LNG Bunker Snapshot: Rotterdam’s price falls with lower bunker premiums

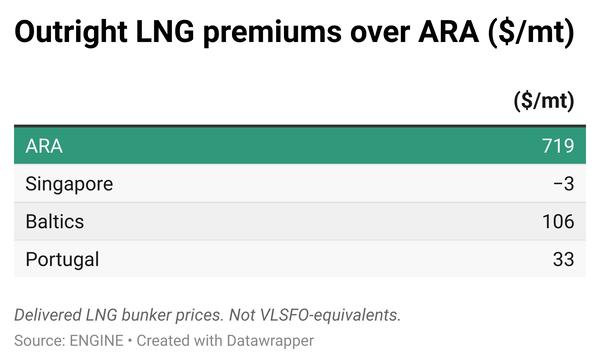

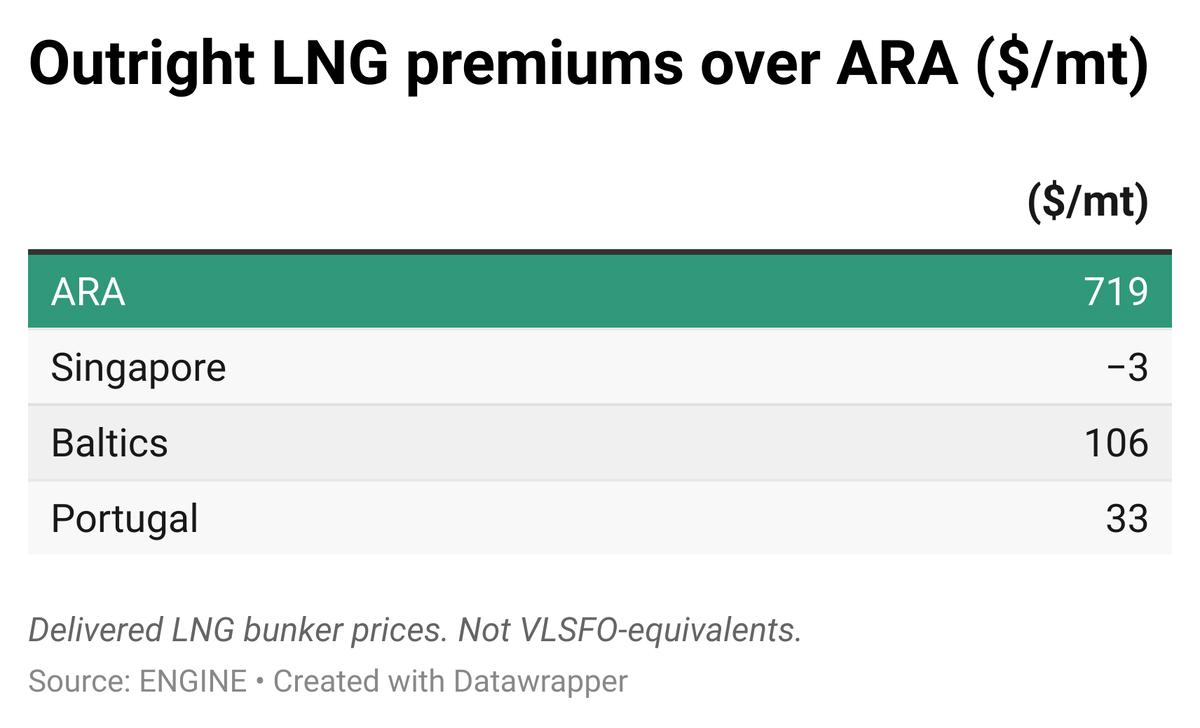

Rotterdam's LNG bunker price has dropped alongside narrowing bunker premiums, while Singapore's price has edged down amid weak demand across the broader Asian LNG market.

Weekly changes in LNG bunker prices:

- Rotterdam down by $19/mt to $719/mt

- Singapore down by $7/mt at $716/mt

Rotterdam

Rotterdam’s LNG bunker price has declined for a second straight week, reaching $719/mt. The latest drop has been primarily driven by an 11% fall in the LNG bunker delivery premium, which has narrowed to around $119/mt over the past week.

Rotterdam's price has also been under downward pressure from a 1% dip in the front-month Dutch TTF Natural Gas contract, Europe’s key gas benchmark. TTF now stands at $11.55/MMBtu (equivalent to $601/mt).

The TTF price has come under pressure due to an “easing of the heatwave in Europe, reducing demand for air conditioning, and supplies from Norway are also stable,” according to the Japan Organization for Metals and Energy Security (JOGMEC).

“[The] Weather in Northern Europe is turning milder and windier, curbing gas demand,” commented Mind Energy, formerly known as Energi Danmark.

“A recovery in Norwegian gas flows to Europe following an unplanned outage last week has eased supply concerns,” said two ING Bank analysts.

As of 25 July, the EU's underground gas storage had risen to 66.5%, up from 64.4% the previous week. However, this remains 20.8% lower compared to the same period last year, according to Gas Infrastructure Europe data.

“European gas prices decreased this past week as Asian demand slowed,” observed Rystad Energy.

Singapore

Singapore’s LNG bunker price has edged down by $7/mt over the past week, driven by “ample supply and sluggish demand,” according to JOGMEC.

LNG bunker prices in the region are generally tied to NYMEX Japan/Korea Marker (JKM) values, and the front-month JKM contract fell by $0.12/MMBtu to $11.88/MMBtu ($618/mt) during the same period.

Singapore’s earlier $15/mt discount to Rotterdam has now disappeared, with prices between the two hubs nearing parity.

“China’s absence from the spot market amid subdued demand has increased the number of LNG cargoes available,” noted Daniel Hynes, senior commodity strategist at ANZ Bank.

“China's LNG imports plummeted by 20% in H1 2025,” said Greg Molnár, gas analyst at the International Energy Agency (IEA).

Multiple factors such as weaker domestic demand, stronger piped gas inflows, higher domestic production, and lower storage injections have contributed to “China’s fading LNG appetite,” Molnár explained.

As of 22 July, LNG inventories for power generation in Japan stood at 1.92 million mt, up by 40,000 mt from the previous week, according to Japan’s Ministry of Economy, Trade and Industry (METI).

Other LNG bunker news

Galveston LNG Bunker Port (GLBP) has signed a letter of intent with climate tech company Loa Carbon to produce e-LNG for bunkering. GLBP will expand beyond fossil LNG by producing e-LNG at its upcoming Texas City facility.

TotalEnergies and CMA CGM have agreed to form a joint venture to supply LNG in Rotterdam.

In another development, Swiss shipping firm Sallaum Lines has taken delivery of an LNG-capable vehicle carrier named Ocean Breeze.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.