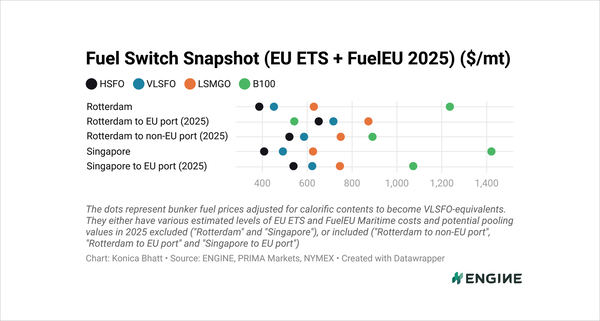

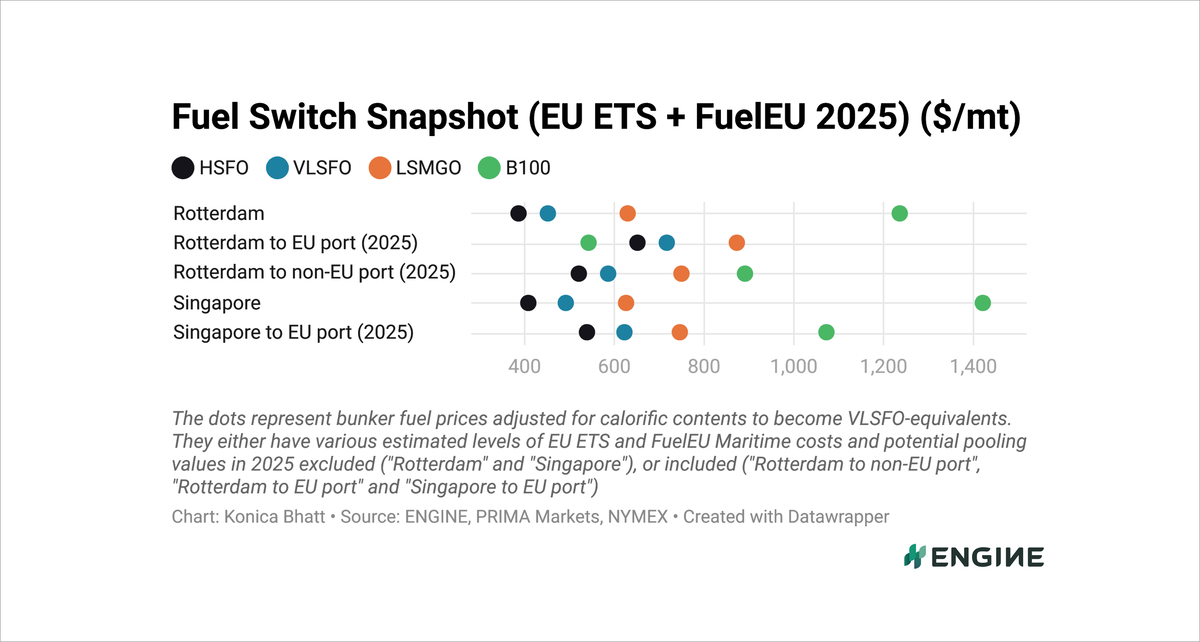

Fuel Switch Snapshot: B100 sweetens on higher Dutch rebates

Dutch HBE rebate for B100 gains $30/mt

Rotterdam’s B100 $330/mt cheaper than LSMGO

LNG gains on higher bunker premiums

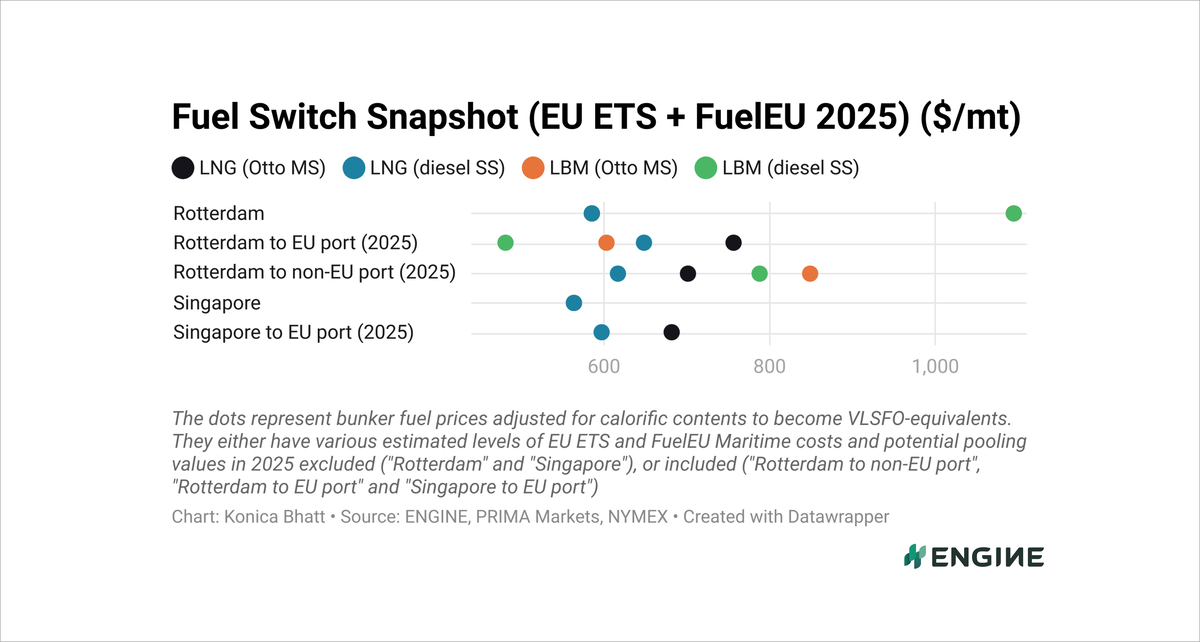

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

A sharp weekly decline in Prima Markets' assessed Dutch HBE rebate for marine B100 has pushed the B100 bunker price higher.

Rotterdam’s B100 discount to VLSFO has widened by $8/mt to $175/mt. Its discount to LSMGO has gone up by $38/mt to $331/mt.

Rotterdam's B100 discounts to LNG have widened by $41/mt to $108–216/mt, depending on LNG engine type.

LNG’s premium over VLSFO in Rotterdam for vessels with Otto medium-speed (Otto MS) engines has increased to $40/mt in the past week. For dual-fuel ships with diesel slow-speed engines, LNG is now $68/mt cheaper than VLSFO in the port.

Liquid fuels

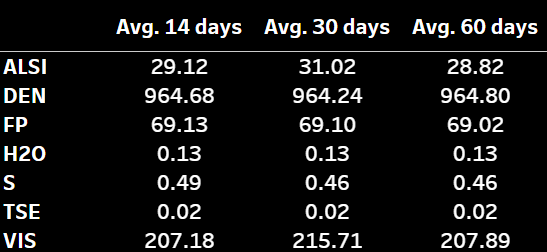

VLSFO prices have moved lower, falling $13/mt in Rotterdam and $12/mt in Singapore, largely tracking a $15/mt drop in front-month ICE Brent futures.

Lead times of 5–7 days are recommended for VLSFO in Rotterdam, a trader told ENGINE. In Singapore, VLSFO deliveries now require 8-11 days of lead time for good supplier coverage, slightly up from 7–10 days a week ago.

Rotterdam’s B100 benchmark has fallen $22/mt lower over the past week, with a $31/mt rise in Prima-assessed Dutch HBE rebate for marine B100 appearing to weigh heavily on the price.

Liquid gases

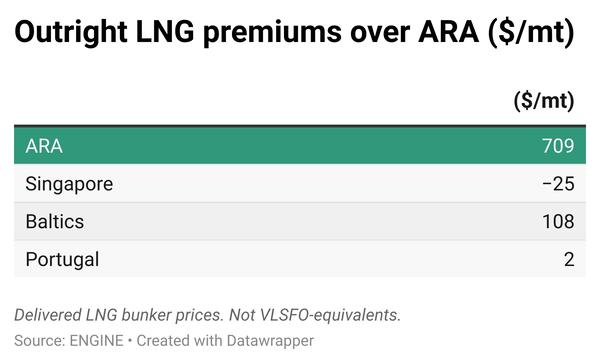

Rotterdam’s LNG bunker price has risen by $19/mt over the past week, driven mainly by a 5% increase in ENGINE-assessed LNG bunker premium from around $131/mt to $137/mt.

Rotterdam’s liquefied biomethane (LBM) price has risen by $12/mt over the past week. LBM now stands at $154–168/mt discounts to LNG, which is $8/mt wider than last week.

Singapore’s LNG bunker price has held mostly steady, edging up just $4/mt. This is in line with a stable front-month NYMEX Japan/Korea Marker (JKM).

The JKM benchmark has risen on concerns over potential sanctions on Russia’s Arctic II supplies and strong Japanese demand, but gains have been capped in a cautious market, Japan Organization for Metals and Energy Security said

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.