Biofuel Bunker Snapshot: Soaring rebates pressure Dutch bio-bunker prices

B30, B100 Dutch HBE rebates tick up further

B100 HBE rebate surges over $100/mt in a month

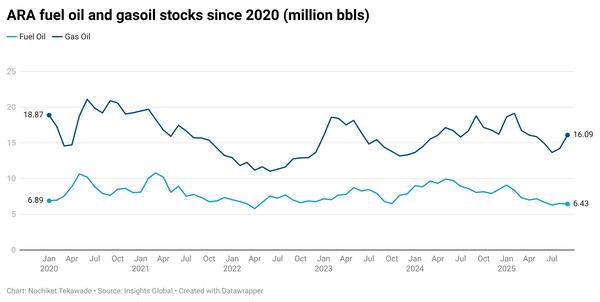

China’s UCOME demand subdued yet again

Rotterdam

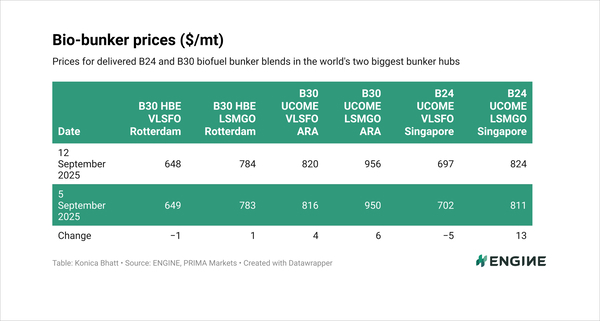

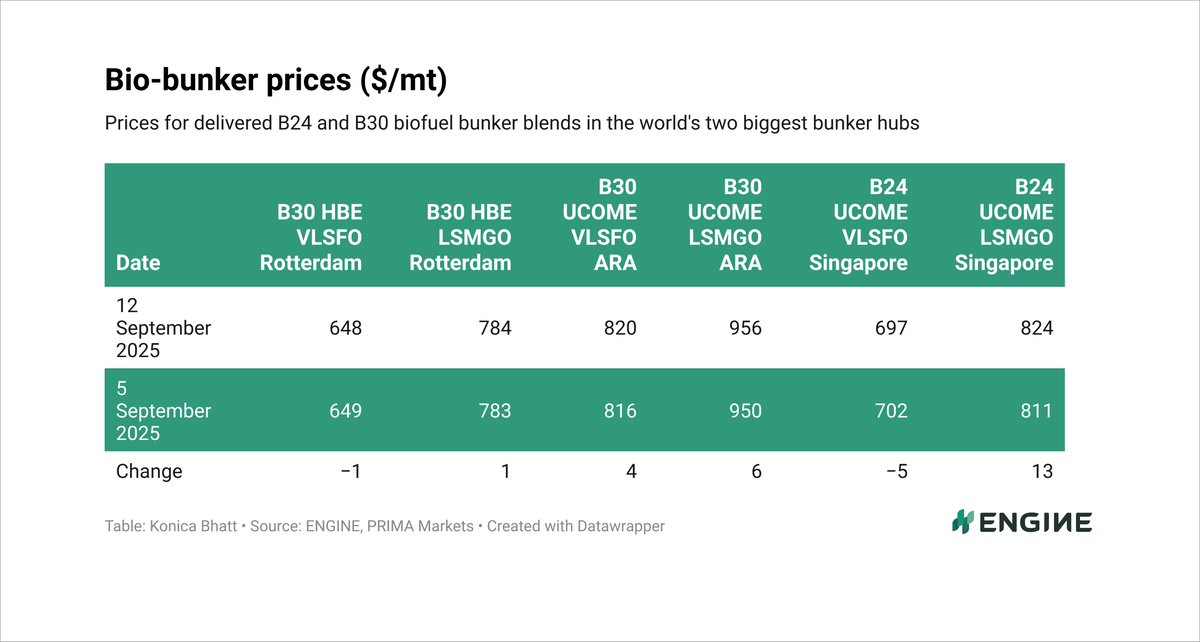

The port’s HBE-rebated B30-VLSFO price has remained largely steady, edging down by $1/mt over the past week.

A $16/mt decline in Prima Markets’ POMEME CIF ARA barge price, combined with a $5/mt increase in Prima’s HBE rebate for B30 marine biofuels, has weighed on prices. But the downward pressure was almost entirely offset by a $12/mt rise in ENGINE’s pure VLSFO benchmark.

B30-LSMGO HBE has also seen upward pressure, with a $16/mt rise in LSMGO keeping bio-blend prices steady with just a $1/mt gain over the week.

Soaring Dutch rebates have helped soften Rotterdam’s bio-bunker prices over the past month.

The HBE rebate for B30 has jumped by $34/mt since 1 August.

Over the same period, Rotterdam’s B30-VLSFO benchmark has fallen by $32/mt, dragged lower by higher rebates and a big $32/mt drop in ENGINE’s VLSFO price. A $43/mt rise in Prima’s POMEME barge price has not been enough to offset the downward move.

For B100, the shift has been even more dramatic. The rebate has surged by a whopping $112/mt since 1 August, which appears to have pushed Rotterdam’s B100 bunker price sharply lower — down by $95/mt to $1,100/mt over the same period.

Singapore

The B24-VLSFO UCOME price in Singapore has dropped $5/mt in the past week, while its B24-LSMGO UCOME price has gained $13/mt.

A lack of movement in Prima’s UCOME FOB China cargo benchmark has left price direction to be largely dictated by ENGINE’s conventional fuel benchmarks. As a result, bio-bunker blends have mirrored a $7/mt drop in VLSFO and a $17/mt rise in LSMGO.

China’s UCOME market continues to remain “in a limbo”, Prima said.

“Traders have not been offering UCOME in recent sessions, and have not received any price requests from buyers during this time,” it added.

Other bio-bunker news

Japan’s Cosmo Oil Marketing and NX Shoji will start supplying B24 blends at the Port of Tokyo starting this fall, which is typically between September and November. NX Shoji will procure fatty acid methyl esters (FAME)-based biofuel and blend it with conventional fuel, as well as carry out ship-to-ship bunkering at the port.

Netherlands-based BTG Bioliquids (BTL) and Canadian tech company NanosTech Technology & Innovations (NanosTech) will build a facility to produce drop-in biofuels for shipping and other sectors. The companies are assessing sites in Canada and Europe for a modular 500 b/d-capacity biorefinery.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.