East of Suez Market Update 9 Sep 2025

Prices in East of Suez ports have moved in mixed directions, and prompt availability is tight in Fujairah.

IMAGE: Container cargo freight ship with working crane bridge in shipyard in Singapore. Getty Images

IMAGE: Container cargo freight ship with working crane bridge in shipyard in Singapore. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($2/mt), unchanged in Zhoushan, and down in Singapore ($2/mt)

- LSMGO prices up in Singapore ($8/mt), and down in Zhoushan ($4/mt) and Fujairah ($1/mt)

- HSFO prices down in Singapore and Zhoushan ($5/mt) and Fujairah ($4/mt)

- B24-VLSFO at a $249/mt premium over VLSFO in Singapore

- B24-VLSFO at a $262/mt premium over VLSFO in Fujairah

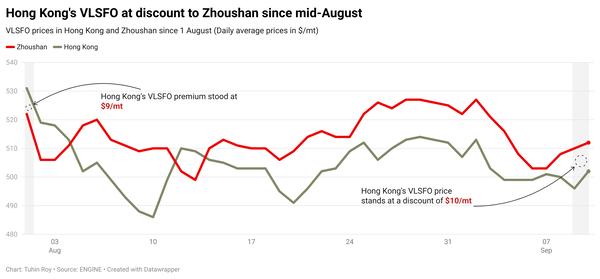

VLSFO prices across the three major Asian bunker hubs have moved in a narrow range over the past day, showing no major changes. Singapore’s VLSFO price is currently at a $20/mt discount to Zhoushan and remains near parity with Fujairah.

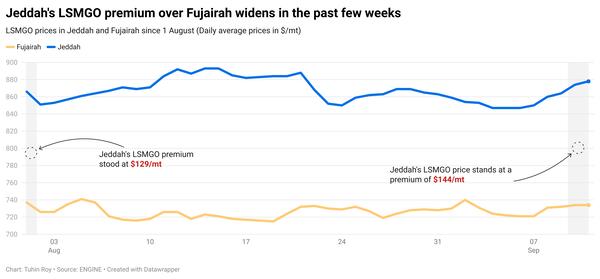

Singapore's LSMGO price has risen by $8/mt on the day, supported by a higher-priced stem fixed there, while prices in Zhoushan and Fujairah have declined. Even after the price rise, Singapore’s LSMGO stands at discounts of $63/mt to Fujairah and $11/mt to Zhoushan.

Delivery times for VLSFO in Singapore vary widely depending on the supplier — some can deliver within eight days, while others require bookings nearly two weeks ahead. This marks a tightening from last week’s 8–11-day range. LSMGO supply has tightened further, with delivery windows stretching to 5–10 days from the earlier 4–9 days.

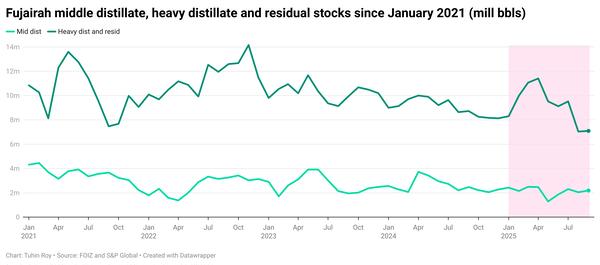

In Fujairah, prompt supply remains tight across all grades, with recommended lead times of 5–7 days. Similar constraints are also reported in the nearby Khor Fakkan port.

Brent

The front-month ICE Brent contract has inched up by a marginal $0.03/bbl on the day, to trade at $66.69/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent prices have found support from expectations that China will continue stockpiling oil and from concerns over possible new sanctions on Russia.

China’s stockpiling — which has helped absorb excess production this year — is likely to continue at a similar pace in 2026, according to Reuters citing a market watcher.

“Sentiment was also supported by data showing strong demand from China,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

Speculation of additional sanctions on Russia also lent support to prices after the country’s largest airstrike on Ukraine set fire to a government building in Kyiv. US President Donald Trump told he was prepared to move to a second phase of restrictions, Reuters reported.

Further sanctions would reduce Russia’s oil exports to global markets, tightening supply.

“Reports that Russian oil flows could be further disrupted provided some support to oil prices,” Hynes added.

Attention is also on the US Federal Reserve, with its Federal Open Market Committee set to meet next week. Traders currently see an 89.4% chance of a quarter-point rate cut.

Lower interest rates reduce consumer borrowing costs and can stimulate economic growth, boosting oil demand.

Downward pressure:

Eight members of OPEC and its allies (OPEC+) have agreed to raise production by a combined 137,000 b/d in October, a move that has weighed on Brent futures.

“This marks the reversal of cuts that were set to remain in place until the end of 2026, following the rapid return of the previous tranche of idled barrels over recent months,” said ANZ Bank’s Hynes. “The …increase was viewed as a warning that the group is ready to push more barrels onto the market,” he added.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.