East of Suez Market Update 13 Jun 2025

Prices in East of Suez ports have surged, and prompt availability is tight in the UAE ports of Fujairah and Khor Fakkan.

IMAGE: Container ships and gantry cranes in Port Khor Fakkan, UAE. Sharjah Ports

IMAGE: Container ships and gantry cranes in Port Khor Fakkan, UAE. Sharjah Ports

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($44/mt), Singapore and Zhoushan ($43/mt)

- LSMGO prices up in Fujairah ($54/mt), Singapore ($51/mt) and Zhoushan ($49/mt)

- HSFO prices up in Singapore ($38/mt), Fujairah ($35/mt) and Zhoushan ($32/mt)

- B24-VLSFO at a $202/mt premium over VLSFO in Singapore

- B24-VLSFO at a $224/mt premium over VLSFO in Fujairah

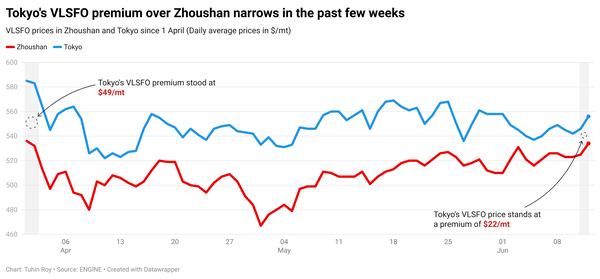

VLSFO prices across the three major Asian bunker ports have increased within a narrow range of $43–44/mt over the past day. Fujairah’s VLSFO is priced at a discount of $17/mt to Zhoushan and $10/mt to Singapore.

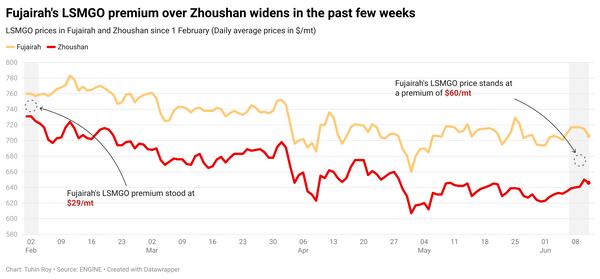

The port has also seen the steepest surge in LSMGO prices among the three East of Suez ports, rising by $54/mt. Fujairah’s LSMGO stands at a premium of $91/mt over Singapore and $65/mt over Zhoushan.

Prompt bunker availability in Fujairah remains tight, with lead times for all fuel grades holding steady at 5–7 days - similar to those in Khor Fakkan.

At Egypt’s Suez port, stocks of all three conventional bunker grades are nearly depleted. In Qatar’s Ras Laffan, VLSFO and LSMGO availability is tight.

In Zhoushan, VLSFO supply remains steady, with most suppliers recommending lead times of 4–7 days. However, HSFO lead times have slightly increased to 4–7 days, up from 3–5 days last week. LSMGO lead times in Zhoushan have improved to 2–3 days, down from 4–7 days previously.

Brent

The front-month ICE Brent contract has moved $5.21/bbl higher on the day, to trade at $74.24/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has rallied over 7% following reports that Israel struck a major nuclear facility in Natanz, Iran earlier today.

Israel has targeted Iran’s nuclear facilities, ballistic missile factories and military personnel in the recent attack, the country’s military said.

“This has elevated geopolitical uncertainty significantly and requires the oil market to price in a larger risk premium for any potential supply disruptions,” ING Bank’s head of commodities strategy Warren Patterson remarked.

The news comes ahead of the sixth round of US-Iran talks in Oman later this week. The US has denied any involvement in these strikes.

“This follows threats from Iran that it will target US military bases in Iraq if a conflict breaks out,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

The risk to supply disruptions was partly offset by OPEC+ decision to ramp up production hikes.

Earlier this month, the oil producers’ group decided to collectively increase their supply by 411,000 b/d in July again – a move the coalition has stuck to for three months now. It’s leader Saudi Arabia wants to increase oil supply to regain market share, according to market analysts.

“Crude tanker loadings from OPEC nations rose 24% w/w last week to 2.28mb/d [2.28 million b/d], the highest weekly loadings since April 2023,” Hynes said citing data from global shipping association Baltic and International Maritime Council (BIMCO).

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.