Europe & Africa Fuel Availability Outlook 18 Jun 2025

Good prompt availability off Malta

HSFO very tight in Port Louis

VLSFO tight in Nacala and Maputo

IMAGE: Bulk carrier docked in Maputo, Mozambique. Getty Images

IMAGE: Bulk carrier docked in Maputo, Mozambique. Getty Images

Northwest Europe

Prompt delivery remains tight in the ARA hub for all grades, a trader told ENGINE. Recommended lead times for VLSFO and LSMGO have narrowed to 7-8 days, while HSFO's remain consistent with last week, at 8-9 days.

The ARA’s independently held fuel oil stocks have averaged 6.74 million bbls in June so far, a 6% drop from May, according to Insights Global data.

The region has imported 87,000 b/d of fuel oil in June so far, less than half of the 176,000 b/d imported across May, according to data from cargo tracker Vortexa. Poland remains the region’s topmost import source, making up about 30% of the total share. Other import sources include Germany (26%), the UK (22%) and Finland (11%).

The ARA's independent gasoil inventories - which include diesel and heating oil – have averaged 5% lower this month. Some 122,000 b/d of diesel and gasoil has been imported, less than half of May’s 315,000 b/d, Vortexa data shows.

Around 10 days of lead time is recommended for bunker stems in in Gothenburg and off Skaw, according to a trader.

Hamburg has good availability of all grades with lead times of 3-5 days advised, another trader told ENGINE.

Mediterranean

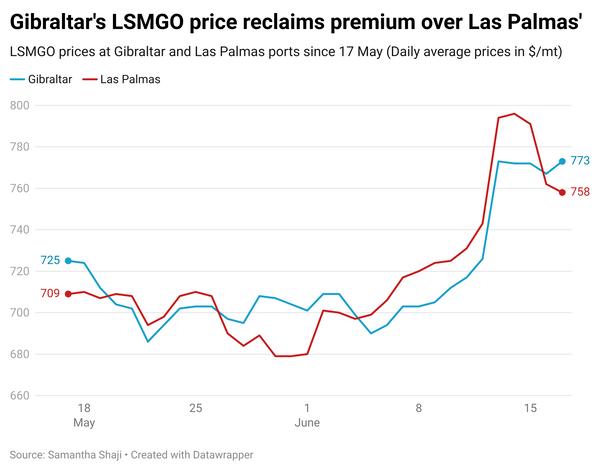

HSFO and VLSFO are readily available in Gibraltar Strait ports, said a trader, while LSMGO is on the tighter side. Lead times of 8-9 days are advised for HSFO and LSMGO, and 10-12 days for VLSFO.

Five vessels awaited bunkers in Gibraltar on Wednesday, according to port agent MH Bland. This is not unusual and bunker capacity is limited by barge availability and a lack of space in the port. One supplier is running 6-12 hours behind schedule, the port agent added.

In Las Palmas, bunker availability remains good and lead times of 5-7 days are recommended, a trader said. Weather conditions for the port are forecast to be suitable for bunkering in the coming week, according to a trader.

In Barcelona, HSFO, VLSFO and LSMGO remain readily available with recommended lead times at 5-7 days, according to a trader.

Bad weather is expected to affect operations off Malta on 22 June, but all grades are readily available.

Prompt supply is tight for all grades at the Greek port of Piraeus, according to a trader. The port could face weather-related disruptions over the weekend, according to a trader.

In Istanbul, prompt supplies of HSFO, ULSFO and LSMGO are readily available, according to a trader. VLSFO remains tight. Periods of rough weather could disrupt some operations between 20-26 June, according to a trader.

Africa

VLSFO is tight in the Mozambican ports of Nacala and Maputo, according to a supplier. Nacala has readily available LSMGO, while that grade is very tight in Maputo. HSFO is in good supply in Nacala.

In Port Louis, HSFO availability is very tight, said a trader. VLSFO and LSMGO remain readily available, with lead times of 7-10 days recommended.

Durban continues to have good bunker supply, with 2-4 days of lead time advised, a trader said. LSMGO supply remains dry.

VLSFO and LSGMO are both readily available in Luanda, according to a trader.

Prompt bunker availability is consistently good off Walvis Bay, with lead times of 3-6 days.

In Togo’s Lome, availability of all grades is good, with lead times of 5-7 days recommended, as according to a trader.

Biofuels are not yet on offer for bunkering in African ports. A supplier on the continent said enquiries have been few and far between, and not presented any viable business case for launching biofuel supply.

By Samantha Shaji

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.