LSMGO becomes Mediterranean favourite after MedECA

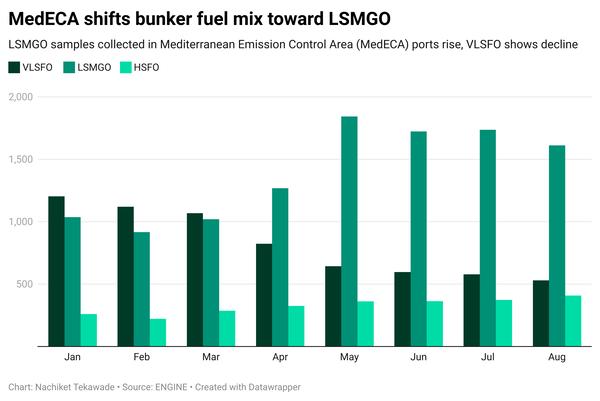

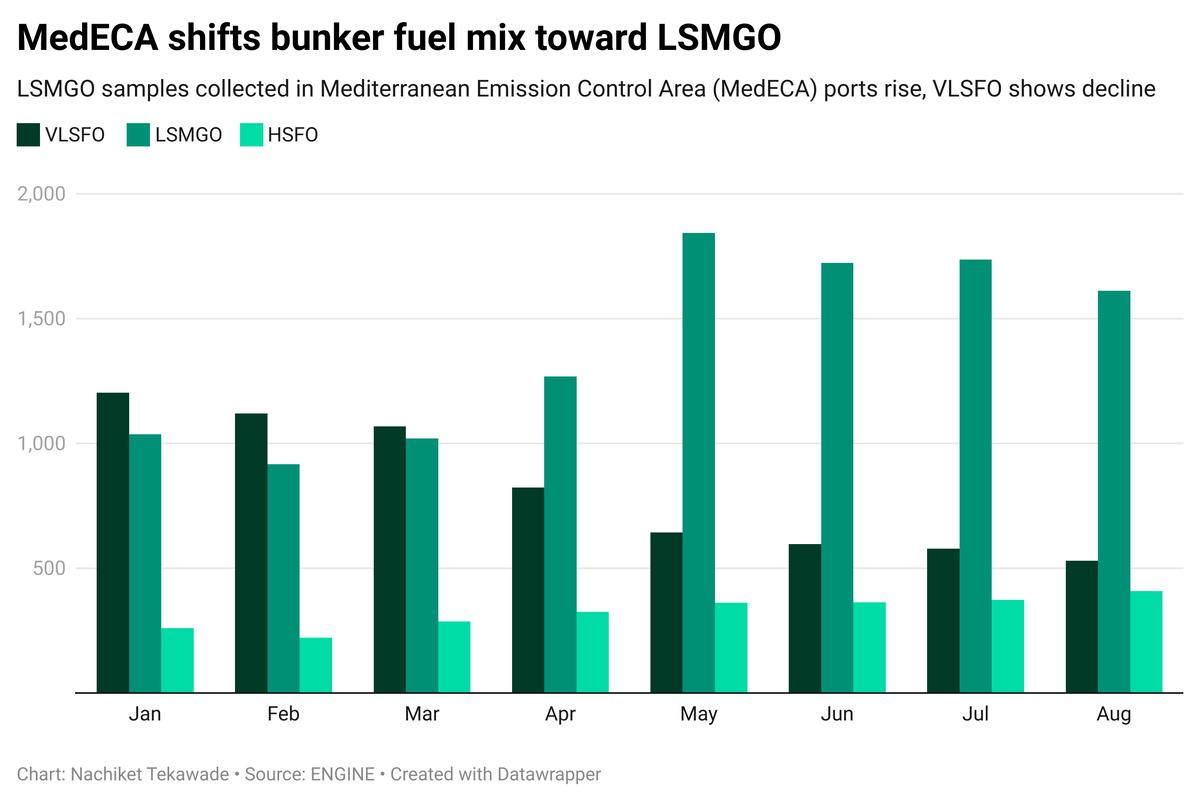

LSMGO has emerged as the leading bunker fuel grade in Mediterranean ports after the Mediterranean Emission Control Area (MedECA) came into effect on 1 May, according to an analysis of ENGINE’s fuel quality samples covering the first eight months of 2025.

The MedECA was formally adopted as part of MARPOL Annex VI. Since 1 May, it has mandated all ships in the Mediterranean Sea to use fuels with maximum 0.10% sulphur, unless they have scrubbers installed to bring sulphur emissions down below 0.10%. LSMGO is one such fuel.

The rules apply to both international and domestic voyages, a factor that has already led to an overhaul of marine fuel supply and demand dynamics across the region.

LSMGO’s share of total fuel quality lab samples rose from 43% in January-April to 58% in May-August.

VLSFO is no longer a compliant fuel in the Mediterranean and the number of VLSFO samples as a share of the total more than halved over the same period, from 43% to 20%.

The fuel quality sample data analysed for this story represents about 60% of all lab samples collected in the world. There could be variations in the extent of coverage between regions and ports. Around 9,900 samples were available for the January-April period, against 12,000 samples for the May-August period.

The data revealed that most of the realignment in the fuel mix across MedECA ports took place ahead of the 1 May deadline, as buyers and suppliers rushed to comply with the new rules. LSMGO’s share jumped by 31% between April and May, while VLSFO share fell by 28% over the same period.

There has been a clear trend of stronger compliance-driven demand for low-sulphur fuels in the lead-up to and after the MedECA implementation. But this trend has not seemingly supported LSMGO prices.

LSMGO price premiums over VLSFO have not increased more in Mediterranean ports than in major non-Mediterranean bunker ports such as Houston, Rotterdam, Singapore or Fujairah.

Meanwhile, HSFO's share of total fuel samples in Mediterranean ports has not changed significantly with the MedECA.

HSFO's discounts to low-sulphur fuels means that it is still in demand from scrubber-fitted ships sailing in the region, a Greek supplier told ENGINE. However, this could shift if future regulations remove exemptions for scrubber-fitted vessels, or if VLSFO's price premium over HSFO comes down in the region and decreases the cost advantage of installing scrubbers.

Uneven impact across MedECA ports

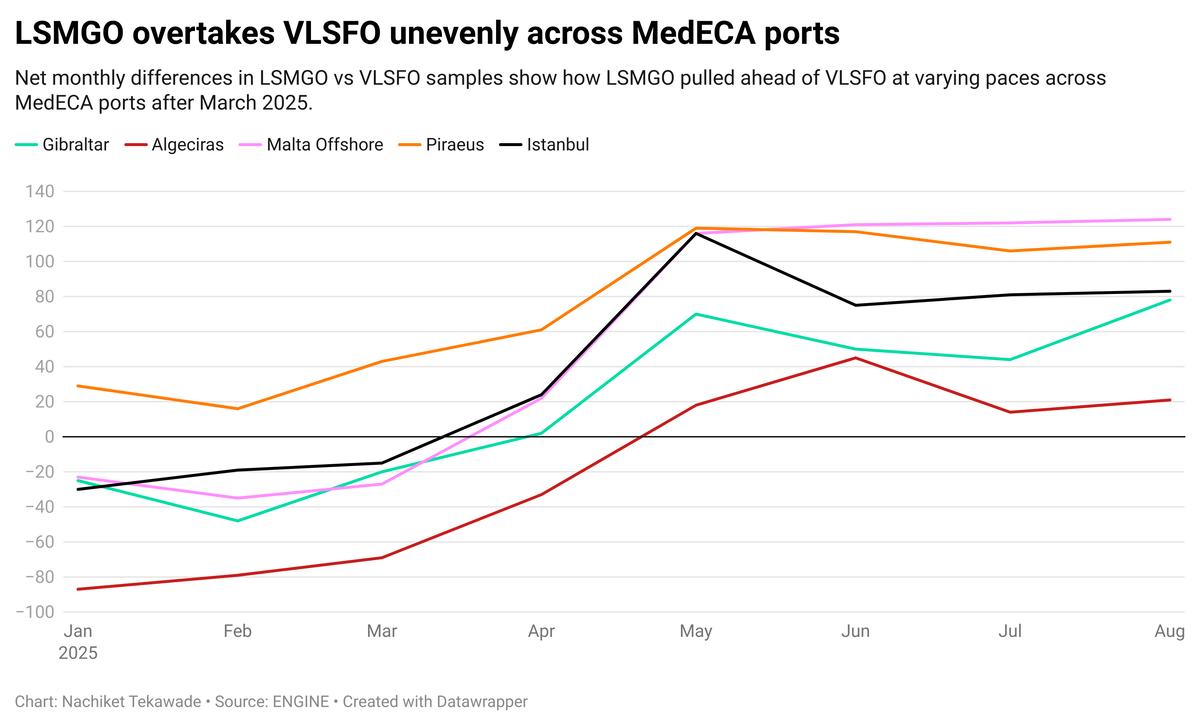

Beyond the aggregate jump in LSMGO samples, the trends have not been uniform when we compare Mediterranean ports.

In Gibraltar - the region's biggest bunker hub - the shift has been less pronounced. VLSFO still accounted for around 37% of total samples in the May-August period, down from 48% in the first four months of the year. VLSFO demand could continue to be supported by ships bunkering there before sailing out of the ECA and consuming it there, a trader said.

While the number of LSMGO samples started exceeding VLSFO samples in Istanbul between March and April, that shift happened between April and May in Spain's Algeciras.

In Greece’s Piraeus, LSMGO's share of total samples was already greater than VLSFO's by the start of the year. That gap widened between May-to-August, when the VLSFO share slumped to 6% of total samples, from 23% in the four months before May.

A trader told ENGINE that Piraeus was always an expensive option for VLSFO bunkering, and the observations are therefore not surprising.

HSFO’s share in Piraeus has remained almost unchanged, going from 28% before 1 May, to 30% after. A Greek supplier confirmed these observations, saying local refining capacity, among other factors, has helped Piraeus offer one of the most competitive prices for HSFO in the region.

ULSFO gains ground

Mediterranean demand has also increased for ULSFO, a 0.10% sulphur fuel oil alternative. Its share of fuel samples rose from 2% in the January–April period to 9% in the four months following the MedECA implementation.

The growing demand for ULSFO is reflected in its introduction this year by several suppliers, including Petrol Ofisi and Energy Petrol in Turkiye, and Coral Marine in Greece.

Specifically in Turkiye, ULSFO's share increased from 13% before 1 May to 17% in the subsequent four months.

In Algeciras, ULSFO samples more than doubled from 7% to 15%, soaking up demand as VLSFO fell from 51% to 33% and leaving LSMGO with only a modest rise from 32% to 39%.

By Nachiket Tekawade

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.