East of Suez Market Update 27 May 2025

Most prices in East of Suez ports have moved down, and prompt bunker availability is tight in the UAE ports of Fujairah and Khor Fakkan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

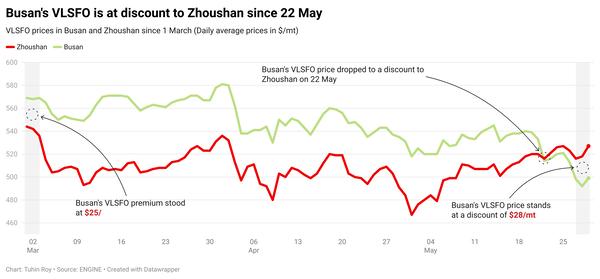

- VLSFO prices up in Fujairah ($5/mt), and down in Singapore ($13/mt) and Zhoushan ($9/mt)

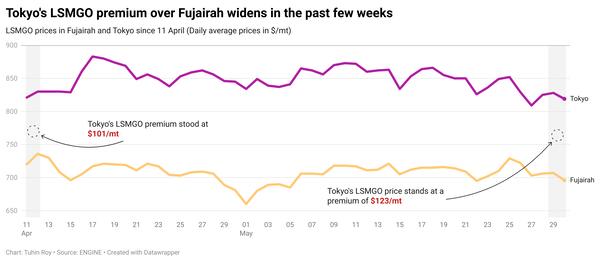

- LSMGO prices down in Fujairah ($30/mt), Zhoushan ($15/mt) and Singapore ($7/mt)

- HSFO prices down in Zhoushan ($14/mt), Singapore ($5/mt) and Fujairah ($2/mt)

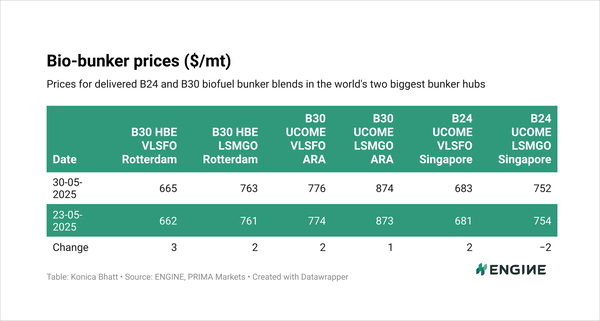

- B24-VLSFO at a $193/mt premium over VLSFO in Singapore

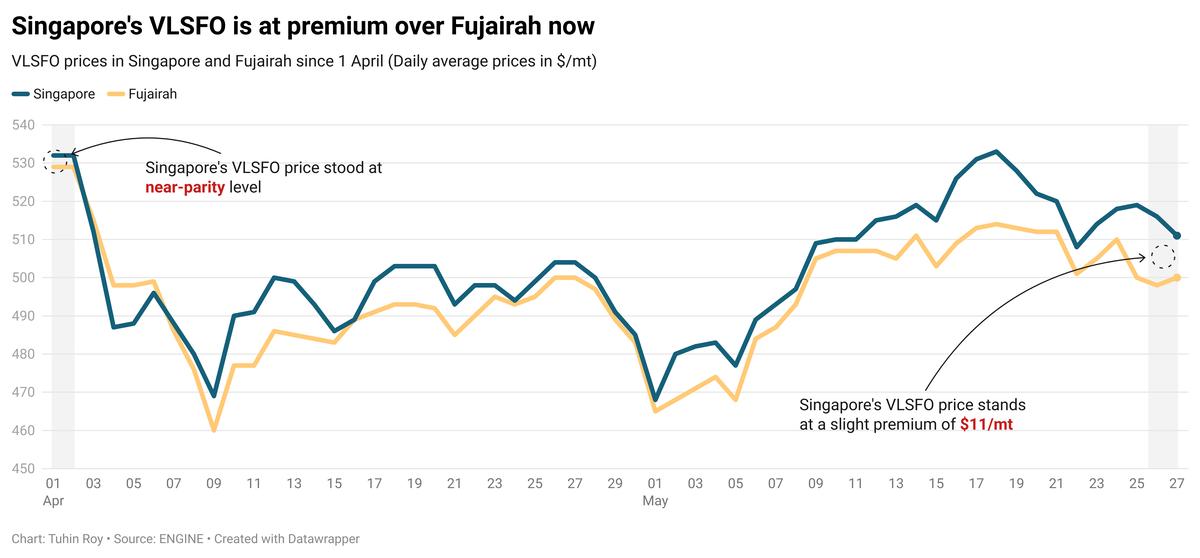

VLSFO prices have dropped by $13/mt in Singapore and $9/mt in Zhoushan over the past day, while the grade's price in Fujairah has slightly increased. Singapore’s VLSFO now stands at an $11/mt premium over Fujairah and an $8/mt discount compared to Zhoushan.

In Singapore, VLSFO lead times remain steady at 8–15 days amid "slow" demand, a source said. LSMGO lead times have shortened from 5–9 days last week to 4–7 days, while HSFO lead times continue to vary significantly, ranging from 2–9 days.

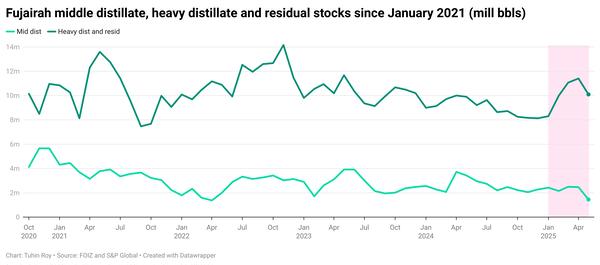

In Fujairah, prompt bunker availability remains tight, with lead times for all fuel grades holding steady at 5–7 days. Bunker deliveries in Khor Fakkan also require similar lead times.

Brent

The front-month ICE Brent contract has declined by $0.33/bbl on the day, to trade at $64.83/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has found some support amid the slow progress of nuclear talks between the US and Iran, according to market analysts.

Delegates from both countries met for a fifth round of talks in Rome last week, “that yielded little progress,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

The agreement was expected to get Tehran to agree to stop its nuclear enrichment program in return for Washington lifting its sanctions on Iranian oil.

“The expectations for these talks are not all that optimistic, despite both sides wanting to avoid a direct conflict,” Price Futures Group’s senior market analyst Phil Flynn remarked.

Downward pressure:

Expectations of higher OPEC+ output have dampened market sentiment, pushing Brent crude lower over the past few sessions.

The group will meet later this week to review supply quotas for its members and decide July production levels. Market analysts expect the Saudi Arabia-led coalition to increase output by another 411,000 b/d in July, for the third consecutive time.

“Any data showing a continued lack of adherence to production quotas will strengthen the resolve of Saudi Arabia to punish those members who refuse to cut their output,” Hynes said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.