Americas Market Update 11 Aug 2025

Bunker fuel benchmarks have mostly moved up, and lead times for HSFO have shortened in Houston.

IMAGE: Vessel docked in the Port of Houston in the US. Port of Houston

IMAGE: Vessel docked in the Port of Houston in the US. Port of Houston

Changes on the day from Friday to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Los Angeles ($14/mt), Balboa ($13/mt), Houston ($11/mt), Zona Comun ($8/mt) and New York ($4/mt)

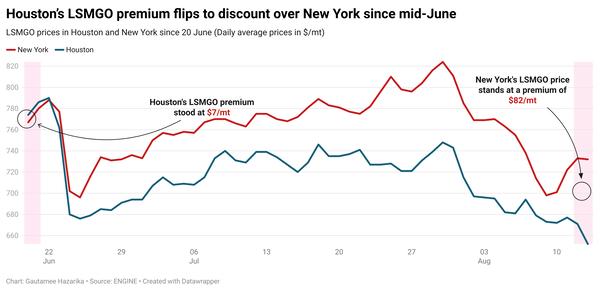

- LSMGO prices up in New York ($34/mt), Los Angeles ($26/mt), Zona Comun ($19/mt), Balboa ($18/mt) and Houston ($6/mt)

- HSFO prices up in Los Angeles ($14/mt), New York and Houston ($12/mt), and down in Balboa ($1/mt)

Balboa's HSFO benchmark has defied Brent and the general market trend by falling in the past session.

Meanwhile, the port's VLSFO price has increased by $13/mt, widening the Hi5 spread to $78/mt today, up from $28/mt three months ago.

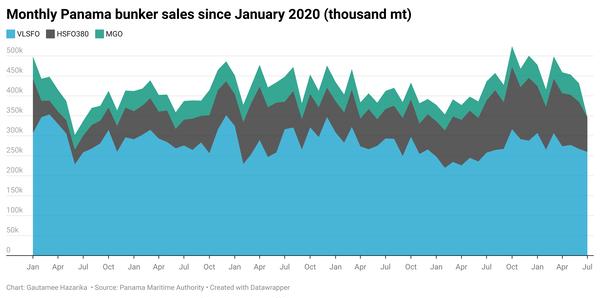

In Panama, bunker fuel demand has been healthier than in previous weeks, and availability remains good in both Balboa and Cristobal, a source said.

VLSFO and LSMGO can be supplied with lead times of 3–6 days, while HSFO requires longer lead times of 7–8 days. The shortest time two suppliers can deliver VLSFO in Balboa in is 1–2 days.

New York's LSMGO price benchmark has recorded the biggest increase and is currently at a premium of $50/mt over Houston's.

Bunker fuel demand is normal in New York, and availability is good for all three grades, with recommended lead times of 3–4 days.

In Houston, lead times for HSFO have improved, allowing for delivery within five days.

"Suppliers had been taking longer to make deliveries because HSFO is typically supplied via barges at the port, which were facing delays," a source said.

Brent

The front-month ICE Brent contract has gained $0.17/bbl on the day from Friday, to trade at $66.90/bbl at 08.00 CDT (13.00 GMT).

Upward pressure:

Brent futures have gained support from rising demand growth expectations.

Last week, the US Energy Information Administration (EIA) reported a 3 million-bbl draw in crude oil inventories. A decline in US crude stocks often signals stronger demand and can lend support to Brent, according to analysts.

Expectations of demand growth from China have provided additional support to oil prices. The country’s daily crude oil imports averaged 11.12 million b/d in July, up 11.5% year-on-year.

Downward pressure:

Brent crude’s price has come down, as the market shifted its focus to the highly anticipated meeting between US President Donald Trump and Russian President Vladmir Putin.

“If we do see some level of de-escalation, it would remove sanction risk from the oil market. This would likely drive prices lower, given the bearish fundamentals,” said two analysts from ING Bank.

The two leaders are set to meet in Alaska on 15 August to discuss a Russia-Ukraine peace deal, though Ukrainian President Volodymyr Zelenskyy has yet to receive an official invitation to the summit.

“News of a Ukraine summit between US President Donald Trump and Russian President Vladimir Putin on August 15 in Alaska prompted growing relief over oil supply stability,” remarked VANDA Insights’ founder Vandana Hari.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.