East of Suez Market Update 11 Sept 2025

Prices in East of Suez ports have remained broadly stable, and LSMGO availability is good across several Omani ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($1/mt), unchanged in Singapore, and down in Fujairah ($1/mt)

- LSMGO prices up in Fujairah ($1/mt), unchanged in Singapore, and down in Zhoushan ($2/mt)

- HSFO prices up in Singapore and Zhoushan ($1/mt), and down in Fujairah ($4/mt)

- B24-VLSFO at a $257/mt premium over VLSFO in Singapore

- B24-VLSFO at a $268/mt premium over VLSFO in Fujairah

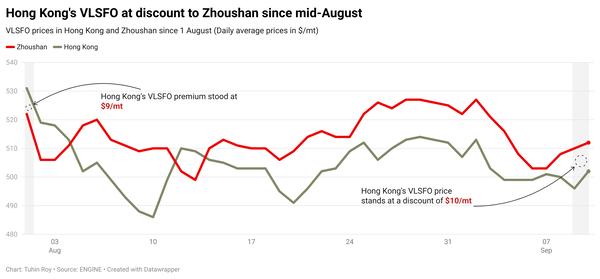

VLSFO benchmarks across the three major Asian bunker hubs have stayed largely stable for the third straight day. In Fujairah, VLSFO is priced at a $25/mt discount to Zhoushan and remains at near-parity with Singapore.

LSMGO prices have also held steady across the three ports over the past day. Fujairah’s LSMGO carries a $58/mt premium over Singapore and a $49/mt premium over Zhoushan.

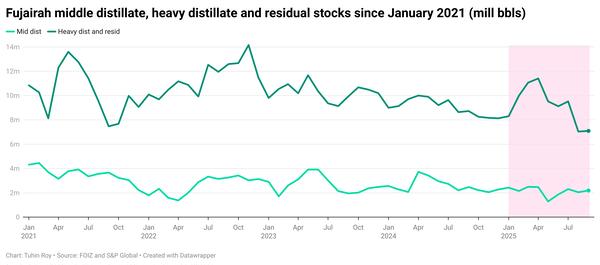

Prompt bunker supply in Fujairah is still tight across all grades, with lead times of 5–7 days advised. Some suppliers can meet urgent demand, though usually at a higher cost.

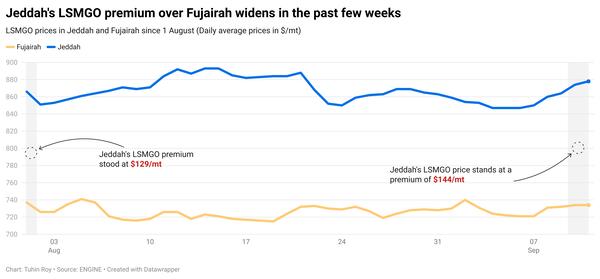

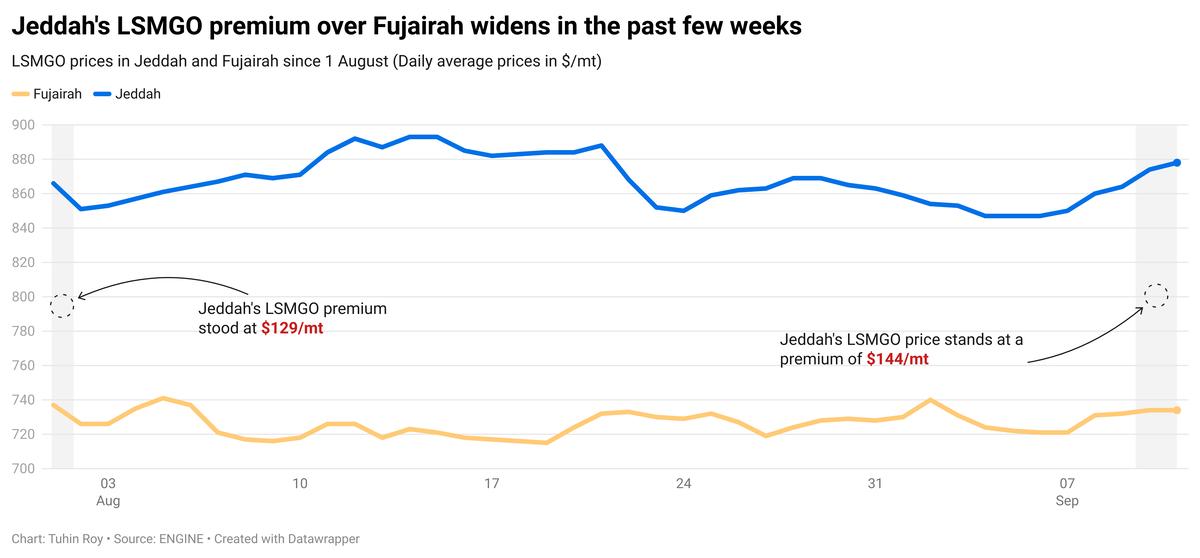

Elsewhere, Saudi Arabia’s Jeddah continues to price LSMGO at a $144/mt premium to Fujairah, reflecting its restricted availability of both VLSFO and LSMGO. In contrast, Oman’s ports — Sohar, Salalah, Muscat, and Duqm — have prompt LSMGO availability.

Brent

The front-month ICE Brent contract has gained by $0.15/bbl on the day, to trade at $67.20/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has moved higher due to a knee-jerk risk premium added to the market after Poland intercepted Russian drones breaching its airspace yesterday.

The development marks the first time a NATO member has directly intervened in the Russia-Ukraine war, now in its third year.

“The incursion of Russian drones into Polish airspace raised concerns that the US would retaliate with further restrictions on Russia’s energy supplies,” remarked ANZ Bank’s senior commodity strategist Daniel Hynes.

Downward pressure:

Brent’s price has felt some downward pressure after the US Energy Information Administration (EIA) reported an increase in US crude stocks.

Commercial US crude oil inventories have gained by 3.9 million bbls to touch 425 million bbls for the week ending 5 September, according to data from the EIA.

A rise in US crude stocks can indicate lower demand for oil and put some downward pressure on Brent's price, according to market analysts.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.