Europe & Africa Market Update 2 June 2025

Prices of most fuel grades in Europe and Africa have risen, and the Port of Las Palmas could face weather-related bunkering disruptions this week.

Changes on the day from Friday, to 09.00 GMT today:

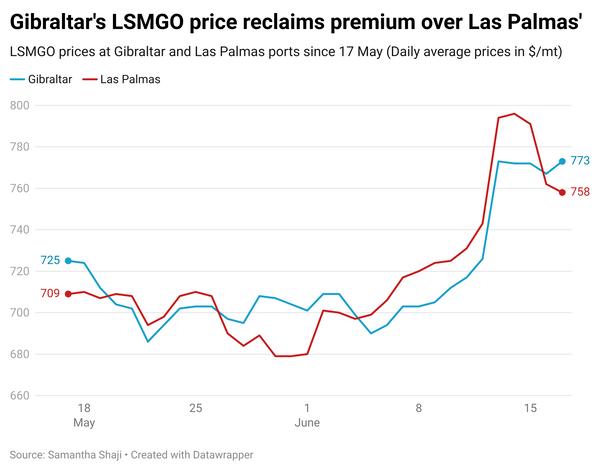

- VLSFO prices up in Durban ($20/mt), Gibraltar ($11/mt) and Rotterdam ($4/mt)

- LSMGO prices up in Rotterdam ($8/mt), and down in Gibraltar ($7/mt)

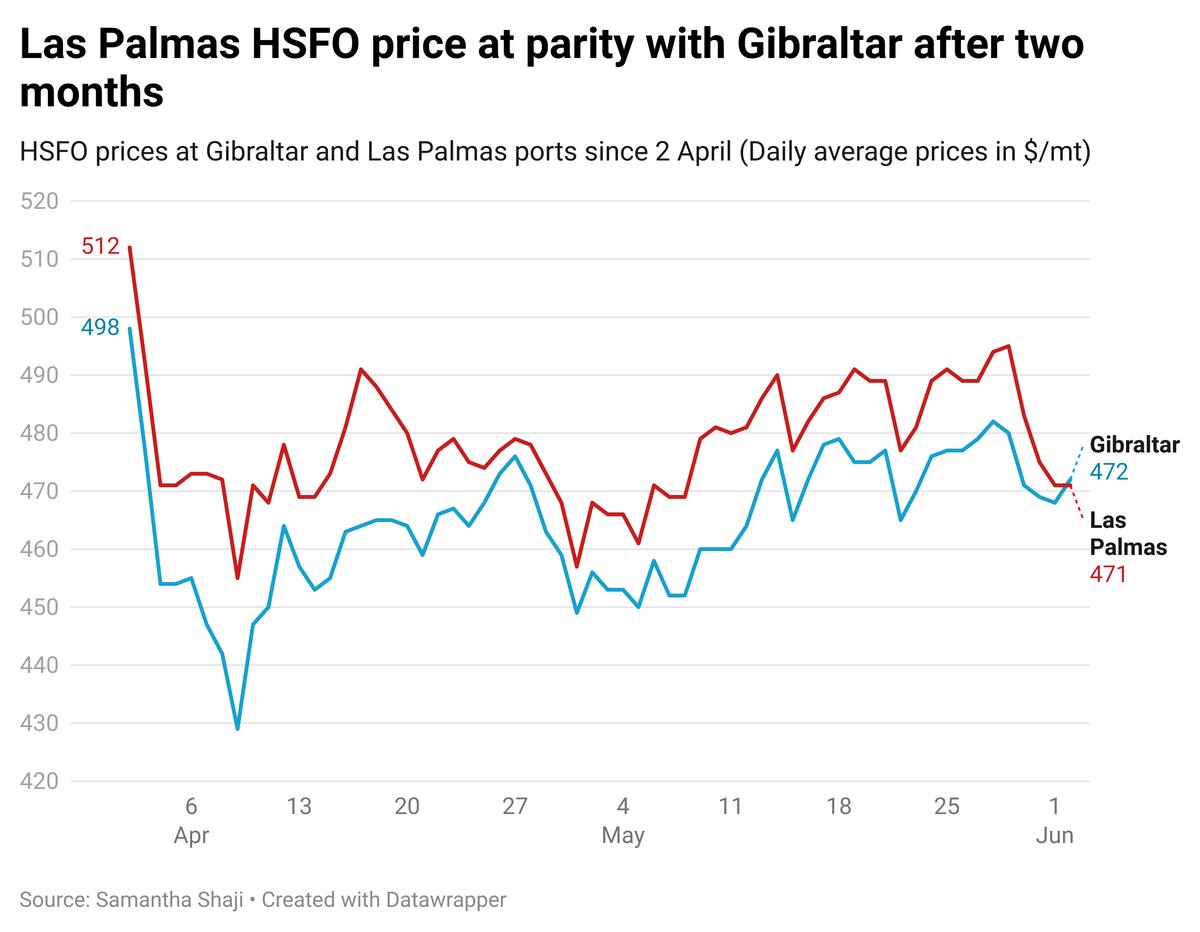

- HSFO prices up in Rotterdam ($5/mt) and Gibraltar ($4/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $16/mt to $246/mt

Prices of most conventional fuels in Rotterdam, Gibraltar and Durban have gained in the past session, except for Gibraltar’s LSMGO which has inched downwards.

There are nine vessels awaiting bunkers in Gibraltar today, four more than Friday, worsening congestion at the port, port agent MH Bland said. The reason for this congestion is a lack of space available for vessels to bunker and limited barge availability, the agent added. Some suppliers are still delayed by 4-24 hours, consistent with last week.

Suppliers in Algeciras are running 2-36 hours behind schedule, down from last week’s 16–72-hour delays, according to MH Bland.

In Ceuta, no vessels are awaiting bunkers, and twelve vessels are expected to arrive today, according to port agents MH Bland and Jose Salama & Co. One supplier is experiencing delays of 8-10 hours, MH Bland said.

Bad weather conditions are forecast in Las Palmas this week, which could affect supply operations at the outer anchorage, according to a trader.

Brent

The front-month ICE Brent contract has gained by $0.08/bbl on the day from Friday, to trade at $64.68/bbl at 09.00 GMT.

Upward pressure:

Brent futures have found some support after eight OPEC+ members—Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria and Oman—agreed to increase their combined oil supply by 411,000 b/d in July, compared to June's production levels. This move came as a relief to market participants who had anticipated a larger supply boost.

“Crude futures were trading… higher early Monday… after the OPEC/non-OPEC Group of 8 on Saturday decided to raise their combined production target by 411,000 b/d for July, avoiding a more bearish course of action,” said Vandana Hari, founder and analyst at Vanda Insights.

“The latest increase is in line with our expectations,” two analysts from ING Bank commented.

Meanwhile, data from the US Energy Information Administration (EIA) showed that US fuel oil production in May averaged 8% less per day compared to April.

This decline, along with low US fuel inventories and concerns about an above-average hurricane season, has added to market supply jitters and contributed to upward pressure on prices.

Downward pressure:

Kazakhstan has notified OPEC that it does not plan to cut its oil production, according to a Thursday report by Russia's Interfax news agency, citing Kazakhstan's deputy energy minister, Reuters reported.

The announcement has put some downward pressure on Brent's price.

By Samantha Shaji and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.