA, with traders recommending lead times of 5–7 days for VLSFO deliveries. In Singapore, prompt VLSFO availability has been tight and with lead times advised at 7–10 days.

Rotterdam’s B100 price has fallen by $12/mt over the past week amid a $30/mt rise in Prima Markets' assessed Dutch HBE rebate for marine B100.

Singapore’s B100 has declined by a sharper $31/mt.

Biofuel availability remains steady across the ARA region, particularly in the Netherlands, a source told ENGINE. Sweden and Finland offer the best supply within the Baltic Sea region, while Germany’s availability is also said to be good.

Liquid gases

Rotterdam’s LNG bunker price has remained steady, inching up by just $2/mt in the past week.

The price has held up despite a 3% weekly fall in front-month Dutch TTF natural gas futures. Stable Norwegian gas supply, mild weather and strong wind power output across Europe have weighed on TTF.

Rotterdam's LBM bunker price has dropped by $6/mt.

Singapore’s LNG benchmark has declined by $7/mt in the past week, pressured by sluggish gas spot demand, surplus LNG inventories and steady supply in the Northeast Asian market.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.