Americas Market Update 1 July 2025

Bunker fuel prices have moved in mixed directions, and weather disruptions are expected in Zona Comun.

IMAGE: Container vessels docked in the Port of Balboa. Getty Images

IMAGE: Container vessels docked in the Port of Balboa. Getty Images

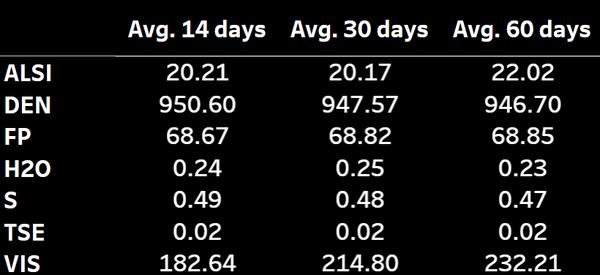

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Houston ($7/mt), Balboa ($5/mt) and New York ($1/mt), and down in Zona Comun ($24/mt)

- LSMGO prices up in Houston ($1/mt), and down in New York ($4/mt) and Balboa ($3/mt)

- HSFO prices up in Houston ($4/mt), and down in New York ($6/mt) and Balboa ($4/mt)

Balboa's VLSFO price has moved up, while HSFO has declined, widening the port's Hi5 spread to $55/mt, up from $16/mt last Wednesday.

Bunker fuel demand has improved in Balboa since last week, and suppliers have received more inquiries, a source said.

All fuel grades are available in the port, where recommended lead times are at 4-5 days.

VLSFO price have gained in most major ports, except in Zona Comun.

Deliveries are currently underway at the Argentinian anchorage. VLSFO availability remains good this week, and recommended lead times are at 5–6 days. There are currently five barges in operation at the anchorage.

Bunkering could be delayed by high winds until 5 July, a source said.

Possible disruptions from high wind gusts are expected until 5 July, which could lead to delays in bunkering operations, a source said.

Brent

The front-month ICE Brent contract has lost $0.35/bbl on the day, to trade at $67.28/bbl at 08.00 CDT (13.00 GMT).

Upward pressure:

Market participants are slowly growing optimistic towards trade talks between the US and China. This has supported Brent futures this week.

Representatives from the two countries have agreed on a framework to ease trade tensions, according to media reports.

The deal is yet to be reviewed and approved by US President Donald Trump and his counterpart Xi Jinping.

The news comes amid growing optimism over another US interest rate cut, with the US Federal Reserve (Fed) set to hold its next policy meeting in July.

“In addition to the rate-cut narrative, global growth optimism is starting to regain momentum,” SPI Asset Management managing partner Stephen Innes said.

Downward pressure:

Brent crude’s price has moved lower due to growing oversupply concerns in the global oil market.

Eight members of the OPEC+ coalition are expected to raise their combined August output by another 411,000 b/d, according to media reports. This news has countered any Brent gains.

“The market is now concerned that the OPEC+ alliance will continue with its accelerated rate of output increases,” ANZ Bank’s senior commodity strategist Daniel Hynes.

The Saudi Arabia-led group will again meet on 6 July 2025 to decide on August production levels, it said earlier.

“It would be the fourth month in a row the group has agreed to such a large increase in output,” Hynes said.

The oil producers’ group had originally agreed to gradually phase out of the 2.2 million b/d production cuts at a rate of 138,000 b/d every month.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.