The Week in Alt Fuels: Bio barrels under pressure

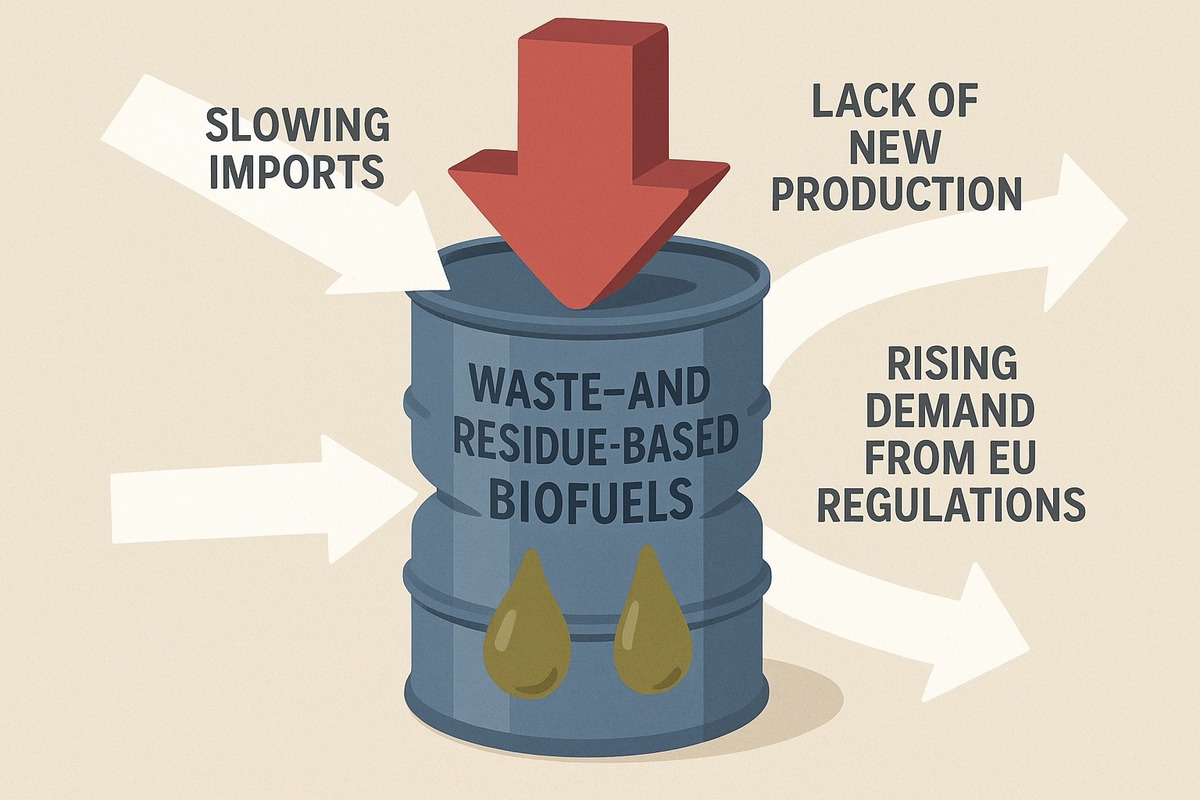

Europe’s dash for biofuel bunkers could hit a supply crunch amid anti-dumping tariffs on Chinese biodiesel, mounting fraud fears over Asian imports and meagre continental production gains.

IMAGE: ChatGPT

IMAGE: ChatGPT

We hear about bunker suppliers launching biofuel supply in more and more EU locations. Regulations have been a clear driver, and biofuel bunker demand has risen with the combined effects of the EU ETS and FuelEU Maritime.

But where do these biofuels actually come from. The latest report from the European Biodiesel Board (EBB) sheds some light on it.

Let’s start with imports. Between 2019 and 2024, EU biofuel imports fell by 2 million mt and EU countries produced 0.6 million mt less. This all happened when demand rose by 0.6 million mt.

Asia is the EU’s biggest import source. China is a massive producer of used cooking oil (UCO), while Malaysia, and especially Indonesia, are major producers and exporters of palm oil mill effluent (POME). Both of these feedstocks are common in biofuels sold in pure or blended form as bunkers.

POME made up 13% of EU biofuel feedstocks across sectors last year, and UCO 24%. POME is more used in the Netherlands, where it qualifies for HBE tickets that can be traded by suppliers in a market. Some of this value is passed on as rebates to buyers and has contributed to make Dutch biofuel bunkering competitive.

UCO used to be on the Dutch advanced list, but was taken off it to rebalance supply with the roads fuels sector. It remains the most common feedstock in biofuels bunkered outside the Netherlands, in ports like Antwerp, Gibraltar and Istanbul.

Dumping and fraud

Imports have come under a lot more scrutiny in the past couple of years. The EBB and other EU-based biofuel producers investigated allegations that Chinese exporters were flooding the EU market with massive quantities of lower-priced biodiesel. In July 2024, the EU enforced provisional anti-dumping duties of up to 36.4% on biodiesel imports from China, and imports have plummeted from a peak in the spring of 2024, EBB data shows.

The International Sustainability & Carbon Certification (ISCC) certified 2.3 million mt of POME in 2023 – about four times global theoretical output – mostly from Indonesia and Malaysia, with smaller volumes from China and Colombia. Indonesian officials estimate up to 94% of POME trade may be fraudulent.

A crackdown on fraudulent supply chains could curb EU access to sustainable biofuel imports. And EU production of waste- and residue-based biofuels will likely not be able to make up for the shortfall.

Rapeseed rules

Only 55% of the 14 million mt of biofuels produced in the EU were waste- and residue-based in 2024, with a substantial 39% crop-based and 6% uncategorised, according to EBB figures. There is a ceiling to how much sustainable fuels the block can produce, which makes it tempting to continue to reach for crops as feedstocks.

A Scandinavian bunker supplier recently told us that it used rapeseed methyl ester (RME) in its biofuels. It was still checking whether that would be compatible with FuelEU, which specifically rules out any crop-based biofuels. Rapeseed oil makes up a whopping 34% of all EU feedstocks – roughly the same as POME and UCO combined.

FAME output flattens

Around 70% of biofuels produced by EU nations in 2024 was fatty acid methyl ester (FAME), with most of the rest being hydrotreated vegetable oil (HVO) with 28%. Hydroprocessed esters and fatty acids (HEFA), which is only used in planes, made up 2%.

FAME is the type that counts for most shipowners, as it’s more cost-efficient to make and considerably cheaper to bunker. But the EU's FAME output has fallen from 11.5 million mt in 2019, and is only projected to rise from 9.8 million mt last year to 10.1 million mt in 2027. That hardly seems enough to cater to coming regulation-driven demand.

The best bet for shipowners looking to bunker biofuels in EU ports in the future could therefore either be that a growing electric vehicle fleet will dampen demand for biodiesel as road fuel, that imports flow from major waste- and residue biofuel producers will pick up, or that new sustainable biofuel feedstocks will be developed and scaled.

But if POME and UCO supply chains are curbed, EU tariffs continue to price out and divert Chinese UCO, and demand keeps rising with tighter emission targets, that could put enormous pressure on the EU’s supply-demand balance.

In other news this week, Hafnia and Socatra’s joint venture Ecomar said it has taken delivery of a third methanol-capable tanker. The two others were delivered in January and May, and all three will be chartered to TotalEnergies.

Maersk took delivery of the methanol-capable Beijing Maersk, which is the 15th in its fleet. The Danish container liner plans to deploy a total of 19 methanol-capable vessels by the end of the year.

Methanol also featured in DNV’s monthly orderbook statistics with three new orders in July. But it was overshadowed by 22 orders for LNG-capable vessels, so reinforced its lead in the alternative fuel space.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.