East of Suez Market Update 30 May 2025

Prices in East of Suez ports have moved down, and VLSFO supply is tight in several Japanese ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Singapore ($9/mt), Fujairah and Zhoushan ($8/mt)

- LSMGO prices down in Fujairah ($14/mt), Singapore ($7/mt) and Zhoushan ($6/mt)

- HSFO prices down in Zhoushan ($11/mt), Fujairah ($7/mt) and Singapore ($6/mt)

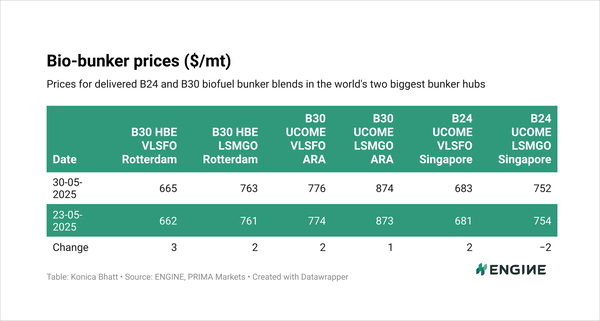

- B24-VLSFO at a $191/mt premium over VLSFO in Singapore

- B24-VLSFO at a $218/mt premium over VLSFO in Fujairah

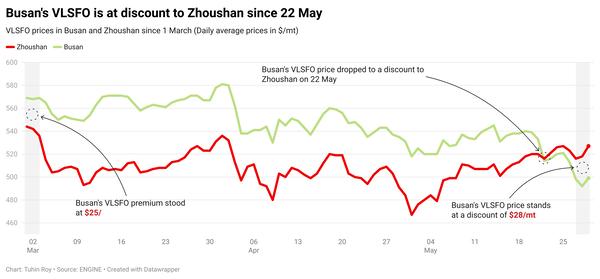

VLSFO prices in East of Suez ports have seen a modest decline of $8–9/mt over the past day. In Fujairah, VLSFO is priced at a discount of $22/mt to Zhoushan and $9/mt to Singapore.

Fujairah’s LSMGO price has dropped by $14/mt—the sharpest fall among the three major Asian bunker hubs. Despite this decline, Fujairah's LSMGO remains at premiums of $103/mt and $72/mt over Singapore and Zhoushan, respectively.

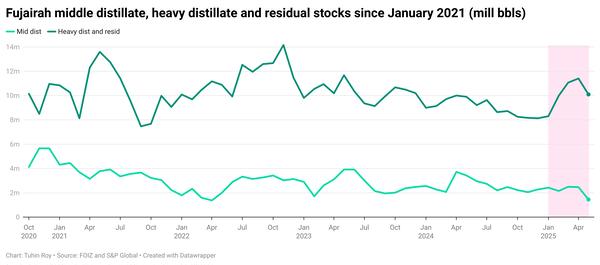

Prompt bunker availability in Fujairah remains tight, with lead times for all fuel grades steady at 5–7 days.

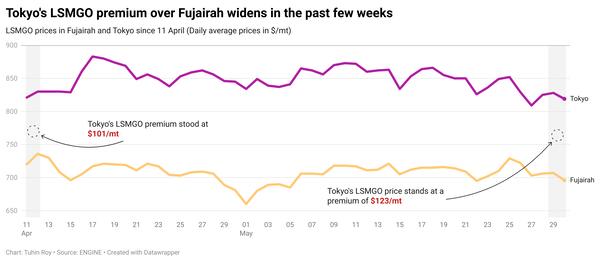

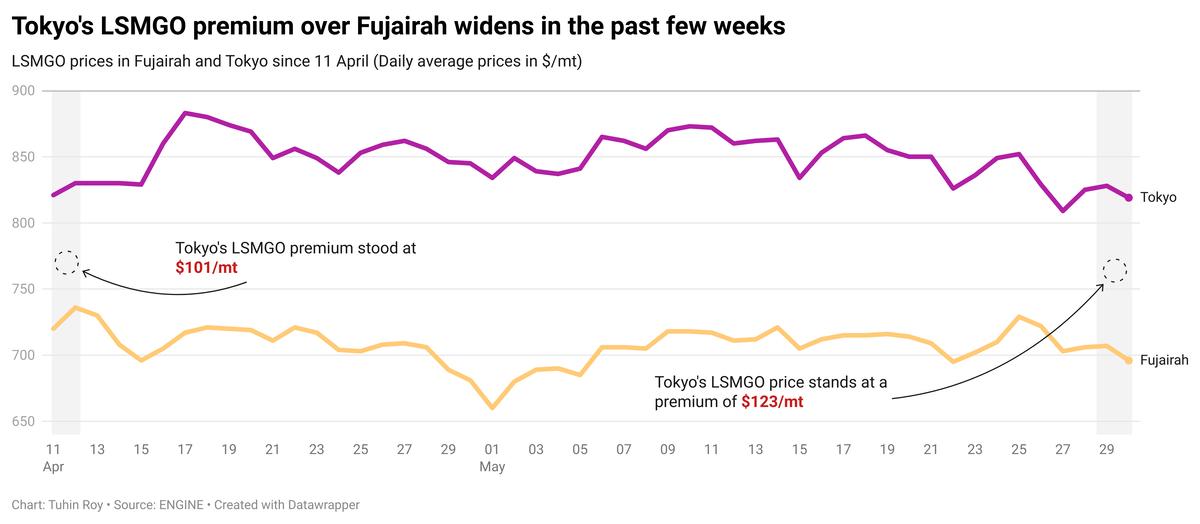

In Japan, Tokyo continues to price its LSMGO significantly higher than Fujairah, with a premium of $123/mt.

VLSFO supply is tight across several Japanese ports, including Tokyo, Chiba, Yokohama and Kawasaki. Prompt availability of VLSFO is also constrained in Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima.

While LSMGO is generally available in these ports, securing prompt deliveries can be difficult. HSFO availability is stable overall, though prompt delivery is limited in Mizushima. All fuel grades remain tight in Oita.

Brent

The front-month ICE Brent contract has declined by $1.04/bbl on the day, to trade at $64.60/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has found some support after the weekly official US oil stocks figures from the US Energy Information Administration (EIA) were released yesterday.

Commercial US crude oil inventories have decreased by about 2.8 million bbls to touch 440 million bbls for the week ending 23 May, according to data from the EIA.

“US inventory data added a little light to the gloomy outlook,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Earlier this week, the American Petroleum Institute reported a larger draw of 4.2 million bbls for the same week.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

Downward pressure:

Brent crude’s price has slipped on growing concerns over a potential supply glut from OPEC+.

Kazakhstan does not plan to cut oil production in July, its deputy energy minister Alibek Zhamauov said, according to a Reuters report citing Russia’s Interfax news agency.

The Saudi Arabia-led alliance is widely expected to increase output for the third consecutive time at its upcoming meeting on Saturday.

The group of eight OPEC+ members, currently unwinding the 2.2 million b/d of output cuts, are expected to raise their collective production target by 411,000 b/d in July.

“The exact size of the hike is to be announced at the meeting but is expected to be larger than currently scheduled,” Hynes remarked.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.