East of Suez Market Update 16 Sep 2025

Prices in East of Suez ports have moved in mixed directions, and VLSFO and LSMGO availability is good in Malaysia’s Port Klang.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($2/mt), unchanged in Fujairah, and down in Zhoushan ($19/mt)

- LSMGO prices up in Singapore ($3/mt), and down in Zhoushan ($14/mt) and Fujairah ($4/mt)

- HSFO prices up in Singapore ($2/mt), and down in Zhoushan ($7/mt) and Fujairah ($2/mt)

- B24-VLSFO at a $227/mt premium over VLSFO in Singapore

Zhoushan’s VLSFO price has dropped sharply by $19/mt in the past day. Even after the decline, it still commands a $13/mt premium over both Singapore and Fujairah.

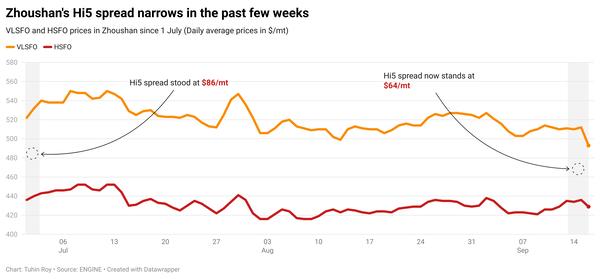

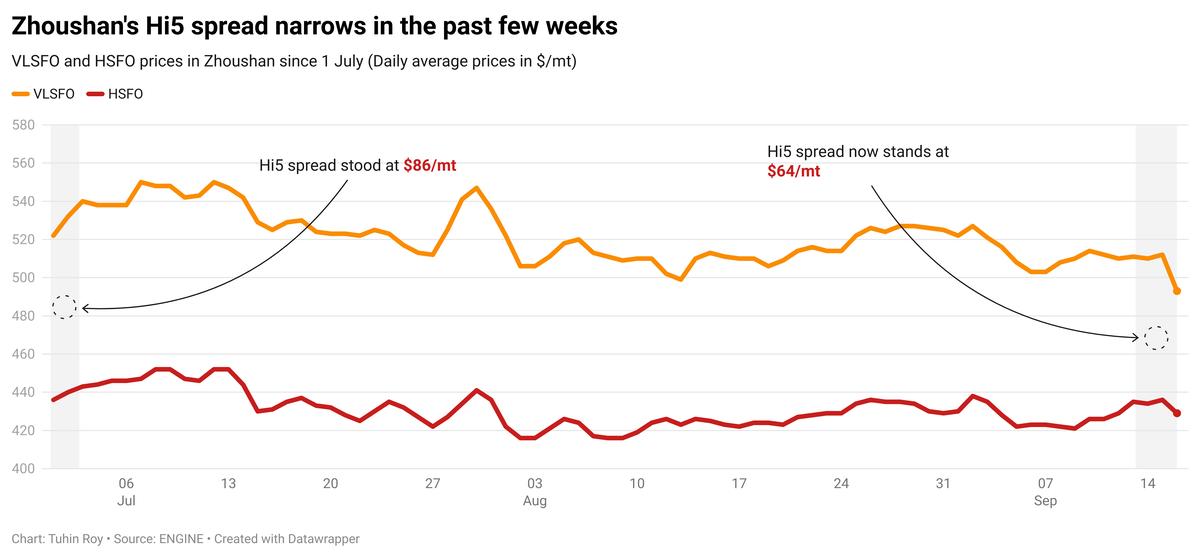

The fall in Zhoushan’s VLSFO price has outpaced the drop in its HSFO benchmark, narrowing the port’s Hi5 spread by $12/mt to $64/mt. This is lower than spreads in Fujairah ($99/mt) and Singapore ($75/mt).

Bunker demand in Zhoushan remains weak. VLSFO lead times are steady at 4–7 days, while HSFO and LSMGO lead times have risen to 4–7 days from 3–5 days previously.

At Malaysia’s Port Klang, VLSFO and LSMGO grades are readily available, with prompt supply possible for smaller parcels. HSFO, however, continues to face limited availability.

Brent

The front-month ICE Brent contract has lost by $0.17/bbl on the day, to trade at $67.08/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has gained some upward momentum as traders factor in production risks to Russian energy supplies, with Ukrainian drone strikes on its oil infrastructure continuing to intensify.

Yesterday, Kyiv struck the Kirishi oil refinery, one of Russia’s largest oil refining facilities, Reuters reported. The facility has halted a major processing unit following the attack, the report added.

The refinery has an “annual processing capacity of over 20mt [20 million mt],” according to ANZ Bank’s senior commodity strategist Daniel Hynes.

Last week, Ukraine struck one of Russia’s largest oil exporting terminals in Primorsk. The strikes coincide with reports that Washington and the EU are preparing tighter sanctions on Russia and on major buyers of its energy exports, particularly China and India.

“The market participants are waiting for any further developments regarding the potential of further Western sanctions on Russian supplies,” remarked two analysts from ING Bank.

Downward pressure:

Brent’s price has moved lower as market participants shift focus to the US Federal Reserve’s (Fed) meeting scheduled for today and tomorrow.

The meeting carries significant weight, with the US central bank expected to decide whether to maintain interest rates at current levels or implement a cut, according to market analysts.

Oil prices came under pressure last week after US inflation rate, based on Consumer Price Index (CPI) rose 2.9% year-on-year in August, up from 2.7% in July, dampening the likelihood of interest rate cuts.

Higher interest rates in the US can dampen demand growth and make dollar-denominated commodities like oil more expensive for holders of other currencies.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.