Fuel Switch Snapshot: LNG premiums narrow in major ports

LNG priced $20-100/mt over VLSFO in Singapore

Rotterdam’s LBM at $150-200/mt discounts to LNG

Estimated B100 pooling benefit increases

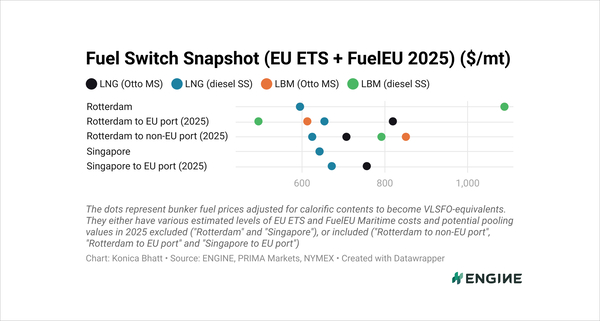

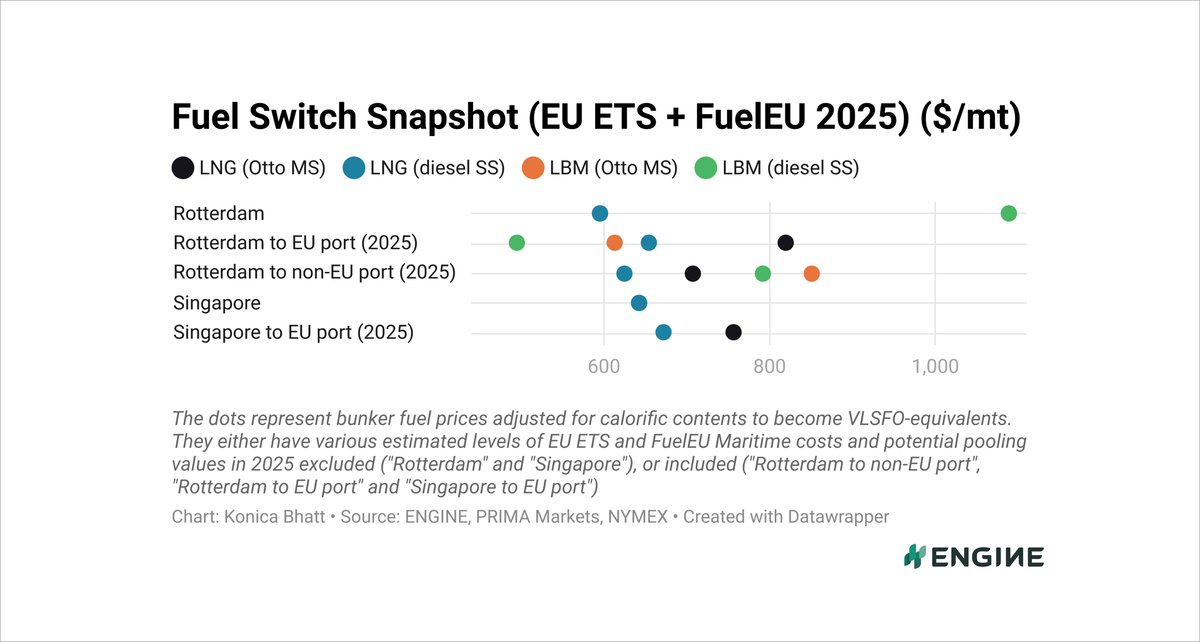

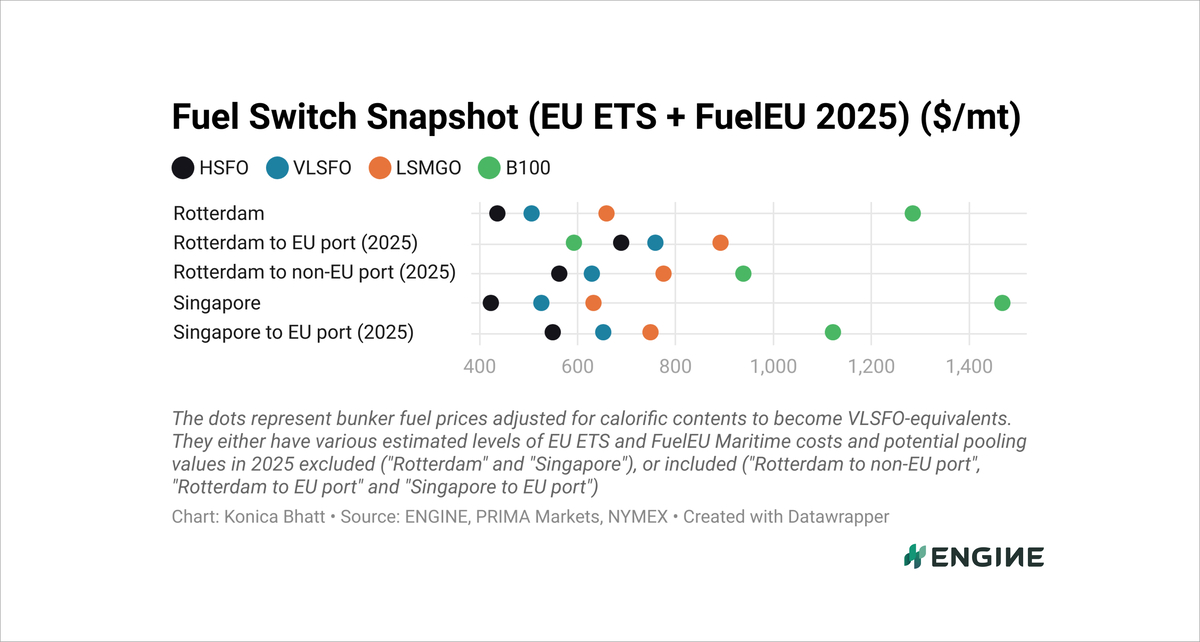

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

Rotterdam LNG’s premium over VLSFO has narrowed to $63/mt for dual-fuel vessels with Otto medium-speed (Otto MS) engines. For vessels with diesel slow-speed (diesel SS) engines, LNG is now priced $104/mt below VLSFO.

LNG is priced between $19-102/mt higher than VLSFO in Singapore, depending on the LNG engine type.

For dual-fuel shipowners comparing liquefied biomethane (LBM) and B100, Rotterdam’s LBM is now $20/mt more expensive than B100 for vessels with Otto MS engines, down by $36/mt from the previous week.

For vessels with diesel SS engines, LBM is now $97/mt cheaper than B100 in Rotterdam.

B100’s discount to VLSFO in Rotterdam has stayed largely stable at $165/mt, a slight $2/mt increase from the week before. The theoretical FuelEU pooling benefit for a vessel sailing between EU ports and selling the compliance surplus generated from using B100 went up by $10/mt to $693/mt over the past week.

In Singapore, B100 is priced $469/mt higher than VLSFO after factoring in estimated pooling benefits for voyages between Singapore and EU ports.

Liquid fuels

Rotterdam’s VLSFO price has gained by $12/mt in the past week and Singapore’s VLSFO benchmark has risen by $7/mt.

VLSFO lead times remain highly variable in Singapore amid weak demand. Some suppliers are quoting as little as six days, while others advise booking up to two weeks in advance due to long-term nominations, which are typically contract-based stems that take priority over spot demand.

This is a slight improvement from last week when recommended lead times varied dramatically, and ranged between 5-21 days.

B100 prices have held mostly steady, rising by $10/mt in Rotterdam and $4/mt in Singapore.

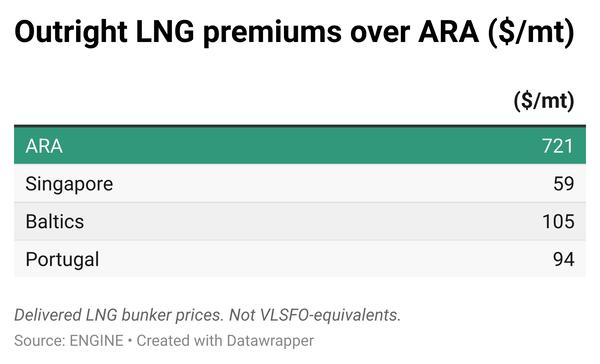

Liquid gases

Rotterdam’s LNG price has dropped by $33/mt over the past week, bringing its two-week decline to $93/mt. This fall has nearly wiped out almost all of its gains (+$97/mt) recorded in first three weeks of June.

Rotterdam's LBM price has declined by $35/mt in the past week.

One supplier told ENGINE that LBM bunker demand across its operations is broadening beyond the usual container ships and car carriers to other vessel segments, such as tankers.

Singapore’s LNG price has remained mostly stable, edging $5/mt lower in the past week.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.