Europe & Africa Market Update 18 Jul 2025

Fuel prices in European and African ports have climbed in the past day, with Gibraltar’s B30-VLSFO premium over Rotterdam rising sharply. IMAGE: Oil tanks and terminals in the Port of Gothenburg, Sweden. Getty Images

IMAGE: Oil tanks and terminals in the Port of Gothenburg, Sweden. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO up in Durban ($10/mt), Gibraltar ($7/mt) and Rotterdam ($5/mt)

- LSMGO prices up in Rotterdam and Gibraltar ($6/mt)

- HSFO prices up in Gibraltar ($5/mt), Rotterdam ($3/mt) and Durban ($2/mt)

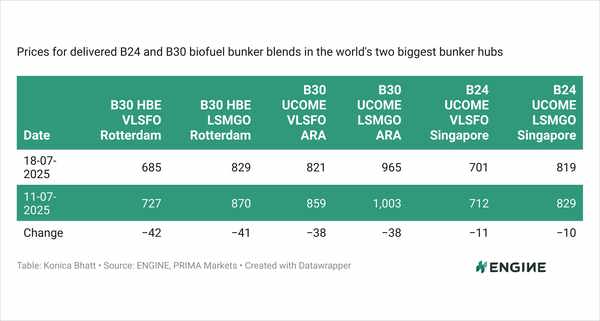

- Rotterdam B30-VLSFO premium over VLSFO up by $6/mt to $243/mt

- Gibraltar B30-VLSFO premium over VLSFO up by $64/mt to $297/mt

Bunker prices in Rotterdam, Gibraltar and Durban have recorded gains in the past session, tracking Brent’s upward movement.

Gibraltar’s B30-VLSFO price premium over Rotterdam has widened by $60/mt to $83/mt now.

Bunkering is progressing normally in Gibraltar today amid conducive weather conditions, according to port agent MH Bland.

The Spanish port of Ceuta is forecast to experience wind gusts of 27 knots today, which could complicate bunker deliveries. Six vessels are scheduled to arrive for bunkers in Ceuta today, according to shipping agent Jose Salama & Co.

Securing prompt bunker deliveries can be difficult in Gothenburg and off Skaw, with recommended lead times of around 10 days.

In South Africa's Durban port, VLSFO price increase has outpaced gains in its HSFO benchmark, widening the port's Hi5 spread by $8/mt to $59/mt.

Brent

The front-month ICE Brent contract has gained by $1.62/bbl on the day, to trade at $70.04/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price has moved higher due to oil supply-related concerns, snapping a three-day losing streak.

Several oilfields in Iraq’s semi-autonomous Kurdistan region halted production, following drone strikes that targeted infrastructures operated by various companies.

The attacks have reduced crude output from about 280,000 b/d to 140,000 b/d to 150,000 b/d, Reuters reported, citing two energy officials.

“Iraq has lost about 200kb/d [200,000 b/d] of production due to drone attacks on several fields in Kurdistan,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

Besides, Brent’s price gained after the European Union (EU) reached an agreement on the 18th sanctions package against Russia that was proposed last month. The measures aim at further crippling Moscow’s oil and energy revenues.

“Near-term oil fundamentals remain supportive, with the market set to remain fairly tight through this quarter,” two analysts from ING Bank noted.

Downward pressure:

Brent’s price gains were capped by some concerns of a supply glut in the second half of this year as OPEC+ members continue to hike production levels every month.

Total crude oil production by OPEC+ members averaged 41.56 million b/d last month, about 349,000 b/d higher than in May.

Oil production by OPEC+’s de-facto leader Saudi Arabia, increased by 173,000 b/d on the month to 9.36 million b/d in June.

“OPEC+ output is rising and Saudi Arabia increased flows to 6.43mb/d [6.43 million b/d] in H1 July,” Hynes added.

By Nachiket Tekawade and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.