Americas Market Update 14 Aug 2025

Fuel price benchmarks have shown mixed movements, while strong wind gusts are forecast in Zona Comun over the weekend.

IMAGE: Aerial view of container ships at Santos, Brazil. Getty Images.

IMAGE: Aerial view of container ships at Santos, Brazil. Getty Images.

Changes on the day to 08.00 CDT (13.00 GMT) today:

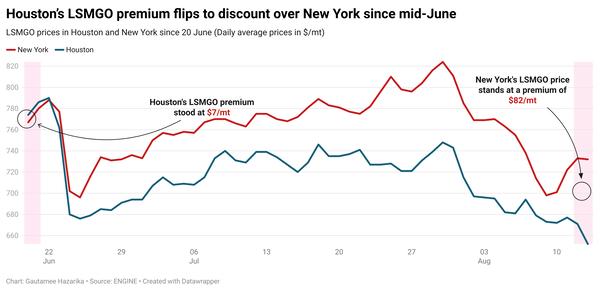

- VLSFO prices up in Houston ($6/mt) and Zona Comun ($1/mt), and down in Los Angeles ($4/mt), New York and Balboa ($3/mt)

- LSMGO prices up in Houston and Zona Comun ($4/mt), and down in New York ($29/mt), Los Angeles ($11/mt) and Balboa ($10/mt)

- HSFO prices up down in Los Angeles and New York ($4/mt), Balboa ($3/mt) and Houston ($2/mt)

Houston's VLSFO price benchmark has recorded the highest increase in the past session and is currently at a $12/mt discount to New York, consistent with the discount it held a month ago on 14 July.

The Houston market has been relatively slow this week, and bunker fuel availability is good for both VLSFO and LSMGO, with suppliers recommending lead times between 3–7 days.

HSFO availability is tight at Houston this week and requires at least 7 days of lead time.

All key ports have recorded a decline in prices for HSFO, with Los Angeles and New York posting the sharpest decreases.

In Zona Comun, VLSFO and LSMGO are in good stock. Lead times have remained largely unchanged from last week, with suppliers usually asking for 5–7 days to make deliveries.

Winds are expected to stay below 20 knots until late Friday, but could rise to 23 knots from early Saturday, potentially suspending bunker operations.

Brent

The front-month ICE Brent contract has lost $0.07/bbl on the day, to trade at $66.07/bbl at 08.00 CDT (13.00 GMT).

Upward pressure:

The US inflation rate, based on the Consumer Price Index for all urban consumers (CPI-U), increased by 0.2% in July, after rising by 0.3% in June. On an annual basis, the US CPI advanced 2.7% last month.

This news has provided some support to Brent’s price as it has boosted market expectations of an interest rate cut at the US Federal Reserve’s (Fed) upcoming meeting in September, according to analysts.

The next month is shaping up to be the “long-anticipated” rate cut, remarked SPI Asset Management's managing partner, Stephen Innes.

A rate cut in the US could spur demand growth and make commodities such as oil cheaper for non-dollar holders.

Downward pressure:

Brent crude’s price has declined further after yesterday’s bearish demand forecasts for the global oil market.

Market sentiment has turned negative following releases from the International Energy Agency (IEA) and Energy Information Administration (EIA).

The IEA forecasts that global oil demand will grow by 680,000 b/d this year and 700,000 b/d in 2026, about 200,000 b/d lower than its previous estimate.

Global oil demand growth has been “repeatedly downgraded” since the start of this year, by a combined 350,000 b/d, according to the IEA.

“The IEA monthly oil market report was largely bearish, with the agency expecting large inventory builds towards the end of this year and through 2026,” two analysts from ING Bank said.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.