Europe & Africa Market Update 7 Jul 2025

Bunker benchmarks in European and African ports have moved in mixed directions, and Barcelona has good bunker supply.

Changes on the day from Friday, to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($9/mt) and Durban ($5/mt), and down in Gibraltar ($2/mt)

- LSMGO prices up in Gibraltar ($1/mt), and down in Rotterdam ($3/mt)

- HSFO prices up in Durban ($11/mt), and down in Rotterdam ($2/mt) and Gibraltar ($1/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $16/mt to $271/mt

Prices of conventional fuels have moved in mixed directions over the weekend, negating most of the losses the fuel grades recorded last week.

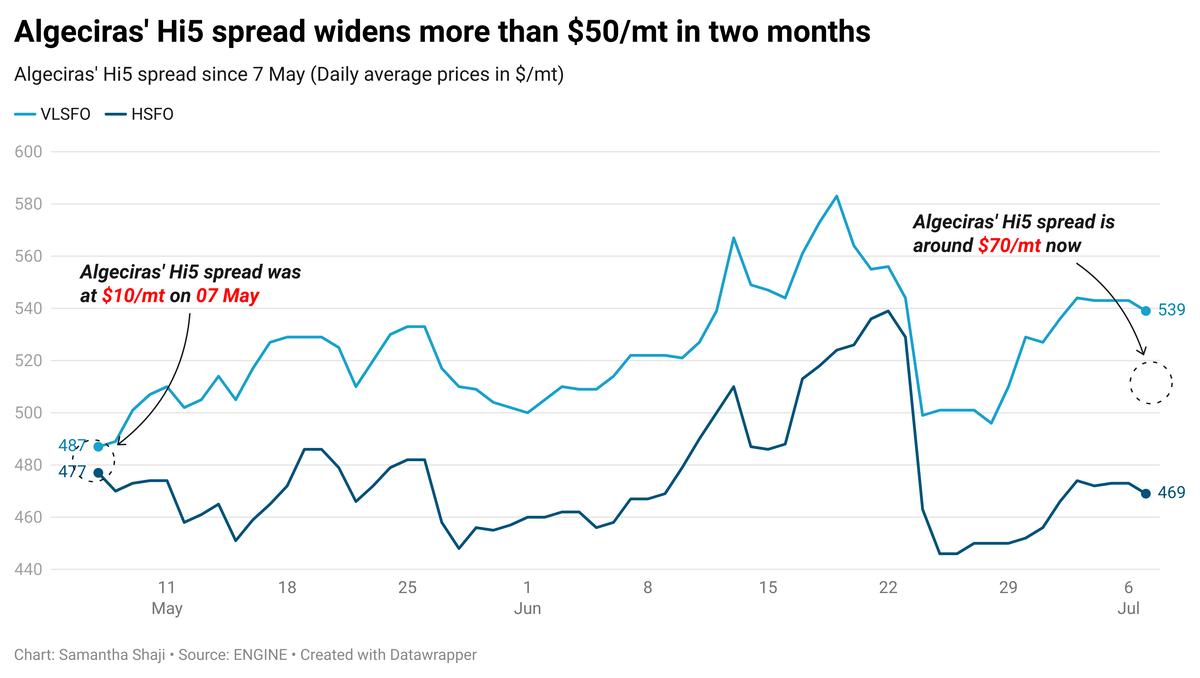

Rotterdam's VLSFO price has risen, while its HSFO price has come down. The price moves have significantly widened the port's Hi5 spread, touching $80/mt over the weekend.

In Barcelona, all grades are readily available, with recommended lead times unchanged from last week at 5-7 days, a trader said.

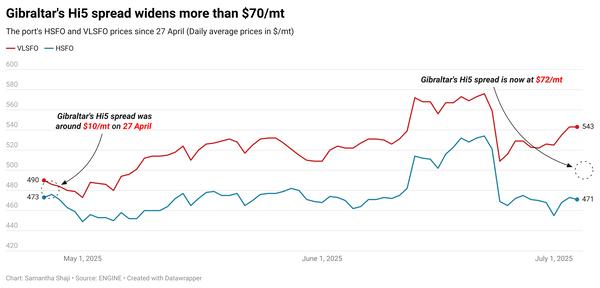

Congestion eased in Gibraltar over the weekend, with only two vessels awaiting bunkers today, according to MH Bland. Suppliers at the port are running anywhere from 2-6 hours behind schedule, the port agent noted.

Suppliers at Algeciras are now delayed by 2-8 hours, down from last week’s 2-12 hours, the port agent said.

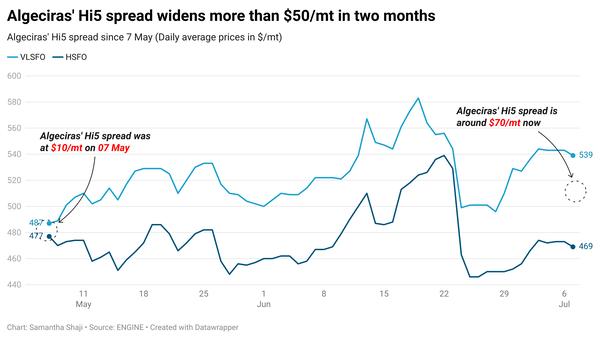

Prices of both VLSFO and HSFO grades have remained steady in Algeciras over the weekend. Meanwhile, the port’s Hi5 spread has widened by more than six times over the past two months.

Ceuta expects seven vessels to arrive for bunkers today, according to shipping agent Jose Salama & Co.

Weather-related disruptions are forecast off Malta, which could negatively impact operations. Prompt VLSFO supply is tight at the anchorage, according to a trader.

Brent

The front-month ICE Brent contract has gained by $0.33/bbl on the day from Friday, to trade at $68.61/bbl at 09.00 GMT.

Upward pressure:

The total number of rigs drilling for crude oil and natural gas in the US fell by eight last week, bringing the count to 539 units, according to Baker Hughes.

Compared to the same period last year, the US rig count is down by 46 rigs, or approximately 8%.

This decline has raised some supply concerns and added upward pressure on Brent futures.

“The latest rig data from Baker Hughes shows that drilling activity in the US continues to slow… The dramatic drop in drilling activity leaves downside to US oil output through 2026,” noted two analysts from ING Bank.

Downward pressure:

Eight members of OPEC and its allies (OPEC+) have agreed to raise their collective crude oil supply by 548,000 b/d in August—an increase that exceeds prior expectations and has added downward pressure on Brent futures.

Oil prices are facing downward pressure “after OPEC+ agreed on a larger-than-expected supply hike,” analysts from ING Bank said in a note.

Oil prices are under pressure “in response to Saturday’s decision by the OPEC/non-OPEC Group of 8 to hike its collective production target for August by 548,000 b/d instead of 411,000 b/d as expected,” Vandana Hari, founder and analyst at Vanda Insights, added.

Additionally, US officials have signalled a delay in implementing the tariffs but have not provided clarity on the revised rates, according to a Reuters report. The US is finalising trade deals with some countries and will notify others of higher tariff rates by 9 July, with the new rates set to take effect on 1 August, the report said.

This has raised concerns that higher tariffs could dampen economic activity and reduce oil demand.

“A more bearish supply outlook, combined with demand uncertainty, doesn’t bode well for prices,” the ING Bank analysts concluded.

By Samantha Shaji and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.