Americas Market Update 18 Jun 2025

Bunker fuel prices in the Americas have mostly moved upward, and a tropical storm surge is expected to disrupt bunker operations along the southern coast of Mexico.

Changes on the day to 08.00 CDT (13.00 GMT) today:

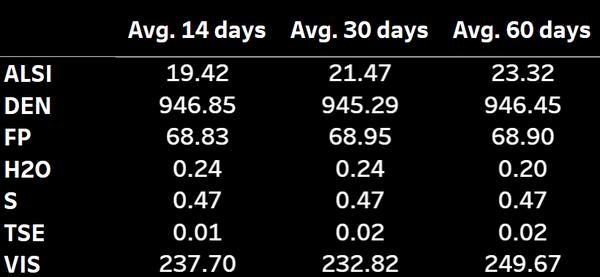

- VLSFO prices up in Balboa ($12/mt), Houston and New York ($10/mt), and down in Zona Comun ($14/mt)

- LSMGO prices up in Balboa ($29/mt), Houston and New York ($20/mt)

- HSFO prices up in Balboa and New York ($20/mt) and Houston ($18/mt)

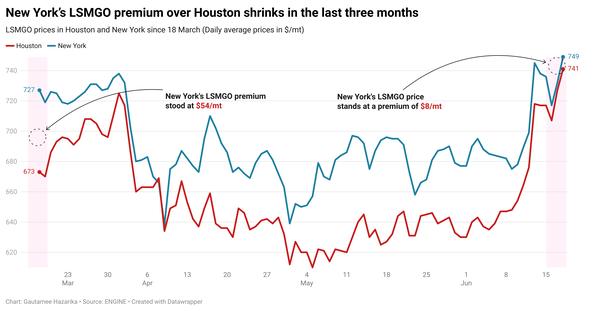

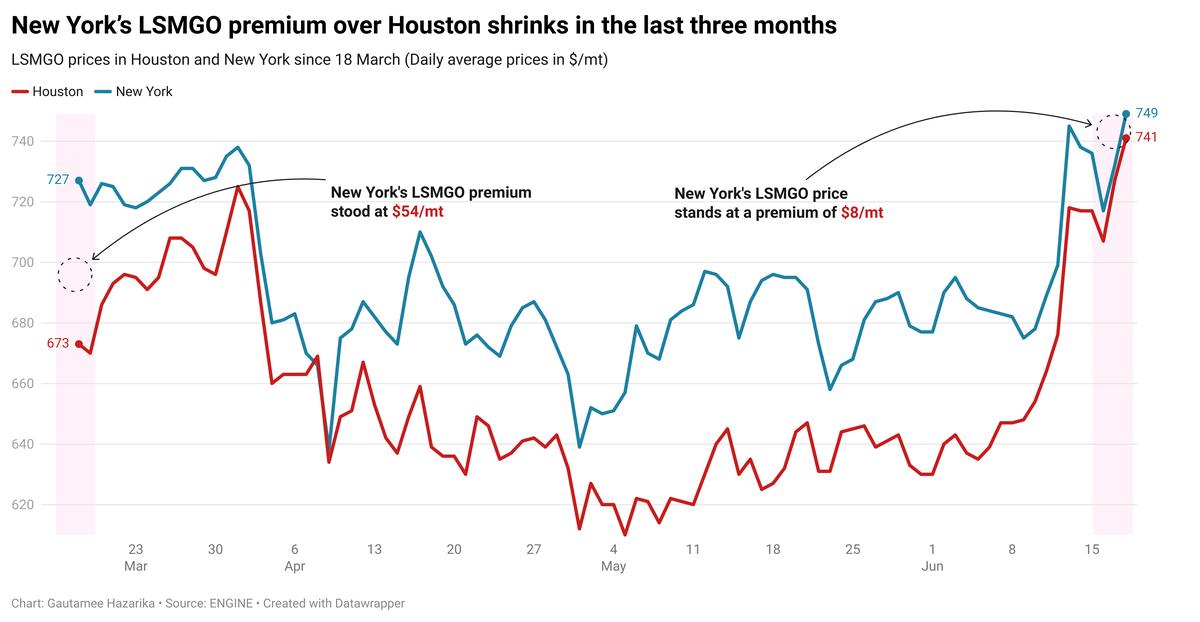

New York’s LSMGO premium over Houston has narrowed over the past three months. In late March, New York's LSMGO traded at a premium of $54/mt over Houston, but the spread has since tightened significantly, standing at just $8/mt as of mid-June.

Houston has begun facing poor weather conditions, which could impact bunker operations. Meanwhile, New York is seeing lower bunker demand this week, a source said.

A storm advisory has been issued for southern Mexico, with the tropical storm Erick forecast to rapidly intensify before reaching the coast on Thursday.

Heavy rainfall, coastal flooding, and storm surge are likely to disrupt bunker operations, particularly in the states of Oaxaca and Guerrero.

Bunker fuel operations have resumed in the Galveston Offshore Lightering Area (GOLA), but elevated sea conditions of up to 5 feet may cause delays.

Disruptions may continue through Saturday, and each delivery is being assessed on a case-by-case basis by the supply vessel, another source said.

Brent

The front-month ICE Brent contract has gained $2.56/bbl on the day, to trade at $76.83/bbl at 08.00 CDT (13.00 GMT).

Upward pressure:

Brent crude has surpassed the $75/bbl mark as hopes for a swift resolution to the Israel-Iran conflict fade, with the dispute now entering its sixth day.

US President Donald Trump is weighing several options amid rising hostilities in the Middle East, including a possible US airstrike on Iran, the Wall Street Journal reports.

“Crude prices [are] ripping higher on intensifying speculation that the US could soon join Israel in direct military action against Iran,” SPI Asset Management managing partner Stephen Innes remarked.

The conflict has renewed fears about the security of vital oil transit chokepoints in the region, including the Strait of Hormuz, Gulf of Aden and Bab al-Mandab Strait.

“The biggest fear for the oil market is the shutdown of the Strait of Hormuz,” two analysts from ING Bank noted. “This could impact oil flows from the Persian Gulf. Almost a third of global seaborne oil trade moves through this chokepoint,” they said.

Downward pressure:

Concerns related to global oil demand growth have capped some of Brent’s price gains this week.

Paris-based International Energy Agency (IEA) now expects global oil demand to grow by 720,000 b/d in 2025 and by 740,000 b/d in 2026 - both revised down by around 200,000 b/d from its earlier forecasts.

The weakness in US and Chinese oil demand growth in the second quarter will be a major contributor to the downward trend, the agency said.

On the supply side, the IEA projects global oil production to grow by 1.8 million b/d to average 104.9 million b/d in 2025, and by another 1.1 million b/d in 2026.

The energy agency has also projected “an average 1.1 million b/d of supply overhang this year,” VANDA Insights’ founder and analyst Vandana Hari said.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.