Americas Market Update 24 Sep 2025

Fuel prices have mostly moved upwards, and two hurricanes have triggered marine warnings in the Eastern Pacific and Atlantic.

IMAGE: Aerial view of Houston Ship Channel. Port of Houston

IMAGE: Aerial view of Houston Ship Channel. Port of Houston

Changes on the day to 08.00 CDT (13.00 GMT) today:

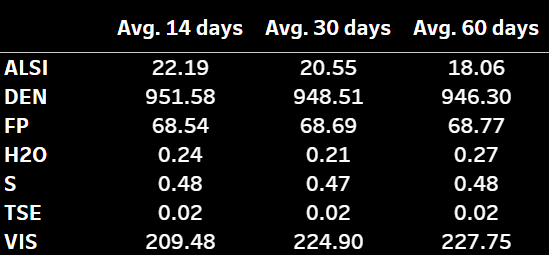

- VLSFO prices up in Houston ($19/mt), Zona Comun ($9/mt), Los Angeles, Balboa ($5/mt) and New York ($3/mt)

- LSMGO prices up in Zona Comun ($19/mt), Houston ($15/mt), Balboa ($10/mt), unchanged in Los Angeles, and down in New York ($7/mt)

- HSFO prices up in New York ($6/mt), Los Angeles, Houston ($1/mt), and down in Balboa ($2/mt)

New York's LSMGO price has defied Brent's upward movement and the general market direction, falling by $7/mt in the past session. Nonetheless, it maintains a $53/mt premium over Houston.

Fuel availability in New York has remained healthy this week. VLSFO and HSFO can be delivered within lead times of 3–6 days. LSMGO is more readily available at the port, requiring around 2–3 days.

Houston's VLSFO price rose the most among major hubs, gaining $19/mt, while the port's HSFO increased only $1/mt, bringing the Hi5 spread to $67/mt today.

The East Coast port is expected to have calm weather through the week, remaining conducive for bunkering.

Off the Atlantic coast, hurricane Gabrielle is active, and two other tropical depressions have an 80–90% chance of turning into cyclones.

Marine warnings are in effect in both the Atlantic and the Eastern Pacific, where another hurricane Narda is ongoing.

In Zona Comun, the anchorage is experiencing rough weather with high wind gusts, expected to worsen over the weekend. Bunkering operations are underway, but delays are expected, a local supplier has informed ENGINE.

Brent

The front-month ICE Brent contract has made a $0.91/bbl gain the past day, trading at $68.46/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

Brent’s price has moved higher after the American Petroleum Institute (API) reported a second consecutive weekly draw in US crude stocks.

US crude oil inventories dropped by 3.8 million bbls in the week ending 19 September, according to estimates from the API cited by Trading Economics.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

Brent has gained further support from renewed geopolitical tensions after US President Donald Trump said Ukraine could regain territory lost to Russia with NATO's help, Reuters reported.

“This [Trump’s remarks] raised the spectre of Trump increasing pressure on Russia, including new sanctions on Moscow and the buyers of crude oil,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

Downward pressure:

OPEC’s second-largest oil producer Iraq has greenlighted a plan to resume pipeline exports of crude oil from its semi-autonomous Kurdistan region through Turkey, according to Reuters.

This tripartite deal between the Iraq’s federal government, the regional Kurdish government and a consortium of oil companies operating in Kurdistan could add at least 230,000 b/d of supplies to the global oil market, amid growing OPEC+ output.

The news has put some downward pressure on Brent, according to market analysts.

“Oil prices dropped after news that Kurdistan will restart pipeline exports,” Price Futures Group’s senior market analyst Phil Flynn said. “Baghdad, Erbil, and oil companies agreed to resume crude exports under federal control,” he added.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.