Fuel Switch Snapshot: B100-LNG spread tightens in Rotterdam

Rotterdam’s B100 nears $300/mt discount to LSMGO

LNG’s premium over B100 shrinks in Rotterdam

LNG oversupply pressures bunker prices in key ports

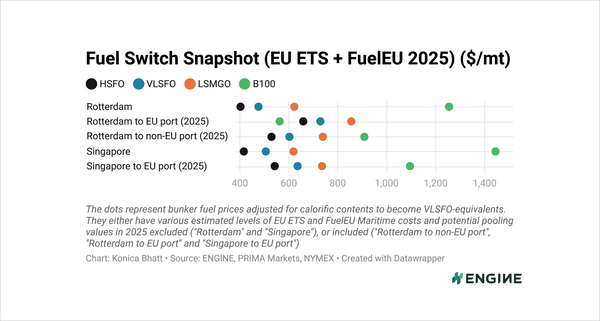

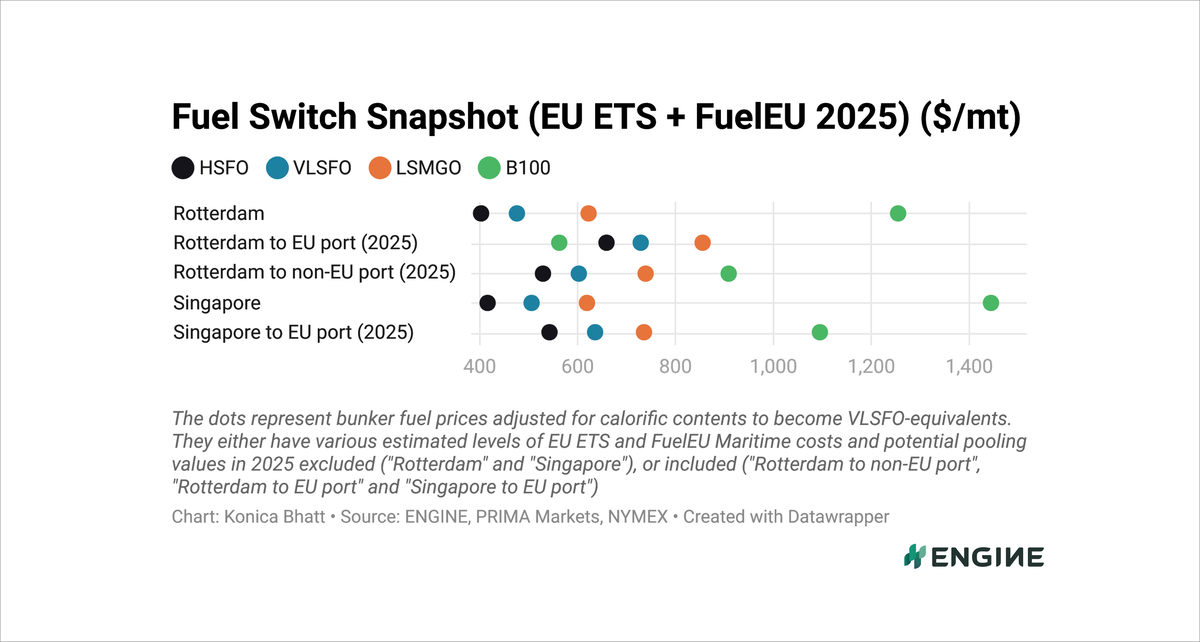

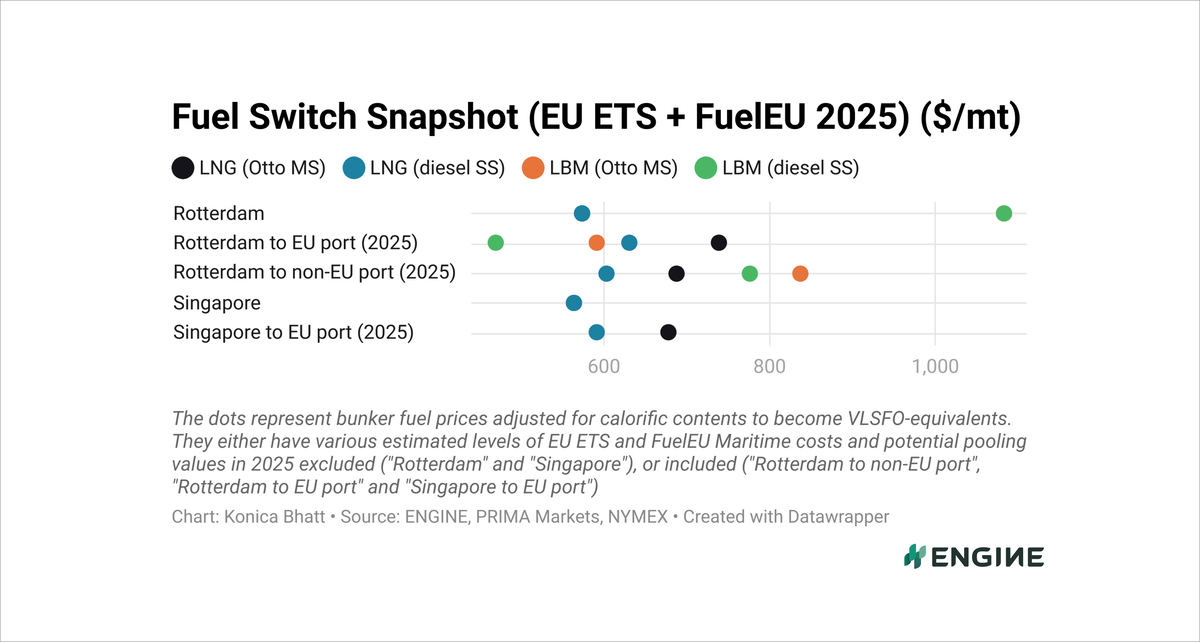

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

Rotterdam’s B100 has widened its discount to VLSFO by $4/mt over the past week, bringing the spread to $167/mt. Its gap to LSMGO has also grown, with B100 now $293/mt cheaper – up $8/mt from the previous week.

B100’s discount to LNG in Rotterdam has narrowed by $17/mt, to $175–167/mt depending on engine type.

B100’s discount to liquefied biomethane (LBM) for vessels with high-methane slip Otto medium-speed (Otto MS) engines has decreased by $17/mt, to $29/mt.

For low-methane slip diesel slow-speed (diesel SS) engines, LBM still remains the cheapest compliance option – carrying a $93/mt discount to B100 in Rotterdam.

It should, however, be noted that B100 and LBM typically serve different vessel segments, so only some bunker buyers will directly choose between the two.

LNG is now only $8/mt more expensive than VLSFO in Rotterdam for vessels with Otto MS engines, after its premium narrowed by $21/mt over the past week. For dual-fuel ships with diesel SS engines, LNG is now $100/mt cheaper than VLSFO in Rotterdam.

In Singapore, LNG’s premium over VLSFO has fallen by $20/mt to $43/mt for Otto MS-engine vessels, while rising by the same margin, to $42/mt, for diesel SS-engine ships.

Liquid fuels

Rotterdam and Singapore’s VLSFO prices have each increased by a modest $6/mt over the past week.

VLSFO has remained readily available in ARA, with buyers advised to enquire 5–7 days ahead of delivery to ensure good coverage from suppliers, a trader has told ENGINE.

Bunker demand has been subdued in Singapore over the past week and lead times of 7–10 days have been recommended for VLSFO, a source said.

Rotterdam’s B100 benchmark has remained largely steady, edging up by $2/mt. Singapore’s B100 price has gained by a sharper $16/mt.

Liquid gases

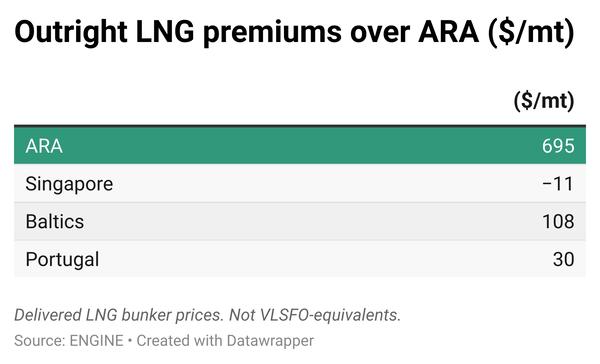

Rotterdam’s LNG bunker price has declined by $15/mt in the past week. The decline is largely linked to a 4% drop in the front-month Dutch TTF Natural Gas contract, on the back of “ample” supply within the EU and more Russian output.

Rotterdam’s LBM price declined by a larger $16/mt in the past week. LNG is priced at $146-160/mt premiums over LBM in Rotterdam.

Singapore’s LNG bunker price has fallen by $14/mt, marking the third consecutive week of declines. The drop largely reflects a weaker NYMEX Japan/Korea Marker (JKM), pressured by excess supply amid subdued Asian demand.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.