Fuel Switch Snapshot: Bunker fuel prices slump in major ports

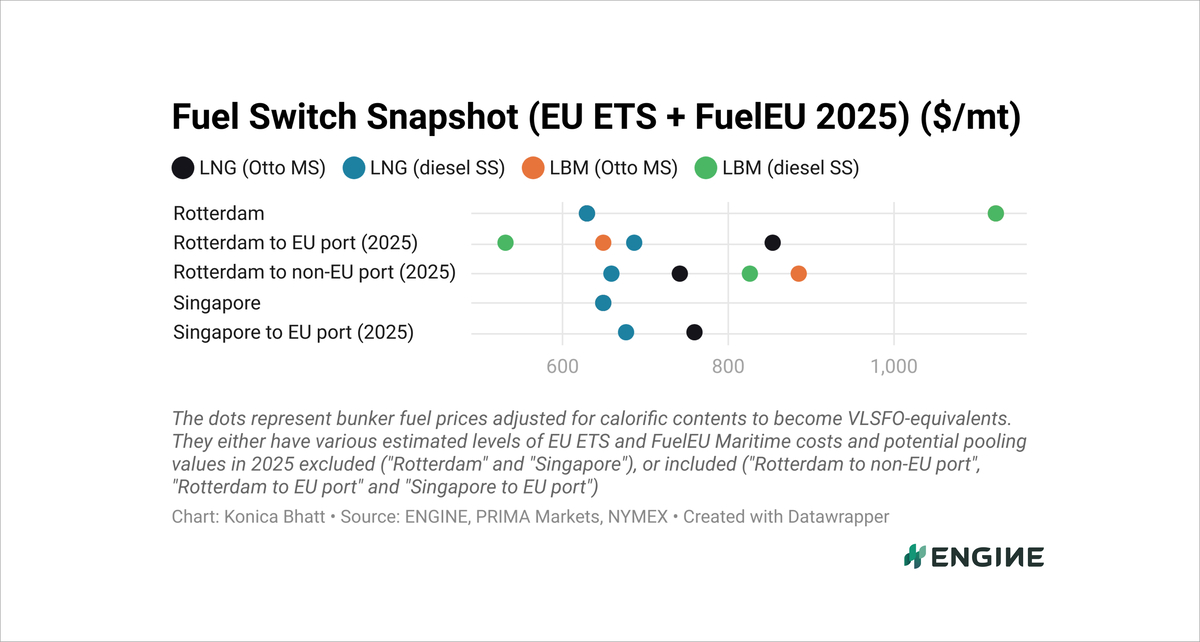

Conventional fuel prices slide with Brent

B100 prices drop in major ports

B100 pooling value estimated at premium over LBM

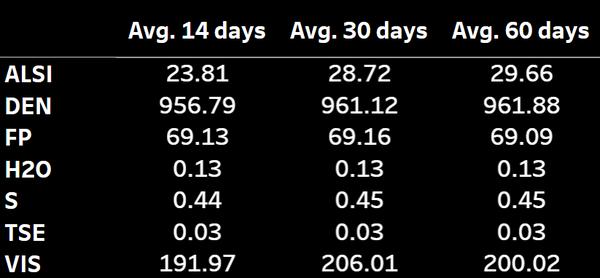

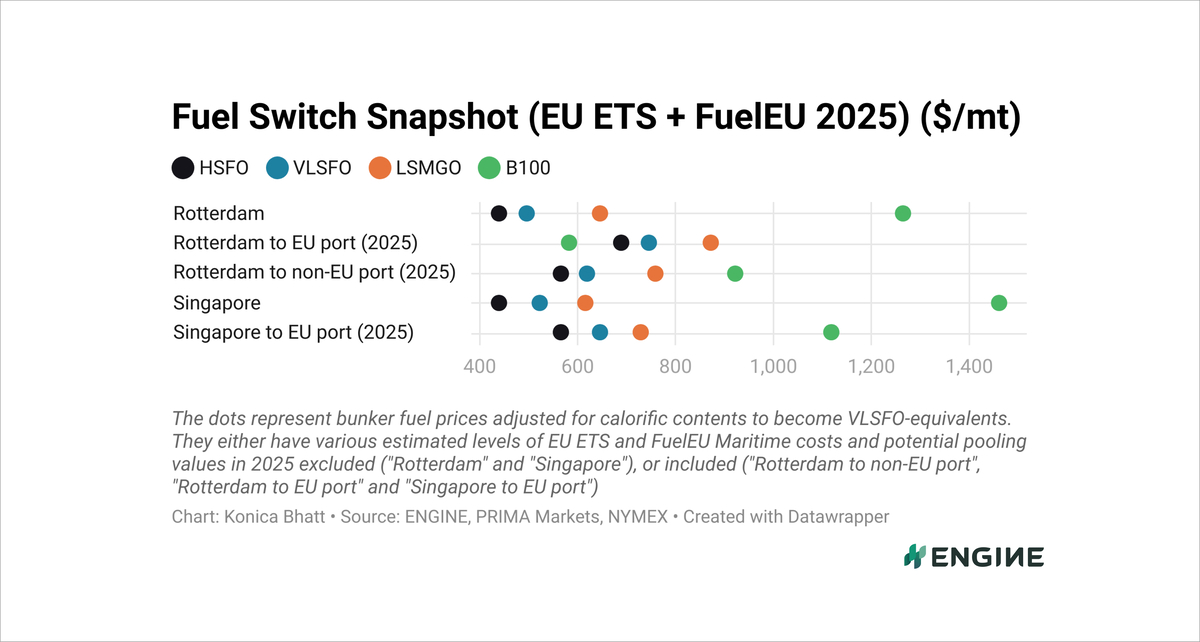

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

Rotterdam LNG’s premium over VLSFO has narrowed by $26/mt to $108/mt for dual-fuel vessels with Otto medium-speed (Otto MS) engines. For vessels with diesel slow-speed (diesel SS) engines, LNG's discount to VLSFO has shrunk to $59/mt.

Singapore’s LNG now carries $30–113/mt premiums over VLSFO, depending on the vessel’s engine type.

LNG’s premium over liquefied biomethane (LBM) in Rotterdam has remained mostly steady, now at $156–205/mt depending on the vessel’s engine type and methane slip.

Few dual-fuel shipowners directly choose between LBM and B100, as they generally fuel different vessel segments.

But for those vessels still considering both, Rotterdam’s B100 is priced at a $66/mt discount to LBM for dual-fuel vessels with Otto MS engines. For vessels with diesel SS engines, B100 has shifted to a $52/mt premium over LBM in the past week, up $26/mt from the week before.

Depending on the vessel’s engine, the theoretical FuelEU pooling benefit for a ship sailing between EU ports, and selling the compliance surplus it generates from using LBM, ranges from $475–592/mt.

This is $91–208/mt lower than the estimated $683/mt pooling benefit for using B100.

Liquid fuels

Conventional fuel prices have cooled over the past week. This follows steep rises in previous weeks of Israel-Iran attacks and worries over oil and gas supply disruptions.

Rotterdam’s VLSFO price has fallen by $33/mt and Singapore’s benchmark has dropped by $46/mt, broadly tracking a $32/mt decline in front-month ICE Brent futures.

VLSFO lead times remain highly variable in Singapore. Some suppliers advise as little as five days, while others recommend booking up to three weeks ahead due to tight delivery schedules. Last week, typical lead times ranged from 6–10 days.

Rotterdam’s B100 price has declined by $33/mt, while Singapore’s has plunged $74/mt lower.

Liquid gases

Rotterdam’s LNG price has slumped $60/mt lower over the past week, ending a three-week streak of gains. The port’s LBM benchmark has tracked closely, down by $59/mt.

The price has come off both because of a smaller LNG bunker premium, and because of a 3% drop in the front-month Dutch TTF gas price. “De-escalation in the Middle East might ease concerns over potential LNG supply disruptions,” ING Bank analysts added.

Singapore’s LNG bunker price has declined by $55/mt over the same period, pulled lower by a declining front-month NYMEX Japan/Korea Marker (JKM) contract.

Similar to Rotterdam, Singapore's LNG has declined after the Israel-Iran ceasefire, but also because of weaker Chinese LNG cargo demand.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.