Europe & Africa Market Update 28 Jul 2025

Bunker benchmarks at European and African ports have moved minimally in mixed directions, and bunkering operations have partially resumed off Malta. IMAGE: Tankers during a bunker operation off Malta. Getty Images

IMAGE: Tankers during a bunker operation off Malta. Getty Images

Changes on the day from Friday, to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($6/mt), and down in Durban ($8/mt) and Gibraltar ($5/mt)

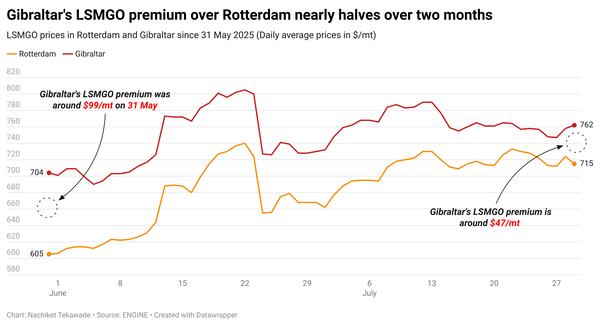

- LSMGO prices down in Rotterdam ($10/mt) and Gibraltar ($9/mt)

- HSFO prices up in Gibraltar ($7/mt), and down in Durban ($7/mt) and Rotterdam ($3/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $32/mt to $237/mt

- Gibraltar B30-VLSFO premium over VLSFO down by $4/mt to $249/mt

Rotterdam's B30 VLSFO price recorded the biggest decline among the fuels at the Dutch port. The port's $26/mt slump in the fuel price has widened its discount to Gibraltar to $39/mt over the past session.

Similar to Gibraltar's B30 VLSFO price that recorded losses, the port's Hi5 spread has also narrowed to $44/mt, marking a considerable decrease since the beginning of July, when the Hi5 spread was around $70/mt.

Bunker suppliers in Gibraltar are now 4–8 hours behind schedule, down from 6–12 hours last week, according to port agent MH Bland.

Bunkering operations have resumed in Area 4 off Malta, after operations were suspended at the anchorage due to bad weather conditions, the port agent told ENGINE. However, laden tankers are not permitted to receive bunkers due to regulations.

Operations in other anchorages off Malta remain suspended, the agent added. Wind gusts of around 24 knots are forecast today.

Bunker availability off Malta is good, with traders recommending lead times of 1-5 days for all grades.

Meanwhile, VLSFO supply has now improved at Greece’s Piraeus and Istanbul continues to report good bunker availability, traders told ENGINE.

Brent

The front-month ICE Brent contract has declined by $0.34/bbl on the day from Friday, to trade at $69.06/bbl at 09.00 GMT.

Upward pressure:

The US securing a trade deal with the European Union (EU), along with the potential extension of a tariff pause with China, eased fears that higher tariffs might dampen economic activity and curb fuel demand, according to Reuters. These developments have contributed to upward pressure on Brent futures.

Oil prices received support “after the US signed a trade deal with the European Union on Sunday and was reported to be poised to extend the tariff truce with China by another 90 days during talks this week,” said Vandana Hari, founder of VANDA Insights.

Oil prices were supported “after the US and EU announced a trade deal, which will see most EU exports to the US facing a 15% tariff,” analysts at ING Bank shared a similar view.

Adding to the price support, the total number of rigs drilling for crude oil and natural gas in the US fell by two last week to 542 units, according to Baker Hughes.

Specifically, oil rigs dropped by seven to 415, while gas rigs increased by five to 122.

This overall decline has sparked some supply concerns, further contributing to upward pressure on oil prices.

Downward pressure:

The prospect of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) further easing supply restrictions has exerted downward pressure on Brent futures.

Four OPEC+ delegates said last week that the group is unlikely to recommend any changes to the existing plan by eight member countries to increase oil output by 548,000 b/d in August, although another source noted it was still too early to determine, according to Reuters.

“The group may feel emboldened to go with yet another large supply hike for September, given that prices are holding up relatively well despite supply increases already announced in recent months,” commented two analysts from ING Bank.

Market watchers are closely awaiting the outcome of the OPEC+ meeting scheduled for later today.

Adding to the bearish sentiment, the US is preparing to issue new authorizations for key partners of Venezuela’s state-owned PDVSA—starting with Chevron—allowing them to operate under certain limitations and engage in oil swap agreements with the sanctioned OPEC nation, Reuters reported.

“The Trump administration announced last week it will allow Chevron to resume pumping oil in Venezuela,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

This move has also contributed to downward pressure on oil prices.

By Nachiket Tekawade, Samantha Shaji and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.